Hey, friends.

Today I am starting an interview series with people I find interesting in the crypto space.

The first person out in this series is the crypto trader @art_xbt which I discovered last year on Twitter.

I was fascinated by Art_XBT’s deep reflections on his trades and his monthly summaries.

To give you an example, just take a look at the 7 reflections in the thread he posted below:

https://twitter.com/art_xbt/status/1609118775915479040

One lesson that really resonated with me was this:

“TA (technical analysis) is a meme: I was put off by trading for a long time because I don't believe in drawing triangles. I thought it was not for me. Surprisingly I came by very well with zero technical analysis. The most I ever did was support/resistance for entries and exits.”.

So what’s Art_XBT success formula?

Let’s get straight ahead and start this interview.

What attracted you to trading in the first place? Have you had a normal 9-5 job earlier?

Honestly, the money you can make trading was the main reason I got into it.

I never had a real full-time job because I started to play online poker when I was young. So after finishing school, I moved abroad and continued doing that for a while until I started other online businesses.

The transition to trading was easy for me as I learned how to manage and risk my money from my poker years.

Did you trade other markets before crypto? How long have you been trading?

I have been involved in crypto since 2017 but only started actively trading in early 2022. Before that, I was mostly a spot investor with a buy-and-hold mentality. This strategy worked well in the bull market but also made me lose all of the gains in the bear after that.

This was the main reason I started actively trading in 2022 because I knew buying spot bags won't work out well for me. So I started utilizing shorts as hedges for my spot positions and, later on, had only pair trades running for most of 2022.

I know you from Twitter as a news/narrative trader and that you don't use TA. How has your trading strategy evolved over the years, and what kind of setup/criteria do you use now before entering/exiting a trade?

In the beginning, I thought TA was a meme. I had a hard time believing drawing a few lines on the chart would give you any reasonable edge in this market, so I focused heavily on narratives, which made perfect sense for pair trading.

I longed coins that were in an uptrend and had a narrative going and shorted overvalued vaporware that had absurdly high market caps/fdvs and no catalyst/hype in sight.

Later, I added news plays to my toolbox and utilized some simple TA with support/resistance to find better entries and exits. After being involved in the trading community, I got to know many people who are killing it just with TA, so I changed my opinion about that.

I stay open-minded and learn as much as possible from people whom I know for a fact that they actually make money. There are so many ways to make money in crypto; you just need to find what works best for you.

The most important criteria is that I always know what my risk is. Usually, that's 1% of my portfolio. I also try to be patient and get "cheap" entries. I would rather not take a trade and "miss out" rather than chase it with a bad entry – unless it's an urgent news play.

How do you practice risk and money management? Are you comfortable about sizing up when you feel you have an edge?

Honestly, this is one of my weakest points. I misplayed many opportunities by under sizing when I should have oversized and oversized when I should've undersized. It's the most important thing, as maximizing your EV in those situations will impact your returns the most.

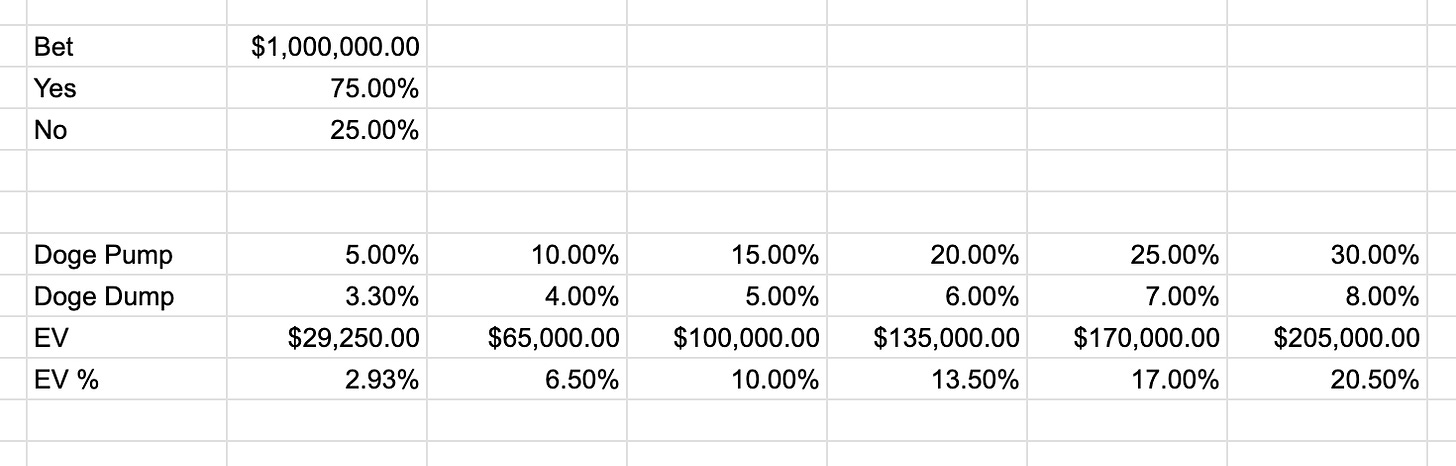

For example, when Elon offered to buy Twitter, and everyone was speculating if it would happen, the risk/reward ratio was insanely good.

In the scenario that the deal would go through, Doge would've pumped much more than it would've dumped. On top of that, prediction markets had the odds for an acquisition at 75% percent.

Below I attached an image of a basic calculation I used to run some numbers. I'm no math genius, so they might even be wrong. However, this is my default framework whenever I make decisions.

When reflecting on this, I underestimated how much it would've pumped (it went up ~150%) and also criminally undersized given how much liquidity there was available and how good the odds of a deal happening were.

I thought about going big but didn't have the balls because the bear market spooked me. If I had applied the Kelly criterion, this would've easily been a much bigger bet where it's worth it to put the majority of your portfolio into it. You only need 1-3 trades like this a year to be insanely profitable.

Would you say that you trade with 100% of your crypto capital? Or how much are you for example allocated to spot long, staking, or yield farming?

Until this week, I kept it all under one portfolio for simplicity. But it has affected my trades as it was hard to differentiate between short and long-term positions, especially if they were trades within the same account.

Now I split my funds into three portfolios and manage them individually.

Long-term Spot Portfolio

Short-term Spot Portfolio

Futures Trading Portfolio

We will see how this goes in the following months. But given the feedback I observed all over CT, almost everyone agrees their performance improved by managing individual portfolios.

On top of that, I cash out profits frequently and invest it in other assets and financial products to protect the wealth I'm building.

How long is a typical trade for you? And what is your relationship to shorting and/or hedging positions?

A typical trade ranges from a few minutes to up to a month if there is a specific catalyst that I'm waiting for. However, the extended timeframe trades are always hedged if the market direction isn't clear.

I rarely do directional shorts, which is a big leak. For some reason, most people, including myself, don't like to be short. However, I am improving that by taking minimal-sized directional shorts to get used to them and build my confidence. It is an invaluable skill that will bring your portfolio to all-time highs even when the market is nuking.

In news trading speed is everything. What are your thoughts about using bots? And which services/tools/bots do you personally use to make your trading more efficient?

Bots are a great resource to make your trading more efficient. I mostly use them to get alerts for an on-chain activity or to track specific things I want to monitor.

However, the most valuable bots are the ones you build for your specific needs, as the publically available things get very overcrowded fast.

Finding your edge and building custom bots as an accessory is the key to magnifying your edge. Usually, this means you need to be early to a new thing (Think of botting NFTs or extracting value on a new protocol/chain/app).

If you use public bots, you compete with hundreds of others with access to the same thing, so the playing field is balanced again -- you don't have much of an advantage. Very different if you are the only one doing it.

In 2022 it didn't make much sense to be spot long as we constantly dropped lower. However, in 2023 this changed and it suddenly felt much easier to just relax with spot longs and just hold instead of constantly monitoring PnL on perps. How fluid are you in terms of turning around in the market? How easy is it to change your mindset to maximize your gains from the market?

This is another big leak that caught me off guard at the start of 2023. I didn't trust the pump and slowly scaled into it, waiting for dips and taking my time.

Looking back, it's almost always better to size up immediately. When a trend has been sustained for a long time, the initial reversal has the best risk-to-reward ratio. You can cut fast if you are wrong, but let it run for a long time if you catch the reversal early.

In the future, I will pay more attention to these things and deploy fast and hard instead of adding slowly. Because by the time I am ready to deploy fully, the meat of the move is already done. Much better to put all my chips in right away and take a more considerable risk.

How long did it take you to become profitable? Were there any major milestones where things just started to click?

I was lucky and started to book decent wins immediately. That beginner's luck boosted my confidence, as things almost always turned out well. It enabled me to place bigger bets without being fearful. Of course, this changed after experiencing my first significant losses.

Sometimes I wonder what would've been if I wasn't so lucky at the start. I may have given up and stuck to the spot investing. I really don't know, but I'm grateful for how things have turned out so far.

What does a typical day look like for you? How much screen time do you typically have on an average week?

I have a hard time balancing this like a normal human being. I'm either in full grind mode (min 12 to 16-hour days) or chill mode (0 to 8-hour days). It depends on how hot the market is or if there's something exciting to work on.

When the market is boring, I have a very healthy routine of waking up early, meeting friends for coffee/lunch/dinner, and exercising 3-5 times a week.

When the market is hot, I live like a goblin clicking buttons in my underwear all day.

Unfortunately, there is no in-between for me. Unsurprisingly the more goblin mode I go, the more attractive the pnl. There is definitely an edge to being connected to the market at all times. In the past months, I have focused on building healthy habits, which shows in my pnl – it is very correlated.

Who are the people you look up to in terms of trading?

I probably learned the most from GCR and Tree of Alpha, as those have been the guys with a public track record.

Learning from smart and successful people is much easier than reinventing the wheel. So I reverse-engineered what they did and tried to do the same. In my mind, it made perfect sense because if I did the same things as they did, I would have similar results.

So whenever I see someone making a lot of money and having the receipts for it, I learn as much as possible from it and apply my own spin to it that works for me – I use this model for all aspects of life, not just for trading. It literally works for any skill you would love to learn.

What does "fuck you money" mean to you? Also, a lot of people coming into CT saying they want to make enough money and then quit crypto forever. Is this your plan too, and do you have a number where you feel confident to step away?

There is no fuck you money. We are addicted to making money, and I don't think it will ever stop. The bar will always get raised, and there will always be something new to gamble on.

This mindset (or call it a disease) is also part of why most of us are where we are. I believe you don't get to this point without being addicted to it.

What is your best trade? Doesn't necessarily have to be the one you earned the most from.

Long TRX, Short LUNA

Thesis: 30% APY > 19% APY

What advice would you give to people that want to reach your level? Any books, resources, or tips you could share?

I haven't used any books or resources in regards to trading. All I know I learned from random guys on Twitter for free. There was no hidden alpha; it's all out there in public – Especially smaller accounts are more confident to share serious alpha.

You need to be able to identify who is larping and whos not. Then study the winners and create your strategies based on that.

Why have you been successful in trading? What sets of qualities do you think you have that make you able to profit month after month? Are there other qualities traders should have that you strive to become better at?

The most important thing is having confidence in your abilities and work ethic. I am not a very smart guy, not a great poker player, and probably an average trader at best. But I know that I have an insanely strong work ethic and can at least outcompete my other not-so-smart counterparties.

Have you made some major mistakes? And was there ever a time when you wanted to just give up trading completely?

My biggest mistake was not starting to trade earlier. I thought trading was the devil's drug that was not to be touched because almost everyone I know personally lost a fortune. I thought the market was too efficient and unbeatable. Little did I know the market is inefficient as fuck.

Sometimes I lose interest when things aren't going too great, but I won't quit until I find something new that excites me. I genuinely enjoy figuring things out and making money. It's like playing a game for me.

Where can we follow your journey?

Twitter: https://twitter.com/art_xbt

Binance leaderboard: https://www.binance.com/en/futures-activity/leaderboard/user?encryptedUid=A33E019F1D8B8AEE1919221DA6C9121D

Performance on Binance hasn't been too impressive lately, as my focus in the past months was trading spot positions instead of futures. On top of that, I started trading on other exchanges to mitigate risks in case any of the fud became true. After what happened with FTX I am not taking any chances.

That’s it for now!

What do you think of this interview?

Make sure to give me some feedback in the comment section below.

Want To Sponsor This Newsletter?🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

ENJOYED

Thank you very much for this interview. Very helpful, full of interesting info. Will read more times and learn. You do the best work for us. Here, on tg, Twitter..