Hey, friends!

New day, new FUD.

Will we see massive positive inflow into the ETF’s again soon?

Today’s newsletter is a look into crypto DePIN coins. Enjoy ;)

If you want to start trading crypto in the new year, use my ref link on Bybit:

https://partner.bybit.com/b/route2fi

You get lower fees, a bonus of up to $30,000, and are able to join my trading group.

I have a trading group only for my affiliates where I share my own trades + the ones from people much smarter than me once they share in their private TG/Discord.

Also, I will arrange a trader contest in cooperation with Bybit starting this week where PnL % is what matters, so even small traders have a chance to win the money prizes + an iPhone.

Once you've signed up on the ref link —> go here to join my private trading group: t.me/route2fiibot

Today’s newsletter is sponsored by TaoPad

TaoPad is a project leveraging Bittensor's network to build DeFi for $TAO and has built the first Bittensor-focused launchpad. TaoPad has already built a bridge for $wTAO, TaoBank and will incubate BioTensor in the future.

TaoPad already has partnerships with big DeFi protocols such as Layer Zero and Camelot.

Here are some TaoPad features:

● TaoBridge: TaoPad will enable $wTao to be breached to from Ethereum mainnet to Arbitrum.

● Launchpad for projects building within the Bittensor ecosystem.

● The first project that launched on TaoPad is TaoBank, a protocol that accepts $wTAO as collateral and provides immediate liquidity to the asset holders while allowing them to retain ownership of their $wTAO.

● Holding more TPAD tokens results in increased discounts and rewards, following a linear tier system by design. E.g holding 1000 TPAD or more gives people access to earliest rounds of a sale. ○ Earn $WTAO rewards.

You can buy TaoPad tokens here

And also read more about the project on their website here: https://www.taopad.io/

DePIN - A New Paradigm in Crypto

In the last newsletter, we talked about the AI sector that has high potential for upside in this bull market. Another sector that I’m bullish on and have some overlap with the AI narrative is DePIN.

DePIN is another sector that has been performing well while still having room for growth in the future. On CoinGecko, the DePIN category saw a 35% increase in market cap across that sector demonstrating its strength.

In today’s newsletter issue, I want to share my thoughts on this sector and also some interesting projects that caught my attention.

So what exactly is DePIN? DePIN - a term coined by Messari which is short for Decentralized Physical Infrastructure Networks describes networks which pool and provide services or resources for users, ultimately matching the supply and demand of the particular resource.

It is a very broad category and can be split into physical infra networks and digital resource networks. Within these 2 categories are sectors such as storage, compute, AI, wireless networks, imagery and mapping etc.

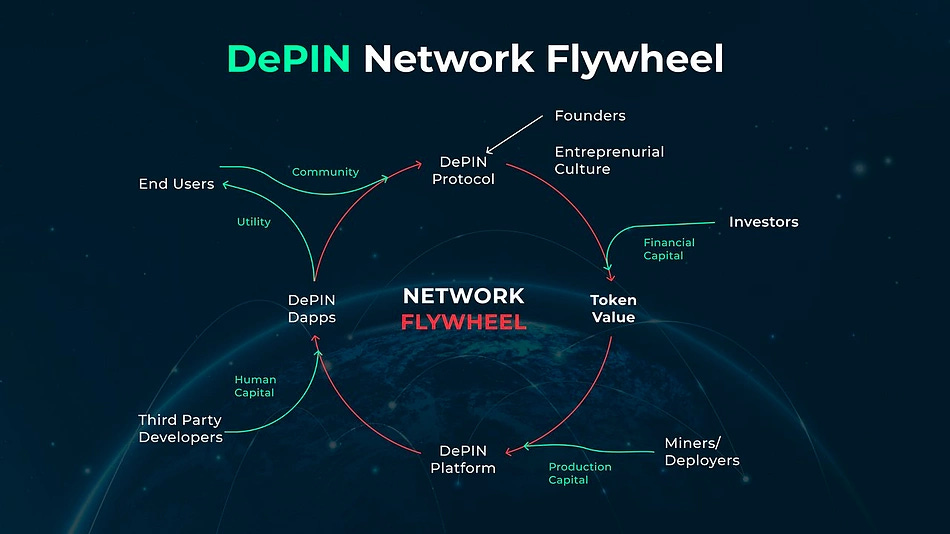

DePIN protocols leverage on token incentives to reward and incentivize users to contribute and provide value to the overall network.

DePIN protocols are advantageous in a few different aspects:

Resource efficiency: Providers with underutilized resources can “rent out” the resource to other consumers ensuring that idle resources are not wasted

Lower barrier of entry. DePIN effectively lowers the barrier of entry to access certain resources. Imagine requiring to use certain GPUs for a task that is not easily obtainable in the open market, users can easily “rent” the compute power from the suitable providers rather than having to worry about buying the component.

Decentralisation. Users of a service do not have to worry about a centralised entity experiencing downtime which affects the end user as a whole.

Now that we covered briefly what DePIN actually is, let’s cover some DePIN projects and what they are doing that is interesting for the ecosystem as a whole.

Why do we need DePIN?

According to CoinGecko, DePIN allows facilities to grow their capability in a more flexible manner. Networks can increase resources instead of increasing the capacity of each resource. This allows a good level of flexibility and facilities built using this system can easily scale in and out depending on the demand. The blockchain can control the available resources and ration demands.

In a low-demand scenario, certain providers could experience a lower workload. In high-demand scenarios, the network can re-activate dormant resources adding more instances and increasing the overall network capacity without any shifts. Depending on the available dormant resources and rationing system of the DePIN, systems like this can scale infinitely.

DePIN, like DeFi, is decentralizing infrastructural systems, moving from corporations to a collective of individuals committing their resources to build a facility. This system distributes the facility’s control to the different providers – this is similar to miners in a PoW network.

DePINs are a sort of industrial DAO where everyone in the system contributes resources and has control relative to their capacity. In a system where every provider has equal capacity, the DePIN becomes an (almost) perfectly decentralized system.

DePIN pricing models are relatively different from the traditional facilities. Factors that contribute to the pricing model include the cost incurred by the private providers to run their individual facilities and other network-related factors. Additional charges from the platform could be lesser as the platform itself incurs no cost to provide these facilities.

Overall, the pricing model of DePINs is expected to be cheaper, with the expectation that the pricing will be fair as it considers basic factors without unfair price bloating which is usually associated with facilities operated by centralized institutions. For a system powered by people, DePINs are also more likely to consider affordability in their pricing model than corporations.

The DePI network spends little or no cost to bring the network to life; the providers have a good level of flexibility as regards the services they provide. For instance, a provider can commit their facility to multiple networks. Users also pay a fair price for the services they obtain from the network. DePINs are designed to deliver the best possible service for the least possible cost, offering a cost-efficient system.

Anyone can contribute their resources to a DePIN. On the user side, anyone can also obtain the services offered by a DePIN. There is no bargaining around price or user screening for each of these. Once a provider has the required infrastructure, they can run a provider-side account on a DePIN, just like anyone can deploy a liquidity pool on a DEX or obtain a loan from a money market without hassles.

Incentivization is a great tool for DePINs. For the providers, they offer a passive or active income opportunity depending on how the DePIN operates. Individuals can also build an income stream primarily from DePINs. Projects like Nunet hope to reduce the amount of dormant computing resources through its AI-powered marketplace for computing power. Providers earn an income from their facilities which originally would be lying dormant.

Okay, now that we know what DePIN is, let’s look at some of my favorite DePIN projects:

Filecoin ($FIL)

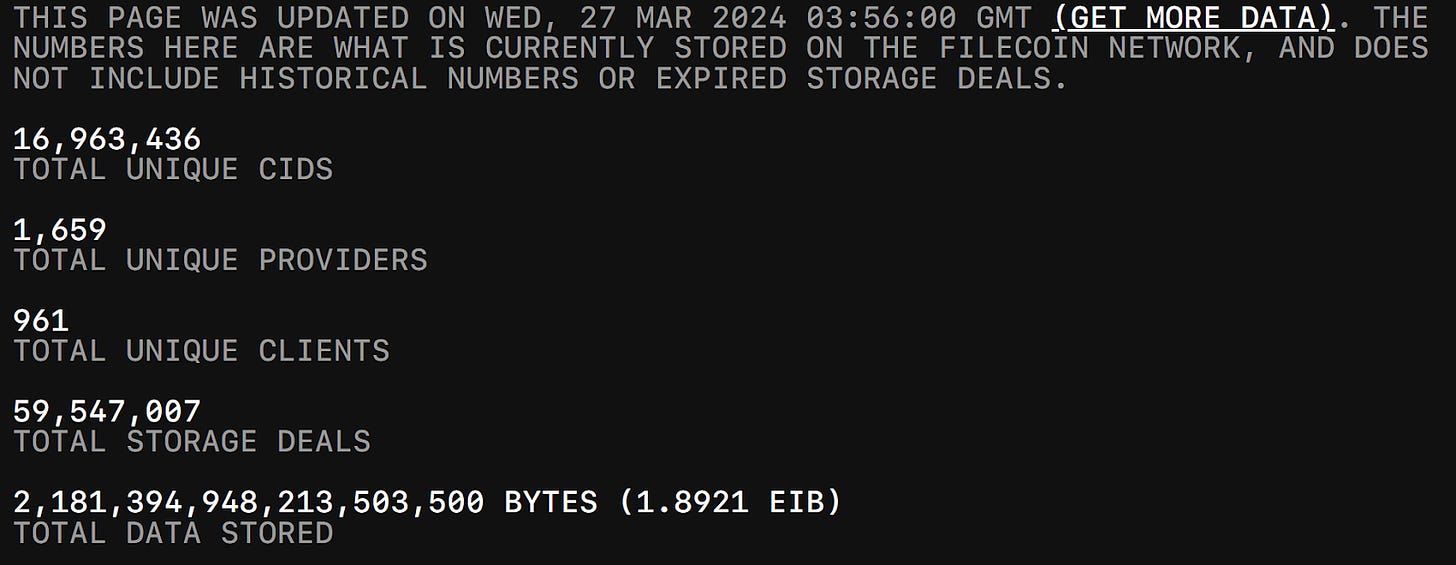

Filecoin is widely known as a decentralized storage layer allowing anyone to store their data in a decentralized manner (also known as the “Dropbox” of Web3). It is built on top of the InterPlanetary File System (IPFS) incentivizing the data storage providers to ensure that the data is stored safely and is retrievableFilecoin facilitates an open-market for anyone who wants to store their files or get paid for storing other users’ files. Filecoin is already being actively used by users, this is a snapshot for the data that is currently stored on Filecoin:

Additionally, the Filecoin Blockchain supports smart contracts via the Filecoin Virtual Machine (FVM) that was introduced on March 14 2023. The FVM allows smart contracts to be deployed on the Filecoin network similar to smart contracts on Ethereum. With the FVM, computational logic conditions can be paired with the traditional Filecoin storage and retrievals which unlocks many potential use cases.

Filecoin is currently still the market leader when it comes to long term data storage. When paired with its innovations, Filecoin still remains to be a strong player within the Decentralized Storage sector.

Helium ($HNT)

Helium is a decentralized wireless infrastructure network powered by Solana. It started as an IoT network using the Low Range Wide Area Network (LoRaWAN) protocol to provide connectivity to IoT devices. This then expanded to 5G hotspots where the Helium 5G network is powered by user operated nodes. Node operators are compensated in tokens for providing resources to the network.

An interesting real-world use case for Helium is Helium Mobile - a network provider in the US which utilizes Helium nodes whenever available. Whenever there is a Helium node within range, the mobile network will utilize those Helium nodes.

Shadow Token ($SHDW)

Shadow Token by GenesysGo, often referred to as the ‘Filecoin of Solana’, is a cloud storage platform which aims to decentralize the traditional cloud storage stack. shdwDrive achieves this via DAGGER - the core of shdwDrive’s distributed ledger technology allowing them to reduce the cost of enterprise-grade data center storage.

Combining DAGGER’s consensus and Solana’s execution environment, shdwDrive becomes a powerful cloud service platform which paves way to a suite of file storage applications.

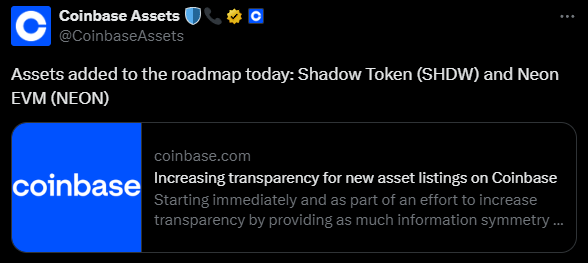

Shadow Token already has its own native token - $SHDW which currently sits at around $378.5m FDV. An upcoming catalyst for this token is the anticipated Coinbase listing that was just announced recently. Currently, users can only buy this token on-chain on Solana, however, you can expect more retail flows into this token once it is made available on a Centralized Exchange.

Upon this news, the price of $SHDW is up about 55% in the past 24 hours and went as high as $2.49 from $1.35

Aethir ($ATH)

Aethir Cloud is a new cloud computing protocol that entered the market and will be the new competitor to current decentralized compute giants such as Render and Akash. Aethir serves as a decentralized platform that acts as an aggregator for computational processing power. Aethir connects providers of this computing power to users and consumers who require the usage of GPU hardware for different applications such as AI, ML, and cloud gaming.

The Aethir network is comprised of 3 components:

Containers

Checkers

Indexers

A brief rundown of these components:

Containers are the virtual endpoint where the actual work for executing and rendering. Workload from the local device is shifted to the container to offer users a “zero lag” experience

Checkers can be seen as the “referees” overseeing the Containers to ensure quality of services provided by the network

Indexers are the matches that match suitable Containers to consumers based on their requests, aiming to deliver services in the shortest time possible

Aethir Cloud is backed by notable investors such as Maelstrom, Mirana Ventures and Animoca Brands. They also have also raised a substantial amount in their latest pre-Series A round raising over $9m at a $150m valuation. Additionally, Aethir held a Node sale for their Checker Nodes and raised over 26.8k ETH.

Grass

Grass is a Layer 2 data rollup which utilises web scraping nodes to obtain AI training data from different websites for builders to access. Grass has recently garnered a lot of attention as users are running the Grass application and becoming a Grass Node in anticipation of an airdrop.

How does Grass work? Devices around the world host a network of nodes that scrape and process web data. This data is then refined into structured datasets which can be used for AI training

What issue do they solve? Data and algorithms behind AI applications are usually block boxed and users will have no idea how the AI model arrives at certain conclusions. This lack of data transparency means that AI models can potentially be trained with bad data or cherry picked data whether intentionally or unintentionally

How does Grass solve the above issue? This is where the Layer 2 Data Rollup steps in. With the Layer 2 Data Rollup, every bit of data scraped by Grass Nodes is recorded to verify the website that it is scraped from. This metadata will be stored in the datasets giving confidence in the data’s accuracy. Due to the large amount of data that is required, a large amount of throughput is required which is why the L2 will be using a ZK processor for batched validation. Here is a breakdown of the Grass network architecture:

Grass is still currently running their points program for users who are running nodes while speculating on an airdrop. Grass just had their most recent raise on December 20 where they raised $3.5m in their seed round led by notable investors such as Polychain Capital and Tribe Capital.

…

I hope I gave you a little sneak peak into DePin.

You can check out all DePIN coins here:

https://www.coingecko.com/en/categories/depin

That’s it for today!

Happy trading and good luck with buying all the dips in 2024!

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads