An Overview Of Crypto Bridges

Okay, what are crypto bridges?

To ELI5 this (explain it to me like I am 5 years old), you could say that blockchain bridges work just like the bridges we know in the physical world.

Just as a physical bridge connects two physical locations, a blockchain bridge connects two blockchain ecosystems.

Bridges facilitate communication between blockchains through the transfer of information and assets.

We have a multichain crypto universe now.

In today’s newsletter, I want to look at some of the bridge projects out there and how to move your tokens across different blockchains.

🐸 Also, join my free Telegram channel here: Crypto Goodreads 🐸

An Overview Of Crypto Bridges

So many bridges out there right now, from the top of my head these are the biggest ones:

Stargate, Orbiter, Synapse, Bungee, Multichain, Lifi protocol, Rango, Layer Zero, Connext, Relay, Hop and Router protocol.

I’m sure I’ve forgotten some.

Let’s take a look at some of them.

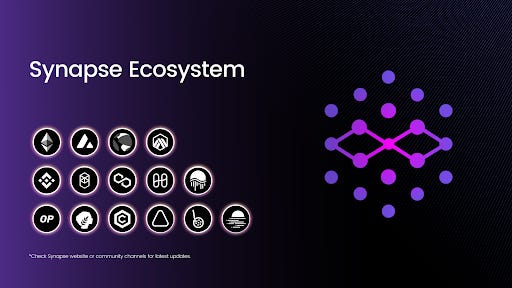

Synapse Protocol ($SYN)

Synapse is in essence a cross-chain liquidity protocol that offers its user base the ability to bridge assets between the various chains. In order to play the multi-chain narrative, it is best to familiarise yourselves with the many bridge options out there, and Synapse represents one of, if not, the most user-friendly bridges available. Based on data provided by DefiLlama, we note that Synapse currently has a TVL of 204m, which ranks this as a top 10 bridge across the whole ecosystem.

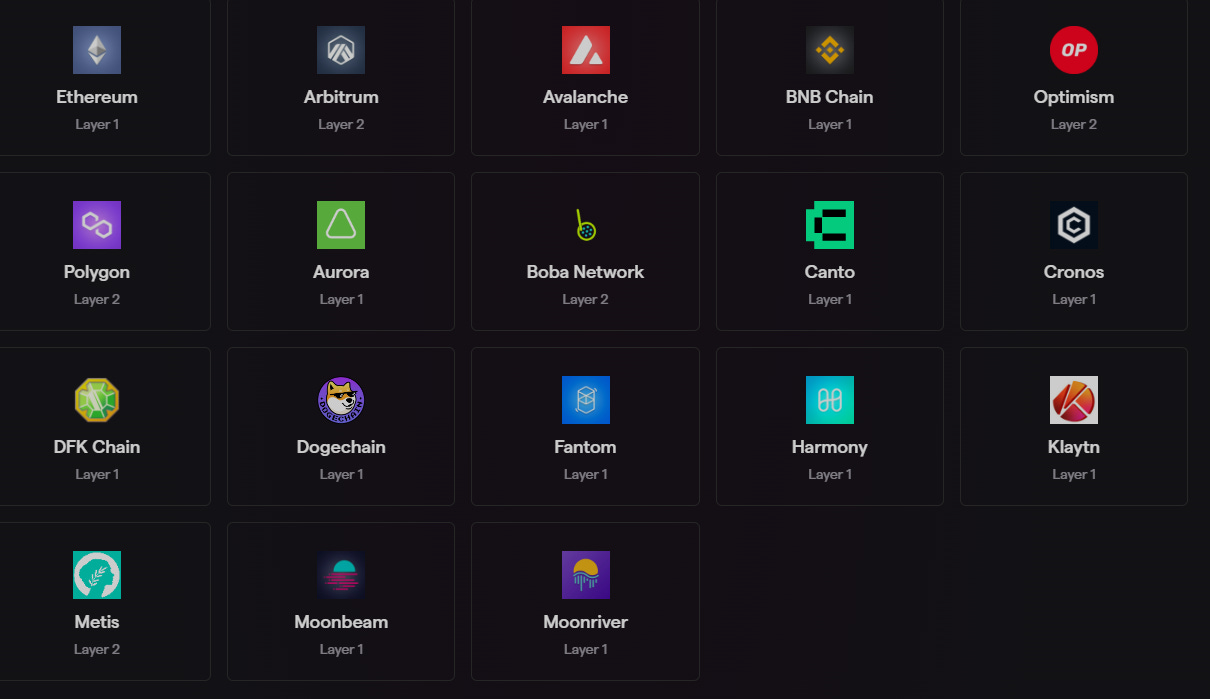

On Synapse you can bridge back and forth from all of these chains:

Synapse plans to launch their own chain: SynChain. Critics on crypto Twitter speculate based on price action and discord interactions, that the announcement is to be made in or around Eth Denver Feb 2023.

Given the L2 narrative and the large influx of unique wallets into L2 kings: Optimism and Arbitrum, we can deduce that Synapse is looking to position itself as the cheapest L2 roll-up by FDV, sitting at roughly 350m.

One thing to note about upcoming chains is that airdrops are a massive part of initial user acquisition - although speculative, rumors that there may be a Synapse airdrop for holders may be in play.

With the already approved single-sided staking being approved by Synapse in November, it would be no surprise if Synapse hops on board with the Real Yield narrative and eventually begins protocol revenue shares. Remember to always do your own research, and as usual, not financial advice!

Finally, we take a look at Synapse’s financials:

Mkt Cap: $247M

Price: $1.30

FDV: $325M

TVL: $204M

Long-term followers might remember that I did an introduction thread of Synapse almost 1 year ago. If you want to learn more about them, check out:

Connext

Connext is an interoperability Ethereum L2 solution. Previously they were known as xPollinate, and their main function is to facilitate the transfer of assets across blockchains and roll-ups.

Since launching in early February out of closed beta, Connext has seen immense growth in the month of February, with their weekly volume averaging $5.5M and weekly transactions peaking at around five thousand (5000) weekly.

One notable feature on Connext is that they rely on AMMs to price liquidity on each chain against an internal unit of accounts. According to crypto Twitter pepes, there is an excess of liquidity on Optimism and Arbitrum meaning users of Connext get positive slippage whilst bridging there! In layman's terms, Connext is literally paying you $ETH to bridge to the L2 kings!

Connext features an extremely quick and safe bridge, this is very ideal for your average crypto ape. They do this via a concept called active liquidity, to break it down it essentially means Connext’s router fronts the liquidity to the user on the destination chain (chain user is bridging to) only to be repaid by the protocol later on.

Connext effectively loans funds to awaiting users and then gets repaid by the protocol - this affects the latency of transactions. Overall Connext has an incredible product that is both innovative and promising. Will be looking forward to the developments by the Connext team.

Finally we take a look at Connext’s metrics:

TVL: $18.4M

Total Volume: $17.4M

Total Transfers: 20,221

These metrics are essentially only based on the month of February, we can deduce these to be monthly metrics. Will be worth re-visiting

https://connextscan.io/ in the future to check up on these metrics.

RelayChain ($RELAY)

Relay is a cross-chain bridge aggregator and its main purpose was to combat the fragmentation and the lack of interoperability between the various chains. The core product is a bridge, which aggregates the most efficient bridge for their users; to incentivize new users, Relay also has a lottery system in place for each time users use the bridge (up to $5,000 in lottery winnings). Relay aggregates liquidity and costs across five (5) bridges and with this data, they act as a price comparison site; they find the cheapest, quickest, most liquid route for their users to take in order to bridge.

Currently, Relay’s bridge supports 15 blockchains. Relay also features staking, which is mainly used to source liquidity for the protocol.

It seems that Relay has positioned itself to be a long-term project, their interesting vesting schedule for advisors, ensures short to mid-term support from their advisors. In simple terms, the unlocks are time-based: the first 10% (30 days), 15% (60 days), 25% (each quarter after). The team has partnered with a variety of large names within the web3 scene and is also the team originally behind the first DEX on Avalanche.

Finally, we take a look at RelayChain’s metrics:

TVL: $77M

Bridged Value: $1.03B

Total Transactions: 50,988

Mkt Cap: $4M

PS! Small mcap, be very careful if you decide to buy the token. Probably best to stay away tbh. Could go up or down a lot.

Stargate

Stargate is a protocol that has built the first fully composable native asset bridge. Stargate runs on the LayerZero cross-chain messaging technology, and is in fact the first dApp to be deployed using LayerZero. Stargate’s main differentiating factor when compared to other bridges lies in its implementation, which has been stated to be the first to solve the famous bridging trilemma, first coined by Vitalik.

While bridges are usually forced to give up on one of the three trilemma components (Instant Guaranteed Finality, Native Assets and Unified Liquidity), Stargate does not sacrifice any of these properties.

Stargate also uses an innovative pool balancing algorithm that incentivizes users to deposit in pools that are underweight (withdraw from pools that are overweight). This ensures that liquidity remains deep on chains supported by Stargate, giving users a better bridging experience via low slippage and price impact.

Stargate is backed by one of the best-capitalized teams in the space, LayerZero. LayerZero was so well capitalized in fact, that they bought back all tokens and equity relating to Stargate/LayerZero owned by Alameda post-FTX. This, therefore, clears the headwinds that many Alameda-backed projects have faced with regard to forced selling upon asset-recovery liquidations.

Stats:

Mcap: $176M

FDV: $1.065B

TVL: $480.1M

Fees: 176.46k (annualized)

P/E ratio: 490.93x

Hop Protocol

Hop Protocol is a scalable rollup-to-rollup general token bridge and DEX, providing users with the ability to transfer and send tokens from one rollup or sidechain to another, without having to wait for the network’s challenge period.

Hop Protocol is able to contribute towards a multichain future, by introducing market makers (or Bonders) to front liquidity at the destination chain in exchange for a small fee. The Bonder extends this credit in the form of hTokens, which are later exchanged for their equivalent native tokens in an AMM on the destination chain.

The hTokens were created to enable Hop Protocol to programmatically create and burn tokens in order to move them more quickly between chains, as well as to reduce the native exit time of any scaling solution and enable Bonders to deploy and use capital more effectively.

In order to ensure a safe bridging experience for users, Hop Protocol ensures on-chain guarantees that users will receive their funds even in the rare event that Bonders are offline. Increased on-chain guarantees ensure funds will not be able to be withdrawn by the Hop Bridge, with the trade-off of a slower user bridging experience if Bonders are offline.

Hop Protocol is able to compete against trustless bridges due to its security model, as other bridges may have to pay higher interest rates to attract liquidity compared to trustless bridges such as Hop Protocol. With this efficiency in mind, trustless bridges will then be able to offer lower bridging fees compared to centralized bridges.

Key Highlights (As of 1/3/2023):

-Market Cap: $13,135,651

-FDV: $201,000,502

-TVL: $79,733,768

Multichain (prev known as Anyswap)

Multichain is a web3 router that uses the SMPC network which supports almost 40 chains and over 1000 tokens.

There are 2 aspects to Multichain: The Bridge and the Router. The bridge works similarly to how other bridges work. An asset is deposited into the MPC smart contract on the source chain and the wrapped asset is minted on the target chain.

The reverse of this would be to deposit the wrapped assets into the smart contract to be burned in exchange for the assets on the original chain.

The router on the other hand enables any assets to be transferred between multiple chains, no matter if they are native or created with Multichain's Bridge.

Multichain’s token is $Multi and can be locked in exchange for veMulti NFT. The NFT gives governance rights for the protocol and will be able to initiate proposals as well as vote on them. In addition to the governance rights, the NFT can also earn yield.

As I mentioned in the intro, there are countless bridges, if you want to read about more of them, I recommend you to check out this thread:

But maybe the most important question:

Which bridge should you choose and in what occasion?

It really depends on where you want to go.

Personally, I often tend to end up on Multichain because it’s so insane many chains there, and I don’t have to think. But I’m not sure it is the best. Sometimes I’ve experienced it taking longer time than other bridges. The other day I used Connext and was very happy with the UI/UX and the speed.

I also like using the tool Find My Bridge

You just type in what chain you want to go from, and what chain you want to end up on. Find My Bridge will search through 55+ bridges and find the cheapest route for you.

Other than that, just try the different bridges out for yourself and I’m sure you’ll find a favorite. Always go through their webpage through their official Twitter site or CoinGecko. Do not search them up on Google as you risk entering a fake bridge.

Risk using bridges

The following text about risks is from the official Ethereum site, but I found it so good that I saw no point in writing it in my own words:

Bridges are in the early stages of development. It is likely that the optimal bridge design has not yet been discovered. Interacting with any type of bridge carries risk:

Smart Contract Risk — the risk of a bug in the code that can cause user funds to be lost

Technology Risk — software failure, buggy code, human error, spam, and malicious attacks can possibly disrupt user operations

Moreover, since trusted bridges add trust assumptions, they carry additional risks such as:

Censorship Risk — bridge operators can theoretically stop users from transferring their assets using the bridge

Custodial Risk — bridge operators can collude to steal the users’ funds

User's funds are at risk if:

there is a bug in the smart contract

the user makes an error

the underlying blockchain is hacked

the bridge operators have malicious intent in a trusted bridge

the bridge gets hacked

And you may wonder, have there been any hacks on bridges?

Unfortunately, yes.

BNB Bridge, Wormhole, and Harmony Bridge to mention some of the bigger ones. You can see the biggest hacks here: https://rekt.news/leaderboard/

I guess that’s it for today.

If you want more educational content you can always subscribe to my Telegram channel where I post the latest within crypto every single day:

Link to Telegram group: https://t.me/cryptogoodreads

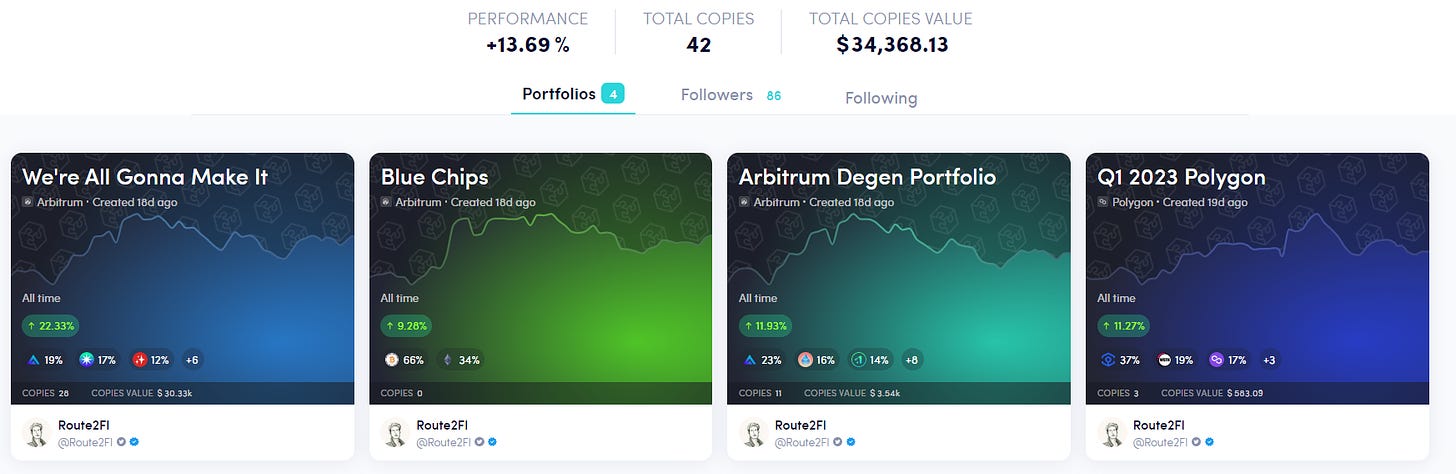

An update on my 4 portfolios ⚡️

I am tracking my portfolios with the help of the Chads at @NestedFi

I have 3 Arbitrum portfolios (click on the links to get directly to them).

We’re All Gonna Make It: My first portfolio is called “WAGMI” and is a portfolio that will perform better than $BTC during an uptrend.

Blue Chips: My second portfolio consists of $BTC and $ETH and is a “safer” portfolio with less volatility.

Arbitrum Degen Portfolio: My third Arbitrum portfolio is called the “Arbitrum Degen Portfolio” It consists of $VELA and $GRAIL (among others) which have done more than 60% in the last week alone + some other tokens to diversify

Q1 2023 Polygon: A portfolio consisting of $ANKR that just partnered with Microsoft, $MATIC (Polygon ZK EVM coming), Stader (ETH LSD staking narrative), $AVAX with upcoming web3 gaming narratives +++

.I’m usually updating my portfolio 1-2 times a month, but changes could occur more often/seldom depending on the market conditions. For example, if we get a new bearish pattern I might reallocate more into stablecoins.

You can head to Nested here and copy these portfolios with 1-click, or add your own portfolio

*I have entered into a long-term partnership with Nested.

Thank you for reading!

See you next week :)

Follow me @route2fi on Twitter for more threads and crypto content.

If you’re not subscribed to my newsletter yet, subscribe for free below:

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads