Every now and then, there are some new DeFi applications that suddenly takes off.

Friend.tech is definitely one of them with over 15k active users and lots of hype from the biggest influencers on crypto Twitter.

In this issue we will look at the ponzinomics and discuss game theory.

Before we start, I have been doing a lot of sports betting lately.

If you’re interested in that yourself, join my free Telegram group with 680+ degens to get a free money bonus so that you can try out SX Bet yourself:

TG group: https://t.me/bettingbr0s

Let's talk about Friend.Tech Game Theory - WAGMI or just a giga Ponzi? 3,3 (aka fren,fren)

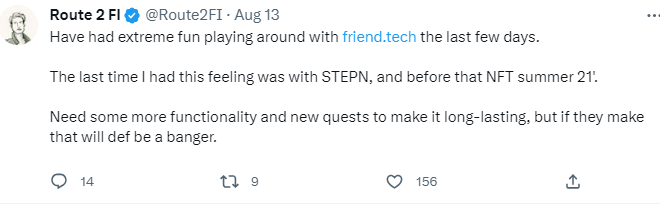

Friend.tech launched a little over a month ago, and I started using it the very first day it launched.

This was my immediate reaction to it:

So friend.tech is built by @0xRacerAlt, a crypto OG. He was the lead dev of @TweetDAO - an NFT that granted access to posting from a shared Twitter account. The project went viral before devolving. It was one of the first forays into decentralized social media.

friend.tech is a decentralized social media app that tokenizes crypto personalities:

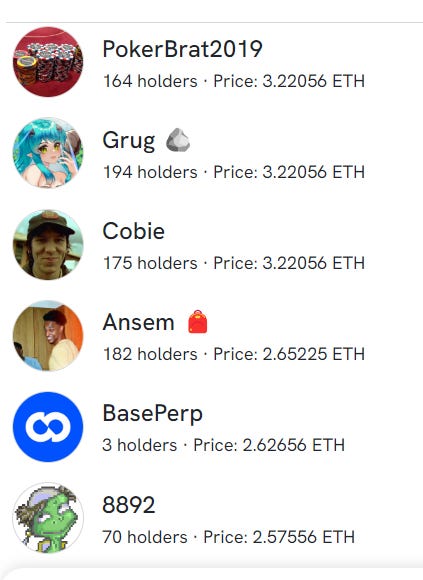

You can buy and sell "keys" of people

Ownership of a key grants you access to a private chat with that person

The key price fluctuates according to supply and demand

So the price is based on supply/demand.

Friend.Tech Game Theory

But how do you calculate it?

Someone made a spreadsheet for this: https://docs.google.com/spreadsheets/d/1AW6by8ZXqD1vV3z4TfC8N7SZwt8RD-lFT-G9_hGMdPk/edit#gid=0

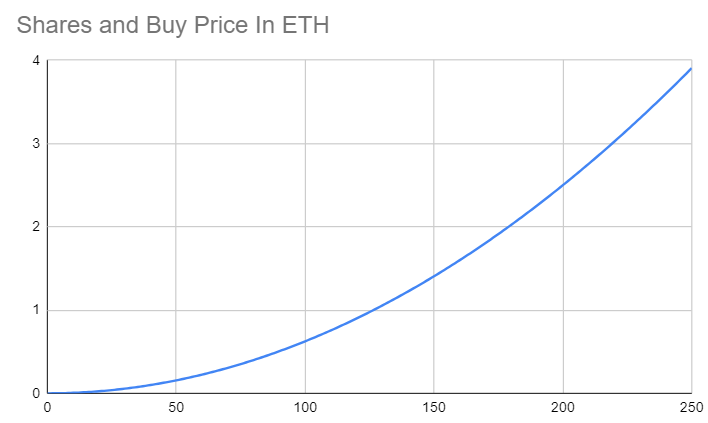

In the figure below you can see the supply/demand curve based on the number of keys (shares) and what the price equivalent is in ETH.

As you can see the bonding curve is getting steeper and steeper the more keys a person has outstanding.

Creators earn a share of the buy / sell tax on every transaction (5% to the protocol & 5% to the creator) of their keys. So that means that the cheaper a key is, the easier it is to earn money from it.

Let me explain.

Let’s say you buy a key from a person that has 10 holders.

The buy price for a 10-holder key is 0.00625 + 10% tax = 0.006875 ETH.

Let’s say you want to resell the key when this person has 15 holders. The selling price is: 0.0125 -10% tax = 0.01125ETH.

Your profit is therefore 0.01125 - 0.006875 = 0.004375. Btw, these prices you can find in the Excel sheet that I linked above.

Okay. But what if we wanted to buy a key with 150 holders?

Buy price for a person with 150 outstanding keys: 1.40625 + 10% tax = 1.546875

Let’s say you want to resell the key when this person has 155 holders. The selling price is 1.48225 x 10% tax = 1.334025.

You can easily see that this is approx. a 0.2 ETH loss.

To break even you need 17 buyers after you! If you sell when it’s 167 holders you sell at: 1.7225 + 10% tax = 1.55 ETH

While you need 1-2 people to buy after you to profit with few key holders, you need a lot of them when the key price gets higher.

Now imagine buying Racer’s key for over 8 ETH. Quick napkin math tells us that this will be 8.8 ETH for buying and 7.2 ETH for selling. As you may understand, you’d need quite a few new key holders after you to profit on this.

Okay, so people understood that flipping was an impossible game to succeed at for bigger accounts (as in my example this mostly works for the cheaper keys).

So what did the smart people do to earn money?

Do you remember Olympus DAO ($OHM) and 3,3?

Let’s go back to 2021, Olympus DAO and 3,3. The biggest ponzi game theory there is.

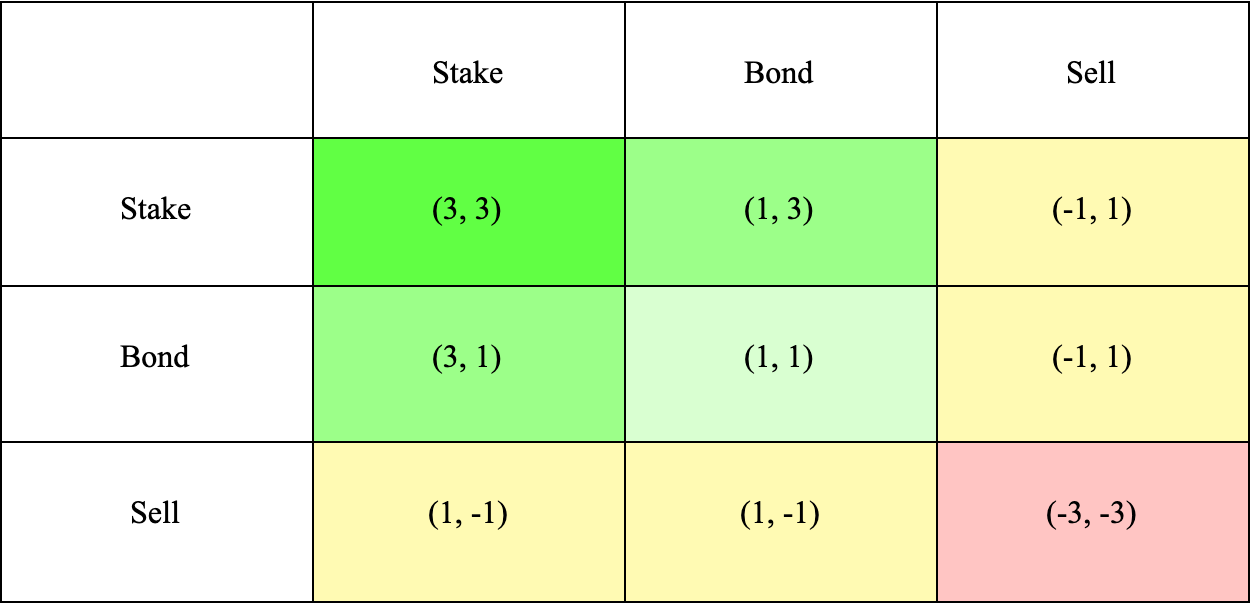

So originally when you saw (3, 3), it’s just a reference to pure staking as the most beneficial strategy for $OHM.

Combinations of staking and bonding (3, 1) or selling and bonding (-1, 1) are less beneficial overall, so you’re unlikely to see anyone boasting about those strategies.

Staking is considered to be the most beneficial action for all Olympus network participants to take — it helps to increase the value of OHM by causing positive buy pressure from the initial purchase of tokens, and it furthermore increases OHM scarcity by locking up more of the supply.

See anything familiar in that table above? Perhaps where the two “stake” headings line up? This (3, 3) notation is game theory shorthand for a maximum positive outcome between participants in OlympusDAO. If everyone stakes OHM, then the value of OHM will climb.

So tacking (3, 3) onto the end of a Twitter handle is a bit of a rallying cry that says something like, “I stake OHM and you should too!” It telegraphs that this person has OHM exposure and wants to see its value climb, so it can be understood as subtle encouragement that you should stake OHM as well.

The (3, 3) meme has worked to great effect….until it didn’t (more about this later down here).

Anyway, cryptoyieldinfo and 0xMakesy where some of the first Twitter profiles that started talking about how 3,3 could work for friend.tech.

Let’s recap. Everyone wants to earn money.

How can you earn the most money possible?

-Fees when people buy or sell your keys

-Flipping (buy low/sell high)

-3,3

Let’s say your key is worth 0.1 ETH and you have a friend that is also worth 0.1 ETH. What if you bought buy each others keys? You both would earn 5% in fees + your value would increase according to the bonding curve (0.10 to 0.12 ETH).

So technically you’ve actually increased your portfolio value by approx. 0.02 ETH (0.015 in key value + 0.005 in fees).

Then you repeat the same with another friend, increasing your value again. Repeat this x100 and your key is starting to become very valuable.

This also brings some other effects.

The goal behind 3,3-ing is to climb up the leaderboard and to signal to other accounts that you're a holder and won't sell their keys.

This should in turn bring attention to your keys, more holders, and more networking opportunities. This should also bring attention to flippers and people that only want to signal that they have a high portfolio value (net positive).

The drawback with the strategy is that you also have to be able to buy your key holders back, which either involves adding more ETH or selling some non-reciprocating keys that you own.

What could go wrong with 3,3?

As long as everyone is buying and holding, everyone is happy.

The prices go up, your friends’ prices go up, and everyone is earning money.

Everyone gets lots of points for the potential airdrop.

As long as the incentives are there, this could go on for a very long time.

However, eventually this will become a race of getting the quickest out of the exit gate.

friend.tech is currently in beta. The beta period is supposed to last for 6 months in total (so 4,5 months left). People are speculating that the airdrop will come at that time.

I think this will be the time where people really start to sell off.

Remember 3,3?

Well, it works in reverse too.

-3 , -3.

If you sell, I sell. And now everyone is losing. If you’re not awake when the mass selling starts you’re going to end up broker than the NFT guys.

And since the UI/UX is so smooth, this can happen fast. No need to deal with Metamask.

Eventually we will come to a point where mass selling will happen (based on the info we have today). Maybe the friend.tech creators manages to launch a system to make this sustainable? I don’t think so, but let’s see.

The funniest thing you see on the Twitter timeline though is the people saying there is alpha in their channels on friend.tech

But ask yourself, have you really gotten any alpha here that you didn't snag up on Twitter/TG/Discord? After seeing what was shared in Friendbook some days ago I am not convinced that there are any alpha there at all. IMO it makes more sense to buy big undervalued people because of the bonding curve. The cheaper they are, the more you can resell them for because of the fees.

What if friend.tech is a game like NFTs. You just try to collect the most valueable players for the cheapest price possible, and then resell it later for a higher price than you bought it for. Do you really care if your favorite influencer chats with you or not? I think this point is overplayed.

Let's be honest. We use this app because we want the airdrop and for quick pumps/dumps.

In that sense 3,3 works out perfectly (so far).

I use friend.tech myself to earn money, not because I believe in the concept long-term. To me it is a pump/dump scheme similar to what Olympus DAO was and what Wonderland DAO is.

3,3 will work until one day it won’t.

Just search up the prices for $OHM and $TIME.

Or Stepn (earning money by walking/running). Lol.

Okay, that was it!

See you next week, anon.

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

Thanks for the explanation