LandX - Real World Assets On Blockchain

Hello, friends!

How are you holding up in this market? The bull market is here, and the Monday dip was a dip I personally was buying. ETH decision in January, the BTC halving is getting closer —> with 129 days left (end of April 2024), I am mentally preparing for bullish sentiment going forward. I have a hard time being max bearish here.

Today’s newsletter is a sponsored deep dive into LandX.

Btw, I have made a free private TG group for trading with approx. 2k members. You can join it here:

LandX Finance - Real World Assets On Blockchain

Okay, first things first!

LandX will mark a significant milestone with the listing of its LNDX token Uniswap on Ethereum and Arbitrum as well as on two major exchanges - GATE.IO AND MEXC.COM. Listing on all platforms is planned for 14:00 UTC on 14 December 2024

More about why this is bullish in this newsletter issue (PS! They target an APR of 18,5% ). If that’s not great yield, I don’t know what is ;)

Introduction

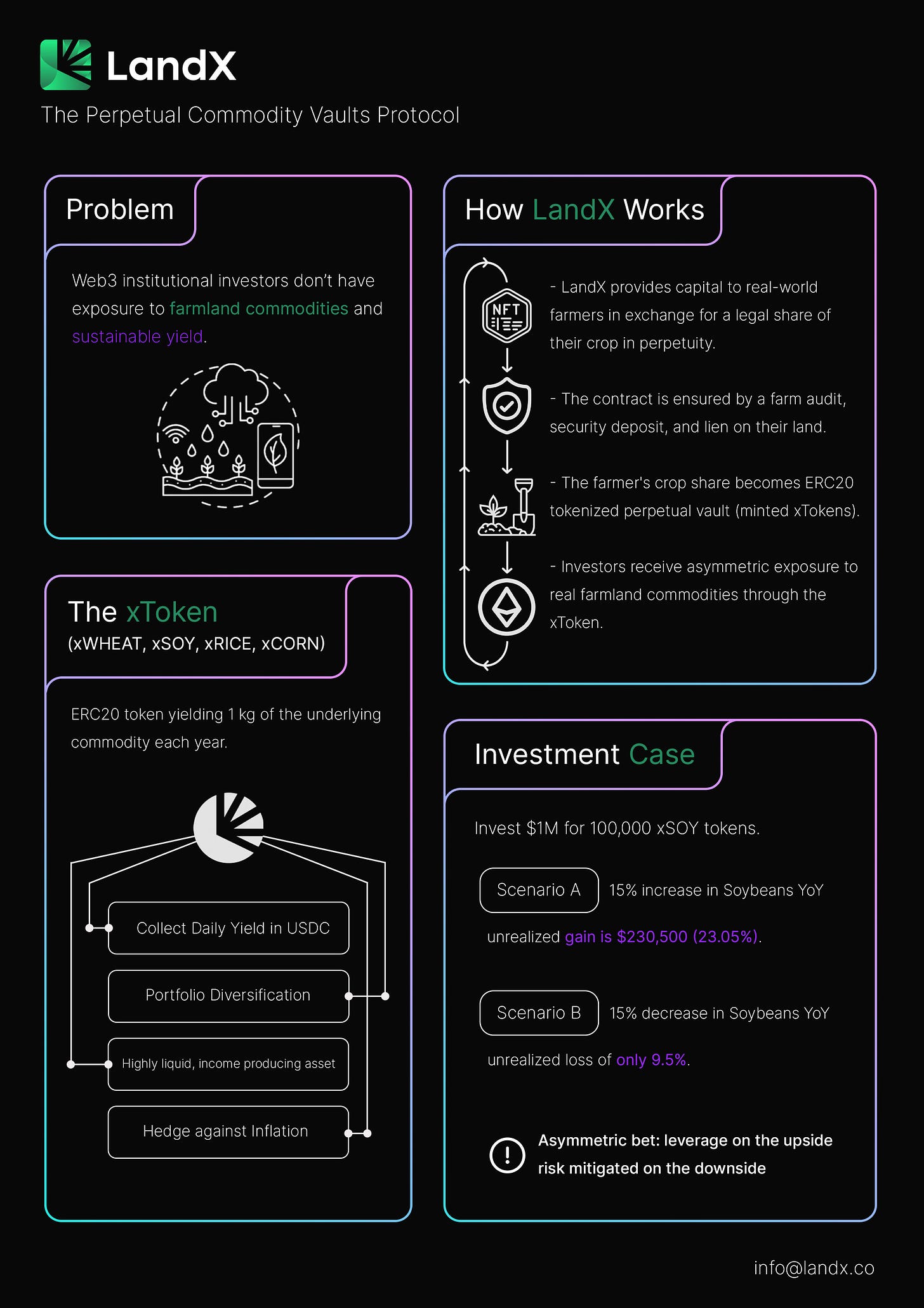

LandX Finance is a blockchain protocol that aims to introduce Real World Assets (RWAs) into the world of decentralized finance (DeFi) through Perpetual Commodity Vaults. By bringing agricultural RWAs on-chain, the protocol can provide investors with yield opportunities and exposure to uncorrelated asset classes.

As the name LandX indicates, they’re closing the gap between farmland owners and crypto investors through blockchain-based perpetual commodity vaults.

The LandX protocol enables an agreement between borrowers (farmers) and investors. The vault acts as a blockchain-based token that trades for a market-determined principal price. The holder of the staked token receives a daily yield of the underlying commodity in perpetuity.

Over the last year, we have seen a great growth of Real World Assets (RWA) in DeFi. This sector is going to onboard the next trillion dollars to the crypto market.

LandX plays a crucial role in integrating a $15 trillion asset class - farmland - into DeFi. This is a world that until now only has been available for tradFi.

To give you some perspective: RWA Total Value Locked (TVL) on-chain by 2040 is projected to be between $16-20 trillion. Today the total value locked in all of DeFi is a mere $50 billion.

Imagine the potential, anon…

Okay, but why was this project created? Do we need it in DeFi?

Currently, DeFi-native and institutional investors don’t have ways to get exposure to farmland commodities. As a result, LandX was created to enable crypto-native investors to diversify their digital asset portfolios and get access to sustainable yield sources that are only available off-chain. LandX achieves this by linking digital assets to real-world farmland and agricultural production, and offering real-yield opportunities to users on-chain.

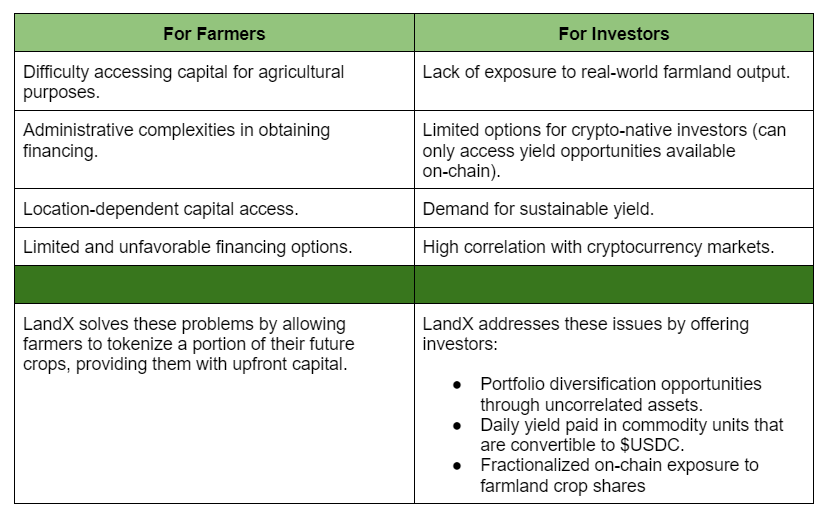

On the one hand, farmers frequently face challenges accessing funds. Several factors contribute to this issue, such as the difficulties involved in obtaining financing for agricultural purposes, cumbersome administrative processes, the dependence on the location… As a result, the available choices are often unfavorable.

On the other hand, investors in DeFi currently have no means of gaining exposure to the production of real-world agricultural land. As a consequence, the majority of investment portfolios in crypto remain highly correlated to the overall crypto markets (which also have a strong correlation with stock markets). Furthermore, most market participants are often searching for sustainable sources of yield on-chain.

Farmers require funds to acquire additional farmland, new equipment, and improve their facilities. These efforts directly contribute to local food security, but cannot be accomplished without liquidity. LandX solves farmers' funding difficulties by providing them with upfront funds in exchange for a percentage of their land's future crops.

In simple terms, farmers utilize LandX to convert a proportion of their future harvests into tokens in order to receive upfront capital. At the same time, crypto investors can get direct exposure to the output of the underlying farmland. LandX’s commodity vaults offer these investors a daily yield paid out in units of the underlying commodity.

Many DeFi applications often promote unsustainable yields through inflationary tokens and aggressive marketing tactics to attract liquidity providers. These practices can lead to short-term gains but often lack long-term viability.

LandX takes a different approach by focusing on sustainable yield and regenerative finance. The platform utilizes capital as a tool to invest in real-world yield opportunities while addressing systemic issues to regenerate natural environments. This approach aims to provide a lasting and meaningful impact on both DeFi and the environment.

Summarized we get the problems solved by LandX in the table below:

The 3 tokens used in Land X

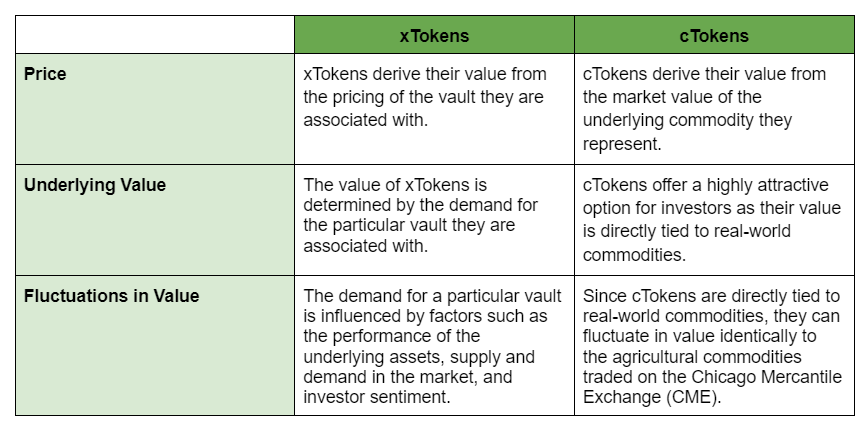

There are 3 main tokens that are used in LandX: xTokens, cTokens and the governance token LNDX.

Let’s start with the xTokens.

xTokens - DeFi Diversification

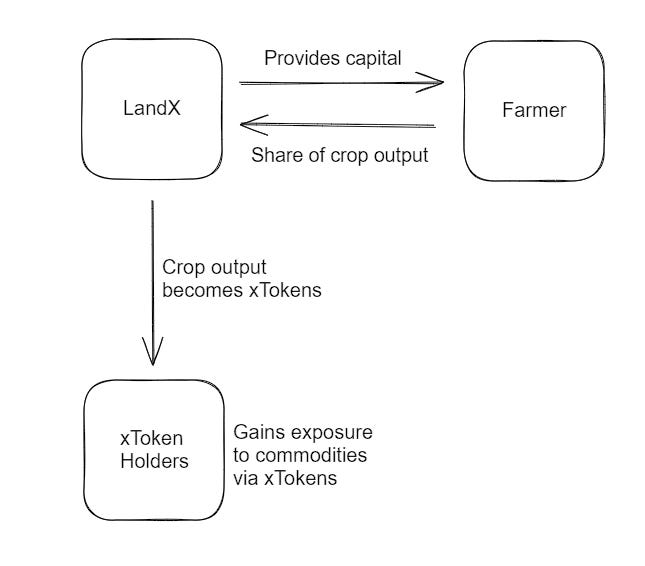

Very simplified LandX provides capital to farmers, and in return, farmers give a share of their crop output. LandX makes sure that the crop output becomes xTokens.

The actual crops produced are represented on-chain as cTokens. xTokens are fractionalized debt obligations farmers have to deliver crop share to LandX.

This is illustrated in the figure below.

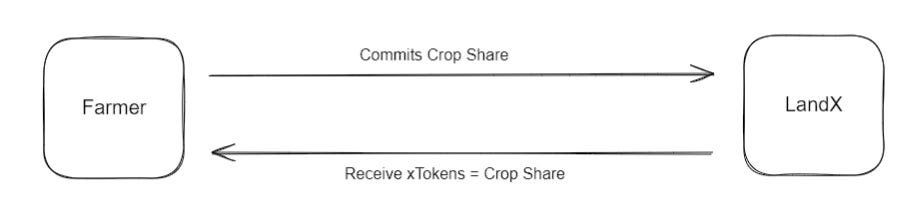

Farmers receive xTOKENs equivalent to the crop-share they agreed to (i.e. if a farmer commits 1000kg of soybeans per year, they receive 1000 xSOY tokens).

The LandX platform requires farmers to keep 12 months of crop share payments on the platform in order to hedge against potential crop or cash uncertainties. Additionally, LandX requires a 12-month security deposit from every farmer.

LandX relies on 49-year rolling legal liens. These liens are independent legal agreements that give LandX the right to take ownership of the collateral (farmland) if the loan is not repaid. This is by far the biggest collateral element used to secure the loan.

Farmers commit a percentage of their yearly harvest through a legal contract, known as a lien, after undergoing an extensive qualification process. In return, they receive xTokens equivalent to the agreed upon crop-share. These tokens are then sold to interested investors, providing farmers with upfront capital.

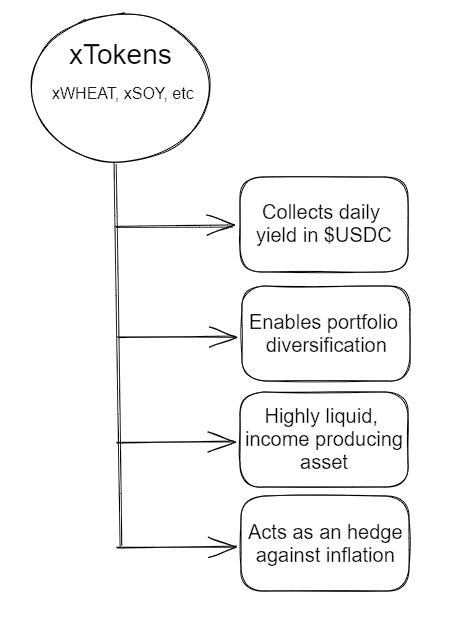

xTOKENs benefit investors in several ways:

Hedge against inflation: xTOKENs offer exposure to the crop output of farmland, which has historically been a dependable inflation hedge.

Liquid, income-producing asset: xTOKENs make farmland commodity vaults tradable 365 days/year on decentralized exchanges.

Collect daily yield in USDC: Staked xTokens produce cTokens daily. cTokens are redeemable for USDC using the vault accessible in the LandX dApp

Portfolio diversification: xTOKENs provide an uncorrelated diversification from crypto, stocks, and traditional vaults.

cTokens - Commodity Collateral

Each xTOKEN entitles its owners to receive 1 kg per year of the commodity yield (CY) in perpetuity, paid out in cTokens.

cTokens can be sold at the protocol level for USDC at the current market price of the commodity delivered by a Chainlink oracle.

If someone holds xWHEAT, they receive 0.0027 kg of wheat per day, equating to 1 kg/year. The CY is paid out daily in units of the underlying commodity (kilograms). When an xTOKEN holder wants to claim their rewards, the value of their CY is converted to USDC and given to the holder.

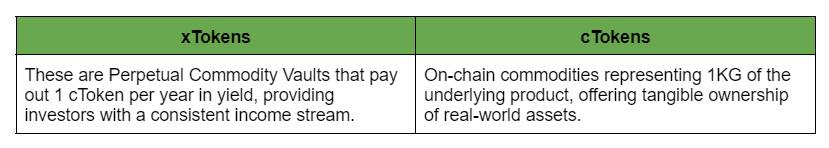

To make it perfectly clear, let’s look at the difference between xTokens and cTokens:

xTokens vs. cTokens

xTokens produce real yield payments in cTokens, a commodity token that represents one kilogram of wheat, soy, rice, or corn. For example, one cWheat is equal to the current market price of 1 kilogram of wheat.

xTokens are tradable on the open market.

cTokens are redeemable in the LandX dApp for $USDC. They are not tradable on the open market.

LNDX Token

While the xTOKEN represents perpetual commodity vault, LNDX is the native token of the LandX protocol. The price of LNDX is driven by speculation and the performance of LandX as a company. Its price is also impacted by the demand to participate in LandX’s system.

Here’s how LNDX is tied into the protocol:

The LNDX token receives a percentage of the protocol’s revenue. As a result, it’s partially represented by the intrinsic value of LandX.

LNDX holders vote on governance decisions for the platform, future updates, and more. It’s an integral piece of the LandX DAO.

LNDX stakers are eligible to become validators for LandX. To refresh, validators have the responsibility of onboarding farmers to the protocol and receive a commission in return. Additional conditions apply to becoming a validator.

Investment Case Example

An investor wants to purchase $1M of the protocol’s Soybean vault xSOY. In exchange for their investment, they receive 100,000 xSOY tokens, priced at $10 each. The xSOY tokens represent 100,000 kilograms of Soybeans each year.

Along with owning commodity vault that represent 100,000 kilograms of soybeans per year, the holder also earns an approximately 9% annual percentage rate (APR) as the CY. Once the CY (1 kg/yr) is claimed for USDC, the 9% is realised.

LandX controls supply of xSoy (as well as other xTokens) by controlling the supply of tokenized farmland onto the platform. Because of this ability to control supply LandX sets a Target Asset Appreciation rate for xToken vaults (currently 10%).

To summarise, the investor captures:

+ 9% commodity yield

+ 10% target asset appreciation rate

~Aggregate 19%

Also investor captures any potential appreciation of the commodity yield as the underlying commodity price increases due to global warming, soil erosion, and growing energy prices affecting commodity prices.

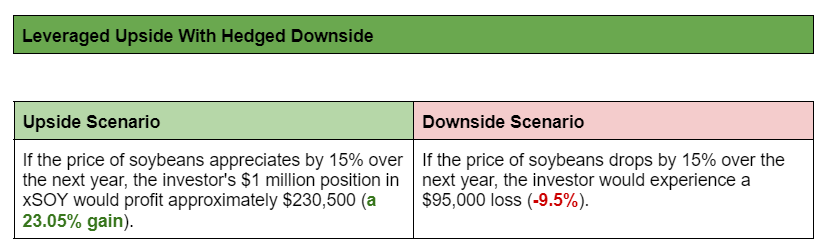

If Soybeans appreciate by 15% over the next year, and the investor sells their $1M position, they’ll profit approximately $230,500 (23.05%).

If Soybeans drop in price by 15% over the next year, and the investor sells their $1M position, they’ll only realize a $95K loss (-9.5%).

This is an asymmetric opportunity in an asset class that blockchain-based investors do not currently have access to. If the price goes up, you get the increase in xSOY and the yield. If the price goes down, some of your losses in the value of xSOY are offset by the daily yield you receive.

The value of xTokens comes from the real yield they produce and their price appreciation.

Target Asset Price Appreciation (TAPA)

Supply of xTokens is controlled by the speed of onboarding of new farmlands. New farmers mint an amount of xTokens equivalent to the amount of crop share they are contractually obligated to pay in return. We carefully control the supply of new xTokens by managing the onboarding speed and making new farmland-backed xTokens available only when demand is appropriate.

LandX determines the Target Asset Appreciation Rate and evaluates it every 3 months. Currently this target appreciation rate is set at 10% per annum in line with actual inflation.

Collateral

The low volatility makes xTokens and appreciating price trajectory makes xTokens an ideal building block in the DeFi landscape.

Their backing by real world production of staple crops such as soy, rice, cord, wheat, makes them naturally resistant to wild price swings in either direction.

xBasket (our index token composed from equal parts of each xToken) presents an auto-compounding vault whose price is formed by appreciating xTokens and yield they produce targeting an APR of 18.8%

Impact of LandX

Many DeFi applications advertise unsustainable yield through inflationary tokens and marketing dollars as an effort to incentivize liquidity.

LandX creates sustainable yield built upon regenerative finance. Capital is used as a tool to invest in real-world yield opportunities and solve systemic issues to regenerate natural environments. LandX believes in providing financial flexibility to farmers, while creating new primitives in decentralized finance that offer access to a dependable asset class.

The LandX protocol is a bridge between real world assets and blockchain technology. Farmers are able to enter agreements with investors on a global scale and receive capital for business expansion and long-term food security efforts. LandX created a robust legal and financial framework to connect farmers and investors in a brand new way.

Let’s summarize what we have been through so far with an infographic:

Okay, anon…but why Agricultural Commodities?

In the current economic climate, marked by crises and soaring inflation rates, agricultural commodities present an appealing combination of a safe haven and a unique investment opportunity for investors.

Land has consistently proven to be a sustainable asset that outpaces inflation by at least 2% annually. Moreover, the availability of arable land—land capable of producing quality crops—is diminishing due to erosion and industrialization.

According to the World Bank, arable land has fallen below 20 hectares per person. Europe, for instance, is currently facing shortages of agricultural commodities and fertilizer from countries like Russia, Ukraine, and the Netherlands. Combined with global warming and a growing world population, key commodities like wheat, soy, rice, and corn are expected to witness increased demand and, consequently, value.

Unlike finite resources like gold, arable land is a productive asset. It not only preserves its value against inflation but also generates income for the owner through the sale of agricultural produce.

Agricultural commodities such as rice, corn, soy, and wheat have been traded for millennia. Think of historical marketplaces like the Dojima Rice Exchange, where rice brokers issued rice bills to successful bidders, ultimately leading to the creation of a rice futures market in 1730. Rice futures provided a means for farmers and investors to hedge against economic and political uncertainties, and this system remains in place today for various agricultural commodities.

Despite the evident value of agriculture as a hedge in turbulent times, it remains relatively undervalued in the contemporary financial landscape. While speculation in growth stocks and digital assets like Bitcoin is popular, LandX recognizes significant potential in agricultural commodities, especially when combined with the immediate, trustless, and decentralized attributes of blockchain technology.

LandX Tokenomics

LandX is structured as a decentralized autonomous organization (DAO) with voting rights belonging to holders of the LNDX governance token.

LNDX Token Model & Governance

LandX offers something relatively unique in DeFi markets; real yield from real-world production. This contrasts greatly with the majority of governance tokens which are built around zero-sum tokenomics.

LNDX value accrual ensures stakeholders' interests are aligned with the project.

Validators are required to stake LNDX tokens as part of their commitment to the land agreements they set up.

Traders and investors in crypto markets seek out volatility and LNDX is the flagship way to gain exposure to LandX growth. While xTokens are expected to maintain strong correlations to their underlying assets, LNDX will likely fluctuate inline with crypto markets and the overall success of LandX.

LNDX token holders earn a percentage of platform fees from the xToken yield. These platform fees create utility and demand for LNDX due to the current and future value distribution. LNDX is priced on future earnings potential which makes it highly volatile and attractive as an altcoin investment.

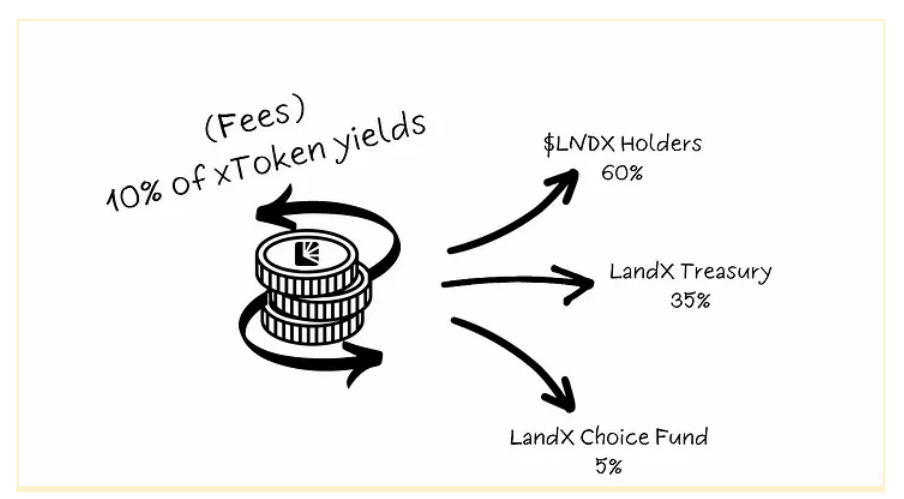

Platform fees are set to 3% of initial financing amount provided to the farmer, 0.25% of crop share payments and a 10% tax on USDX yield claimed. Collected fees are distributed in USDC as follows:

60% LNDX token holders

35% LandX Treasury

5% LandX Choice

Fee percentage and distribution percentages are open to change in line with market conditions via a DAO proposal & vote. Valuation potential can be estimated using existing DeFi protocols and their TVL relative to their governance token market cap.

All right, some facts and hard thoughts here from me. Is the token valuable?

LandX's circulating supply is 5.4M LNDX, with 2.4M held by the treasury.

The initial market cap at $0.50 per LNDX is approximately $2.7M.

Considering over $6M in cash reserves, the intrinsic token value could potentially rise significantly.

Seed investor tokens are fully locked for 4 years and vest over an additional 4 years, reducing immediate market impact.

The Fully Diluted Value (FDV) should be adjusted accordingly as over 40,000,000 LNDX will be released starting from year 4.

55% of the circulating supply at launch is community-held, demonstrating wide adoption of the circulating supply

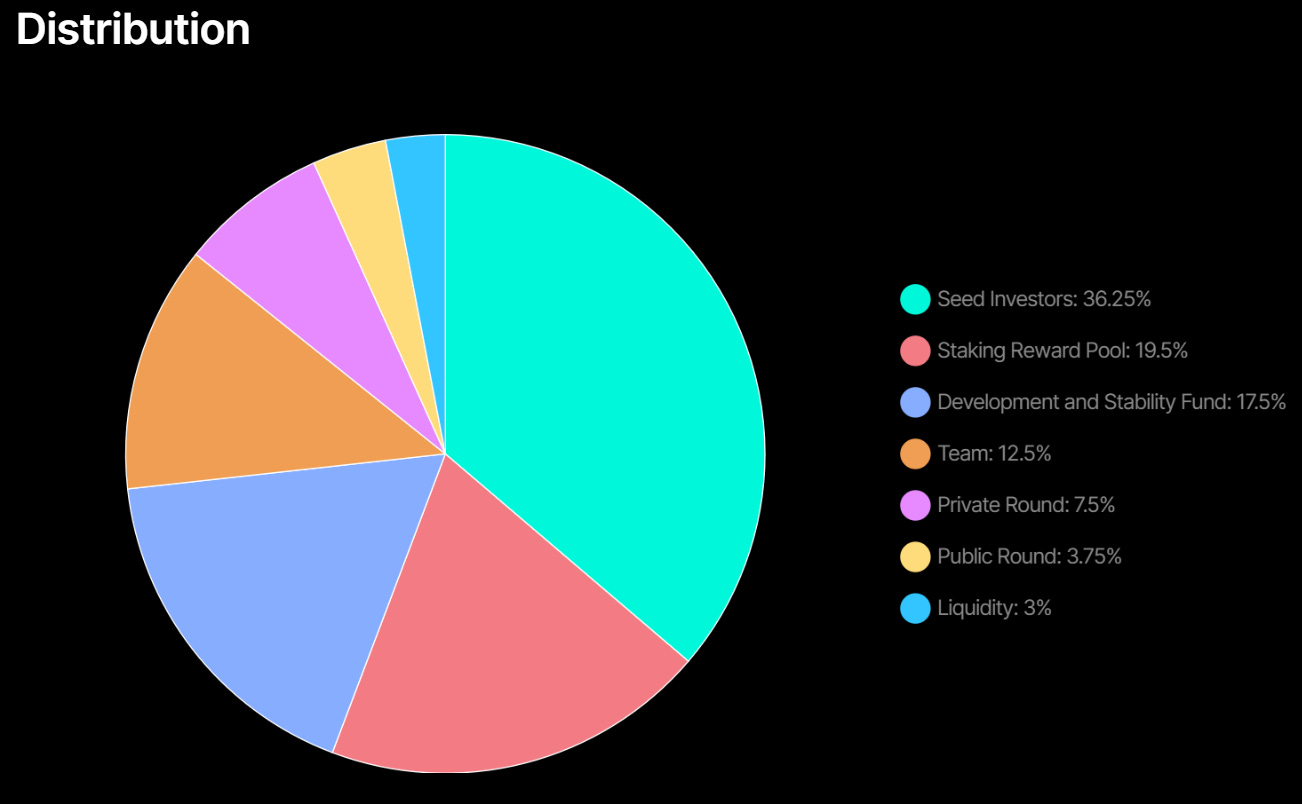

The token distribution for fundraising, amounting to 38M (47.5%) is as follow:

Seed

$0.189 per token.

29M tokens (36.25% of total supply).

4 years cliff and 4 years vesting.

Large farmland owners.

Private

$0.23 per token.

6M tokens (7.5% of total supply).

3 months cliff and 9 months vesting.

Omegas (whitelisted discord members) and VCs, DAOs, etc

Public

$0.50 per token.

3M tokens (3.75% of total supply).

Unlocked immediately at TGE..

Anyone

The remaining 42M (52.5%) are allocated accordingly:

Team

10M tokens (12.50% of total supply)

6 months cliff and 24 months vesting.

Staking Reward Pool

15.6M tokens (19.50% of total supply)

60 months vesting.

Liquidity

2.4M tokens (3% of total supply)

Unlocked immediately at TGE.

Development and Stabilty Fund

14M tokens (17.50% of total supply)

48 months vesting.

The distribution of the LNDX token is designed to create aligned interests between all stakeholders in the project.

Seed investors have agreed to a 48 month lockup and a further 48 months vesting schedule.

Staking rewards represent a significant amount and will be distributed over a 5 year period to stakers of the LNDX token.

Liquidity funds will be used to create 24/7 trading venues across decentralized and centralized exchanges.

Tokens are emitted according to the following schedule:

29.6M tokens (37%) for staking reward pool and development and stability funds starts vesting immediately, over a 48 and 60 months period respectively.

29M tokens (36.25%) for the seed round starts vesting at the 4th year, over a 4 year period.

16M tokens (20%) for private and team start vesting at the 3rd and 6th month respectively, over a 9 and 24 months period.

5.4M tokens (6.75%) for public sales and liquidity are unlocked immediately at TGE.

You do the math, anon. But at least these metrics look very good.

Think about the potential market disruption LandX brings to the RWA sector and the underpriced value of LNDX considering its limited supply and utility.

Stake LNDX Token

Grow your digital asset portfolio with LNDX staking. Staking mechanics will distribute a fixed amount of LNDX tokens over a 5 year period to a variable number of stakers.

Holders willing to lock their tokens for longer periods will receive a higher allocation of staking rewards and voting rights.

3 Months @ 1x VOTING & STAKING REWARDS

12 Months @ 2x VOTING & STAKING REWARDS

48 Months @ 4x VOTING & STAKING REWARDS

So someone that locks their tokens for 4 years will earn four times the rewards each day as someone who locked them for 3 months. This encourages long term commitment to the project.

All stakers will receive a veLNDX, a non-transferable token which will act as a receipt for their deposit.

Who are LandX’s typical customers?

There are currently two target markets that would act as ideal customers for LandX:

DAO Treasuries looking to diversify crypto exposure to protect against market cycle downturns

Crypto-native investment funds looking for yield and inflation hedges

DAO Treasuries

DAO treasuries have amassed huge amounts of capital with over $10B USD now being managed by decentralized autonomous organizations. The top ten largest treasuries shown below:

LandX is looking for partners who wish to diversify their portfolios and DAO’s are a perfect customer, they have a strong balance sheet that is overexposed to crypto assets.

Crypto Native Investment Funds

There are many different types of investment funds in the crypto industry that have grown out of the sector's success. Many now manage billion-dollar portfolios of digital assets such as Alameda Research, Multicoin Capital, Paradigm & Wintermute. These funds often run a combination of strategies including:

Market Making

Venture Capital

Arbitrage Trading

Basis Trading

Directional Momentum

Funds are rarely delta-neutral entirely because of their exposure to low liquidity tokens. Their directional bias could be hedged or de-risked with an uncorrelated digital asset. Let’s look at an example investment scenario.

A purchase of $1,000,000 USD into the protocol’s xBASKET index fund will give exposure to all four xTokens and return a yield expected to be in the region of 7% APR. Each xBASKET token returns the USDC value of 0.25 KGs of each commodity annually.

There is also expected appreciation of the commodity yield as the underlying commodities price increases. The 7% only represents the yield upside from cTokens, so with the Target Asset Price Appreciation (TAPA) pushes this to a projected APR of 18.8%!

High inflation expectations suggest that commodities should increase in price relative to the USD over a long enough time period. This scenario creates a leveraged upside while at the same time providing a hedged downside for the investor.

If a basket of wheat, soy, corn and rice appreciates by 15% over the next year, and the investor sells their $1M position, they’ll profit approximately $230,500 (23.05%). If the basket drops in price by 15% over the next year, they’ll only realize a $95K loss (-9.5%). Over longer term periods inflation further reduces the risk of short-term downside.

This is an asymmetric opportunity in an asset class only now opening up to treasury and fund managers. If the commodities go up, you get the increase in underlying and the yield. If the price goes down, some of your losses in the value of xTokens are offset by the daily yield received in USDC.

Business Model

LandX operates on a business model that bridges the gap between farmland owners and crypto investors while providing exposure to agricultural commodities.

The platform's revenue model is designed to ensure sustainability and align with the mission of offering food security and real yield in a DeFi context.

As LandX expands its offerings and integrates with various DeFi applications, it seeks to diversify its revenue streams further. This includes opportunities for short-term borrowing/lending, auto-compounding of yield, and more.

Revenue Streams

LandX generates revenue through various channels, which are integral to its ecosystem's functionality and growth:

Transaction Fees: LandX charges transaction fees for activities such as trading commodities and xTokens on its internal marketplace. These fees contribute to the platform's revenue.

Validator Commissions: Validators play a crucial role in onboarding farmers, managing legal contracts, and ensuring the security of landowner commitments. LandX pays validators a commission for their services, typically a percentage of the financing amount brought in by farmers.

Revenue sharing: The $LNDX governance token is a key element of LandX's ecosystem. Token holders earn protocol fees, further incentivizing participation in governance decisions and the growth of the LandX platform.

LandX's native token, $LNDX, is central to its economic model and revenue generation:

Protocol Fees: $LNDX token holders earn a percentage of the protocol's revenue, which includes transaction fees and other platform-related charges. This provides a direct financial incentive for holding and staking $LNDX tokens.

Governance Influence: $LNDX holders also have voting rights in the platform's governance. They participate in decisions related to protocol upgrades, rule changes, and other critical matters, influencing the direction of the ecosystem.

Fee Breakdown

LandX imposes a 3% fee on farmland financing and 0.25% on regular crop share payments. The distribution of these fees is as follows:

60% to $LNDX stakers.

35% to LandX Labs operations.

5% to the LandX Choice fund, supporting regenerative agriculture initiatives, education for land operators, SDG goal certifications, ESG programs, agricultural monitoring technology, and sustainable farming tools and equipment.

Roadmap

LandX has published a roadmap, indicating 3 core objectives that are guiding their progress:

Bringing tokenized farmland commodities exposure to all crypto-native investors.

Providing a secure, stable, and intuitive platform to access all services and products.

Positively impacting every farm we work with to encourage regenerative practices.

LandX's growth strategy includes expanding the range of crop-share opportunities. This expansion will allow the protocol to accommodate a broader spectrum of agricultural assets, providing both farmers and investors with increased diversification options.

The next step for LandX is to integrate with DeFi applications for short-term borrowing, lending, and more.

LandX tokens can be utilized as collateral for borrowing or lending within decentralized finance applications. This creates opportunities for users to access liquidity or earn interest on their holdings.

The protocol can be integrated with auto-compounding mechanisms, allowing users to automatically reinvest their earned yields. This strategy can potentially magnify returns over time.

By integrating with various DeFi platforms, LandX tokens can gain expanded utility, opening doors to innovative financial instruments and services.

The fundraise is completed with a total of $8.38 mil raised.

The next step is mainnet launch and after that LandX will be looking at the following objectives:

Integrating with more networks.

Launching the xBasket index.

Enhancing security and transparency measures.

Expanding their product offerings to include xUSD and xNFTs.

Forming LandX DAO

Risks & Audit

Similar to other RWA platforms, LandX implements several safeguards and transparency measures to mitigate counterparty risk and protect the interests of different participants.

Security Deposit for Uncertain Risks: LandX addresses the uncertainties in agricultural production by requiring landowners to maintain the equivalent of twelve months of the crop share as a security deposit. This deposit acts as a safeguard against potential crop or cash flow uncertainties, providing a buffer for landowners and investors.

Centralized Platform Risk: As a centralized platform dealing with real-world assets, LandX carries inherent risks associated with such projects. However, it actively works to minimize these risks through robust legal structures and transparency.

Transparency and On-Chain Recording: LandX is committed to transparency. Every aspect of the platform, including land details, harvest records, lien documents, payment histories, and commodity yield, is recorded on-chain. This ensures an immutable and verifiable record of all activities, enhancing accountability and trust.

Yield Reserves and Staking Mechanism: To further safeguard investor interests, the yield reserves are locked inside the smart contract. These reserves are paid out to stakers in a traditional DeFi staking manner, with a yield runway exceeding 14-18 months. This extended runway provides stability and security in the event of unforeseen challenges.

Transparency Around Farmers and Land: LandX provides transparency around farmers and land. Information about the actual land, including its location and historical crop yield, is stored in NFTs and immutable IPFS records. These details are accessible on the platform, ensuring clarity for all participants.

Validator Accountability: Validators play a crucial role in the LandX ecosystem. They are responsible not only for onboarding but also for timely collection of crop share. Validators are incentivized to ensure that crop share payments are collected promptly, as their stakes are affected if the farmers they onboarded fail to meet their obligations.

Protection Against Collusion: Collusion between farmers and validators is discouraged through legally binding agreements. Farmers make commitments to LandX, and any breach would carry legal repercussions. Validators, as trusted third parties, undergo rigorous vetting processes, minimizing the risk of collusion.

The following audits have been completed:

Security Assesment - Quantstamp - February 3, 2023

High - 5 (5 Fixed)

Medium - 4 (3 Fixed, 1 Acknowledged)

Low - 6 (5 Fixed, 1 Mitigated)

Informational - 8 (7 Fixed, 1 Mitigated)

Undetermined - 2 (2 Fixed)

LandX has a bug bounty program in collaboration with Immunefi.

Resources & more info

Website: https://landx.fi/

Docs: https://landx.gitbook.io/landx/introduction-to-landx/video-explainer

Whitepaper: https://www.dropbox.com/s/cril4d0kk7cvkfg/LandX-Whitepaper-v1.0.9.pdf?dl=0

LandX Academy: https://sites.google.com/view/landx-academy/home

Terms and Conditions: https://landx.gitbook.io/landx/landx-terms-and-conditions-of-use

Twitter: https://twitter.com/landxfinance

Discord: https://discord.com/invite/landx

Telegram: https://t.me/landxfinance

Some threads on LandX that I enjoyed:

Conclusion

LandX bridges the gap between real world assets and decentralized finance. With LandX you get an asset class that is non correlated to crypto and DeFi (eg. the flash crash dip Monday December 11th in crypto would have no effect on agriculture commodities).

LandX gives you exposure to RWA and a potential upside with the LNDX token due to good tokenomics. LandX also has a strong community who has shown dedication from day 1. This is crucial for LandX’s further development. The team's commitment and strategy makes me bullish on LandX's readiness for future growth, and with over $6M in LandX Foundation treasury it is positioned for exponential growth.

To summarize, here is a short video that explains what LandX is within 3 minutes in an easy way:

Thanks for reading!

And a huge thanks to Revelo Intel, who made the tables and graphics for this research report. Go follow Revelo Intel here: Revelo Intel Research

And again, don’t forget the dex listing:

LandX will mark a significant milestone with the listing of its LNDX token Uniswap on Ethereum and Arbitrum as well as on two major exchanges - GATE.IO AND MEXC.COM. Listing on all platforms is planned for 14:00 UTC on 14 December 2024.

LNDX and xToken investment instruments are not currently available in the US or to US investors.

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads