5 different stablecoins that give you the best yield right now (perfect in a boring "bull market")

Happy Wednesday, friends!

We got some “fake” hope last week that we were out of the trenches, but this week it feels over again.

Today, let’s look at some stablecoins that you can hold that produce yield in different forms.

It could be good to hold some stables while we wait for better opportunities.

Before we start, today’s newsletter is brought to you by ETHWarsaw 2024

The third edition of ETHWarsaw Conference and Hackathon will take place September 5–8!

ETHWarsaw will bring close to 1000 builders and innovators from the community to discuss growth in the bull market, responsible innovation, and challenges we're about to face.

The conference has a broad topic list:

Infrastructure and Scalability — L2, L3, ZKP, OP-rollups, Account Abstraction, dApps Building, De-PIN, Data Storage, Machine Learning, AI and blockchain interoperability;

Security and Resilience — Privacy, Security, Consensus Mechanisms, White Hacking;

Financial Freedom — DeFi, Wallets, DEX, RWA, Investments, Cryptoeconomy, Tokenomics, Regulations, Legal;

Mass Adoption — Web3, Blockchain Experience, UX, CommunityManagement, Web3 Marketing, Web3 Startups, Public Good, Web3 Jobs and Recruitment.

I will personally be at this conference and hope to see you there.

Tickets can be bought here

Or here: https://www.ethwarsaw.dev/tickets

5 different stablecoins that give you the best yield right now (perfect in a boring "bull market")

Introduction

While everyone is experiencing dissatisfaction with the current market, some leave while others stay with their bearish views, political talk, etc. Your timeline is inundated with non-crypto discussions.

That’s when crypto degens rest and chill by finding the best protocols to LPs their assets, especially stablecoins, to utilize those funds when the market turns bullish and directional. Here are five leading stablecoins and how to maximize their yield:

USDe

USDe is one of the fastest-growing synthetic stablecoins, reaching over a $3.5 billion market cap in just 8 months, thanks to its airdrop opportunities and exclusive yield for USDe holders. Although the supply has dropped 14% since June, which can be attributed to bearish market sentiment:

The adoption has been like a hockey stick. Some highlights include: USDe is now natively deployed on Solana & Scroll, and there’s a collaboration with Securitize (a Blackrock-backed RWA project), among others. So, while the chart might be down, adoption is scaling.

If you're looking to maximize the yield of holding USDe, here are some of the best farms I found:

1. Bybit recently integrated USDe. Every user can earn up to 20% APR per USDe held daily while using it as collateral for trading derivatives, with 0 fees for buy/sell on USDe/USDT and USDe/USDC spot pairs. You can check yesterday’s APR on the savings page on Bybit.

2. Infinex (built by Synthetix founder Kain with over $25m invested) is offering up to 20x sats per USDe each day, with an additional 20x if you swap USDC to USDe in-app, along with a 200x sats bonus.

3. Depositing USDe on Kinto (the safest L2 with $5m raised) through their mining program nets a 20x sats reward and a 5% boost on Kinto mining rewards, with 0 deposit fees. There are more benefits if you deposit the staked version of USDe (sUSDe), which nets a 17% APY, a 5% boost on Kinto mining rewards, and 5x sats rewards from Ethena.

4. A good thread by PendleIntern explains how you can get as high as 55% APR by purchasing PT-sUSDE, detailing where the yield comes from and the risks involved

5/ By depositing on Gearbox, you can earn up to 180x Sats on USDe and up to 45x on the staked version (sUSDe).

6/ You can buy/sell the USDe/FRAX pair on Morphoblue (raised over $69M) with Contango (raised $4M from investors like Coinbase Ventures), which offers 20x per USDe held in the position (up to 15x leverage) while simultaneously farming two tokenless protocols.

7/ Deposit USDe on Origami to net up to 155x Sats and 10x Origami Points, with up to 7x leverage on USDe and the staked version (sUSDe).

8/ Users who stake at least 25 USDe on Binance Web3 Wallet will receive an equal share of a $12K daily reward pool while enjoying a 50% boost on their Sats, on top of 4% rewards with USDe staking (subject to change). This campaign ends on August 29.

USD0 (Usual Money)

USD0 is a decentralized RWA stablecoin that redistributes value and power back into the ecosystem, differentiating it from other stablecoins like USDC and USDT, which offer no value accrual for holding them. USD0 is currently trailing behind USDB (a stablecoin from Blast L2).

There’s an ongoing event where users can earn “Pills” daily for a share of 7.5% of the $Usual supply. The TGE is expected in Q4. Here are some of the best farms to maximize your Pill earnings:

1/ Depositing on Origami nets 15x boosted Pills with 10x Origami Points. With lender liquidity via Morpho, it’s a three-in-one Lego.

2/ PendleIntern moon math shows how you could get 38.3% on your capital by depositing on Pendle.

3/ Collect trading fees while farming Pills by swapping your USDT for USD0 or staking USD0-USDT LP on PancakeSwap.

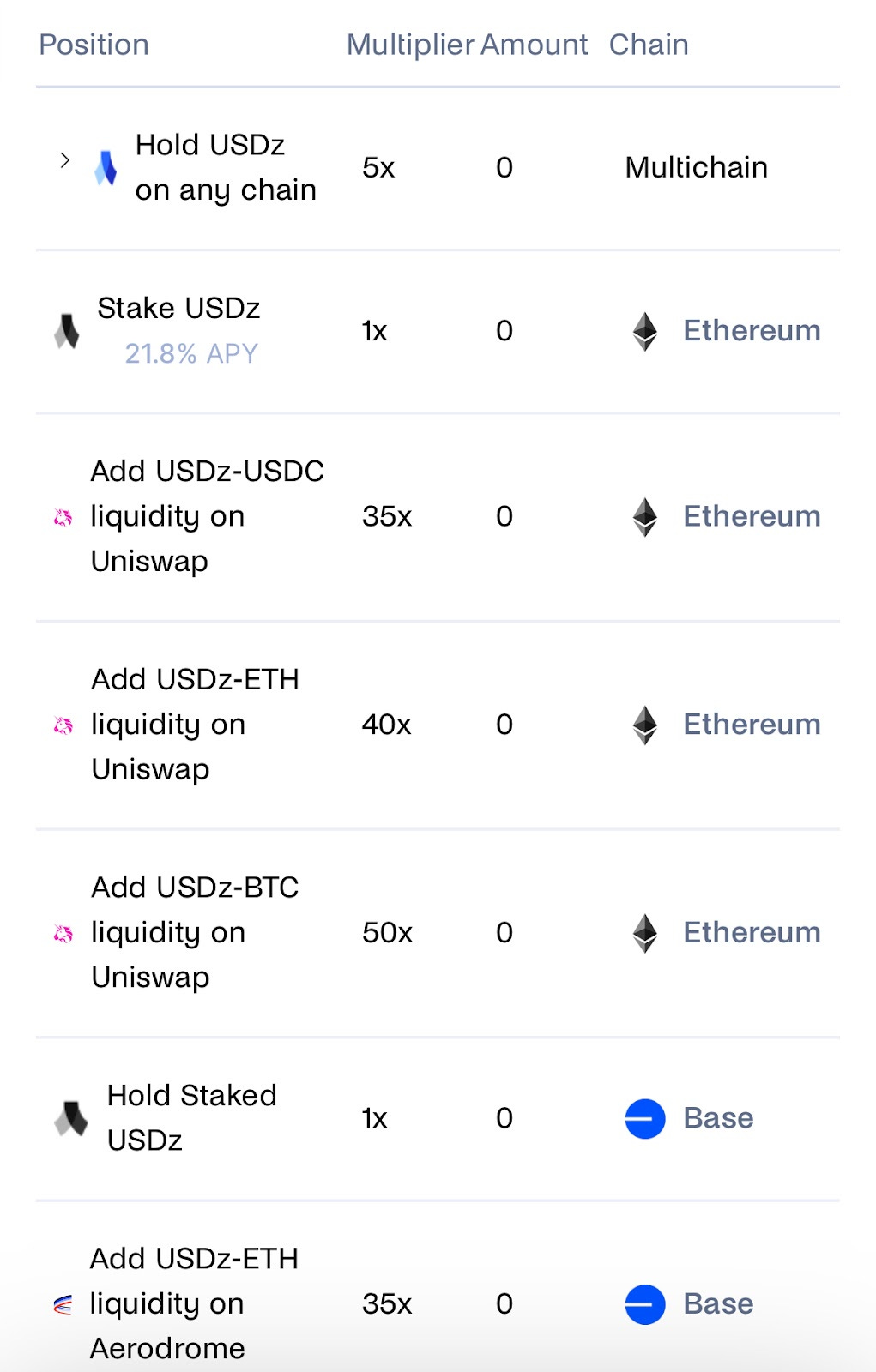

USDz

USDz is a dollar backed by tokenized real-world assets (RWA), allowing users to diversify their portfolios away from crypto price fluctuations to earn yield from the $7 trillion private credit market, which is said to be in V2.

Season 1 focuses on users holding USDz or providing liquidity to earn points convertible to a token, which is expected in Q4.

There are different multipliers for providing liquidity to certain pools

But at the time of writing, the best pool with the highest multiplier is providing liquidity to the USDz-BTC pool (ETH) on Uniswap. To save on fees, you can opt for a 35x boost by depositing on Hyperlock (Blast) or farming the USDz-ETH Aerodrome LP (Base) for the same boost while simultaneously interacting for future drops on both L2s.

Deusd

Deusd (Decentralized US Dollar) is a fully collateralized synthetic dollar powered by the Elixir network. It’s minted by stETH and sDAI, with deposited collateral used to short ETH, creating a delta-neutral position. It’s similar to USDe but on the Elixir network. There’s an ongoing 10-week campaign to bootstrap Deusd liquidity, where users can earn portions for their contributions.

Here are the best farms to increase your portion balance:

1/ Stake your Deusd/FRAX LP tokens to earn a maximum 5x portion boost.

2/ Add liquidity to the sdeUSD/deUSDon balancer for a 5x portion boost.

3/ Stake deUSD-USDC or deUSD-USDT on Ethereum to earn $CAKE and up to 134% APR yield on pankcakeswap (note that the APR drops as liquidity increases).

4/ You can earn up to a 29.5x portion boost by depositing on Abracadabra, depending on your leverage.

USDM

USDM is the first prudentially regulated, yield-bearing stablecoin. The underlying assets backing USDM are U.S. Treasuries, which also provide the yield. It’s currently the 30th largest stablecoin, surpassing defacto stablecoins like EURC issued by Circle.

Ways to maximize yield while holding USDM:

1/ Long/Short wUSDM/USDT pairs on Dolomite via Contango to net 5% APR with Arb rewards on top while simultaneously interacting with two tokenless protocols for future drops.

2/ The wUSDM pool on Morpho Blue currently nets 5% APR plus Morpho rewards on top while establishing your on-chain footprint on Base (3-in-1?).

Dyad

Dyad aims to outcompete existing stablecoins on capital efficiency through a unique model. The power of Dyad lies in its deployment of three assets: $DYAD, the stablecoin; Note, the DYAD NFT (dNFT); and $KEROSENE, the tokenized excess collateral. The Note (dNFT) is like a ticket to the Dyad ecosystem, tracking user activity within the ecosystem via metadata called XP. The more XP your Notes accumulate, the more yield you earn. $KEROSENE can be acquired by providing liquidity in certain pools exclusive to Note NFT holders. Kerosene is more than just a yield...

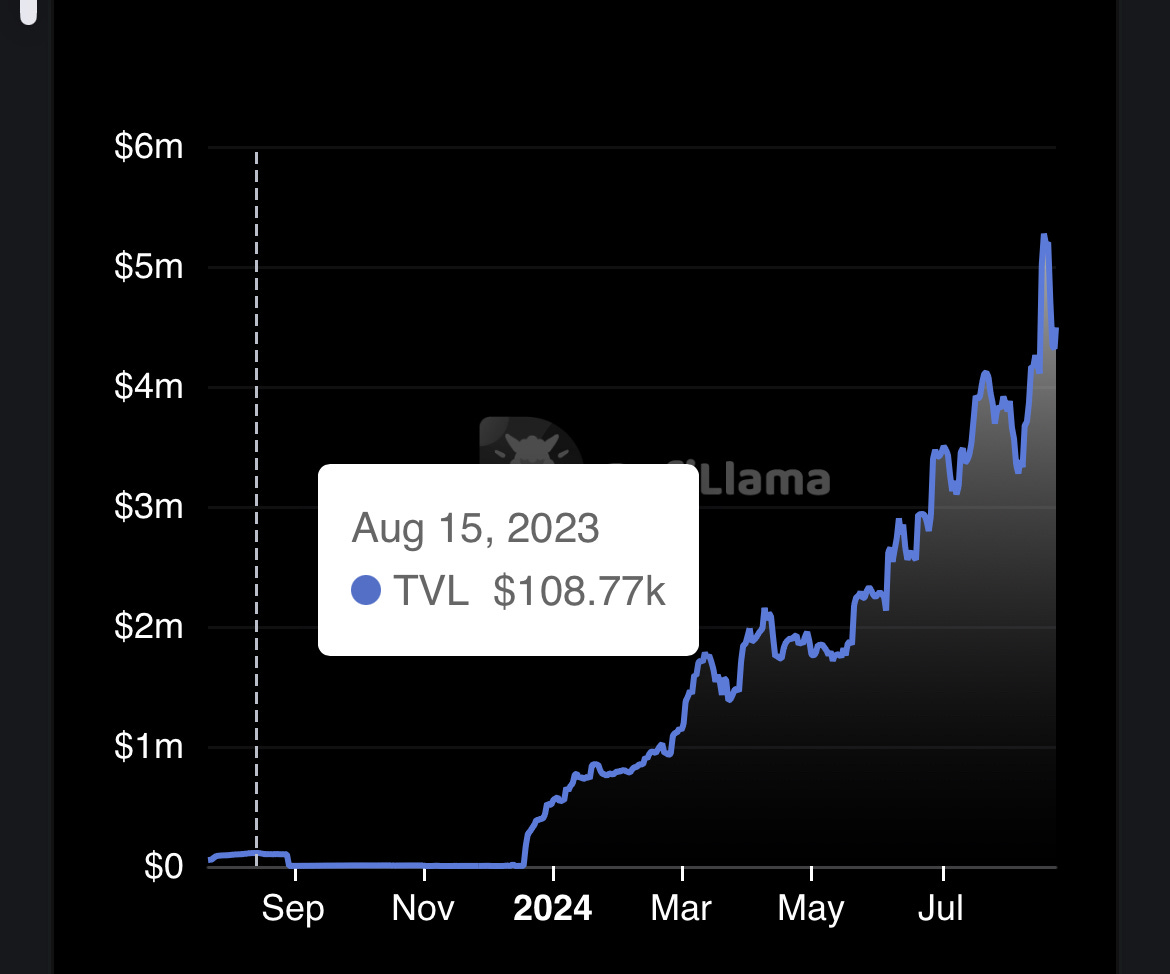

Everything works together to make Dyad the most capital-efficient stablecoin. Dyad has experienced significant growth, with TVL on an upward trajectory since launch.

You can currently earn over 80% APR by providing liquidity to the USDC-DYAD pair. Supported collateral includes $wstETH, $tBTC, and $sUSDe.

See below:

…

Okay.

That was it for today.

See you around, anon.

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

If you just want to follow my journey on Twitter, you can simply just follow as well :)

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads