Nice to meet you again, anon.

While I was writing this I was on my way to ETH CC in Paris.

Starting to get a decent number of crypto events under my belt now, and enjoying it more and more. Probably because the number of friends increases for every event.

Btw, just a short notice.

I’ve partnered up with SX Bet and everyone who signs up with my link, gets an airdrop of money to bet for.

Join my betting Telegram group for more details about this:

Before we jump into today’s newsletter, let’s have a word from our sponsor Stader Labs

Stader Labs is a non-custodial, multichain liquid staking platform. With a presence on 6 chains—including Polygon, BNB, and Hedera—they’ve recently expanded to their 7th chain, Ethereum.

ETHx, Stader’s liquid staking token, is designed to keep Ethereum decentralized while being accessible, reliable, and rewarding.

ETHx smart contracts are triple-audited by leading blockchain security providers Sigma Prime, Halborn, and Code4rena.

With exciting rewards for early stakers, ETHx clocked in a TVL of ~$13M in the first 72 hours of launch.

They’re offering stakers:

1.5x staking boost for the first 30 days

$800k in upcoming LP rewards for the first 90 days

Additional exclusive rewards for DAOs and communities

When it comes to DeFi, partnerships with Balancer, Uniswap, and Curve are already underway.

Get in early.

PowerUp your ETH with ETHx.

Is The China Coin Narrative Dead?

Okay, so do you remember Hsaka posting this:

That’s right.

It’s the Chinese Ethereum $CFX 0.00%↑(Conflux). I will write more about this coin in this newsletter, but for now, let’s talk more broadly about the China coin narrative.

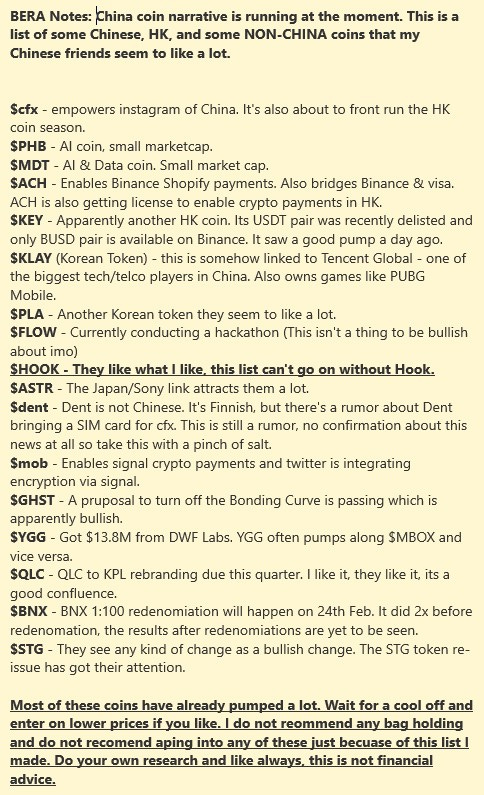

Just to give you an overview of which coins I’m talking about, let’s see what @doomsdart wrote on Twitter earlier this year:

“Here is a list of the China coin narrative. Some are Chinese coins and some are non-Chinese coins that my Chinese friends seem to like a lot”.

After a whole year of narrative rotations, there has been one that stood out: the “China coin narrative”.

Throughout 2023, we’ve seen various narratives pop out such as but not limited to:

AI Coins

China Coins

ZK Roll Ups

LSDs (Liquid Staking Derivatives)

BTC Ecosystem Hype

Memecoins

And over the years in crypto, I’ve noticed narratives being for the most part short-lived, they disappear as quickly as they’re brought into existence. Narratives are built on belief, and at times greed, as we’ve seen in the recent “memecoin” hype but the China coin narrative stood out like a sore thumb, given that Crypto Twitter is western dominated, why would this narrative come to light?

In this week’s feature, I want to discuss where the China coin narrative came from and especially one interesting coin that has gained traction from this narrative - is this coin strong fundamentally? Are they here to stay? Read on, anon.

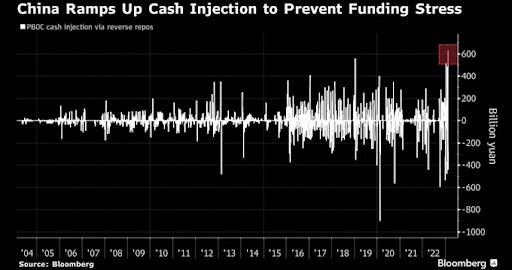

In February 2023, there were speculations that the next wave of retailers would be from the Chinese market. The Chinese Central Banks were injecting liquidity into the economy.

Shortly after, we hear of the Hong Kong Securities and Futures Commission (SFC) proposing a licensing regime for CEXs taking effect in June 2023, which I would consider the main catalyst in the China coin narrative, the main factor in the “Asia is bidding” storyline. So here is a TLDR of the June 2023 regulations:

Applies to anyone “1) offering services in HK or 2) advertising to users in HK”;

Applies to ALL types of tokens;

Outlines rules on the custody of assets;

Prohibits conflicts of interests;

Retailers must pass knowledge tests and validate financial circumstances;

No futures/derivatives, not even to other countries.

If you’d like to read more about this, Adam Cochran has written about this previously:

With that in mind, we understand that Hong Kong is indeed separate from China, and they do have differing views on crypto regulations, so how does this so-called China coin narrative come to existence?

Hong Kong follows the “one country, two systems” principle in such that Hong Kong is allowed to have their own economic and political systems, and although these new regulations are in contrast to China’s ban over crypto, it seems there has been little to no argument from Chinese officials to allow Hong Kong to open up as a crypto hub in the region. Taking all that into consideration, it does seem like there just could be the next wave of retailers coming from Hong Kong, and by extension China in the coming months/years.

Fast forward to June, when everything took effect, instead of any bullish signals to China coins, we instead saw a sell-the-news event.

However, one thing remains certain, whilst the overall markets have been choppy throughout the year, China coins saw a large increase in price over 2023, with $CFX rising up more than 10x so far (at one period being up 20x) on the year.

Let’s take a look at their fundamentals.

Conflux ($CFX)

Conflux is essentially a PoW/PoS hybrid blockchain without barriers, crowned the Chinese Eth, they have raised over $50m from Sequoia and various other investors and is readily tradable on Binance, Kucoin, Mexc and other large centralised exchanges.

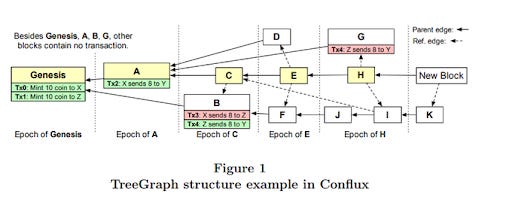

The main features of Conflux are tree-graph consensus algorithm, PoW consensus and cross-chain asset bridge (ShuttleFlow).

The tree-graph consensus algorithm is a key innovation utilised by Conflux, unlike existing blockchains such as Ethereum, Bitcoin and others, which can only confirm one block at a time, Conflux’s tree-graph structure allows for the confirmation of multiple blocks simultaneously.

This on its own sets Conflux apart from the other L1s, and offers desirable advantages, such as: the ability to process more transactions simultaneously (enabling faster and more efficient operation execution on the network).

Confirmation times are also likely to be reduced as a result of the tree-graph consensus algorithm. This same consensus also makes Conflux scalable, where they are able to mitigate congestion and various scalability challenges faced by other blockchains.

Conflux also has partnered with China’s second-largest telecommunications firm to pilot blockchain-enabled SIM cards and they have also partnered with XiaoHongShu (小红书), essentially China’s instagram.

Overall Conflux seems to have potential to perform well in the upcoming cycle, whether or not the China coin narrative is here to stay or not, $CFX definitely is. As always, NFA and DYOR.

Let’s talk about another Chinese favorite: Filecoin

Filecoin ($FIL)

Filecoin has been around for several years now and had an all-time high of $237 in the previous cycle, it has retraced by about 98% however recently gained traction again due to the China coin narrative.

In essence, Filecoin is a decentralised storage protocol that allows anyone to rent out storage space on their own system/PC to get crypto in return.

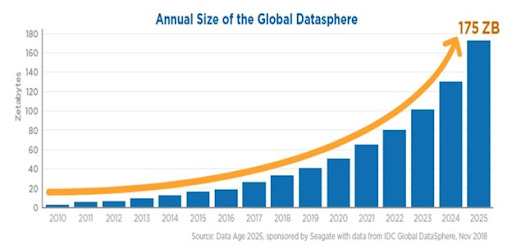

The problem $FIL saw with data storage was that this was one of the largest challenges web3 has to face: storage space. Crypto generates over 2.5 quintillion bytes of data daily, and as per IDC Global Datasphere, this figure is expected to grow exponentially.

Blockchains are “databases” however they aren’t ideal, they hold only small amounts of information and it is also extremely expensive to store data on any blockchain, which is why data for crypto is often hosted on a centralised server instead of directly on the blockchain.

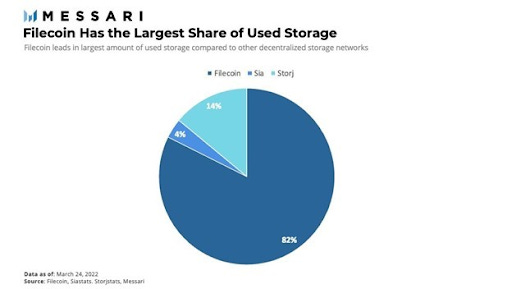

Filecoin comes with the solution of being the provider of both capacity and usage, they offer solutions for NFTs, assets, permanent storage, metaverse and audio/video. According to Messari, Filecoin has the largest share of used storage, which on its own is a huge competitive advantage

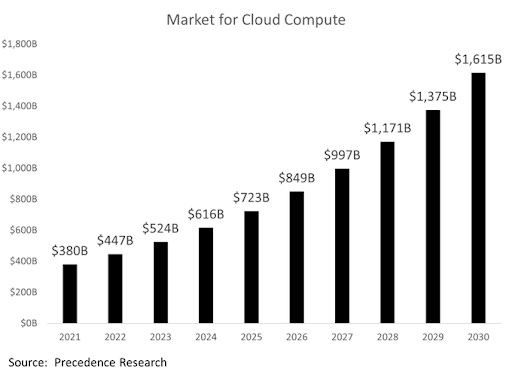

.Filecoin eventually aims to become a full-stack cloud services provider and viable alternative to web2 providers such as AWS, Google Cloud and Azure and given the market statistics for cloud computing, it is worth keeping an eye on Filecoin, they’ve been around before the China coin narrative, and are here to stay.

Let’s look at another crypto Twitter favorite ($PHB).

Phoenix Chain ($PHB)

Phoenix global’s aim and focus surrounds leveraging the AI space of decentralisation, as such hits not one, but two narratives: AI and China coin narrative. $PHB currently sits at a small mcap of around 30m despite being over 10x up on the year. In essence, Phoenix is a L1 and L2 blockchain infrastructure which empowers web3 applications whilst focusing on the generation of AI.

The main features of Phoenix’s L2 computation layer infrastructure are AI model compute services, multi-party computation (MPC) and decentralised AI processes; the goal of these are to bring AI-driven capabilities to both blockchain applications and web3 features to off-chain AI apps. Phoenix plans to create a paradigm shift in data and AI-driven web3, with some development plans planned out already. As of recent, Phoenix has introduced their strategic technology partners:

APEX technologies

Federated Learning Consortium (FLC)

Tensor Investment Corporation

Each of these strategic partners specialise in their respective fields and aid Phoenix in various aspects - it is worth noting that these partners are immensely influential outside web3, The partners are also either HK or China based which could potentially drive a new wave of retailers if China were to lax regulations on crypto.

With this in mind, $PHB could be an interesting protocol to keep an eye on, the team is consistently shipping updates and this small cap could potentially develop into a huge success.

What’s common among these 3 Chinese coins is that they have a relative high trading volume compared to their market cap, eg. PHB 0.00%↑is number 600 or so mcap-wise, but in the top 100 of coins for trading volume.

With that said, I have no idea if these coins are good buys going forward, but my gut feeling tells me that CFX 0.00%↑and PHB 0.00%↑ will trade a lot higher in a bull run.

All right, over to the question of the year.

Is $10m enough to quit your 9-5?

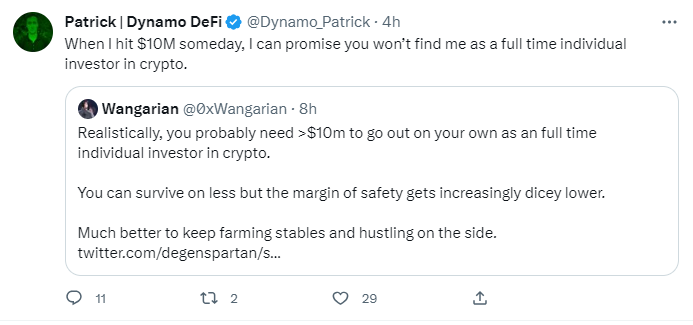

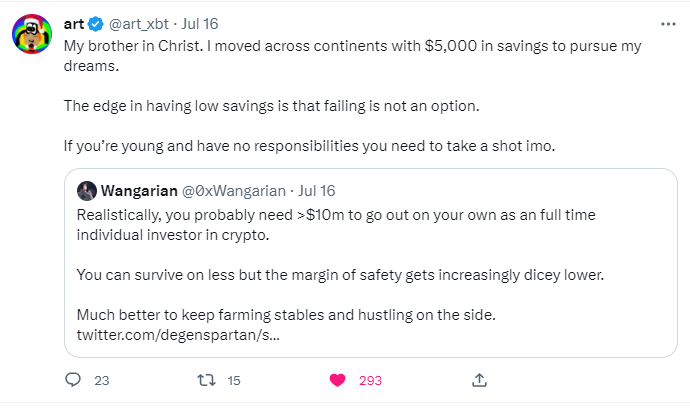

This was a debate in the end of the 2021 bull cycle too, and now the question popped up on the timeline again

Not very surprising, the tweet got a lot of responses in a very short time.

Because 99,9% of people would never even in their lifetime ever reach an investable net worth of over $10m.

Ansem even did a poll where he asked the audience how much they spent monthly, and 50% said they spent less than 1 $ETH monthly ($1,900). That’s equal to $24k per year. Without even investing you could last 40 years on $1m (not including inflation here).

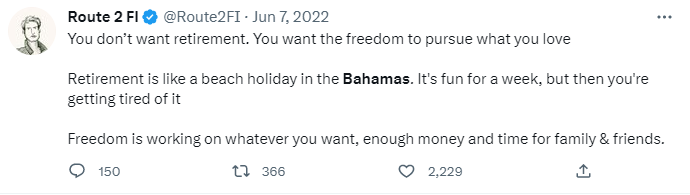

Here some other people’s reactions to it:

Money is an infinite asset with unlimited upside.

Time is a finite asset slowly ticking down to 0.

Yet we focus more on accumulating as much money as possible.

There is a time for everything. There was a time in my life when I saved a lot of money. I was extremely frugal. Now is the time to live more like I want. To live and don't think about the consequences. I mean, what's the point of saving for so long if you can't enjoy what life has to offer?

After all. You are getting older. We are getting older. I am getting older. My family is getting older. My friends are getting older. Their priorities have changed. They're not what they used to be. But neither am I. And neither are you. Tbh, I definitely feel I am the same, but obviously, I have changed too. Life is short, and if you’re in a phase that you’re really trying to make it it may be worth spending all time in front of the computer all day, every day. But this has an opportunity cost. Your time.

The biggest bullshit I hear is people who say they need $10M+ in the bank in order to retire from their 9-5. Unless you spend $50k or more per month you would need an amount like that relying on the 4% rule (a rule that states that you can withdraw 4% of your portfolio every year without the risk of going bankrupt, eg. your money lasts forever). If you spend $50k per month it means that you’re raking in $600k or more every year. If that’s you and you earn this much in a normal job and you’re not able to invest anything per month, send me a DM and I help you for free. No one should be able to have a zero net worth with this income. My point here was that I’m hearing: “Oh, I need $10M in order to pursue my dreams”. I counter them with: “So you’re spending more than $50k per month?”. Usually they say something like $5-7k per month which means they would need a lot less in order to retire from passive income. But let’s face it, most people won’t retire to do nothing.

Life is getting boring if you don’t do anything. But having the freedom to pursue exactly what you want and to spend your time doing things you love is just beautiful. It takes away the pressure on earning money just to pay the bills.

Time is finite, while money is infinite.

Win the money game to buy your time back.

Memento Mori.

PS! Don’t listen to a guy that says you need $10m to even start to invest full-time in crypto…

Want To Sponsor This Newsletter?🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

Hi, what an interesting post!

as a 30-year-old loan officer in Germany, I share your thoughts on the subject of financial independence. I too dream of a life of freedom and have calculated that I could live well on $3000 net income per month. If I were to live to 80, I would need 1.8 million in one lump sum.

Unfortunately, the chances of achieving this through wage labor alone in Germany seem very slim to me. The economic situation worries me. I fear that living conditions will deteriorate.

Therefore, I place hopes in the crypto market. However, I remain realistic - quick wealth is unlikely. It takes staying power and a smart strategy.

Nevertheless, the idea of one day no longer being dependent on wage labor spurs me on. Time is our most precious commodity! I would like to be able to use my time in a self-determined way.

Thank you for the inspiring thoughts! I wish you all the best and hope that we both can realize our dream.

Best regards

Mandy

cool article!

10/10