Gm, frens.

New week, new red candles.

Starting to become so tiresome. Bad news only. No one wants to buy our coins. Only the 10 degens left are buying.

Luckily it’s just 185 days left to the Bitcoin halving. At least that should be bullish, right?

Right? …

Before we start, I have been doing a lot of sports betting lately.

If you’re interested in that yourself, join my free Telegram group with 769 based degens to get a free money bonus so that you can try out SX Bet yourself:

Free Telegram group: https://t.me/bettingbr0s

Today I wanted to take an extra look on airdrop strategies and the long-term effects they got for DeFi protocols. Basically I am trying to answer if airdrops and liqudity mining are worth it seen with the eyes of an protocol.

As always I am trying to write my articles in an easy way, so you don’t have to be a giga brain to follow my resonating here.

Okay, let’s go!

How effective are airdrops for DeFi protocols in order to keep their users long-term?

Friends, today I want to explore token distribution mechanisms protocols use in the crypto scene; oftentimes we see protocols use either or both of these mechanisms: airdrops and liquidity mining.

What these mechanisms are and their effectiveness in growth/user retention? Well, that’s what this week’s newsletter is all about!

I’ll briefly touch on liquidity mining, but the focus will be on airdrops.

Read on, I’ve got you covered!

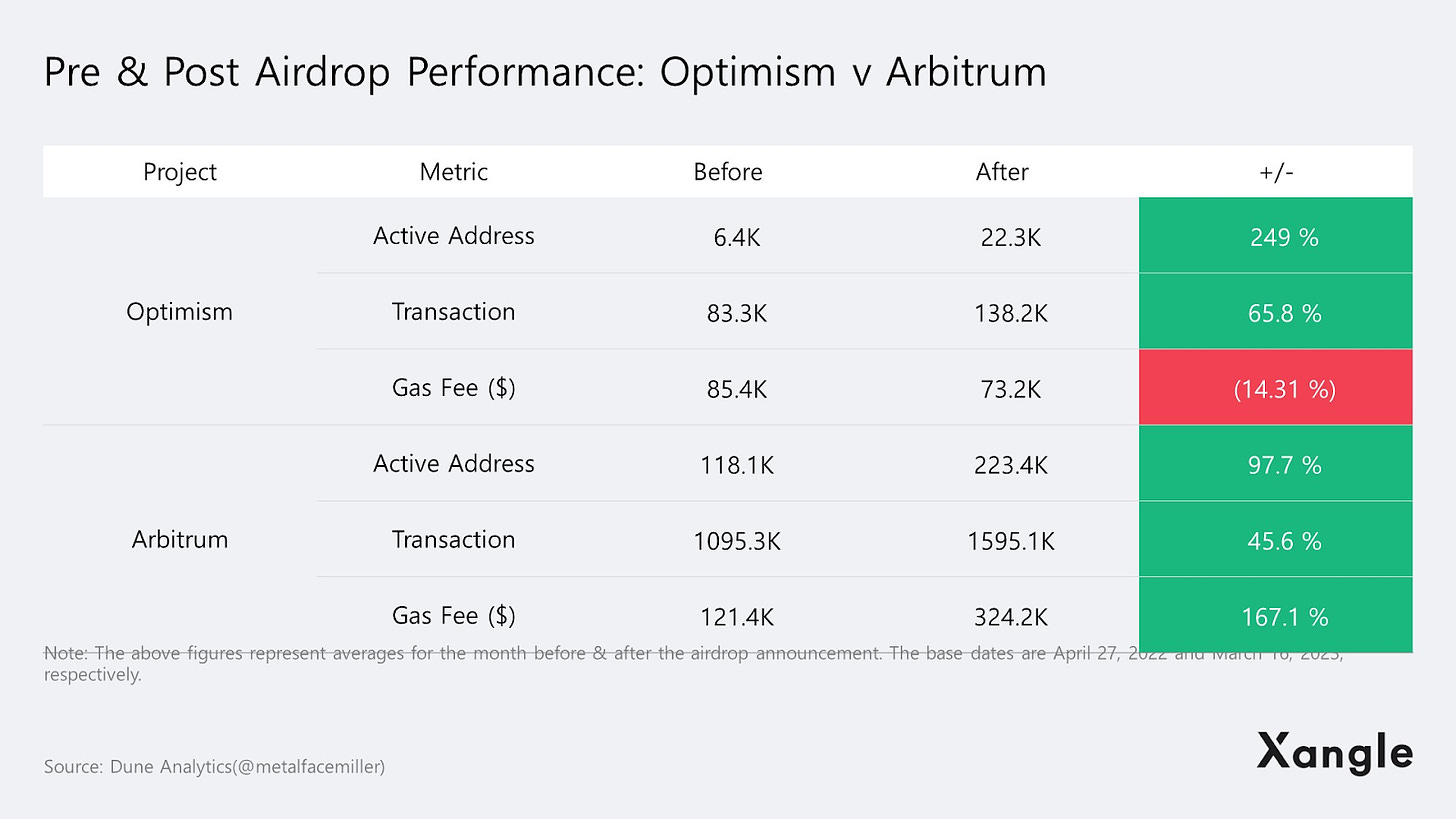

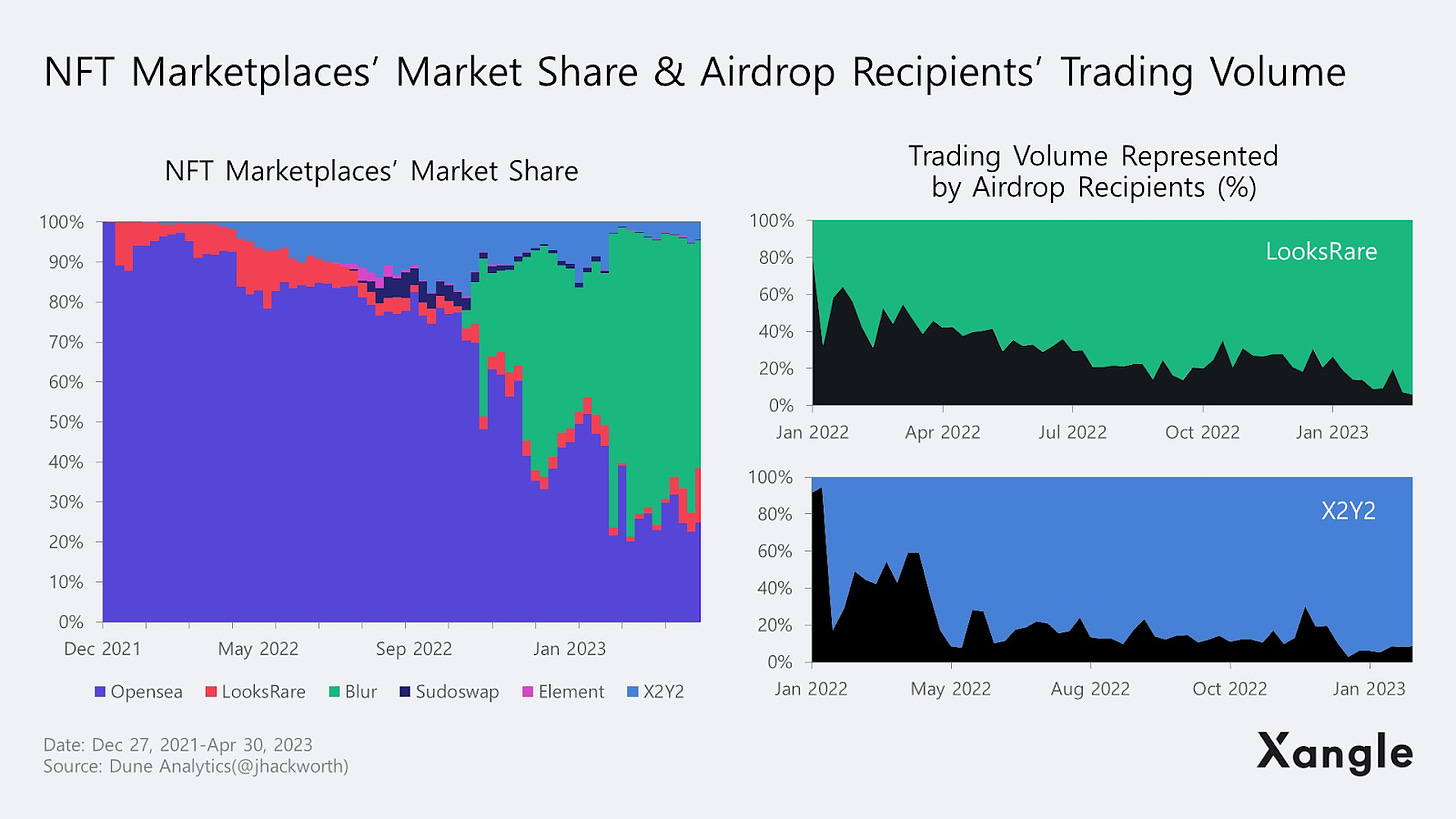

Image 1: Xangle

Airdrops and liquidity mining are two of the most common mechanisms used by protocols for user growth however they both have differing aspect focuses.

Ultimately, the objective of airdrops is to first obtain active users and to encourage these users to use the product as much as possible. From image 1, we identify the metric changes in Optimism and Arbitrum pre and post-airdrop.

To no surprise, all important metrics of these L2s increased tremendously, however, how well did they do on retention? We’ll dive into that later on. As for liquidity mining, this is primarily used by DEXs to enhance the liquidity of pools.

I spoke to a couple of CT frens about airdrop strategies and its retention for protocols - what sort of things they wanted out of an airdrop, and a common answer I got was the free money, the ability to literally have money from the sky. I also further did research into this and here are my findings: airdrop strategies can ultimately impact the final user retention rate of protocols, initial strategies made by early protocols were simple and had low user retention.

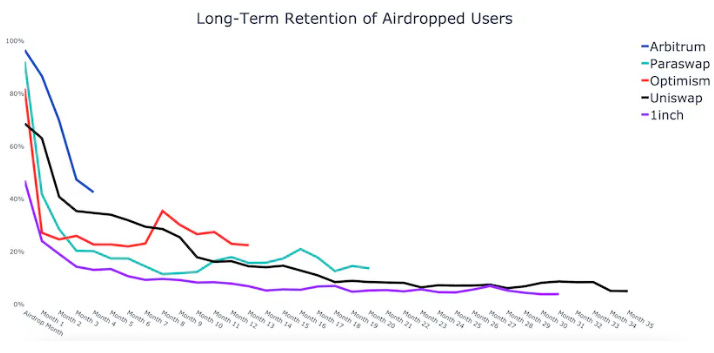

However, as time went on, we saw protocols such as Arbitrum, Optimism, 1inch, Paraswap, and more come up with optimized airdrop strategies, which of course resulted in higher user retention. According to data I found, almost all airdrops saw little to no user retention in the first 4 months and somewhat stabilize after four strong ones, but this is not the case for lower-quality airdrops. Generally, data suggests that a strong retention rate would be anywhere above twenty percent (20%) after the first 4 months, and twelve to fifteen percent (12-15%) after 1 year.

I have reason to believe that protocols are indeed aware that most airdropped tokens are not held by users long-term. Almost all protocols have a token retention rate of lower than twenty percent (20%), and varying strategies are able to prevent token retention rates from dropping over a long time perpetually, a perfect example of this is the recent second and third Optimism airdrop. Below is a chart I found that outlined the retention of airdropped addresses:

Image 2: CT

Based on the graph, we note that 1inch had the worst performance amongst the other protocols, we conclude this to be a non-successful airdrop, as it failed to result in long-term retention. One thing to note would be the timings of airdrops, and given that crypto is a large attention economy, of course, the attention of the general CT user is extremely important. Based on some factors I considered, for the purpose of this feature, when retention rate is used, it would mean the amount of tokens held by addresses who claimed their airdrops / total amount of tokens claimed.

Long-term, retention rates of addresses who received airdrops of any kind eventually gradually decrease to eventually below twenty percent (20%) - this decrease in tokens being held by claimers does not necessarily mean a selling of the token, various factors can be considered: did they send it to a sub-wallet? Were the tokens staked?

Well, it’s impossible to consider all these factors so the general decrease in retention rate would just be accounted for tokens moving out of the addresses. Going back to what was mentioned above, Optimism’s subsequent airdrops saw a higher retention rate than the first, the reasoning? Well, it’s simple, they required users to be active on a variety of on-chain “quests” in order to be eligible for the airdrops, which bolster the main objective of airdrops: user retention and protocol growth. As such we consider an airdrop like this a success. This also means that addresses eligible for rounds 2 and 3 of Optimism’s airdrop were more “suitable” users and the tokens were distributed effectively.

This created a question for myself that I had to answer - is it better for protocols to have one major airdrop or to have multiple micro-airdrops that incentivize on-chain activity on those protocols? Which of these had a higher retention rate along with protocol growth efficiency?

With regards to any marketing campaign, airdrops seem to be considered one of, if not, the most powerful user acquisition tool, and failure to seize such an opportunity may result in loss of growth momentum.

We have seen protocols such as Arbitrum use one major airdrop to obtain a higher user base, but evidently, the retention was not there. So we previously defined Optimism to have a successful strategy with micro-airdrops, and another protocol that was “new” to the sector they entered was Blur.

Prior to Blur coming into the scene, the NFT market share was mainly on OpenSea - in October 2022, Blur’s explosive airdrop strategy helped them overtake OpenSea in market share on trading volume metrics. Blur, much like Optimism also implemented micro-airdrops based on a variety of factors, utilizing uncertainty as a motivation, this caused speculation on eligibility criteria - which in turn created speculation amongst influencers on CT to generate heavy attention on Blur.

Strategies adopted by protocols using micro-airdrops incentivize users to use the protocols and further down the line, there would be a “useful” user base on those protocols. This allows me to come to the conclusion that micro-airdrops are in fact more efficient in terms of growth and retention.

Over the course of this newsletter, I spoke of the decline in retention rates, evidently, there is a huge risk with hosting airdrop distributions - the most prominent risk would be loss of momentum. It is common for protocols to generate attention in the lead-up to their token launch/airdrops, and despite the generic upside airdrops may provide to protocols and their growths, failing to capitalize on the opportunity results in a loss of momentum.

Airdrops are a form of token distribution out of thin air, projects rush into them, focusing on their benefits too much to ensure that they have bootstrapped growth. It is common to see protocols issue an airdrop only to quickly collapse after the event due to poor retention methods and creating consumer loyalty.

Protocols often experience a large influx of traffic and transactional volume between the time they go live, and the time the airdrop is expected to come out, why? Well, this is likely due to market expectations only to then later lose favor in the protocol after the token airdrop. This is also evident from the above segments about retention rates.

According to Xangle, NFT marketplaces are a perfect example of this rise and fall.

Airdrops are often “one-off” events - they happen once for participants and the protocols themselves, however as discussed above I think multiple micro-airdrops benefit a project more than one major drop. Protocols such as Optimism and Blur have been the pioneers of micro-airdrops, introducing retroactive disbursements to addresses that are active on their respective ecosystems post-airdrop (active after the first major airdrop). This methodology combats this risk of loss of momentum to some extent - instead of tokens being distributed at once, it is done in batches, which also provides sustained motivation and expectations to the participants. This works especially well when the first airdrop goes well.

The second largest risk would be your airdrop hunters. This is a double-edged sword for protocols, oftentimes we see protocols announce an airdrop with the hopes that engagement farmers on CT will want to start tweeting about it for engagement. This is the good part for protocols, we see an increase in organic engagement and tweets, however, would this actually be beneficial to the protocol?

A portion of the supply is allocated to airdrops, with airdrop hype and attention growing, there are bound to be people wanting to fully capitalize on this opportunity, leading to airdrop farmers. These individuals identify popular projects with confirmed/speculated airdrops and farm as many wallets as possible to become eligible for token distributions. With larger projects, especially those with high potential, these are often easy targets for these farmers. This creates a massive risk for protocols, as a heavily diluted token distribution may also lead to a large dump, given that these farmers are in it solely for the money - they provide little to no help to the growth opportunity of the project and results in missed opportunities for protocols to sufficiently incentivize genuine contributors to their specific ecosystems.

Conclusion

Some closing thoughts on this, whilst airdrops are a huge driving factor for growth in many protocols, their ability to retain users is questionable given the risk of airdrop farmers and potential loss of momentum.

In order to successfully host an airdrop event, protocols are advised to have a proper strategic plan to firstly, retain as many users as possible, prevent as many farmers from obtaining a majority of the pool (whilst still capitalizing on the organic hype on Twitter) and of course, a plan to capitalize on all the hype received.

Based on the data shared in this feature, it is evident there will be a decline in the token retention rate post-airdrop, but based on metrics, after the decline has stabilized, it is an overall net-win for the protocol.

Also, don’t forget what GCR said about new coins:

And why am I sharing a GCR tweet here?

Simply because old coins = lots of VCs that have been invested for a while and that want to dump on you.

The way tokens are created in the space today, it doesn’t make much sense to keep a token after the airdrop unless you can use the token in the system it exist in.

This could be for example as a medium to pay for gas, you need the token to get rebate on trading fees, you get lower fees, can get merch/perks from the protocol etc.

Simply a token being a governance token is not enough. And that’s why most coins trend to zero.

What do you think?

What would your airdrop strategy be if it were your protocol?

That’s it for today!

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

Product first, airdrop second

Great article!