Navigating Psychological Traps in Crypto Trading

Hey, friends!

Trading psychology reveals the hidden mental game behind successful cryptocurrency trading. As a trader, your mind becomes your most powerful tool – or your greatest weakness.

Your personal biases like confirmation bias and overconfidence can silently sabotage your financial decisions, often without you even realizing it.

The most successful traders aren't necessarily the smartest, but those who understand their own psychological patterns, control their emotions, and make rational choices under pressure.

By recognizing how your brain naturally wants to react, you can develop discipline, manage risk more effectively, and transform your trading from an emotional rollercoaster into a strategic, calculated approach.

Let’s dive in, anon!

Today’s newsletter is in collaboration with dYdX

MegaVault is a new feature on dYdX that allows users to deposit USDC, provide liquidity across various markets, and earn yield.

Key points include:

1. Users can deposit and withdraw USDC at any time, with yield accruing immediately.

2. Yield sources include PnL on vault positions, trading fee revenue shares, and other incentives.

3. An appointed operator manages USDC transfers between sub-vaults and adjusts parameters.

4. Yield is not guaranteed and depends on market conditions and vault performance.

5. The initial version allows withdrawals at any time

6. MegaVault has grown to over $68M in TVL, earning over $4m with an APR of approximately 20%. A good supplement to your stablecoin portfolio.

To use MegaVault:

1. Visit dydx.trade/vault

2. Connect your wallet

3. Deposit USDC to dYdX

4. Approve and confirm

5. Deposit USDC into MegaVault

6. Earn profits

Navigating Psychological Traps in Crypto Trading

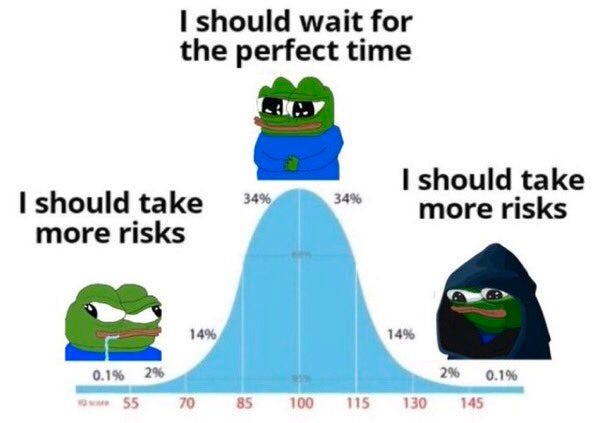

Which one of the pepe’s are you on the bell curve above?

Trading psychology is a combination of traders’ reactions to all the market events and other factors that affect trading.

It is the psychological condition of a trader that determines his trading decisions and trading career improvement at large.

As you prob know, it is not a high IQ that is needed to achieve success, but psychological factors such as patience, perseverance, discipline, and a healthy state of mind.

Traders can react to the same situation differently.

For instance, with a sharp price drop in $BTC, some start to panic and sell off their coins, while others prefer to buy these coins being confident that the price will rise again. Thus, there are various psychological types of traders:

Impulsive traders perform without a well-thought-out plan. They make decisions fast, disregarding consequences, so being subjected to emotional trading with potentially significant losses.

Careful traders comprehensively analyze a market situation and their financial position before hopping into the trade. This type of trader is usually emotionally stable and has a good self-management plan in place. However, sometimes they lack acting risky, which might be profitable.

Practical traders are both risk-takers and careful traders. They know all about risk management and act confidently in their trading. This is the ideal. To not overanalyze but at the same time calculate if the trade is +EV.

You probably recognized yourself in one of the traders’ psychological types and can reflect on the connection between this type and your trading results.

No doubt, trading psychology is a crucial element.

Trading biases

Trading biases are cognitive errors that can significantly impact a trader's decision-making process and overall performance in the financial markets.

Here's a comprehensive overview of the most common trading biases:

Confirmation Bias

Traders tend to seek out information that confirms their existing beliefs about a trade or market condition, ignoring contradictory evidence. This can lead to poor decision-making and overtrading.

An example: let’s say you own a big bag of $ETH. The common thing to do is to seek information, for example on CT, that confirms that Ethereum is a good hold. So instead of doing research on why ETH might not be the best coin to hold, you read tweets that already agree with your current view.

Availability Bias

Availability bias in crypto trading occurs when investors make decisions based on easily recalled or recent information, rather than comprehensive analysis. A prime example of this is when traders rush to buy a cryptocurrency that has been frequently mentioned on social media platforms or news outlets, regardless of its underlying fundamentals

For instance, if a particular altcoin has been trending on Twitter due to celebrity endorsements or viral memes, traders might overestimate its potential and invest heavily, even if the coin lacks strong technological foundations or real-world use cases

This bias can lead to poor investment choices, as the readily available information may not accurately reflect the asset's true value or long-term prospects.Another example is when traders react strongly to recent market events. If Bitcoin experiences a sudden price surge, availability bias might cause investors to believe that such rapid gains are common and easily achievable, leading them to make overly optimistic trades

This can result in chasing short-term trends and neglecting more stable, long-term investment strategies.

Anchoring Bias

A prime example of anchoring bias in crypto trading is when an investor buys Bitcoin at $100,000 during a market peak. Even as market conditions change and the price drops significantly, the trader remains fixated on the $100,000 "anchor" price. This leads to poor decision-making, such as:

Holding onto the investment despite clear indicators suggesting it's time to sell, hoping the price will return to the initial $100,000 level

Ignoring new information or market analysis that contradicts their anchored belief in the $100,000 price point

This anchoring bias can result in significant financial losses as the trader fails to adapt to changing market conditions, missing opportunities to cut losses or make profitable trades at lower price points.

Another anchoring bias I experience on a daily basis is net worth number. As a trader you’re always exposed to your PnL. Some days you are up, other days you are down. As an example, let’s say your total crypto net worth is $100,000. If you lose let’s say $20k, it’s easilt to get fixiated on that the number is lower, and that it will be hard to bounce back. Which can lead you into a too defensive approach towards the markets. You start risking less even on good ideas because you are so afraid of losing more.

Loss Aversion Bias

Traders feel the pain of losses more acutely than the pleasure of gains, often leading to holding losing positions too long or exiting profitable trades too early.

Loss aversion bias in crypto trading can be clearly illustrated through a common scenario many traders face. Imagine a trader buys Bitcoin at $100,000, expecting it to rise. The price then drops to $80,000. Instead of selling to cut losses, the trader holds onto the position, hoping the price will return to their entry point.

This reluctance to sell stems from the psychological pain of realizing a loss, even when market indicators suggest a continued downtrend.

Another example is when a trader quickly sells a coin that has gained 10% in value, fearing a potential loss of profits, but hesitates to sell one that has decreased by 20%, hoping it will recover.

This behavior demonstrates how traders often feel the pain of losses more acutely than the pleasure of equivalent gains.In the volatile crypto market, loss aversion can lead to:

Holding onto underperforming assets for too long

Missing out on other profitable opportunities

Increased emotional stress and irrational decision-making

Tbh, this is a classic and a trap I go into every single day in some way. For example, right now I am shorting some weak altcoins. Let’s say I am up $10k, then the price retraces a bit and I am now only up $5k. Often I fall into the trap of refusing to take profit unless I am up to $10k or more on this trade. Because it feels like a loss, even though both are profits. Since it was 10k, it feels like I lost 5k. i am sure many people can relate to this.

Overconfidence Bias

Traders overestimate their knowledge and abilities, potentially leading to excessive risk-taking and frequent trading.

A prime example of overconfidence bias in crypto trading occurred during the 2021 Bitcoin bull run. Many traders, overestimating their ability to predict market movements, leveraged their positions excessively, believing that Bitcoin's price would continue to rise indefinitely.

This overconfidence led them to ignore potential risks and market volatility. When Bitcoin surged past $60,000 in early 2021, numerous investors, driven by recent upward momentum, became convinced that the price would keep climbing.

They failed to consider the possibility of a market correction.

When the market eventually corrected and Bitcoin's price dropped below $30,000 a few months later, these overconfident degens faced significant losses.

Fear and Greed

These emotions can cause traders to exit trades prematurely due to fear of losses or hold positions too long in an attempt to maximize profits

Don’t think I need to say anything more about this. Pretty self-explaining.

Recency Bias

Traders give more weight to recent events or information, potentially overlooking long-term trends or historical data.

An example is when you overreact to short-term price fluctuations, causing yourself to make irrational decisions. For instance, after a significant price drop on $ETH, traders might assume the downward trend will persist and sell their holdings, potentially missing out on a market recovery. Think about CT after some red days, everyone will tell you that it is over, and that you should have sold. But eventually it turns around.

Herding Bias

Traders follow the crowd, making decisions based on what others are doing rather than their own analysis. Classic CT behavor.

A prime example of herding bias in crypto trading was observed in Ethereum's price movements from 2020 to 2021. During this period, Ethereum's price surged from around $130 at the start of 2020 to an all-time high of $4,859 by November 2021, representing an astounding increase of approximately 3,756%.

This dramatic price increase was characterized by several key factors illustrating herding behavior:

FOMO (Fear of Missing Out): As Ethereum's price kept rising throughout 2020 and 2021, more investors rushed to buy, not wanting to miss out on potential gains.

Market Sentiment: The overall positive sentiment in the crypto market, driven by Bitcoin's performance and institutional adoption, spilled over to Ethereum.

Technological Advancements: Ethereum's move towards Ethereum 2.0 and the implementation of EIP-1559 in August 2021, which introduced a fee-burning mechanism, created additional excitement and investment interest.

DeFi Boom: Ethereum's role as the primary platform for decentralized finance (DeFi) applications fueled increased demand and usage of the network.

Institutional Interest: Growing institutional adoption and the launch of Ethereum futures on the Chicago Mercantile Exchange (CME) in February 2021 lent credibility to the asset.

It's worth noting that after reaching its peak in November 2021, Ethereum's price experienced a significant correction in 2022, dropping to around $900 in June. Many were caught with their pants down.

Framing Effect

How information is presented can influence trading decisions, with traders potentially making different choices when the same data is framed positively or negatively.

A good example of framing effect bias in crypto trading, specifically for Solana, can be illustrated through how market news and price movements are presented:

"Solana surges 10% in the last 24 hours, showcasing its robust ecosystem growth"

"Solana fails to reclaim previous all-time high despite 10% gain"

Both statements describe the same 10% price increase for Solana, but they frame the information differently. The first headline emphasizes the positive aspect, potentially encouraging traders to buy or hold Solana, while the second focuses on a perceived shortcoming, which might discourage investment.

This framing can significantly impact traders' decisions. For instance, a trader might be more inclined to invest in Solana after reading the first headline, perceiving it as a bullish signal for the network's growth. Conversely, the second headline might cause hesitation or even trigger selling, despite the price increase being identical in both cases.

Illusion of Control

Traders overestimate their ability to influence market outcomes, leading to excessive risk-taking.

Example: a trader might spend hours studying Fartcoin price patterns and conclude they've discovered a foolproof strategy to time the market. They might then bet a large portion of their portfolio based on this perceived insight, believing they have control over the outcome.

This illusion of control is particularly strong during bull markets. When the overall crypto market is trending upwards, most coins experience growth. Traders may falsely attribute their success to their own skills rather than the general market conditions. They might think, "I knew this altcoin would surge 30% today because of my technical analysis," when in reality, the rise was due to broader market trends.

Personally I don’t believe in technical analysis at all, because we see that time after time again it is news move the market, not your invisible line ;)

Clustering Illusion

Traders see patterns in random market data, potentially leading to misguided strategies.

Clustering illusion bias in crypto trading can be clearly illustrated through the following example: A degen crypto trader notices that a particular coin's price has increased for five consecutive days. Based on this short-term pattern, he conclude that a bullish trend is forming and decide to invest heavily in the asset. However, this five-day upward movement could be entirely random and not indicative of any genuine trend.

This example demonstrates the clustering illusion bias because:

The trader perceives a pattern in a small sample of data (five days of price movement).

They attribute significance to this pattern without considering the broader context or longer-term data.

The decision to invest heavily is based on the assumption that this perceived pattern will continue, ignoring the possibility of randomness in market movements

In the volatile world of crypto trading, where prices can fluctuate dramatically due to various factors, mistaking short-term random price movements for meaningful trends can lead to poor investment decisions.

We have all been there. And after all, we have to base our analysis on something, right?

Negativity Bias

Traders may focus more on the negative aspects of a trade or strategy, potentially missing opportunities.

Example: imagine a trader who has been successfully trading for months, with mostly positive outcomes. However, one day they experience a significant loss due to a sudden market dip caused by negative regulatory news,

Despite their overall successful track record, the trader becomes fixated on this one negative experience. As a result, they may:

Become overly cautious and miss out on potential profitable trades, even when market conditions improve.

Constantly anticipate similar negative events, leading to premature selling of positions or excessive use of stop-loss orders.

Ignore positive market indicators or news, focusing solely on potential threats or downsides.

I also see this tendency when someone has sold a coin they were bullish on earlier. They start to FUD their earlier bags in the hope that it won’t go up more (because after all they have sold, right).

Self-Attribution Bias

Traders attribute successful trades to their skills and losing trades to external factors, hindering learning and improvement.

A good example of self-attribution bias in crypto trading is when a trader attributes their successful trades to their own skills and expertise, while blaming their losses on external factors.

Let’s say a trader buys Bitcoin at $80,000 and sells it at $105,000, making a good profit. They attribute this success to their excellent market analysis and trading skills. However, when the same trader buys Ethereum at $3,500 and it drops to $3,000, they blame the loss on market manipulation, unexpected regulatory news, or "whales" dumping their holdings.

We have all seen this one (hint: daily on CT!)

Hindsight Bias

Traders believe past events were more predictable than they actually were, potentially leading to overconfidence in future predictions.

A trader buys Solana at $200 in early January 2025. By mid-January, the price rises to $250. Looking back, the trader thinks, "I knew Solana was going to increase by 25%. It was so obvious given the positive market sentiment and technical indicators."This demonstrates hindsight bias because:

The trader overestimates their ability to predict SOL's price movement.

They ignore the inherent volatility of the crypto market, especially for altcoins like Solana.

They fail to acknowledge external factors that influenced the price increase, such as overall market conditions or specific news events.

This bias can lead to:

Overconfidence in future trades

Ignoring potential risks or contrary indicators

Failure to properly diversify their crypto portfolio

Issues in trading that I experience myself

Random reinforcement

Sometimes amateur traders (like myself) find themselves on a huge winning streak, while seasoned traders suffer from several failures in a row. Despite such situations being a game of luck, these traders start to believe in their skillfulness or vice versa, falling into a trap of random reinforcement.

Random reinforcement is a destructive psychological phenomenon that is widespread among traders. Random reinforcement creates a trader's misconception about his capabilities clouding the trader's mind and giving rise to overconfidence, or otherwise, an extreme lack of self-confidence. The thing is, newbies may decide they found an easy way to make a profit, while professionals may doubt their skills, trading plan, and their trading knowledge at large.

One example of a mistake I make over and over again:

Let’s say I start the day by winning huge on $TIA. It could be any asset, but in general if I start with a big win, I often get overconfident and have much easier for just trading more without a solid thesis.

My reasoning is something like this: “Since I already won a lot, I can afford to take bigger risks. It doesn’t matter if I lose, because I now bet with free money”.

Can you see the flaw in this thinking?

Fear of missing out (FOMO)

Haha, everyone is familiar with FOMO.

Social media, news, and herd instincts make us obsessed with the idea that high profits are possible if we act immediately, and this is where panic trading starts.

Trading out of FOMO excludes rationality and reasonableness.

Honestly, I get this feeling from CT almost on a daily basis. There is always a coin that might go to the moon.

One reader wrote this to me:

"I haven’t been on a vacation since 2019, because I feel like the moment I leave for a week, the markets will pump without me. I’m sure others experience this too, not being able to fully live life due to FOMO".

This is sad, but I honestly can relate to times when I’m not fully allocated in the market or at periods when the market is bearish and I’m flat.

If you FOMO on a green day...

You won't have enough ammo to FOMO on a red day.

If you must FOMO - choose a red day.

Revenge trading

This type of trading is pretty harmful and aggravates a trader's financial position.

Let's imagine you had a smooth week and were making good stable returns. However, at the end of the week, you suddenly lost everything earned and even more.

The following reaction is a sense of revenge.

Curious to relate, but the revenge is directed at the market. So, you seek to get your funds back as soon as possible and go wild actively trading shitcoins and usually making some unforgivable mistakes.

I define revenge trading as losing on one trade and then trying to make it back on multiple other trash plays. Pick quality. Don't rush the process. It takes time to find a good opportunity.

Instead of trying to make up for your losses with impulsive trades, take a step back and re-evaluate your strategy.

When you suffer a loss, take a break from trading and reflect on what went wrong. Analyze your trades and try to identify where you made mistakes. This can help you avoid making the same mistakes in the future. Both CoinMarketMan and TradeStream can help you with this.

If you find yourself struggling with losses and revenge trading, consider seeking the help of a professional. A mentor or coach can provide valuable guidance and help you develop a more effective trading strategy.

Gambling

First, let’s just admit that we are huge gamblers all of us.

Trading is about planning, strict discipline, and constant learning; but some traders treat it as gambling. Traders with a gambling mindset don’t consider the trading mechanism in building a proper strategy. They operate unsystematically by a twist of fate driven by adrenaline and excitement to win. Gambling psychology is widespread among both novice traders and professionals who desire to get wealthy without any effort.

Gambling psychology makes traders act impulsively without a well-thought-out plan, which leads to inevitable losses and emotional breakdowns.

You can read more about it here and how to avoid it:

Herd instinct

Herd instinct is a significant issue in the field of psychology. In trading, herd instinct is based on the fear of failure. So, traders often rely on crowd decisions instead of comprehensive market analysis. This dependent behavior can result in panic trading, unreasonable actions, and (eventually) losses.

To become a successful trader, you should always work with your psychological side. This simple formula must be a guiding light in your trading journey.

An example of herd instinct:

Let’s say Ansem posts something on Twitter about a new coin. The ticker starts pumping immediately.

Now all the other influencers is tweeting about it too. Since the herd is in, you feel safe. You follow the herd, and if you’re not paying attention you will get dumped on at the end. It’s always like this.

Recommended reading about trading psychology

1.

Link: https://x.com/ZoomerOracle/status/1699076242270777571?s=20

Link: https://x.com/Trader_Dante/status/1590084159992918016?s=20

Okay, I believe that’s it for today.

Happy trading!

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads