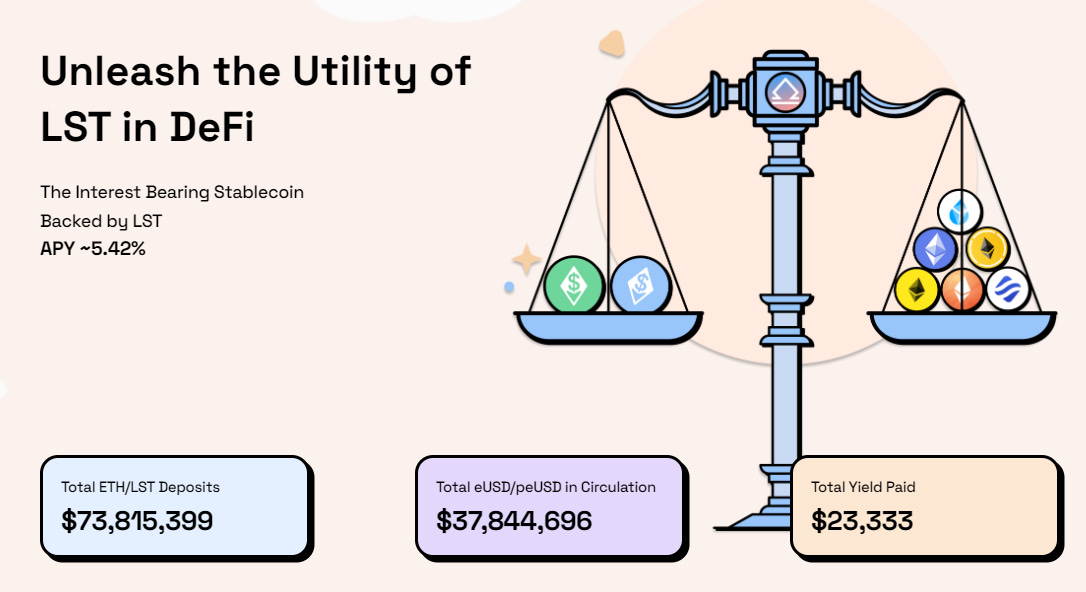

Lybra Finance - Unleash the Utility of LST in DeFi

Hello, friends!

How are you holding up in this market? Besides friend.tech and chilling in DeFi staking/yield farms (incl. friend.tech), it feels like we’re just waiting for the next bull market to start. The BTC halving is getting closer, and with 230 days left (end of April 2024), I am mentally preparing for bullish sentiment going forward.

Today’s newsletter is a sponsored deep dive into Lybra Finance.

Before we start, I have been doing a lot of sports betting lately.

If you’re interested in that yourself, join my free Telegram group with 650+ degens to get a free money bonus so that you can try out SX Bet yourself:

TG group: https://t.me/bettingbr0s

Lybra Finance - Unleash the Utility of LST in DeFi

Introduction

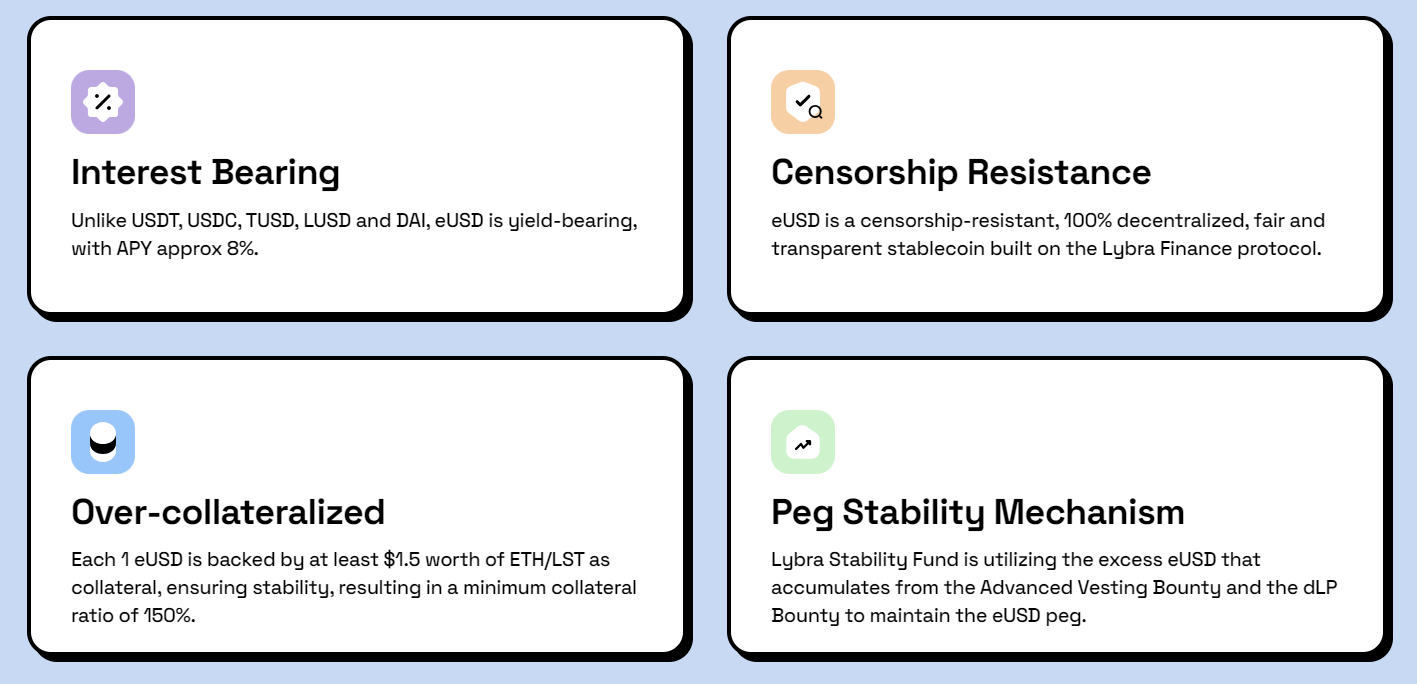

Lybra's primary mission is to create an interest-bearing stablecoin, known as eUSD, which is secure, decentralized, and delivers real yield to its holders. This is achieved through the protocol's innovative structure which allows users to mint eUSD by depositing their ETH and other supported LSTs as collateral.

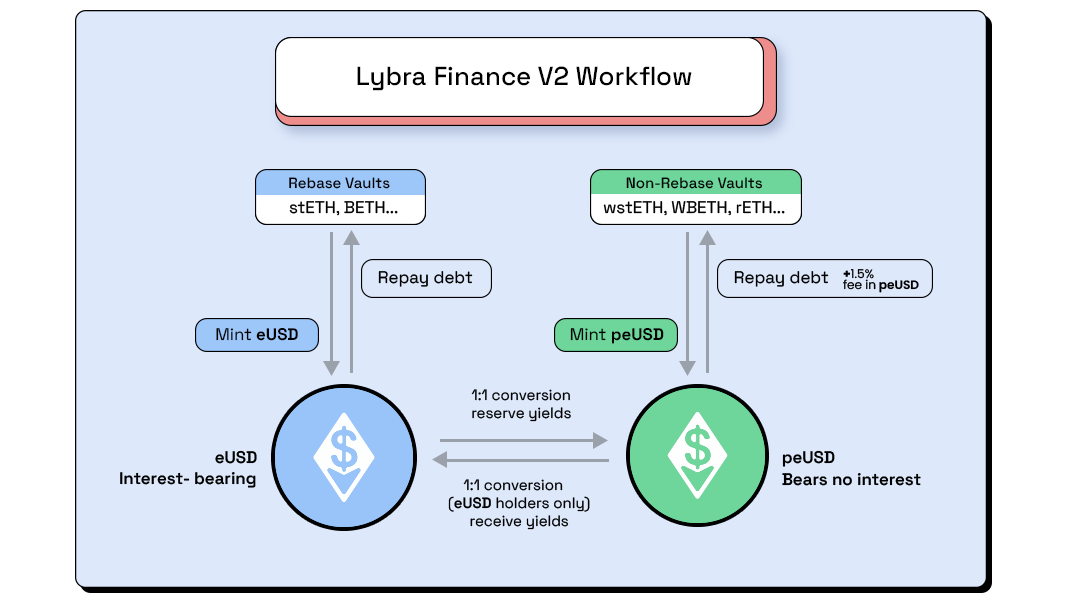

In addition to eUSD, Lybra V2 also introduces an Omnichain version of eUSD, called peUSD (pegged eUSD), which represents the underlying DeFi-utility of eUSD, unlocking wider utility for DeFi applications. Both eUSD and peUSD can be converted at a ratio of 1:1 through the protocol.

eUSD, an over-collateralized asset, offers users much-needed stability in the volatile cryptocurrency market. Meanwhile, peUSD provides users the confidence for transacting in DeFi, with its wide-ranging use cases.

One unique aspect of Lybra Protocol is the opportunity it provides for users to generate a steady income through real yield. By depositing ETH or rebase LSTs and minting eUSD against these assets, users can expect to earn approximately 8% on their eUSD holdings. This income is drawn from the Liquid Staking Token income generated by the deposited collateral. The income is converted to eUSD through the protocol and then distributed to eUSD holders. Meanwhile, the introduction of peUSD allows users to continue earning yield on their eUSD even as they are spending it.

Lybra V2 is designed to support a wider range of LSTs as collateral, offering more flexibility and choice to users and borrowers of eUSD.

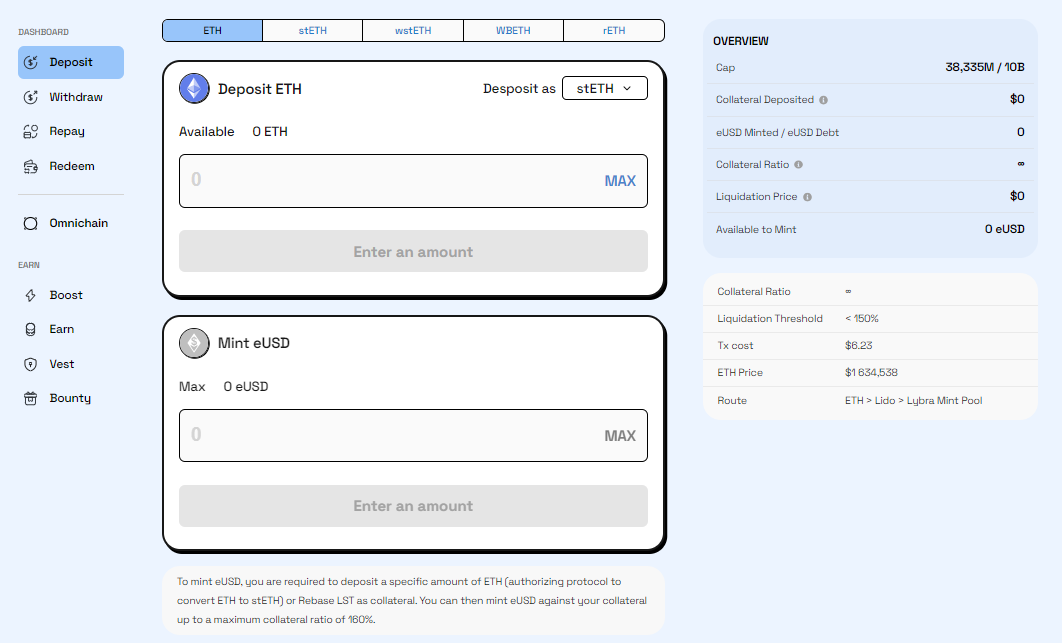

You can deposit ETH, stETH, wstETH, rETH, and WBETH.

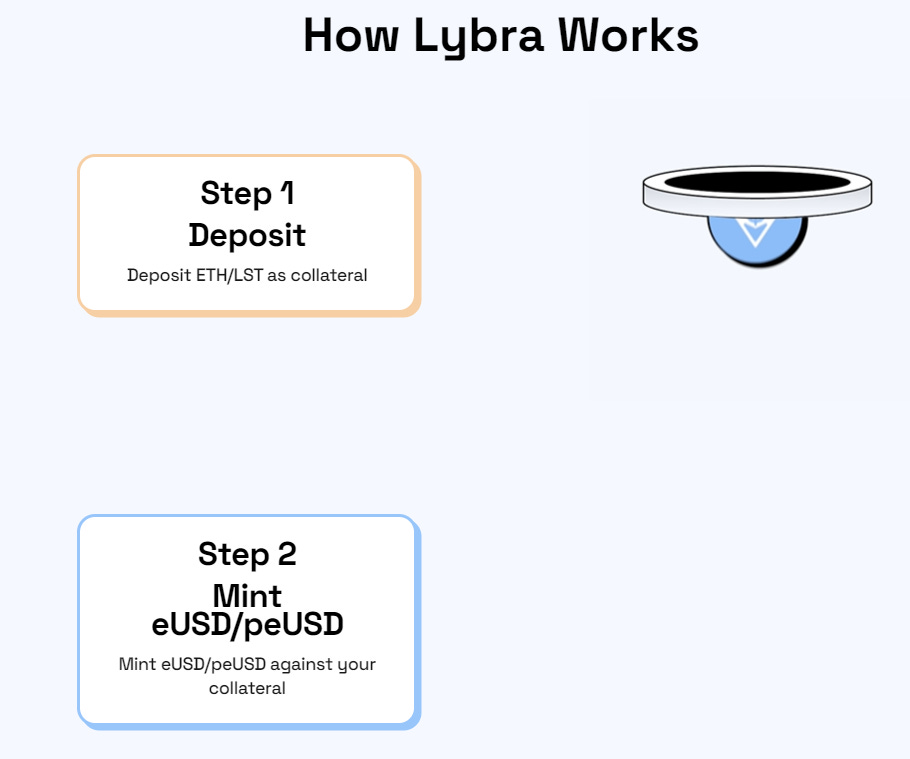

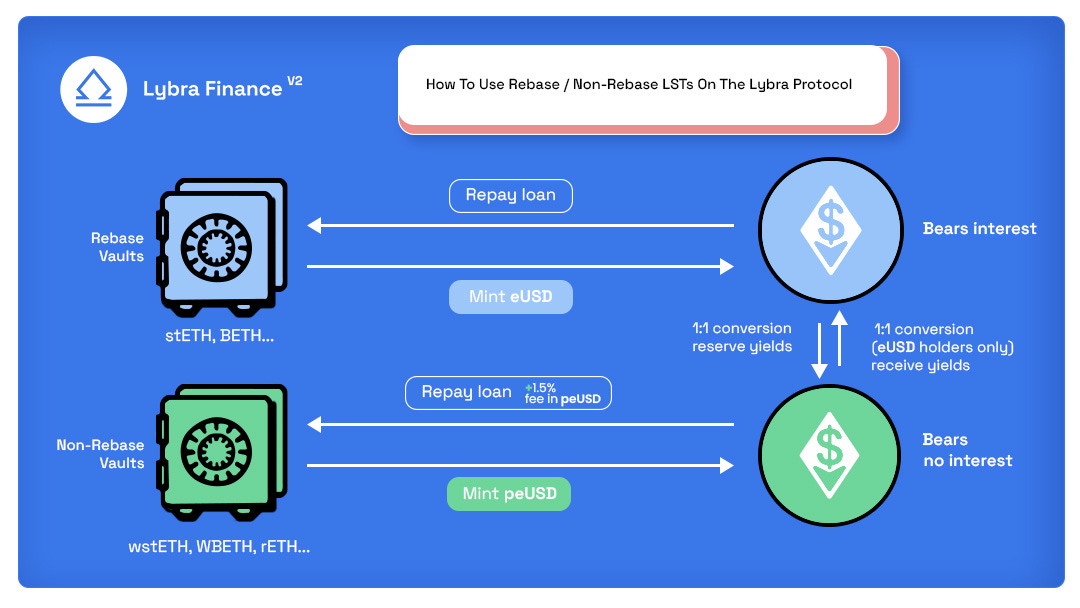

Here is a nice and simple illustration of how you use the Lybra protocol:

Okay, that’s great!

But what is LST’s in the first place?

Regardless of whether you are a casual cryptocurrency investor or a seasoned DeFi enthusiast, you've likely noticed the growing buzz around one of this year's most thrilling new asset classes: Liquid Staking Tokens (LSTs).

LSTs (Liquid Staking Tokens), are tokens that represent the value of a user's staked ETH, providing them with a new source of liquidity and opportunities for increased yield.

Think about it this way. You can have your Ethereum in Metamask doing nothing. Or you could convert it to a liquid taken token, and mint a stablecoin (eUSD) against it to further use it in DeFi.

LSTs act as tokens reflecting the value of a user's staked ETH, unleashing fresh liquidity and paving the way for improved yield opportunities. They serve as evidence of staked ETH within Ethereum staking pools. This provides a solution to the long-standing conundrum of having to choose between staking ETH to earn rewards and preserving its liquidity for other activities that generate yield.

Since LSTs are entirely tradable, users can stake their ETH to earn passive income, while simultaneously employing their LSTs in a multitude of revenue-generating DeFi applications. This has facilitated a solution to the staked ETH liquidity problem and ushered in a new era of high-yield investment opportunities for one of the most trusted assets in cryptocurrency.

Landscape of the LST market

Let’s dive into the 3 staking derivative models and the landscape of staking derivatives.

Rebase model (stETH)

Protocols following the rebase model will give their users the same number of receipt tokens as the ETH that they have staked into the protocol. If a user were to stake 5 ETH into Lido’s deposit contract, they would get back 5 stETH.

Over time, the quantity of stETH in that user’s wallet will go up slowly as staking rewards. This simple model is efficient and it gets the job done, however with legislation differing from country to country, it may be problematic as the influx of new tokens into one’s wallet may be taxable.

Reward-Bearing Model (cbETH, rETH etc.)

Protocols who follow the reward-bearing model such as Coinbase, act in a similar fashion; when users stake for example 5 ETH, they would get back 5 cbETH. Rewards will cause a premium in the price of cbETH therefore the token’s value is the changing variable instead of the actual quantity as compared to the rebase model.

Dual Token Model (Frax)

Protocols following this model such as Frax, give stakers TWO receipt tokens instead of one. The first token represents their position, whereas the other represents the rewards. Stakers on Frax will be given frxETH and sfrxETH, where frxETH maintains a peg with ETH and sfrxETH is designed specifically to accrue staking yield.

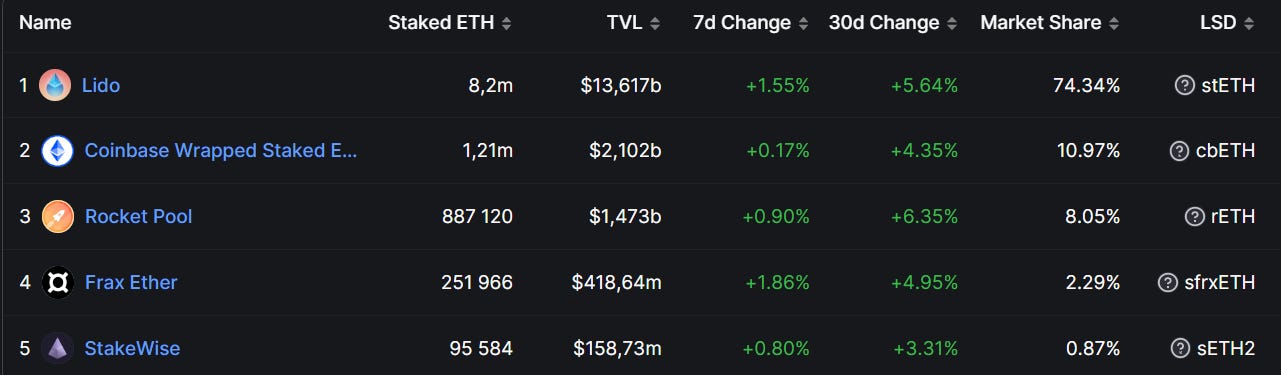

Now let’s have a look at the top staking derivative options by marketshare.

Lido (stETH) has immense dominance in the LSD market with a market share of 74%, in the last 30 days (as of 14th Aug 2023) alone generated $5.38m in revenue showing great potential for this narrative in the space.

The Untapped Potential of the LST Market

LSTs present an exciting new opportunity for DeFi investors, offering passive income from staked ETH while also enabling further yield-bearing activities through LSTs. However, one might wonder: is the LST market really reaching its full potential? Current statistics suggest otherwise.

As it stands, just 17.9% of ETH is staked, leading to an astounding $17 billion worth of ETH lying idle. For context, more than 70% of Solana is staked. This suggests that, despite the ongoing excitement, there's considerable untapped potential in the LST market.

In order to increase the TVL of staked ETH, it's crucial that we augment the utility of LSTs. Even though, theoretically, the liquidity provided by LST's possesses immense potential, the existing avenues for earning yield are currently limited.

This is where Lybra Finance steps in.

Lybra Finance stands as the world’s first Omnichain LST-backed, yield-bearing stablecoin solution. In doing so, Lybra Finance creates the crucial profit-generating utility that LST's require to fully realize their enormous potential.

Okay, so to understand the potential of Lybra let’s talk a little bit of stablecoins.

Stablecoins, a subset of cryptocurrencies, are designed to mirror the value of a fiat currency, such as the USD, on a 1:1 basis.

A significant portion of the portfolios of most DeFi users is often held in stablecoins, given their predictable store of value and provision of liquidity. However, stablecoins pose a considerable challenge for their holders: they do not offer any interest, leaving them susceptible to persistent devaluation due to USD inflation.

There are currently 3 types of stablecoin available on the market today:

Fiat-Collateralized Stablecoins: Fiat-Collateralized stablecoins are stablecoins issued with fiat currencies (such as USD, EUR, etc.) as collateral, such as Tether (USDT), USD Coin (USDC), and TrueUSD (TUSD). These stablecoins are usually issued and managed by centralized institutions, and maintain a collateral ratio of 1:1 in general, which means that for every stablecoin issued, one unit of legal currency needs to be pledged as collateral.

Crypto-Collateralized Stablecoins:

Cryptocurrency-Collateralized stablecoins are stablecoins issued with cryptocurrencies (such as Bitcoin, Ethereum, etc.) as collateral, such as Dai, BitUSD, and sUSD. The collateral ratio of these stablecoins is relatively low, usually 1:1.5 or 1:2, which means that to issue every one of a stablecoin, 1.5 or 2 cryptocurrencies need to be pledged as collateral.

Algorithmic Stablecoins:

Algorithmic stablecoins are stablecoins that use algorithms to maintain stablecoin prices, such as Basis Cash and Frax. The price maintenance mechanism of these stablecoins is relatively complex, usually introducing elastic supply mechanisms and incentive mechanisms to adjust supply and demand and maintain price stability.

None of these options provides a feasible mechanism for providing significant interest income to holders. This is because the underlying collateral assets, be it fiat or cryptocurrency, do not themselves accumulate interest whilst sitting idle as collateral.

This is where Lybra Finance’s interest-bearing stablecoin, eUSD comes in.

Lybra, the Home of all LSTs

Lybra Finance allows users to utilize LSTs as collateral to mint the interest bearing stablecoin, eUSD. Users can deposit either ETH or LSTs, and borrow against it to obtain eUSD, repaying their debt at a later time.

If users deposit ETH, it is automatically converted into a rebase LST through the LST Providers' contract. Given that a rebase LST is an LST asset that intrinsically generates interest, employing it as collateral enables the Lybra Protocol to distribute interest back to eUSD holders.

Consequently, unlike traditional stablecoins, simply holding eUSD produces a stable income with an annual percentage yield (APY) of approximately 8%. This approach perfectly leverages the liquidity offered by LSTs.

By harnessing the interest-bearing attributes of LSTs, Lybra Finance has pioneered a new asset category that can be advantageous to any DeFi market participant: a stablecoin that inherently provides interest to its holders as real yield.

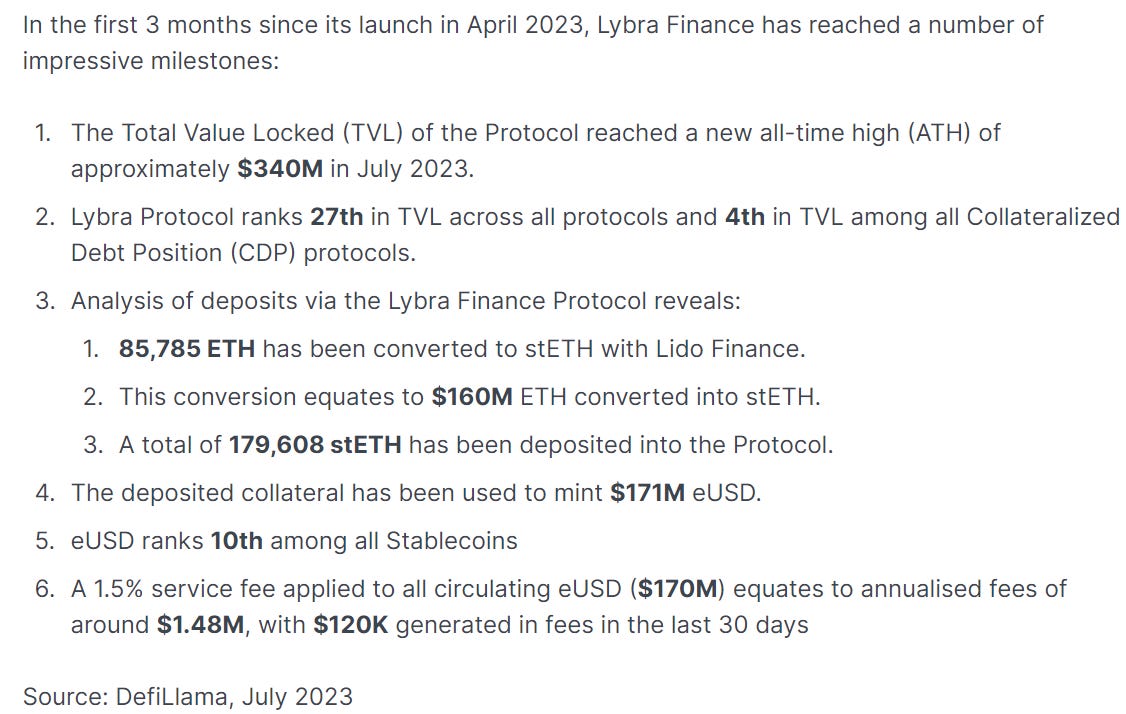

The revolutionary nature of this offering is substantiated by the impressive metrics associated with Lybra's rapid growth.

Just take a look at these impressive numbers:

How to use Lybra Finance?

As mentioned, Lybra Protocol allows users to mint eUSD, an interest-bearing stablecoin, by using ETH or rebase LSTs as collateral. eUSD is unique, as holders earn a base interest of 8% by simply holding the stablecoin.

Lybra's V1 version supported only stETH as collateral. However, with Lybra V2, users can collateralize various LSTs like Rocket Pool's rETH, Binance's WBETH, Swell's swETH (Pending DAO Voting), and more, to mint eUSD and/or peUSD (more about peUSD soon).

The minting process for Rebase LSTs consists of five stages:

Deposit: Users deposit stETH or any supported Rebase LSTs.

Mint: With a collateral ratio above 150%, users can mint eUSD against their collateral assets with no minting cost.

Hold & Earn: eUSD holders earn daily rebase yield with a base APY of ~8%. Holders can then either provide eUSD/3CRV liquidity and continue earning daily rebase yield or convert eUSD to peUSD on the mainnet or on supported L2's (Arbitrum) whilst still receiving the accrued rebase yield upon conversion back.

Repay: Users repay their eUSD debt with eUSD.

Withdraw: Users can withdraw their collateral at any point, provided their Collateral Ratio remains above the safe CR of at least 150%.

If you want an even more detailed guide, I recommend checking this guide out:

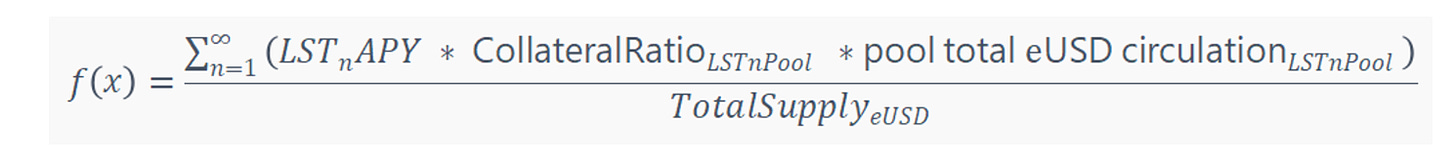

Curious about how the yield is calculated?

eUSD APR Calculation

Various Rebasing LSTs with different APR are used as collateral asset to mint eUSD, thus, eUSD APR is calculated on the basis of a formula that takes into account factors including the APR of each LST, the total eUSD in circulation for each LST pool, the pool’s Collateral Ratio and the total current supply of eUSD.

How can eUSD stability be ensured?

eUSD stability is maintained through a combination of over-collateralization, liquidation mechanisms, and arbitrage opportunities. These factors work together to ensure that the value of eUSD remains close to its 1 USD peg. Additional peg stability mechanisms have been introduced in V2 of the Lybra Finance protocol to futher ensure the stability of the asset.

What is peUSD and How does peUSD Work?

At the time of writing, Rebase LSTs currently account for over 75% of the total value locked (TVL) in the LST market (largely due to Lido's stETH, which has a 74% market share). However, a majority of the different LST assets available are now Non-Rebase LST's, with 8 out of the top 10 LSTs by TVL adopting this model.

The new thing with Lybra Protocol is that the V2 supports both Non-Rebase and Rebase LSTs.

To facilitate this, Lybra has developed a new minting process specifically tailored to Non-Rebase LST's and introduced a new stablecoin, peUSD (Pegged-eUSD), into the ecosystem.

Whilst holders of Rebase LSTs will mint eUSD (which they can convert to peUSD at a 1:1 ratio), holders of Non-Rebase LSTs will directly mint peUSD. You’ll notice that peUSD does not bear interest like eUSD.

peUSD directly minted from Non-Rebase LSTs cannot be converted to eUSD. However, users who mint with Non-Rebase LSTs need not fear. This is because whilst they hold their peUSD, the underlying LSTs put up as collateral will automatically increase in value, due to the value accruing nature of Non-Rebase LST.

Meanwhile, there is no need to convert to eUSD as peUSD has wider utility than eUSD for usage in DeFi protocols.

So, holders of both types of LST end up receiving similar value via different mechanisms. Those who mint with Rebase LSTs get interest on their eUSD holdings paid in eUSD. They can also convert their eUSD to peUSD whilst continuing to generate interest as they spend it.

Meanwhile, those who mint peUSD with Non-Rebase LSTs can spend their peUSD whilst their underlying LST collateral continues to accumulate value. The end result is that both types of user access all the benefits that a stablecoin offers, whilst continuing to accumulate value as they hold or spend it.

The Benefits of Using Non Rebase LSTs as Collateral To Mint peUSD

Whether you choose to use Rebase LSTs or Non-Rebase LSTs as collateral on Lybra V2 will depend on your priorities and strategies. Here are some of the key reasons why you might use Non-Rebase LSTs instead:

You Want To Receive Your Yield In LSTs Rather Than eUSD: Because any Non-Rebase LSTs put down as collateral automatically increase in value, this means that you will continue to accumulate value in terms of LSTs whilst you spend your peUSD. For those who wish to realize their value increase in LSTs rather than eUSD therefore, minting with Non-Rebase LSTs offer them this option.

Tax Efficiency: Because the value increase is reflected automatically in the value of the LST collateral itself, no additional transactions are necessary. This means there are no potentially taxable events such as interest payment transactions.

Wider Functionality Of Non-Rebase LSTs In The DeFi Ecosystem: The lack of rebasing makes Non-Rebasing LSTs compatible with a wider range of DeFi protocols. This is not an issue once deployed on the Lybra platform itself as eUSD can be converted to peUSD, delivering the same functionality. However, it is a reason why a user may decide to hold Non-Rebase LSTs in the first place. The Lybra V2 functionality means that those holding Non-Rebase LSTs for these reasons can directly use them on the protocol without having to trade them for Rebase LSTs elsewhere.

The Lybra Finance Native Tokens

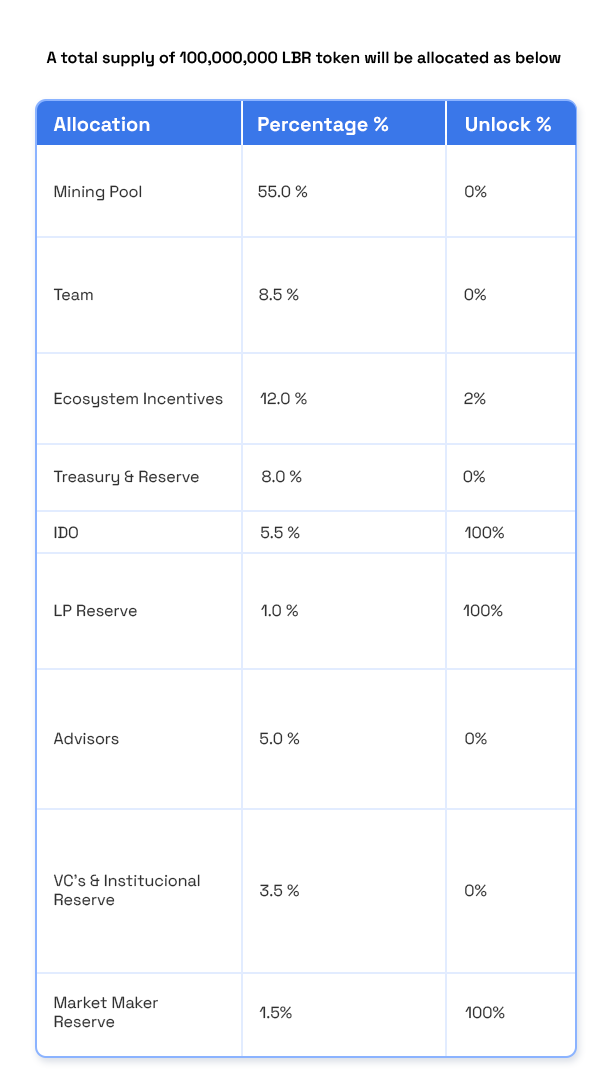

The Lybra Protocol is globally governed by individuals who hold its native governance tokens: LBR and esLBR.

LBR has the capability to be bridged to and traded on any supported L2's without any limitations on liquidity.

LBR and esLBR serve as the fundamental tokens within the Lybra Finance ecosystem. Owners of LBR have the opportunity to stake their tokens, converting them into esLBR, which stands for escrowed LBR.

Having an equivalent value to LBR, esLBR is dictated by the total supply of LBR.

esLBR holders gain voting rights, enabling them to participate in governance decisions, and are eligible to share in the earnings generated by the protocol. This system cultivates active community participation while distributing rewards among the stakeholders.

The Lybra (LBR) Token is the native token powering the Lybra Protocol. Its utility comprises all core network functionalities, such as staking, governance, mint, and liquidators rewards.

LBR is an ERC-20 governance token with a maximum supply of 100,000,000

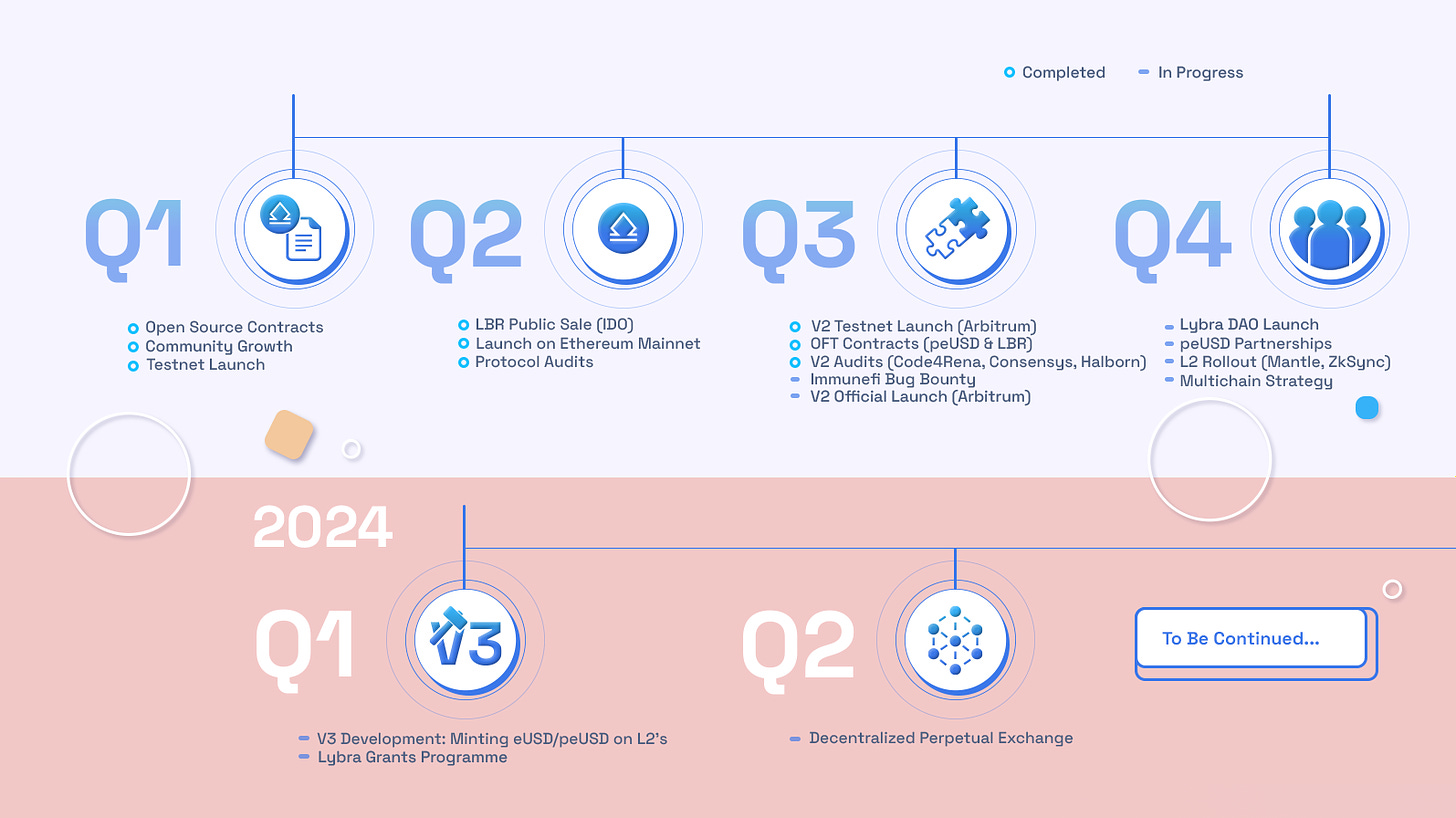

Roadmap

It’s safe to say that Lybra has implemented a lot already.

With the launch of V2 and peUSD they’re already looking forward to Q4 and the launch of Lybra DAO, L2 rollouts (Mantle, zkSync), and going multichain.

Btw for those of you who are wondering what changes have been made from V1 to V2, look no further:

For a complete roadmap, check this out: Roadmap

To summarize Lybra, let’s try to write down some key features:

What are the key benefits of Lybra?

eUSD holders receive stable interest with a base APY of ~8%.

peUSD represents the DeFi utility version of eUSD. Accrued eUSD yield can be realized instantly when converting from peUSD back to eUSD.

Liquid DeFi-Compatible Asset: While enjoying the yield generated from the underlying ETH and LST asset, eUSD holders can also enjoy a liquid asset, peUSD, which opens the door of DeFi.

Zero loan interest - There's no borrowing interest when minting (borrowing) eUSD, allowing users to leverage long on ETH with zero loan cost.

Immutable - Lybra's contract cannot be updated. Only the Collateral Ratios, Redemption Fees, Keeper Rewards, LST Vault Launching/Emissions and LBR shared revenue can be modified according to the LybraDAO community.

Here is an extremely good Dune Analytics dashboard to see key stats for Lybra:

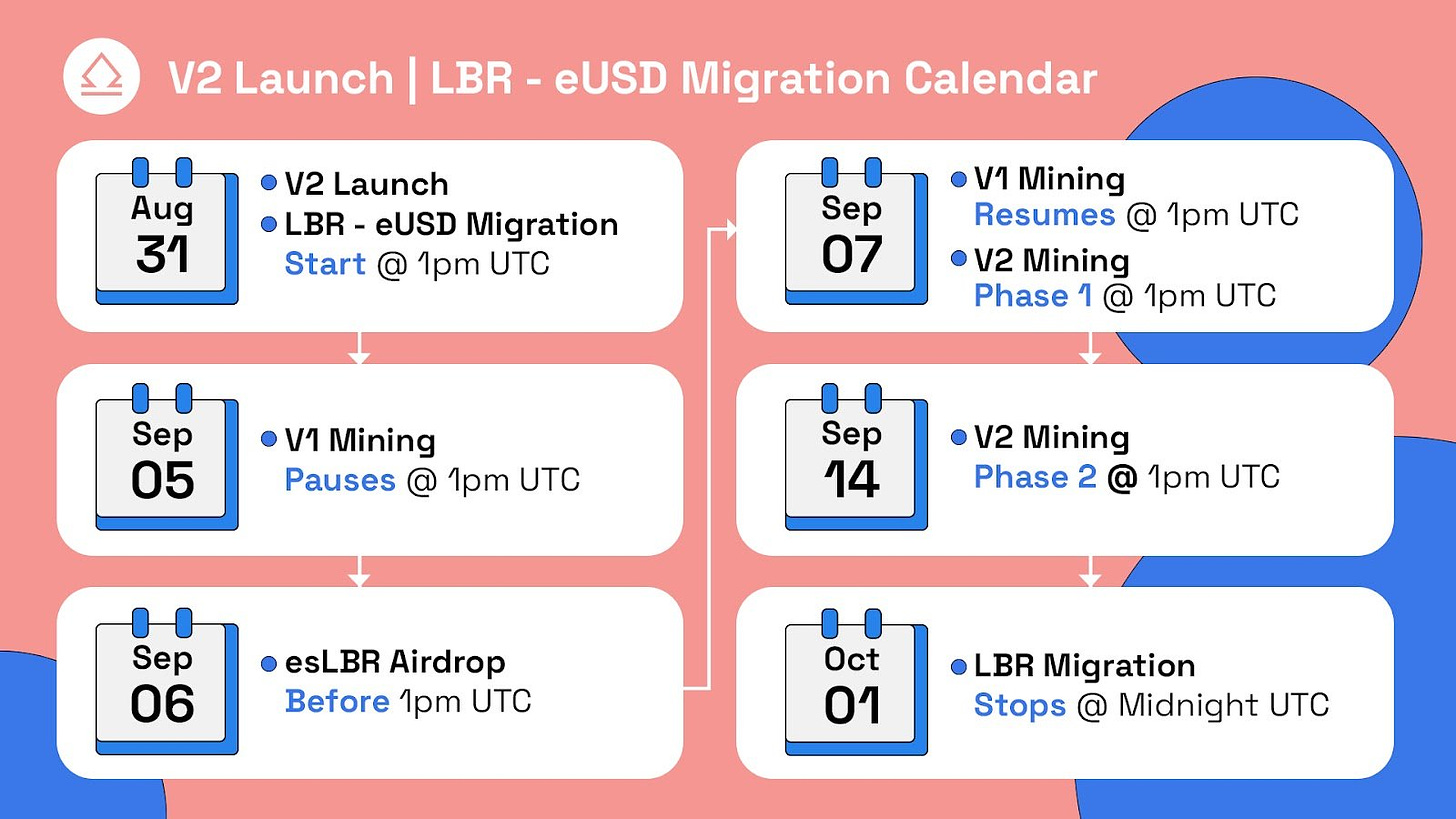

It’s also worth mentioning that Lybra just launched several incentives with the the V2 release:

Here you can read more about the V2 mining program that starts next week:

Just to end this, adding some more reading material that I enjoyed.

Thread by DeFi Saint on Lybra V2: Lybra thread

Thread by Tindoor: Lybra V2

Lybra’s blog: https://medium.com/@Lybra_Finance

Deep dive by Blocmates: https://blocmates.com/blogmates/inside-scoop-on-lybra-finance-v2/

Everything You Need To Know About Lybra V2: https://medium.com/@Lybra_Finance/everything-you-need-to-know-about-lybra-v2-as-we-prepare-for-launch-48783ed28bfd

Walkthrough of Lybra by Ceazor on Youtube:

It’s hard not to be bullish on Lybra going forward.

Getting yield on your stablecoin which is backed by LST’s is a unique concept and I expect them to capture more market share going into 2024 and the next bull run.

Remember only 17% of ETH is staked as of Q3 2023, which means that 83% that holds ETH are not getting any yield.

The demand is clearly there.

Check in again Q1 2024, and I almost can guarantee that Lybra has increased their TVL from today’s $150m.

That’s it for today!

See you next week, anon.

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads