Hey, friends!

Not often I do a write-up in one go.

But particularly two DeFi protocols has really excited me this year:

EigenLayer

Ethena Labs

I have already covered EigenLayer extensively, but this time I wanted to look at Ethena Labs and their crazy 27% APY.

But before we go there, let’s have a word from our sponsor Trestle Protocol

Welcome to Trestle Protocol

Connecting projects and users of Ethereum to the Celestia ecosystem. One trestle at a time.

Mission

To connect the power of Celestia's modular blockchain network with projects and userbase of Ethereum. Trestle aims to not only create a functional bridge between the two chains, but to also supply Wrapped Tia (wTIA) to Ethereum users to allow for ease of purchase of TIA to a larger audience of users.

Trestle's long term vision is to become a roll-up chain and validator. Trestle Chain will be the first native TIA roll-up chain that leverages Celestia's DA. Our new chain will have TIA as it's central currency, allowing for a speculative market to be built on Trestle Chain, and will bring about larger TIA adoption and usage.

What is Celestia?

Celestia is a new revolutionary blockchain that allows for more freedom and sovereignity to it's dApp creators. Celestia changes the landscape for crypto projects by allowing them to choose the language they write their programming in. This structuring allows application creators to focus on logic of their apps, while Celestia handles consensus.

Key Products for Trestle Protocol

The key products for Trestle Protocol will revolve around bringing our $TRESTLE holders recurring value and revenue for holding and staking our token, while supporting the growth and decentralization of $TIA.

TIA Bridge

Trestle will create the first TIA bridge from ETH <> Celestia. Allowing for TIA to be available to a larger audience and also introducing $wTIA to the Ethereum Network. Trestle will charge a small service fee for each bridge and will build up revenue for the protocol and it's holders.

Wrapped TIA Payouts

$TRESTLE Holders will be able to participate in our staking pools to earn $wTIA. These pools have unique mechanisms that allows $TRESTLE to become deflationary, while rewarding loyal holders with wTIA, their APY is based on lock length.

TIA Launchpad and Token Bridge

Once the initial bridge is built out and tested, the Trestle team will then collaborate with future TIA teams to raise funds and market their projects on Ethereum to launch on the TIA network. We also can provide a bridge for tokens to migrate between ETH and TIA network so that teams can smoothly cross over with minimal impact on their communities

Check it out here:

https://www.trestleprotocol.io/

If you want to start trading crypto in the new year, use my ref link on Bybit:

https://partner.bybit.com/b/route2fi

You get lower fees, a bonus of up to $30,000, and are able to join my trading group.

I have a trading group only for my affiliates where I share my own trades + the ones from people much smarter than me once they share in their private TG/Discord.

Also, I will arrange a trader contest in cooperation with Bybit starting this week where PnL % is what matters, so even small traders have a chance to win the money prizes + an iPhone.

Once you've signed up on the ref link —> go here to join my private trading group: t.me/route2fiibot

27% APY on a stablecoin - how sustainable is Ethena Labs?

Ethena is a synthetic dollar protocol built on Ethereum that will provide a crypto-native solution for money not reliant on traditional banking system infrastructure, alongside a globally accessible dollar-denominated savings instrument - the 'Internet Bond'.

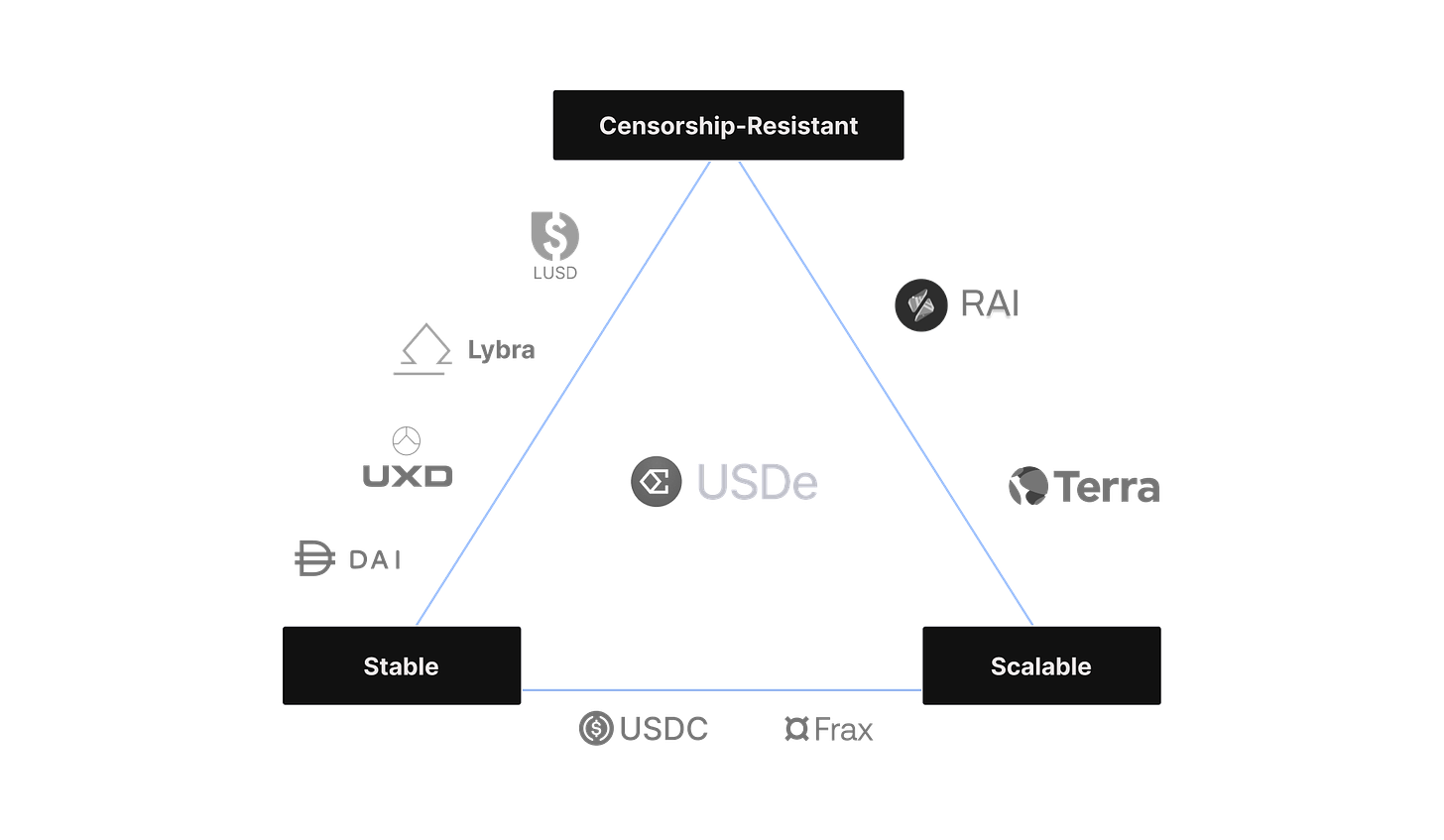

Ethena's synthetic dollar, USDe, will provide the first censorship resistant, scalable and stable crypto-native solution for money achieved by delta-hedging staked Ethereum collateral.

USDe will be fully backed transparently onchain and free to compose throughout DeFi.

USDe peg stability is ensured through the use of delta hedging derivatives positions against protocol-held collateral alongside a mint and redeem arbitrage mechanism.

The 'Internet Bond' will combine yield derived from staked Ethereum as well as the funding & basis spread from perpetual and futures' markets.

Ethena has been built to address the largest and most obvious immediate need within crypto. DeFi attempts to create a parallel financial system, yet stablecoins are the most important financial instrument and remain completely tethered to, and reliant upon, traditional banking infrastructure.

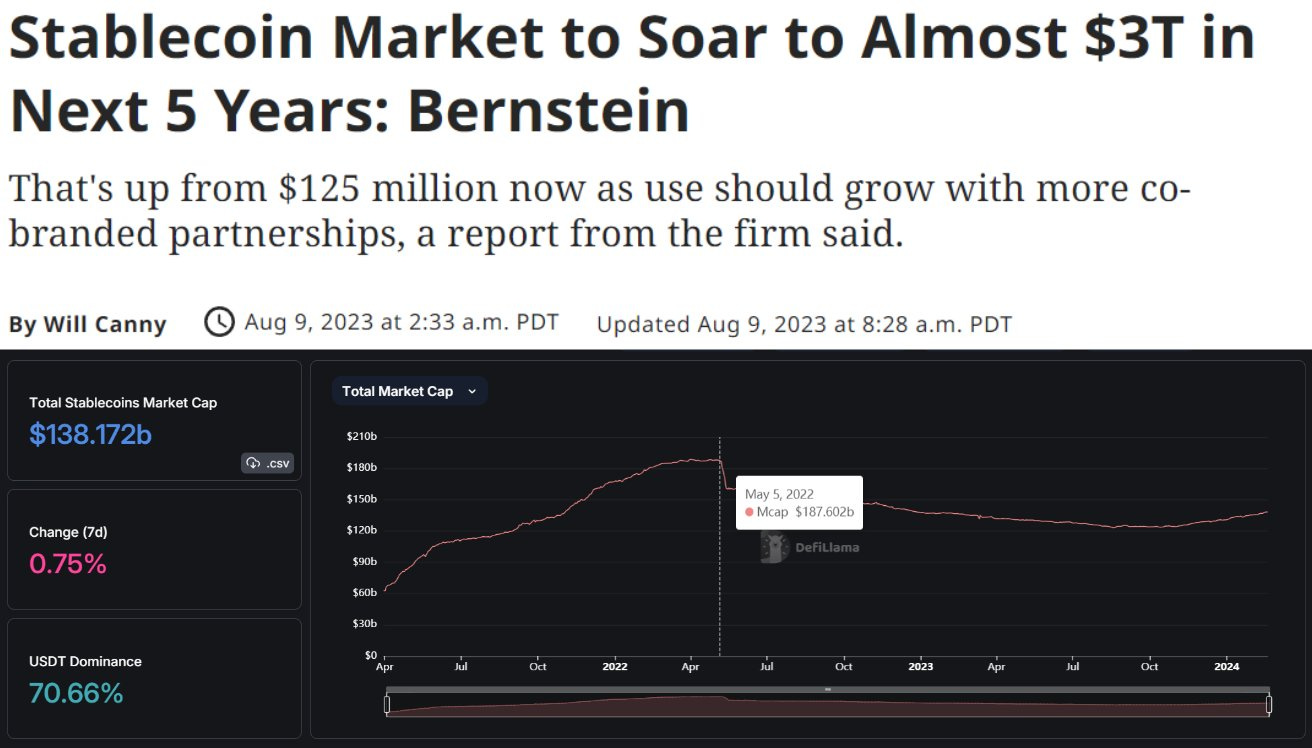

Why are stablecoins so important?

Stablecoins are the single most important instrument in crypto.

All major trading pairs across spot and futures markets in centralized and decentralized venues are denominated in stablecoin pairs with >90% of orderbook trades and >70% of onchain settlements being stablecoin denominated. Stablecoins settled >$12 trillion onchain this year, constitute 2 out of the 5 of the largest assets in the space, >40% of TVL in DeFi, and are by far the most utilized assets across decentralized money markets.

Centralized stablecoins, such as USDC or USDT, provide stability and capital efficiency, but they introduce:

Unhedgeable custodial risk with bond collateral in regulated bank accounts which are prone to censorship.

A critical reliance upon the existing banking infrastructure and country-specific evolving regulations.

A "return-free risk" for the user as the issuer internalizes the yield whilst exporting the risk of depeg to users.

Decentralized stablecoins have historically experienced a number of issues relating to scalability, mechanism design, and a lack of embedded yield.

"Overcollateralized stablecoins" have historically experienced issues scaling as their growth was inexorably tied to the on-chain growth in leverage demand for Ethereum. Lately, some stablecoins have resorted to onboarding Treasuries in an effort to improve scalability, at the cost of censorship resistance.

"Algorithmic stablecoins" have faced challenges with their mechanism design which were found to be inherently fragile and unstable. We do not view these designs as sustainably scalable.

Prior "delta-neutral synthetic dollars " struggled to scale due to a critical reliance on decentralized trading venues that lack sufficient liquidity.

As a result, USDe provides the following benefits:

i) Scalability is achieved by utilizing derivatives which allows for USDe to scale with capital efficiency. Since the staked ETH collateral can be perfectly hedged with a short position of equivalent notional, the synthetic dollar only requires 1:1 "collateralization."

ii) Stability is provided through hedges executed against the transferred assets immediately on issuance that ensures the synthetic USD value of USDe backing in all market conditions.

iii) Censorship Resistance by separating backing from the banking system and storing trustless backing assets outside of centralized liquidity venues in onchain, transparent, 24/7 auditable, programmatic custody account solutions.

How does it work?

A user deposits ~$100 of stETH and receives ~100 USDe atomically in return less any execution costs to execute the hedge.

Ethena Labs opens a corresponding short perpetual position for the approximate same dollar value on a derivatives exchange.

The assets received are transferred to an "Off Exchange Settlement" provider. Backing assets remain onchain and off-exchange servers to minimize counterparty risk.

Ethena Labs delegates, but never transfers custody of, backing assets to derivatives exchanges to margin the short perpetual hedging positions.

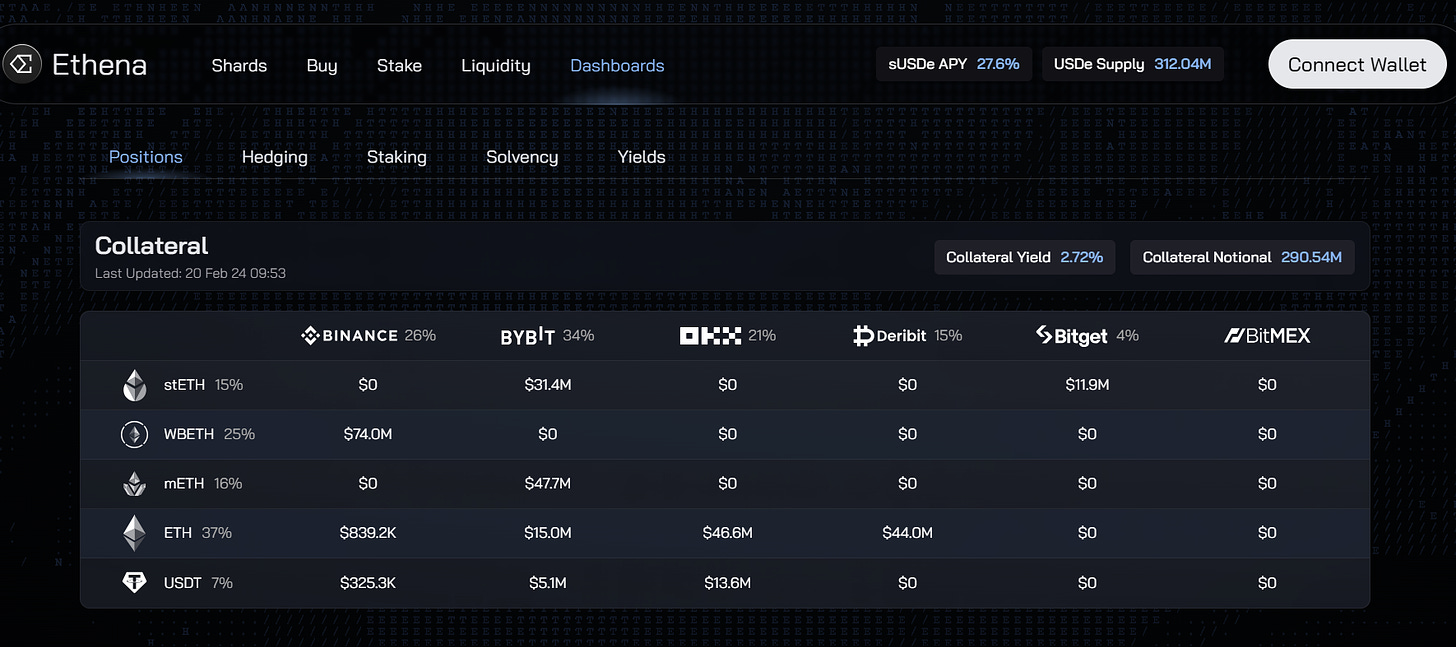

Ethena Labs generates two sustainable sources of yield from the deposited assets.

The returned yield to eligible users is derived from:

Staking Ethereum to receive consensus and execution layer rewards (3,5% APR)

The funding and basis spread from the delta hedging derivatives positions. (5-20% APR)

Yield from Staking Ethereum is floating by nature and denominated in ETH.

The funding and basis spread yield can be floating or fixed.

The funding and basis spread has historically generated a positive yield given the mismatch in demand and supply for leverage in crypto as well as the existence of positive baseline funding.

If funding rates are deeply negative for a sustained period of time, such that the staked Ethereum yield cannot cover the funding and basis spread cost, the Ethena insurance fund will bear the cost.

You can find historical yield here: https://ethena-labs.gitbook.io/ethena-labs/solution-overview/yield-explanation/historical-examples

Once users stake their USDe for sUSDe, they begin to accrue protocol yield without any further action or cost.

The amount of sUSDe a user receives is determined by how much USDe was deposited as well as when it was deposited. Ethena's sUSDe utilizes a "Token Vault" mechanism, the same as Rocketpool's rETH or Binance's WBETH.

The protocol does not rehypothecate, lend out, or otherwise utilize deposited USDe for any purpose. There is no need for any such action, as the USDe backing mechanic inherently creates protocol yield.

If the protocol were to suffer a loss due to funding or another reason, Ethena's insurance fund would bear the cost, rather than the staking contract.

Ethena Labs opens a short position when a user mints USDe.

Ethena Labs closes a short position when a user redeems USDe.

Ethena Labs closes/opens positions across exchanges to realize unrealized PnL.

If USDe is worth LESS in an external market than from Ethena Labs, a user could:

Buy 1x USDe at 0.95 from Curve using USDC.

Redeem 1x USDe at 1.00 from Ethena Labs receiving ETH.

Sell the received ETH for USDC on Curve.

Profit.

If USDe is worth MORE in an external market than from Ethena Labs, a user could:

Mint USDe using ETH from Ethena Labs.

Sell the USDe in the Curve pool for > 1.00 for USDC.

Buy ETH using USDC on Curve.

Profit.

What are the risks?

Funding Risk:

"Funding Risk" relates to the potential of persistently negative funding rates. Ethena is able to earn a yield from funding, but could also be required to pay funding (= lower protocol yield).

Ethena insurance fund exists and will step in on occasions when the combined yield between the LST asset, such as stETH, and the funding rate for a short perpetual position, is negative. This ensures the collateral underpinning USDe is unaffected. Ethena does not pass on any "negative yield" to users who stake their USDe for sUSDe.

Combining annualized stETH yields and funding rate values, only 10.8% of days had a sum negative yield. That compares positively when compared to the ~20.5% of days yielding a negative funding rate when not also incorporating the stETH yield.

If you remember Anchor Protocol’s yield reserve, the Ethena insurance fund will work in a similar way, supporting the yield on the “negative” days.

Liquidation Risk

Ethena uses staked Ethereum spot assets to collateralize short derivatives positions. Ethena uses staked Ethereum assets, such as Lido's stETH, to collateralize short ETHUSD and ETHUSDT Perpetual positions across CeFi Exchanges. Ethena therefore is using a different asset, stETH, than the underlying asset of the derivatives positions, ETH.

The spread between ETH and stETH would have to diverge to 65%, which has never happened before, with the maximum being 8% in history (before Shapella and around the Luna depeg in May 2022), before incremental liquidation of Ethena's position would begin & Ethena would incur realized losses.

$USDe peg stability is automated through programmatic dela-neutral hedges with underlying collateral assets. Based on @CryptoHayes “Dust on Crust” article here: https://blog.bitmex.com/dust-on-crust/

To mitigate "Liquidation Risk" as a result of the aforementioned risk scenarios:

Ethena will systematically delegate additional collateral to improve the margin position of our hedging positions in the event either risk scenario eventuates.

Ethena is able to cycle collateral delegated between exchanges temporarily to support specific situations.

Ethena has access to an insurance fund that we are able to rapidly deploy to support hedging positions on exchanges.

In the event of an extreme occurrence, such as a critical smart contract flaw in the staked Ethereum asset, Ethena will immediately mitigate the risk with the sole motivation being that we protect the value of the collateral. This includes closing the hedging derivatives leg to avoid liquidation risk becoming a concern as well as trading out of the affected asset into another.

3. Custodial Risk

Given that Ethena Labs relies upon "Off-Exchange Settlement" provider solutions to custody protocol backing assets, there is a dependence upon their operational ability. Ethena’s ability to deposit, withdraw, and delegate to & from exchanges. Any of these abilities being unavailable or degraded would impede the trading workflows & availability of the mint/redeem USDe functionality.

Exchange Failure Risk

Ethena Labs utilizes derivatives positions to offset the delta of the digital asset collateral. These derivatives positions are traded upon CeFi exchanges such as Binance, Bybit, Bitget, Deribit, and Okx. As such, in the event an exchange were to suddenly become unavailable such as FTX, Ethena would need to manage the consequences. This is the "Exchange Failure Risk".

Collateral Risk

"Collateral Risk" in this context refers to the fact that are collateral asset for USDe (stETH) differs to the underlying asset of the perpetual futures position (ETH).

At this point in time, all protocols reliant on stETH (and any ETH LST), accept this liquidity risk profile. This means the amount of stETH that can be unstaked with Lido might be subject to delay or the user may have to accept a slight discount if required to trade immediately in external markets.

Approved users of Ethena are able to redeem USDe for stETH (or any ETH LST) at any time on-demand or request an alternate asset and tap Ethena's ability to access multiple pools of liquidity.

The loss of confidence in the integrity of an LST might occur because of the discovery of a critical smart contract bug in the LST. In this event, users would all likely attempt to unstake or swap out of the LST for alternative collateral as quickly as possible. This would likely lead to long exit validator queues with protocols, such as Lido, as well as liquidity drying up on DeFi and CeFi Exchanges.

Discussion

All right, that was quite a technical go through.

Now let’s look at why the product is interesting.

27.6% APR on Stables

Yields are derived from LSD $ETH being used as collateral for a 1x $ETH short position

Airdrop is coming (called Ethena Shards) farming ongoing for 3 months or when $USDe supply hits $1b

Provide LPs + Lock LP tokens = 20x Shards / day

Buy and hold $USDe = 5x Shards / day

Stake and hold $sUSDe = 1x Shards / Day

TVL is moving up pretty fast : $300m TVL so far

All stable pool caps currently full (expecting them to lift caps, just my gut feeling)

Lower smart contract risk, but higher centralization risks (funds on cex), and works best in bull markets when people take leverage (when everyone wants to short ETH, don’t expect the funding rate to be positive

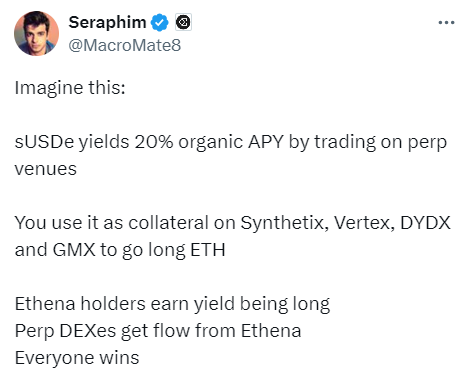

Take it further, you can use your sUSDe in DeFi soon, see example from Seraphim (head of growth for Ethena Labs) below:

One thing people have a hard time to understand though is why we have the funding rate at all.

The funding rate is in place to ensure that the funding mechanism aligns the futures market price with the index spot price: whenever there’s too much demand to long $ETH, $ETH perp price > $ETH spot price, such that CEXs need some ways to disincentivize people from longing any more.

Thus, funding rate is a way to maintain the dynamic equilibrium of futures market price with reference to the index spot price. As the whole market is long-skewed, ie bulls > bears, if you short $ETH, you get what’s earned from people who long $ETH, counteracting the overwhelming demand to drive $ETH perp price more closely back to $ETH spot price.

AllianceBernstein, a global asset management firm with $725B AUM, predicts that the stablecoin market cap will reach $3T by 2028. If we examine today's market, the stablecoin market cap is currently at $138B, peaking at $187B. That's a 2000% potential increase!

Further, Ethena has received $14M from the world's top investors including @binance, @CryptoHayes, @Bybit_Official, @mirana, @lightspeedvp, @FTI_US, & more. Notably, Angels include @dcfgod, @cobie, and @blknoiz06.

Ethena has a really nice dashboard which you can monitor here, at least it gives some peace of mind in terms of risk.

The drawbacks with Ethena

In its simple form, it’s just a basis trade. When yields invert you start losing money, and the bigger the stablecoin is the more money it loses. Right now people who long $ETH pays the ones who short. This can go on for a long time, and especially in a bull market. But at some point, the yield will invert and people will short ETH and get paid for it. Now suddenly Ethena has to take that cost. They have their insurance fund to solve this temporarily. But as the yield on sUSDe is going lower I suspect people might want to withdraw. With that said, this is not a death spiral. Just that people might want to seek yield elsewhere.

Using stETH as collateral provides a margin of safety over negative rates. That means Ethena is only concerned with days when ETH funding is more negative than stETH yields. However the stETH liquidity matter a lot for the peg. USDe can not scale to $100B without sufficient stETH liquidity.

Okay so in a scenario where this happens:

Useres redeem

Insurance fund can be used to cover. According to Ethena $20m per $1bn of USDe would survive almost all bearish forecasts of funding rates (Chaos Labs said $33m per 1bn).

The biggest risk for this project is probably not a blow-up, but more that who would like to lock up their money in a token with non-yield when you have “trusted” alternatives (by trusted I am just pointing out lindy stablecoins like USDT or USDC - not saying these are better, but since they’ve been around for a while, they are per def more trusted by most people).

Counterparty risk from CEXs and smart contracts is likely one of the biggest issues. According to @tbr90 the long-term risk is a slow bleed as the negative rates inevitably wipe out the insurance fund and then force a slow de-pegging.

As Cobie points out, people can do this trade themselves.

Eg. short ETHUSDT and bank the funding every 8 hour, long stETH or mETH (for higher temporarily yield). No 7-day staking queue, and you choose the risk yourself. You have to rebalance yourself though.

@leptokurtic_ (the Ethena founder) agrees to this, but points out that “@ethena_labs isn't created to save you some hassle to execute a cash and carry trade. What is exciting is being able to tokenize this asset, make it extremely liquid through DeFi and CeFi, and then allow new and interesting use cases to be built upon it Composing different money legos together.”

Anyway, I like the project. It’s interesting with something new. I can see perp dex’es implement their stablecoin, and that DeFi protocols want to use it as money lego similar to what has happened with EigenLayer and the restaking narrative.

People might remember that I was a big fan of Anchor Protocol back in the day, and Ethena feels like a healthier way of doing things. Personally won't use the protocol much as I think there are bigger opportunities in a bull market than chasing a 20% annual yield. Will ofc chase the airdrop though.

Another thing that I don't like is that it takes 7 days to redeem from staking, and 21 days from LP. If it were possible to instantly unstake I would consider using it in periods where I need a break from the market, but waiting 7 days in crypto is a long time.

With that said they will probably implement sUSDe in several DeFi protocols so you can earn yield while you're trading/farming etc., and when these solutions are in place I will try it out more.

Overall positive about the product, even this rant might overall seem a little negative.

Here is a thread of all the FUD against Ethena:

https://x.com/MacroMate8/status/1759686681504923985?s=20

Okay, that’s it for today!

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

Good summary. Read a lot of threads on twitter but this pulls everything together nicely

Amazing thread ! Seriously. I have some concerns since I have PtSD from anchor protocol .. I do like the idea something fresh! Let’s see how this goes. As always great content.