Hey, friends!

Today I wanted to show you my watchlist of tokens that I think will perform well in 2024. Notice that I don’t talk much about $SOL here, but that doesn’t mean I am not bullish on it. It’s just that for me it’s a part of a core portfolio consisting of BTC, ETH and SOL.

If you haven’t joined my trading group with 2.4k members already, you can find it here:

Today’s newsletter is sponsored by LandX

Exciting News: LandX Teams Up with Timeswap for a DeFi Adventure! 🌱

Unlocking a new frontier, this groundbreaking partnership integrates LandX products into the Ethereum and Arbitrum DeFi ecosystem. Brace yourself for the ability to borrow stablecoins using xBasket as collateral on Timeswap's innovative platform!

Dive into the Details:

🌐 Platform: Timeswap

🏛️ Collateral Asset: xBASKET

🚀 Borrowing Asset: USDC

📊 Trading Pair: 2.60 xBASKET/USDC

⏳ Maturity: 10 weeks

📈 Initial Interest: 3% (per annum variable)

To kick things off, LandX ensures smooth transactions by providing initial USDC liquidity, allowing users to dive into borrowing right after launch.

💰 For early adopters, a lucrative incentive awaits! 20,000 LNDX and 433,000 Time tokens are up for grabs, offering an APR over 30% across the pool's lifetime and a dazzling 60% boost at the start.

Why xBasket on Timeswap? It's the dynamic duo of LandX's unique index fund token and Timeswap's pioneering DeFi protocol, promising an exhilarating journey in the decentralized financial landscape!🌽🌾

🌐 Dive into the action: https://timeswap.io/

My crypto watchlist going into 2024

2023 is almost over, and it’s time to look forward to a new year.

I am quite bullish for 2024 (as everyone else). The reason for this is that we have the BTC spot ETF most likely approved in January, and the BTC halving in April. On top of that we have the Dencun upgrade for Ethereum in Q1 2024.

One of the key features of Dencun is the inclusion of Ethereum Improvement Proposal (EIP) 4844, also known as "proto-danksharding."

This will allow layer-2 (L2) rollup networks to store certain transaction data temporarily using a new format called "blobs." Blobs can be deleted after 18 days, significantly reducing transaction fees on layer 2s. This is a highly anticipated upgrade for L2s like Arbitrum and Optimism.

Anyway, I wanted to list up some tokens I think will be strong for the next year. Can be fun to see what price they are at 3, 6, 9 and 12 months from now.

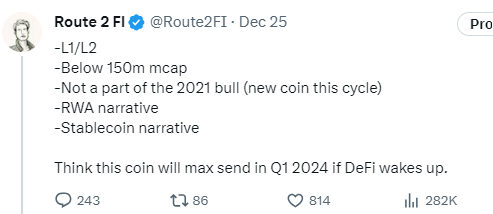

Layer 2: ARB/OP/CANTO/MATIC/METIS:

Let’s start with the Layer 2 projects. As I mentioned proto-danksharding (EIP 4844) goes live Q1 next year. Layer 2 projects should catch a bid on this narrative (we have actually seen this happening already), but I think there will be a new wave in Q1. Out of these tokens I think Canto is the one with the biggest potential. Not many people know that this will be a L2, and the mcap is like 200m. Very low compared to the rest. I hinted to Canto with this tweet some days ago (price up 50% since).

Metis is almost 400m mcap, and tbh I don’t know much about METIS other than that many influencers are bullish on it. Still on my research list.

Restaking tokens (SD, Swell, EigenLayer, Ankr, LDO, RPL, FXS, JTO, PICA)

EigenLayer will launch next year, and restaking is the new narrative. I have already talked about this 1 week ago, but will repeat it here.

In terms of airdrop I think the best opportunity on EigenLayer is to deposit swETH (Swell). This protocol doesn’t have a token yet, and in that way you can get both Swell tokens and Eigenlayer tokens airdropped. Lido already have a token. The same is true for all the other EigenLayer pools too: RocketPool, Coinbase (Base token), StakeWise, Origin, Beacon (Binance has BNB), Ankr and Stader.

However, I do think Stader ($SD) is undervalued. The mcap is a mere $30m (TVL $330m), they have the fourth highest deposit amount on EigenLayer (ETHx). The Stader team is consistently building. They are soon transitioning to a model similar to Rocket Pool, but validators are allowed to borrow SD. SD holders can lend to validators and receive a share of the yield from validators.

PICA is another interesting pick. It’s the restaking protocol for $SOL. The token did a 4x right after this narrative started to run.

JTO is Solana’s liquid staking protocol. The token was airdropped and has gotten dumped pretty heavily ever since. At this moment $2.28.

FXS recently had its halving, has a liquid staking narrative, ETH narrative and this token might have a solid run in Q1 2024 if ETH performs well.

Artificial intelligence

This is the latest buzz word. And Q4 this year has really been AI-narrated. You’ve probably seen coins like TAO, RNDR, FET, AGIX, OCEAN, PRIME ++. See the full list here: https://www.coingecko.com/en/categories/artificial-intelligence

I would say that the whole list has had a good run, but to me there is one that looks quite cheap: $MOZ. Only $10m mcap. Mozaic provides automatic yield farming strategies leveraging AI and LayerZero tech. Thread here: MOZ thread

$PRIME also looks decent even though FDV is a little high. However PRIME fills both the AI and the gaming narrative. Lots of people are bullish on gaming in crypto for 2024. I am not one of them, but I do find it very interesting.

Layer 1

As with Layer 2’s, I think L1’s will continue to outperform. SOL and AVAX have had a hefty run so far. However, these are not the ones I am mostly interested in.

For me it’s INJ, SUI, SEI, FTM, CANTO (again), and Monad (launch in 2024). And probably there will be more L1s that haven’t launched yet that will have insane run’. Keep your eyes open here.

I’ve developed a love for $SEI already. There is something about this community that makes me insanely bullish. Check out this thread: SEI thread

DEX’es

We have already seen $RUNE with a 6x run so far. We also have DYDX, SNX, JOE++.

Personally I am most bullish on $RBN (soon AEVO) and $RBX.

Ribbon is fairly low priced, hasn’t had a run yet and will soon be converted 1:! to AEVO. New coin, new chart, new believers. Will probably do well.

$RBX is only a $50m mcap, new coin, good marketing. With the insane valuations of DYDX and SNX I definitely think this one has a potential too.

$UNI has broken out of a 500 day range too. Several big traders are bullish on it, including Eugene (Binance top trader).

The rest

I could keep on listing category over category. So many interesting projects in the space, but I wanted to keep this piece relatively short and actionable. So here you have my last coins I think will perform well in a bull.

MINA: $Mina is a privacy protocol and offers an elegant solution using advanced cryptography and recursive zero-knowledge technology. $Mina drastically reduces the amount of data each user needs to download. Instead of verifying the entire chain from the beginning of time, participants fully verify the network and transactions using recursive zero-knowledge proofs (or zk-SNARKs ). Nodes can then store the small proof, as opposed to the entire chain. I think the privacy narrative picks up as ETH grabs attention in Q1.

SYN: Synapse was the token everyone talked about in 2021. It is a cross chain bridge that still has lots of users (including myself). When I bought CANTO the other day I used the Synapse bridge. I made a thread about it 1,5 years ago, check it out here: $SYN thread

TIA: Hard to be bearish on maybe the biggest narrative of 2023 so far. Celestia improves scalability by separating the 3 core functions of a blockchain. Celestia is an exciting new technology that strives to solve the core scaling problems of today's blockchains. Its modular architecture provides developments in scalability, flexibility, and interoperability, enabling developers to build blockchain applications for mass adoption. Celestia's approach to data availability and scalability offers an innovative solution to some of the biggest challenges facing the blockchain industry today.

KUJI: Kujira is an L1 blockchain built on Cosmos. It is 'the blockchain for real yield'. You can best compare it to what $LUNA was trying to be, but better. In fact, $KUJI was initially built on Terra (Kujira launched October 2021), but when $LUNA collapsed it took a new route. hey have different products live that generate revenue, which goes to the $KUJI stakers. A lending platform, a DEX, a liquidation protocol, a liquidity engine, a cross-chain staking protocol, a stablecoin $USK, and a platform to launch projects and tokens on Kujira. $KUJI is a bet on DeFi, which I believe will become a strong narrative again in the next bull market.

BITCOIN: (the people’s BITCOIN - Hpos10inu):

Start by looking at this: https://x.com/ZoomerOracle/status/1715771667593470061?s=20

And then read this thread: https://x.com/ZoomerOracle/status/1682745880590336000?s=20

Now finish it by watching this crazy video and you will see soon how wild this community is: https://twitter.com/taiwancoin888/status/1738216907465969891

That’s the thesis, and that’s why $BITCOIN will run far.

GRAIL:

The main dex on Arbitrum. Seems very undervalued, $30m mcap. Camelot aims to be a dapp, which functions as hub for other protocols and users to bootstrap liquidity. Read this for everything you need to know about Camelot ($GRAIL): https://x.com/LouisCooper_/status/1584922760173670400?s=20

Just to end this, I highly recommend you to read this thread by Thor Hartvigsen on ETH and Ethereum betas: https://x.com/ThorHartvigsen/status/1740325119950520805?s=20

That was it!

Which tokens are you bullish on in 2024?

Let me know in the comments or shill me in the Twitter DMs.

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

You missed kaspa

Excellent ! As always!