Hello, friends!

This is a timeless piece about money, health and time (one of my favorite subjects).

We are all looking to optimize this triangle, and especially us in crypto are trying to more or less escape the rat race by making enough money in quite a short time.

But before we start, today’s newsletter is sponsored by NAV Finance.

NAV Finance is a regulated crypto hedge fund.

The opportunity to deposit into their Structured Investment Products (yield farming, restaking, and directional trading) is closing today.

The projected APR is over 60% for all SIPs!

On top of that, you earn NAV points, which are redeemable for $NAV tokens for airdrop (soon).

They're running a 3x point bonus campaign until June 25th, which means you get way more airdrop points than usual.

NAV has already hit $6,000,000 in AUM (Assets Under Management).

To join the first Epoch on July 1st, you need to make your deposits today and enter the exclusive code for my X fam: ROUTE2FI

Go to: nav.finance and deposit today.

Balancing health, money, and time through your life as a crypto degen

We have discussed this earlier…but what would you do if you had 10+ million dollars sitting in your crypto wallets or your bank account on your deathbed?

An average person has a lifespan of 70-80 years. It might sound quite long, but in practice, how much of the 70-80 years can we truly use?

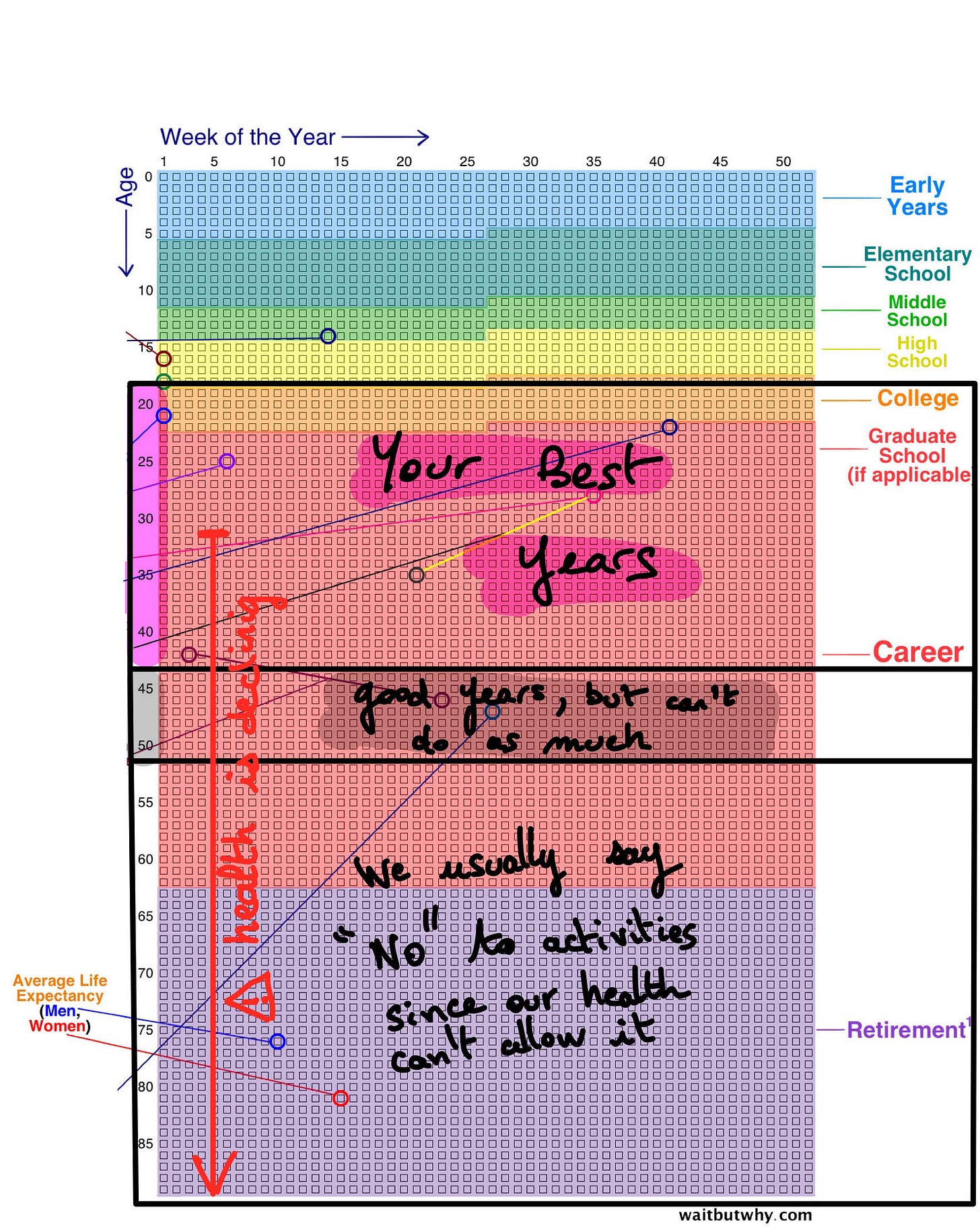

The below figure describes the typical lifespan of the average person. I don’t know if it’s just me, but I am getting a little sad looking at it. On the horizontal line, there are boxes for every week passing, and one vertical line equals 1 year.

In this essay, I'll discuss the three concepts that, in my opinion, are essential to keep in mind in order to maximize our lives: Money, Time, and Health.

As we age, all three either rise or fall.

Most of us concentrate on the financial side exclusively or too much. We work all day long for this reason. All too frequently, free time and health are overlooked.

We believe that the money we earn, while we are young, will help us feel fulfilled when we are retired and have lots of leisure time.

In actuality, our civilization is built upon that chronology. Is this, however, the way we ought to live? What happens if you don't have the required health to travel once you retire? What happens if something goes wrong tomorrow?

Your most valuable and limited resource is time

An average life timeline for someone looks like this:

-When you are under 25 years old you are attending school and spend a lot of time hanging out with pals. Our state of health is perfect. However, we typically lack money and rely on our parents' wealth.

-When you are above 25, you start working and earning money. Nowadays, much of our time is consumed by our jobs. We still strive to maintain a healthy lifestyle by balancing work and activities. But for many, this is easier said than done. Stressful work, getting kids, and more responsibilities can take a toll on your health and freedom.

-40 years old: You may begin to experience knee or lower back problems due to bad seating positions, too much time at work. Some are getting obese. However, you keep earning money, and the majority of our attention is still focused on our jobs.

-50 years old: You keep saving money after the age of fifty and begin to consider retirement. You are aware, though, that your body isn't as fantastic as it was in your 20s.

-65 years old: You retired (ideally) with plenty of money at age 65. You now have plenty of free time to engage in any activity you want. But your health has deteriorated dramatically, and you may not be as motivated to travel or engage in other activities.

The time and energy we have when we are "awake" and able to do tasks is called "Life Energy" in the book "Die With Zero."

The thing with time and energy is that it's just available in restricted quantities. Essentially, the question is: How do you use that time/energy? Is this life energy the same regardless of our age?

In my humble view, the best years of our lives are between the ages of 18 and 40. Our state of health is ideal, and we also begin to make money, which we can then spend for any kind of activities we choose.

But as we get older, our health deteriorates, and we begin to see its negative consequences in our 40s (some would argue 30s). We begin declining requests due to [knees, back, bones, etc.] issues.

The “best years of our life”, when our health is at its peak, and we can start to use our money, are from 18 to 40, so let’s say 22 years.

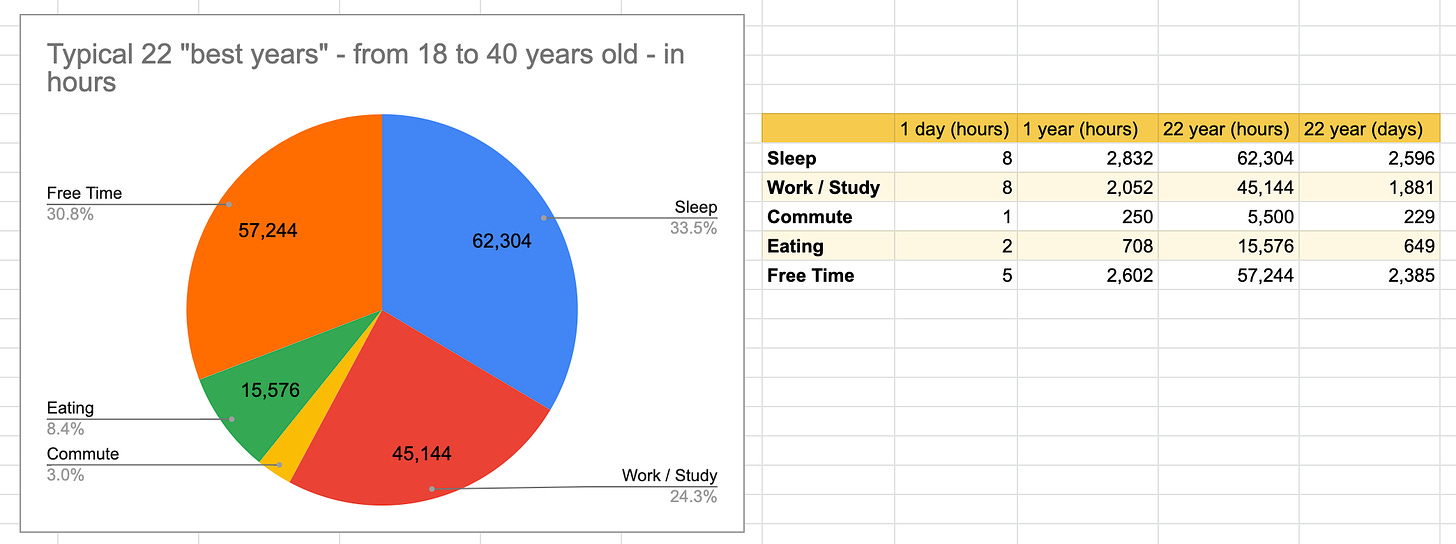

For someone with a 9-5 job (or study), this is how time is split during those 22 years:

62,000 hours (33%) of our time between 18 to 40 is spent in bed. 50,000 hours (27%) is spent working and commuting.

That leaves us with 57,000 hours when we could experience the world or master our preferred skills at our “maximum” potential.

Our free time is limited. Think twice before saying “no”, to delay an activity because of “saving” for the future when you probably can’t do it. Think even more when you work overtime. No one ever said “I wish I worked more” on their deathbed.

There is a balance between money, health and time and no one can tell you what’s your ideal mix between them. Many of us in crypto are trying to save/invest lots of money fast, so that we can take back our time and spend it exactly as we wish.

For many of us though this can become too intensive. Actually way more intensive than our 9-5. Because crypto never sleeps. There is always a trade to take, a protocol to ape, or a skill to learn. As a person myself that easily have a tendency for working too much, I know how it is to be burnt out.

Check this thread I wrote 2 years ago if you want to learn more about how to handle it, and to read my experience about this:

Thread: https://x.com/Route2FI/status/1505574370864885763

The (sad) truth in today’s society is that money is needed to contribute to your happiness. Even though some might argue that money doesn’t make you happy, it definitely contributes to happiness, to fund a pleasant, engaging, and meaningful life:

Financial independence retirement early aka. the art of saving too much

You’ve probably seen me writing about this subject a lot on Twitter before, after all my profile is Route2FI (Route to financial independence).

Most people working think about making money to save for retirement. When time comes, that money will be used for enjoying life and they’ll have more free time. There also exists now many F.I.R.E (early retirement) gurus that keep talking about living frugally to a point where you sacrifice social life, family, and friends (while I didn’t sacrifice this myself, there was a point in my journey where I felt that I wasn’t frugal enough, and this was quite conflicting). Now that I am out of the FIRE journey I must say I’d rather think more out of an abundance mindset rather than the FIRE mindset (which is a really limited mindset where you think you’ll not be able to earn money ever again. Actually you become quite lazy from it, taking few risks. The thing is, if you believe you will make more money, you will also start to attract it. Rather than skipping expensive activities with friends, or avoiding spending money on fun things will omit you from potential opportunities. Eg. business relations later on.

It is true that investing from an early age will make a difference in the amount of money you’ll end up with in 30+ years, but who guarantees you that you’ll live until then?

Even if you reach that stage, what will you do with millions of dollars saved/invested when you will lay on your deathbed? No one died saying “I wish I had more money”.

Will your physical condition at 50+ years old allow you to do the same type of activities as in your 30s?

Money exists to be spent. You’ll never regret spending money on experiences or things that can create memories. They add a lot into fulfilling your life and shape the way we are:

It is also true that we don’t necessarily need money to make memories. When you’re under 25, you’re incredibly good at finding ways to do fun things for free. But the more we move in our age, the more we can unlock some of the experiences that can be accessed with money. You’ll get the most benefit of it the earlier you spend it. One of the benefits of spending it early is those activities is they keep yielding dividends continuously and indefinitely because we keep thinking and talking about them:

As mentioned earlier, we spend 1/3 of our “career stage” at work, and we do this mainly for money. The longer we work, the more skills we get, so the more money we make.

However, our best years also happen during that career phase, and this is when we can get the most out of the experiences that will inevitably compound in time.

Do you want to spend all of your career phase and miss out on all the experiences you can get when you’re young and healthy?

There exist some solutions to better optimize your time during that phase, such as starting your own company, making it in crypto, stocks, trading, early retirement, getting better paychecks, or working for companies with 4 4-day work week to optimize life/health balance.

Saving too little

But…you also don’t want to end up old and poor. There is also a balance to find between spending money and saving money. There is a limit on where you should spend your money, and everyone has a different limit depending on their income.

Generally speaking, spending your money every year on the latest iPhone, defaulting to 5-star hotel, or business class tickets isn’t the best use of your money IMO. Unless occasionally, they won’t bring you much value in your life (except for external validation). This is where I usually start saying no, and invest that extra money for my future self. Find your balance between investing your money for the future, and spending on what matters (memories) in the present.

Optimize your Health

I’ve got my $10 million, but I’d give it back if I could be 25 years old again

Health inevitably declines with age, and we can’t do anything about it (yet). Energy also decreases with our age. It doesn’t mean we should fatally see it decrease without doing anything. We can’t buy more time with money, but we can slow down our declining health. Would you prefer having health issues, being overweight with low energy in your 50-60s? Or would you rather feel great, have enough energy to travel the world and still experience new things?

It is never too late to invest in your health. The time you’re spending (investing) into health will help your future self to get more of those delightful experiences that will make you more of those invaluable memories.

Start checking out Bryan Johnson’s Blueprint. This is a guy that does everything he can to live longer and to reduce his age (while this is not possible physically, he is trying to set back his organs and metabolic rate to a younger age). He recommends a lot of supplements and routines. I am implementing some of them myself.

His Twitter: https://x.com/bryan_johnson

And check this Blueprint out (every supplement he takes and every routine he follows:

https://protocol.bryanjohnson.com/

More about health another time.

…

That’s it for today, anon!

Hope you enjoyed this piece.

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

If you just want to follow my journey on Twitter, you can simply just follow as well :)

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads