I have written a lot about crypto trading in earlier newsletter issues.

As the market is starting to look much healthier again, let’s examine crypto trading again.

In its simple sense, news trading is basically trading on news our upcoming news catalysts.

While I can’t trade for you, I could maybe give you some info about where to start, and what to look for and give you more resources.

Trading is a jungle, and it’s easy to get lost in all the content out there.

Before we jump into today’s newsletter, let’s have a word from our sponsor.

Carbon Browser is the fastest decentralized web3 browser with 100% privacy and an integrated multichain wallet with cross-chain swaps.

The team has been around since 2016 and is constantly building. The browser has been downloaded over 7M times and is being used by crypto degens (including me).

As a privacy advocate myself I can recommend using this browser if you want your data to be private. I mean, who knows what Google and Apple do with your search log…

Carbon has its own token called $CSIX which users can use on their swap LDX.FI or to upgrade to Carbon Browser Pro. You can stake it or spend it on some of the websites that are Carbon partners.

The browser is 3x faster than Google Chrome/Safari and 100% decentralized.

Download it for free on Google Play or iOS today here:

For more info about the browser, wallet, or token, check out their website:

Carbon - the fastest web3 browser

About trading

You have to find your own way to trade. You can't blindly follow standard trading rules and expect to outperform. You must find an effective way to do what others don't.

You can trade stocks, forex, commodities, crypto, etc. Recently I’ve found an edge in crypto because there are inefficiencies that you can take advantage of. For example, when the news about Andre Cronje got out on Twitter that he wanted to focus on other things than DeFi (March 2022), it took at least 10-15 minutes before $FTM, $YFI ++ started to move down. In retrospect, this is one of the easiest shorts I’ve ever taken on Fantom. For me, this was a scalp short, but looking at how bad the market ended I should probably just keep it for months. My point is, that crypto is not as efficient as the stock market. When news breaks out in the stock market you can be sure that this is already reflected in the price seconds later.

Crypto has a lot of retail interest, and tbh there are a lot of idiots in crypto. By that, I mean people that just buy a random dogcoin and hope it goes to the moon. There’s a stark contrast between the smart people on CT and the people that follow Tik Tok influencers and BitBoy for crypto advice. Btw, I’m not referring to myself as one of the smart people here. I’m referring to GCR, Cobie, HighStakesCap, HsakaTrades, CryptoCred, Light +++. Could probably mention 50+ more here.

There is an advantage for the people that actually try to stay up to date on crypto and that are actively seeking alpha. As crypto matures I think the market will be less inefficient, and that it will be harder to trade (in the future). That’s why we need to take advantage of it today.

If you feel like you know the very basics of trading, you should definitely read the thread below.

It will help you understand markets better and hopefully increase your PnL.

Inefficient markets are something I've discussed in several newsletters.

But I read a thread from @tree_of_alpha and was again reminded of how important it is if you want to have an edge in crypto.

As Tree of Alpha writes:

"The Efficient-market hypothesis states that at all times, asset prices reflect all available information. This is only partially true."

I fully agree with Tree of Alpha, because information can't be priced in at the exact moment it comes out.

When something news-worth gets out you have to either interpret it as fast as possible, guess how long time it will take before the effect of the news reflects the market prices, and/or try to understand how people will react to the news.

Let's do a couple of examples since it's always easier to understand concepts that way.

The tweet from the CoinTelegraph intern

On October 16th, around 1 PM, CoinTelegraph tweeted that SEC had approved Blackrock’s Bitcoin Spot ETF.

Immediately after the price increased by 9% in 9 minutes.

However, there was a problem…

CoinTelegraph had snatched up some news from a shitpost on Telegram, and published it as if it was real news. So that’s why the news completely retraced 15 minutes later.

This was definitely news to go long on, but many people ended up rekt because it retraced so fast. And remember, not everyone watched it at $28k.

The hack on Binance Smart Chain Oct 6th 2022

An attacker stole 2 million BNB (~$566M USD) from the Binance Bridge.

The news broke out around 4 PM EST on October 6th.

In a matter of 90 minutes, $BNB fell 4.5%. That isn't too crazy in crypto, but the R/R (risk/reward) was great. That means low risk, potentially high reward.

Let's go through it with the help of a framework to see how we should play this.

How big was the hack from 1-10?

Let's check the leaderboard on REKT: https://rekt.news/leaderboard/

It's in the top 3. So the impact is maybe a 9/10. That sounds like a great shorting opportunity, right?

Consequences for Binance Smart Chain and the holders?

We didn't know at the time, but there was a risk of halting the chain. That's not positive, and a short seems even more tempting.

How will other players in the market interpret this news?

My common sense says this is a shorting opportunity, and the more people that see the news, the more people will try to short it.

How fast should you interpret this?

As fast as possible.

----

All right, this was very simplified. But it just shows my thinking at the time of the news.

Most traders tend to focus too much on the rewards side and not enough on the risk side.

If you regulate a portfolio with sentiments and not discipline, then be prepared for an explosive and depleting ride.

Your goal should be risk management, not risk avoidance. Risk can be managed by significantly controlling the possibility and the amount of loss.

This was a warmup, but now for real…Let’s Talk About Crypto News Trading

There are several ways to make it in crypto.

Right now most of us are only focusing on surviving, but let's talk a little bit about news trading (trading on crypto news in real-time).

News trading can be broadly classified into two categories:

Periodic or Recurring: This includes the scheduled releases of news that moves the markets, including CPI, FOMC, and quarterly earnings reports from companies. An example from the crypto world could be announcements from the CEO of crypto exchanges or a release of a new token on a CEX/DEX.

Unexpected or One-Time: These are bolts from the blue such as a terrorist attack, a sudden geopolitical flare-up, or for example rumors that an exchange is insolvent (think FTX), a returning DeFi-developer (news of Andre Cronje returning to Fantom), Binance CEO mention that they will help tokens that got hit hard because of the FTX insolvency, etc.

News can be specific to a particular coin or it can affect certain parts of the crypto industry or the markets as a whole.

A news trader can be seen as a type of day trader since they classically enter and close a trade on the same day.

They often focus on trading during times when the market is still heavily reactant to news developments. The time can be either immediately after the announcement of the news or the moments leading up to the announcement.

Trading the News

Here are a few examples of possible actions that a crypto trader could have taken in response to particular news events.

FTX announces they're insolvent

The rumors had been circulating for some time about insolvency, but Tuesday 8th of November at 5PM UTC+1, the CEO of FTX, Sam Bankman-Fried announced that Binance would buy FTX.

A news trader could react to this in the following way:

1) Binance, the number 1 exchange acquires the second biggest exchange = bullish $BNB (long)

2) FTX = insolvent --> short all tokens with Sam/FTX-involvement, eg. $FTT as the primary. Because what use case is it for $FTT now that the exchange is dead? Other examples: $SOL

Let's start with number 1. News breaking out that Binance is buying FTX is huge. Remember, that's one competitor less which should give Binance a huge advantage. What's more natural than buying $BNB which is the main Binance-coin? It increased by 17% in 1 hour after the news broke out. The observant reader sees that this retraced pretty quickly though.

And that's the hardest part of news trading. You can be right with your entry, but it's impossible to know if the token will:

a) pump at all

b) if it pumps, when should you get out? (answer, have a take profit or at least a mental take profit, or a trailing stop loss)

c) if it pumps, but then quickly retraces how long should you stay in (answer: you should already have a stop loss before you enter a trade)

All right, let's look at number 2. You could either go long $BNB, or you could look at the other side of the news.

Because if this is bullish for Binance, this has to be bearish for FTX, Sam Bankman-Fried, and the whole $SOL ecosystem, right?

Let's look at what happened with $SOL after the news broke out below.

As you can see, Solana was at a time 67% down in a matter of 24 hours. Personally, I wasn't that fast on this news, but I shorted it from $21 to $13 and made a little profit from it.

Again, the question is always how long should you be in a trade like this, and unfortunately, I don't have any good answer to this.

You need to plan a trade like this in advance so that you don't get emotional and end up losing money.

Once a month you have numbers coming out from FED where they decide the interest rate for the next month (FOMC). This is based on how the general economy is and of course the inflation (CPI). As you can see these are tradeable events.

For example, let's say that people are expecting the interest rate to increase by 0.5% before the FOMC, but when FED releases the data the actual increase is eg. 0.75%. The market should react in a bearish way to news like this because higher interest rates mean that businesses and companies in a growth phase (that have huge loans) have to pay more money on their loans = less money to reinvest into the company = slower growth.

At least this is true for stocks. This means that people are expecting slower returns on their money. But there's another important factor, because when the interest rate increases, it also means that normal people like you and me have to pay more on their mortgages, and thus less money left for investments = slower growth in the equity markets.

If the interest rate comes in lower than 0.5% (eg. 0.25%) we should expect to see a more bullish market, because of the opposite of what I just described above.

A similar case can be made for the CPI. If the inflation comes in higher than what's expected, it should be bearish. And vice versa, if the number comes in lower, the market will react bullishly.

Higher inflation means that our money has less buying power = people have to spend more money on their daily necessities and therefore less money goes towards investing.

These two events gather lots of traders, and when the news releases there are extremely volatile market conditions.

In a matter of minutes, we've seen $ETH swing by +/- 10% during these events. It could be a gold mine to trade during these events, but on the other hand, you could also end up completely rekt because of the volatility. If your stop loss is too tight it doesn't matter if you're long or short, because you're going to get stopped out no matter what.

Trading on FOMC and CPI is not my favorite news trading event because of the enormous amount of players that are trading them. Personally, I don't feel that I have an edge trading on them. You have to be extremely quick to catch this news for going long/short. If you don't react within seconds/minutes after the news breaks out, the opportunity might be gone.

Below is the chart for CPI from November 10th 2022.

You can see that the price of $ETH increased by 7% within 15 minutes.

Actually, it's a little bit more complex than the chart shows because the biggest move happened within the first minute, and the volatility was so big that you could easily end up Giga REKT with too tight stops.

As I said, I feel trading CPI and FOMC is close to impossible. And to catch these wild moves you have to bet in advance which most likely is a gamble.

Andre Cronje is "back" - Example of A Trade on Fantom and Yearn Finance

You might remember that Andre Cronje "retired" from DeFi back in March 2022.

At the point of his announcement $YFI, $FTM, and other Andre-coins dumped immediately.

See below:

Well, in November 2022 some observant people saw that Andre Cronje had updated his profile on Linkedin and that he was back working on $FTM again. The news started to spread and around 20 minutes later Andre Cronje updated his status on Twitter saying the same.

Look at the thread below from Tree of Alpha explaining the whole situation:

Voyager - The Bankrupt Crypto Lender

There have been lots of talks about the crypto company Voyager after they became bankrupt after the 3AC blowup in June 2022.

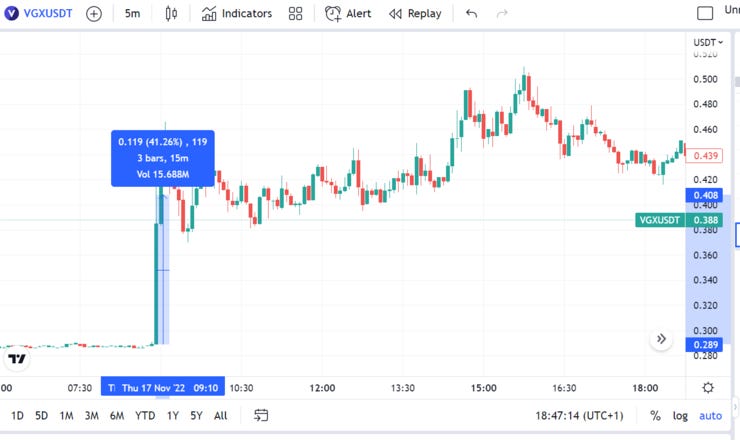

When the news from Coindesk got out that Binance potentially were preparing a bid for Voyager the price of $VGX increased immediately.

Within 15 minutes the price increased by 41%. That's a lot in such a short time span. But again, to be so quick to trade is almost impossible.

This leads me to the next subject: the hierarchy of a news trader.

The Hierarchy Of A News Trader

Have you ever wondered where you are on the ladder in terms of catching a trade?

The Twitter user King G made an interesting tweet where he made a hierarchical ladder from A to G telling at which price you will enter a trade.

I recite from his tweet below with text here so you don't miss it.

The ladder:

A: Insiders, the team - this is generally where the news comes from so the team and fellow insiders accumulate well before the news is public

B: Coders who have found hidden endpoints (leaks), hackers who can see news websites postings early and are able to front-run the public news

C: Coders who have a speed advantage (@Tree_of_Alpha @tier10k and many others that aren’t public on Twitter)

D: Bots that market long/short on group C public tweets. Automated bots on select accounts will generally always be faster than the manual traders (with few exceptions)

E: Manual traders that are early and quickly analyze the implications of news headline

F: Manual traders that are late (even a few minutes can sometimes be late)

G: Laggards who trickle in once the news is blasted on everyone’s timeline and the price has gone up significantly

It’s important to understand where you are in this order when news trading.

The crypto market is incredibly inefficient (good for us) so some catalysts take time to properly price in.

In essence, if you are in groups E-G you need a greater fool to buy your bag for you to profit.

Personally, I'm in group E, but working with some people to make bots to get up to D or maybe even C.

Strategies of News Traders

1. Market familiarization

News traders educate themselves on their respective trading markets to make an educated investment or trading position decisions.

They study their respective markets by looking at historical data and price trends and identifying the relationship between certain news announcements and how they tend to affect prices in the market.

The market familiarization enables the news trader to take informed actions based on the increase or decrease in a security’s price, following an announcement.

2. Fading

Fading can be defined as the action of trading in the opposite direction of a predominant trend as market enthusiasm begins to fade. The strategy is popular among news traders.

An example can be the news of positive earnings for a stock before the market opens. The anticipation of taking a favorable position based on the announcement will result in the stock opening at a sharp high. A news trader will wait for the stock to peak amid the enthusiasm and then sell the stock as the optimism begins to fade.

It is not to say that the stock is no longer trading at a high, but rather to highlight that the news trader would’ve benefited from the highs and lows of the trading day.

The same could be done in crypto on any news really. If there's a gigantic green candle coming fast after a news story has broken out, there will at some point be a retrace (mean reversion). The question is just when.

3. Alerts and timing

Because news traders are reliant on news announcements, it is beneficial for them to keep up-to-date with the latest developments in their trading markets. It can be done by setting up alerts for the latest announcements and taking advantage of the right timing to enter or close a trade, depending on their set trading strategy.

In the end of this newsletter, I will share some Twitter lists that I use myself.

General tips for New News Traders

Know the dates and times of important events: Information on the dates and times of key market events such as FOMC announcements, economic data releases, and earnings reports from key companies is readily available online. Know this calendar of events in advance. Other important announcements could be from the leading crypto companies such as listing of new coins (Binance, Coinbase, Bybit++), AMA with founders, etc.

Have a strategy in place beforehand: You should plot your trading strategy in advance so that you are not forced into making rash decisions in the heat of the moment. Know your exact trading entry and exit points before the action begins. Calculate how much you should bet, your stop loss, your take profit, and if you should put on a trade at all. For example if CPI comes in at 7.8 - 8% you go long, if it's between 8.1-8.3% you stay flat, and if it's 8.4% or higher you go short. You could also plan a fading trading strategy (mean reversion).

Avoid kneejerk reactions: Make rational investment decisions based on your risk tolerance and investment objectives. This may require you to be a contrarian on occasion, but as successful long-term investors will attest, this is the best approach for successful crypto investing.

Cap your risk levels: Avoid the temptation of trying to make a fast buck by taking a concentrated long or short position. What if the trade goes against you?

Have the courage of your convictions: Assuming you’ve done your homework, consider adding to an existing position if the coin plunges to a level below its intrinsic value, or selling out to take profits in a coin that is wildly popular at the moment. So, intrinsic value in crypto is a meme, because how could we value it? Most people agree that $ETH has a value somewhere between $0 and $10,000. But exactly how much is pretty impossible. This is also why you've seen $ETH swing from $880 to $4,800 within the last years.

See the big picture: Often, investor reaction to the news may not be as expected. You'd think an announcement of eg. CPI would lead to a sell-off in the crypto market. But if everyone thinks the same beforehand this may ring an alarm bell, because trading isn't easy and for every winner there is a loser, so expect to see different outcomes of your trades even if you think you know how it will play out beforehand. This shouldn't be a problem if you have proper risk management (see my earlier newsletter post about risk management here).

Don’t be swayed by market sentiment: Being overly swayed by market sentiment may tempt you to buy high—when euphoria runs rampant—and sell low when gloom and doom prevails. Consider the plight of the many hapless investors who were so spooked by the unrelenting tide of bad news in 2008 that they exited their equity positions near the lows, incurring massive losses in the process.

Know when to "fade" the news: Sometimes it is as important to ignore the news or “fade” it as it is to trade it. If you're in it for the long term, you can ignore the noise.

The Bottom Line

Trading the news is crucial for positioning your portfolio to take advantage of market moves and boost overall returns.

Also, some traders are only doing this and are making a living from it.

But again, this is not easy. To become profitable you might try to work on your edge for years. And even then, you might not become profitable.

Who To Follow on Twitter

These are some good accounts that can leak important news/info.

Start by following these 11 accounts and put on notification:

1) DB: https://twitter.com/tier10k

2) Tree of Alpha: https://twitter.com/Tree_of_Alpha

3) Cobie: https://twitter.com/cobie

4) Light: https://twitter.com/lightcrypto

5) Cred: https://twitter.com/CryptoCred

6) High Stakes Capital: https://twitter.com/HighStakesCap

7) Hsaka: https://twitter.com/HsakaTrades

8) GCR Classic: https://twitter.com/GCRClassic

9) GCR: https://twitter.com/GiganticRebirth

10) PeckShield: https://twitter.com/peckshield

11) Sam: https://twitter.com/samczsun

There are obviously several more accounts you should follow, but these 11 are a good start.

Twitter Lists

On these lists there are more names than the 11 people.

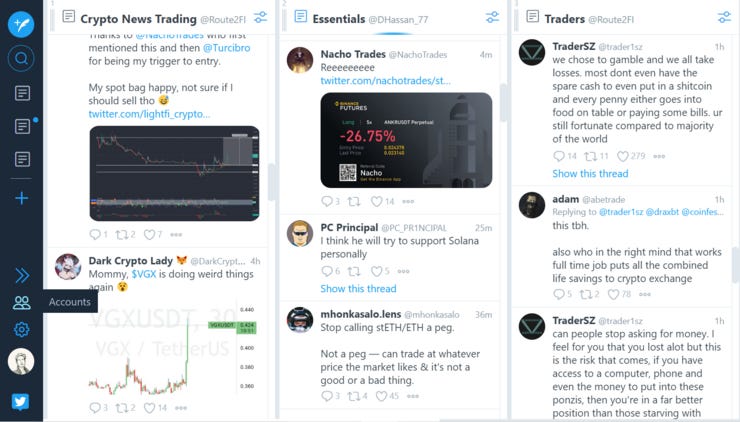

I use a combination of having people on notification and having them on lists. You will see my screenshot of Tweetdeck further down in this post.

1.

This is my ever-evolving news trader Twitter list, 5,000 people followed the list after Cobie commented below on the tweet: https://twitter.com/i/lists/1590828215161036815

2.

This is a good Twitter list from @Dhassan_77 called Essentials:

https://twitter.com/i/lists/1519624419487932416

As Dhassan_77 wrote himself about the list:

This list took me months to make and initially I used a system where I ranked each person within the list based on how accurate of a % their calls/investment theses are. I added those people and it helped me avoid noise. I think the smartest and most often “correct” people on CT are here.

3.

This is a list with good crypto traders:

https://twitter.com/i/lists/1530523194590998533

I mainly use Tweetdeck for these lists to catch the news in real-time.

A screenshot of what it looks like:

4.

Here is Blank’s list of good people for news trading:

https://twitter.com/i/lists/1630086028743823360

Some tools that can give you an edge in crypto trading

Let me present some tools to help you get an edge in crypto trading.

What tools are handy to execute trades faster?

I use Twitter lists. Here is the main one that I use for news and narrative trading: https://twitter.com/i/lists/1590828215161036815

I use Mirrorly to see what some of the top traders on Binance long or short. DM @artikokus on Telegram to get access.

I use Tweetdeck for viewing several lists at the same time. You can even put on notifications with sound alerts. Here is what Tweetdeck looks like on my PC:

To view the market leaders in the crypto future market I use a script in Tradingview. It tracks all the perps listed on Binance in real-time. This is maybe the chart I look at the most during the day. In general, strong tokens will continue to be strong and therefore could be worth buying, while laggards are for shorting or avoiding completely. Link to chart: https://www.tradingview.com/chart/yAR5wCLQ/

If you like what you see so far, why not sign up for my newsletter? Hit the “Subscribe Now” button below 👇

I use Scalp Scanner to get an overview of the market (open interest, volatility) and especially to look for funding plays:

A Telegram channel that monitors Binance futures movements for scalping purpose, and track a + / - 5% amplitude on 5min candles: https://t.me/BinanceGhoztScalps

A Telegram channel that sends an alert if there’s any Binance Futures pair price that changes more than 2% in a 1-minute candle:

A Telegram channel that sends live liquidation signals from Binance Futures with a minimum size of $50k:

A Telegram channel that sends live liquidation signals from Bybit with a minimum size of $50k: https://t.me/BybitLiquidations

Other than these 10 tools I use Tradingview, Discord (several channels), both Binance & Bybit for trading, and CoinMarketMan for tracking trades.

I also have a personal Telegram group that is free to join.

In the TG group, I share tweets, threads, articles, blog posts, etc. that I find interesting within crypto.

Zero spam, only alpha: https://t.me/cryptogoodreads

I hope you liked this newsletter post, even though it was one of my longer ones.

Thank you for reading, and see you again next week!

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

Great post about news trading! Our team is currently working on a bot that will automatically trade on the news: https://www.hindix.trade/

Feel free to contact if you want to share insights :)

Well written and highly informative.. Thank you