Hey, friends!

Getting more and more bullish for every day that is passing.

Even though the prices remain constant.

Today, let’s talk about the restaking narrative.

EigenLayer points are being sold for $0.19 per point OTC on Whales Market. If you know what this means you’re going to get stupid rich, and if you don’t know I recommend you to read the following text.

If you want to start trading crypto in the new year, use my ref link on Bybit:

https://partner.bybit.com/b/route2fi

You get lower fees, a bonus of up to $30,000, and are able to join my trading group.

I have a trading group only for my affiliates where I share my own trades + the ones from people much smarter than me once they share in their private TG/Discord.

Also, I will arrange a trader contest in cooperation with Bybit starting this week where PnL % is what matters, so even small traders have a chance to win the money prizes + an iPhone.

Once you've signed up on the ref link —> go here to join my private trading group: t.me/route2fiibot

Today’s newsletter is sponsored by the Swell

Introducing rswETH

Currently native restaking is only available for users with 32 ETH and infrastructure expertise to run validators. Furthermore restaked ETH is locked in EigenLayer and that capital remains illiquid for the user.

A native Liquid Restaking Token (LRT), Restaked Swell Ether (rswETH) lets you earn Pearls, @EigenLayer points, and future restaking rewards — while still enjoying the freedom to participate in DeFi.

You have two ways to earn Pearls and EigenLayer points with Swell and EigenLayer:

Holding or LPing rswETH on @CurveFinance or @mavprotocol

Restaking swETH on @EigenLayer when deposits open on Monday (February 5th)

Btw, earning Pearl points is anticipated to be of value for getting an airdrop of the Swell token that will come in Q2 2024.

Make sure to mint your swETH in advance if you want to get in on EigenLayer on Monday.

Check out Swell and get swETH or rswETH here:

Let's talk about restaking and all the different airdrops and yield options

EigenLayer opening up its caps again on Monday (February 5th), so I thought I could spare some thoughts about it + the risks. As you know I am an Ethereum bull and restaking is quite fascinating.

About 1/4 of all ETH in circulation is staked (120m ETH in total, approx. 30m staked).

This offers great security to Ethereum and the smart contracts running on it because an attack on Ethereum's consensus system would require lots of ETH.

With the introduction of EigenLayer’s restaking, Ethereum validators can now safeguard other protocols with their 32 ETH stake (the 32 ETH is reused). Validators won't have to unstake or add additional capital + they get extra yield. EigenLayer allows protocols outside of smart contracts to tap into Ethereum's security via restaking which was previously not possible.

EigenLayer is not a DeFi protocol. EigenLayer is a platform to bootstrap new proof of stake (PoS) systems. Through the EigenLayer protocol, users can’t engage in any financial activities such as swapping and lending.

However, for the decentralized services built on top of EigenLayer (we call them AVSs, Actively Validated Services), these services could be DeFi applications themselves or support key functionalities in other DeFi protocols. These AVSs are external to the EigenLayer contracts.

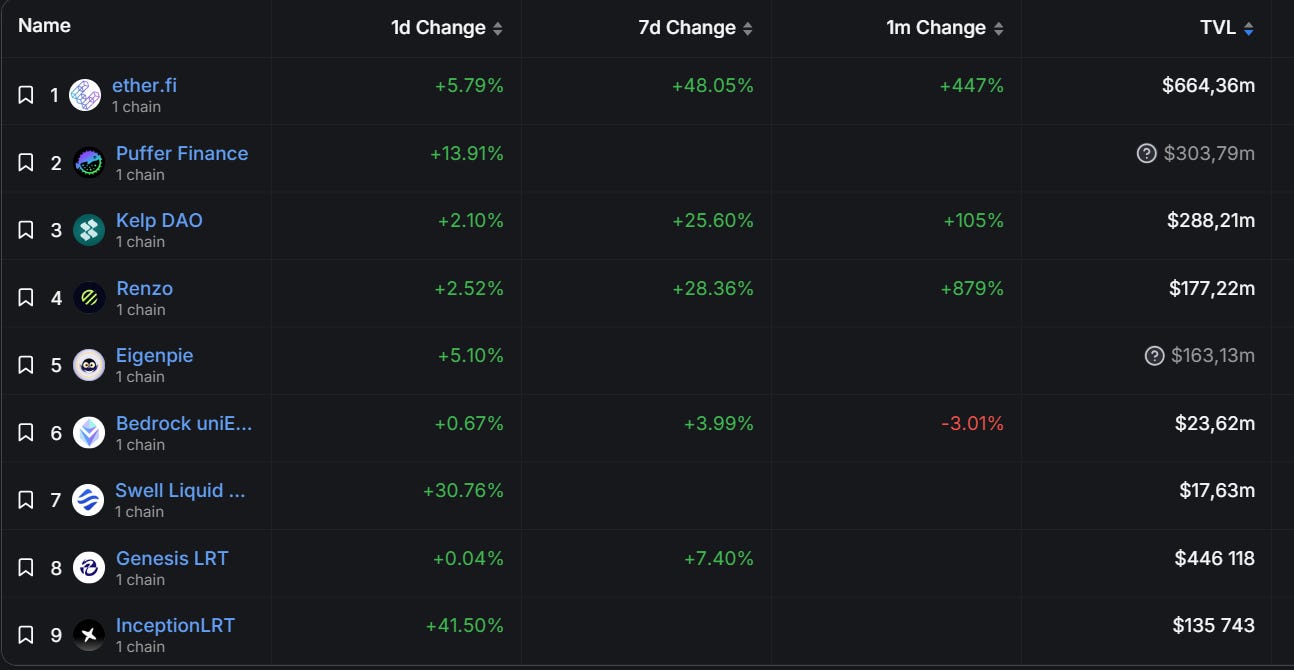

Moreover, another class of protocols built on top of EigenLayer is called liquid restaking protocols (LRT). They are permissionlessly built on EigenLayer. These are the ones degens care about. Swell Network, Ether.fi, Genesis, Puffer, Kelp ++

Swell and EtherFi offer double points through native token airdrops. Also you can earn Eigenlayer Points and KelpDAO Miles by restaking stETH or ETHx (more points for ETHx).

An overview of the different options:

First of all, we just got to differentiate between liquid staking and liquid restaking.

Traditional staking involves locking your assets in a smart contract, supporting the blockchain's operations, and earning staking rewards.

On the other hand, liquid staking allows you to stake your assets with a liquid staking protocol and receive a liquidity token that represents your staked assets.

Liquid restaking is a method where Liquid Staking Token (LST) holders restake by transferring their tokens into the EigenLayer smart contracts.

If you want to read more, Inception made a good blog post about the differences here:

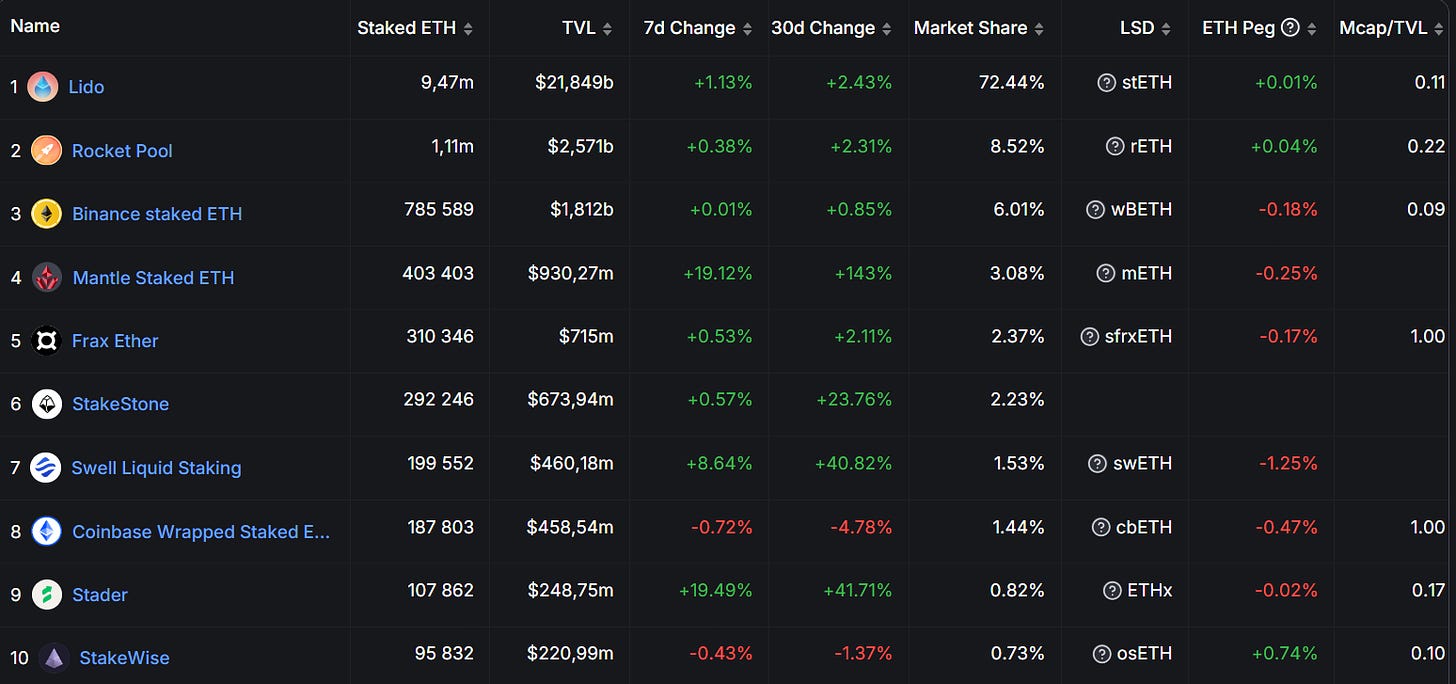

On the screenshot from DeFiLlama below you can see the liquid staking protocols (Lido, RocketPool, Mantle, Frax, Swell) etc.

And on the second screenshot (below) you can see the biggest liquid restaking protocols (ether.fi), Puffer, Kelp, Renzo ++.

In the following section, I am going to outline what I personally think are the most interesting opportunities in LST/LRT right now.

For EtherFi (eETH/

Deposit ETH -> generate eETH + earn EtherFi Loyalty Points + EigenLayer points. Use eETH to interact with different DeFi protocols and earn additional yield (eg. Pendle).

For Swell (swETH/rswETH)

Deposit ETH into Swell for swETH LST -> then re-stake into EigenLayer -> will eventually generate a liquid rswETH LRT. Assumingly the Pearls rewards system will continue to apply unless the TGE happens in advance of the LRT. Stake your ETH with Swell to earn "Pearls"/points for airdrop + receive additional bonuses for referrals and redepositing into EigenLayer and other DeFi partner strategies.

For Mantle ETH (mETH):

Deposit ETH to Mantle LSP (liquid staking protocol) to get 7.2% APY (they promise this yield for the next 2 months, with a possible prolonging). You get mETH which you can hold in your wallet. On Monday EigenLayer opens and you can deposit mETH for additional EigenLayer yield. The drawback with this method is that there is no airdrop because the Mantle token already exists. However, the yield is very good. So you get double yield + EigenLayer points if you enter the pool on Monday.

For Kelp (ETHx):

On Kelp you can choose between stETH, ETHx and sfrxETH. On all assets you will get Eigenlayer points + Kelp Miles (for airdrop). ETHx gives more EigenLayer points than any other LST because Stader (team behind Kelp) used ETH from their treasury to restake in EigenLayer, and it is giving away those extra EL points.

For Renzo:

Stake ETH and get ezETH. You also get EigenLayer points, Renzo ezPoints (airdrop), and the normal ETH staking yield.

For EigenPie:

For every 1 ETH worth of LST deposit, users will earn 1 Eigenpie point per hour. In the first 15 days, depositors get a 2x point boost, rewarding early supporters. These Eigenpie points are your key to sharing in 10% of the total EGP supply via an airdrop, plus to share in 60% of the EGP token IDO at 3 Million FDV.

For Puffer:

Deposit stETH & wstETH to earn Puffer + EigenLayer points. Lock in double points before Feb 9th.

puffETh is a nLRT (native liquid restaking token). nLRTs generate their restaking rewards through native restaking on Eigenlayer, where Ethereum PoS validator ETH is the staked asset. This sets them apart from Liquid Restaking Tokens (LRTs). An LRT tokenizes restaked LSTs within a Liquid Restaking Protocol (LRP). While the LRP yields rewards from restaking services, these are distinct from PoS rewards.

What should you choose?

This is a hard choice because all of them have advantages/drawbacks depending on how you see it.

If you’re an airdrop hunter:

Swell, EtherFi, Kelp, Puffer, EigenPie, Renzo

If you want the highest yield:

Mantle ETH (mETH) - 7,2% on your ETH + EigenLayer points

If you want “safety”:

I’m writing safe with ““. Because nothing in crypto should be declared safe. Even stETH (which has 70% of the market depegged during summer 2022.

However among the safest ones (based on how long they’ve been around (Lido, RocketPool, Binance Staked ETH.

I think Puffer has solid backing, and I have a feeling this could be considered one of the safer options after a while.

What am I playing:

I am doing all of the airdrop plays and mETH. Personally, I like sizing up too, and mETH with a juicy 7.2% APY is very nice.

If you’re a degen and bullish ETH you could buy let’s say 10 wstETH, deposit it to AAVE, borrow against it, eg. borrow 50% ETH (5 ETH). And then buy swETH, mETH, ETHx and do what is suggested above to get airdrops + EigenLayer points.

Do also keep in mind that several LRT tokens are launching soon: Genesis and Inception are 2 of them. Also, Pendle has some degen strategies too where you can get up to 30% yield.

To be continued.

Let me know your favorite plays in the comment section, and if I forgot something.

That’s it for today, anon!

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

hey Bro,

this is the best intro in LRT and LST.

What about stablecoin with:

"Capital efficient money markets on stETH and USDe collateral to allow for both enhanced yield and composable leverage across DeFi_"

https://www.ethena.fi/

Do we start building web3 or bullshit?