News Trading - Is It Worth Using Bots?

Every now and then, there are various catalysts for price movements, whether on specific trading pairs or for the market as a whole - taking action on any of these catalysts is called narrative trading.

Most people know about it, but few are successful, why is that? Obviously, no one can predict the future, but how much of an edge do catalysts and headlines give? Read on.

Before we start, I have been doing a lot of sports betting lately.

If you’re interested in that yourself, join my free Telegram group with 570+ degens to get a free money bonus so that you can try out SX Bet yourself:

TG group: https://t.me/bettingbr0s

Before we go any further, let’s have a word from our sponsor zkLend

DeFi Money Markets are a staple in on-chain ecosystems, enabling a source of capital for borrowers and yield for lenders.

zkLend is the native money market built on L2 Starknet that combines zk-rollup scalability, faster transactions, and lower costs with Etheruem’s security.

Supported by institutions like Delphi Digital and Starkware, they will be launching their permissionless money market which enables any user to deposit, borrow and lend.

Currently, on mainnet, Artemis enables users to lend and borrow assets. The protocol also tokenizes debt and allows borrowers to take flash loans.

How can you benefit? 🤔

Two main use cases:

Earn rewards by providing liquidity to the protocol

Take on leveraged positions – imagine you’re bullish on a particular asset and hold $150 worth of it. You can use this $150 as collateral and receive a $100 loan in another asset. This $100 can then be swapped into the initial asset, effectively giving you a leveraged position with $250 worth of exposure to the asset you’re bullish on.

Explore the latest DeFi Starknet has to offer: https://app.zklend.com/markets

News Trading - Is It Worth Using TG Bots?

In this week’s feature, I want to go into news trading (again) and the psychology behind this. This is a topic I’ve touched on several times, but my interest in it never seems to go away, I simply cannot stop talking about it. The focus here is on sourcing the news and being able to get in quickly, remember, every second counts. Let’s dive in.

News trading is not new, it's been around for as long as I can remember, there exists an economics hypothesis that is known as the efficient market hypothesis, which in short states that asset prices are reflective of all available information out there; many however, do argue that this is only in partly true. The reality of the situation is that at any given time, asset prices only reflect the perception of market participants based on the information that they have. When news or otherwise information surfaces, it is almost never priced in at the exact moment it comes out, so you may be asking, when do we know if it’s priced in? The answer is simple, that’s the job of a trader to decide based on how he/she interprets it and consider how fast the information is likely to spread.

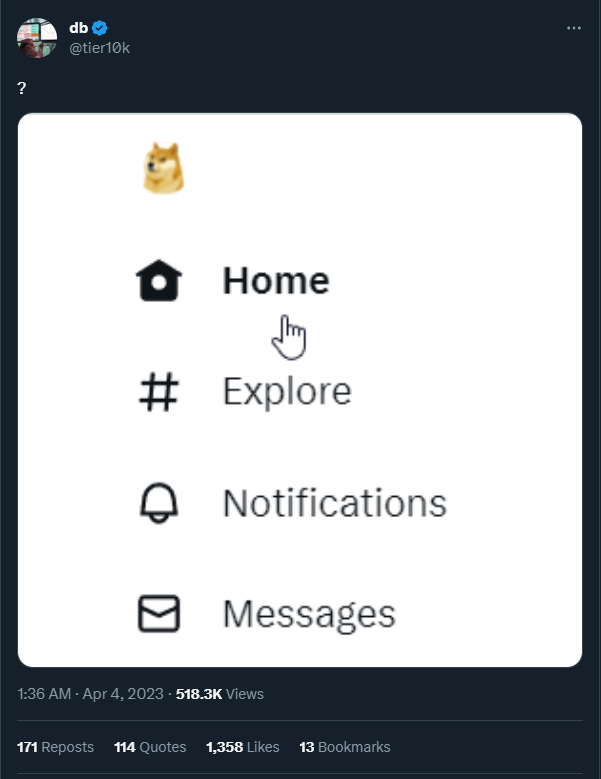

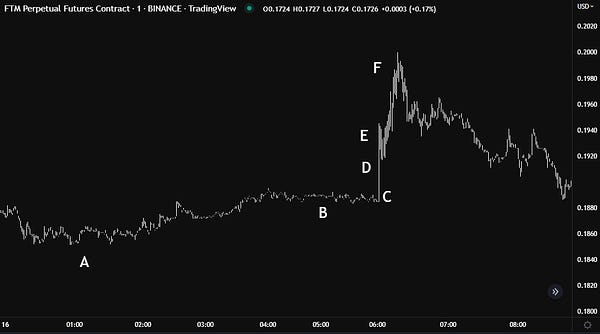

This means that when news comes out, yes timing is everything, everything happens quickly - you have to make your interpretation and judgment on how likely the news is to spread to market participants but in retrospect, you as a trader need to understand that markets are “slow” to react. I do not mean this literally, take for example the news of Twitter-Dogecoin. In a previous feature, I shared my thought-process coming into this trade, and I heard the news via some group chats at around 1:30pm EST of that day, the price of $Doge still had not moved. A minute after I found out, db (@tier10k) posted this:

Understanding that db (@tier10k) is one of, if not, the most credible news source for CT, it was almost inevitable that this was going to cause an increase in price. True enough, within 30 minutes, we saw a 30% move upwards.

If you want to read more about my thinking process behind Dogecoin, you can read my article about it:

In the Dogecoin example, we can consider the markets to be “slow”, the lesson learned here is that if the markets are considered to be slow, then we can get in before others based on our own judgment calls, hence interpretation and considering if news are likely to spread quickly are extremely important. The simplest edges any trader can acquire and consistently practice are the ability to interpret news ASAP, understanding how other market participants may interpret it, and guessing the ability to spread - all of which are simple, but are far from easy to execute. It is also essential to understand what type of news affects specific markets - to be aware of which exact market you’re in.

Tree of Alpha said something wise:

“While everyone is focused on getting entries within 2 seconds of a tweet/blogpost, most aren't spending enough time wondering why they are not sizing appropriately.”

This is an interesting statement, and I feel I can relate. Lots of times I actually see news like this, but decide to not act because I’m afraid the move will be gone because I didn’t act fast enough. I need to think more about sizing and risk management in trading.

Also, since I recently had a pretty bad trading day I wasn’t mentally prepared to size up. The reason was simple: I was afraid of losing again. Trading psychology is so important and something I struggle with. I think everyone struggles with this. But I believe that you only can get better at this by practicing more and also journaling every trade. I like using CoinMarketMan for this.

Let’s consider another example, one that happened just a few days ago, the Grayscale vs. SEC case. The interpretation of the Grayscale victory at face value would be a bullish signal, understanding how other market participants will understand the news, is also understanding the current market state. So we take a look at previous news alike to this and see how price reacted to that, when Ripple ($XRP) won their hearing against the SEC we saw a large increase in price - as a result we can assume Grayscale’s Bitcoin ($BTC) ETF case is likely to do the same. Given that everyone on CT has been awaiting the result of the Grayscale vs. SEC case, the news was bound to spread fast upon surfacing, this was a net positive for the price of Bitcoin and by extension the market in general. In an ideal scenario, it is your job to anticipate, based on all the information you have, how much the market is likely to move up or down. If the expected move is 10% upwards, the later you are, the higher the price goes before you enter a position, the less you’re likely to make based on that 10% upward move. So now you may be asking, how do you find out the news as quickly as possible? Don’t worry, I’ve got you.

Catching A News Trade - Timing Is Everything

The hardest part of news trading is timing. You can be right with your entry, but it's impossible to know if the token will:

a) pump at all

b) if it pumps, when should you get out? (answer, have a take profit or at least a mental take profit, or a trailing stop loss)

c) if it pumps, but then quickly retraces how long should you stay in (answer: you should already have a stop loss before you enter a trade)

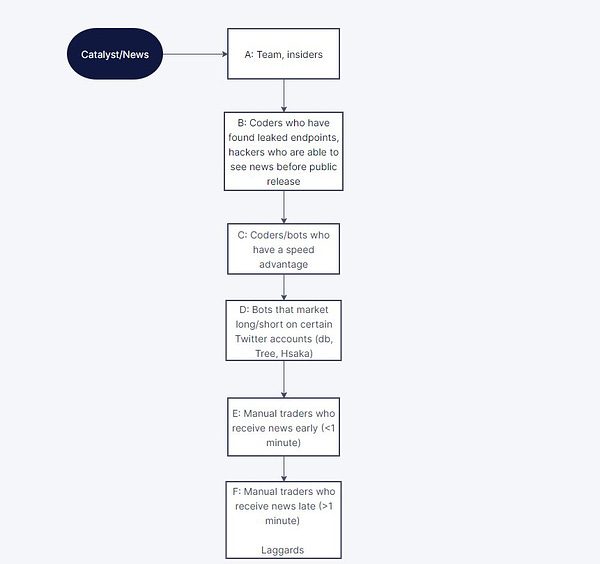

And about timing. Have you ever wondered where you are on the timing ladder in terms of catching a trade?

The Twitter user King G made an interesting tweet where he made a hierarchical ladder from A to G telling at which price you will enter a trade.

I recite from his tweet below with text here so you don't miss it.

The ladder:

A: Insiders, the team - this is generally where the news comes from so the team and fellow insiders accumulate well before the news is public

B: Coders who have found hidden endpoints (leaks), hackers who can see news websites postings early and are able to front-run the public news

C: Coders who have a speed advantage (@Tree_of_Alpha @tier10k and many others that aren’t public on Twitter)

D: Bots that market long/short on group C public tweets. Automated bots on select accounts will generally always be faster than the manual traders (with few exceptions)

E: Manual traders that are early and quickly analyze the implications of news headline

F: Manual traders that are late (even a few minutes can sometimes be late)

G: Laggards who trickle in once the news is blasted on everyone’s timeline and the price has gone up significantly

It’s important to understand where you are in this order when news trading.

The crypto market is incredibly inefficient (good for us) so some catalysts take time to properly price in.

In essence, if you are in groups E-G you need a greater fool to buy your bag for you to profit.

Personally, I'm in group E, but working with some people to make bots to get up to D or maybe even C.

News Trading with Telegram bots

Just last week I was on my regular Twitter scrolling, that’s when I came across a very interesting project, Newsly ($news). To me the mcap it was sitting on did not matter at all - what mattered to me was the actual product they were building. Very briefly, Newsly is a Telegram bot that allows its users to view news whilst also having a button to execute trades instantly through 1-click. The aim of the project is to be both a quick curated source of crypto news and a full fledged trading terminal, whilst maintaining the convenience of being packaged in the Telegram app that everyone on CT is familiar with. Remember what I mentioned above? Every second counts. With Newsly, users are given the edge to act on news instantly, regardless of where you are. They are also first movers in the fact that users are able to directly connect their Binance/ByBit accounts to the bot. Even with quick news, what about the interpretation of the news itself? Well, for Newsly, they’ve included several things on their roadmap and it would be interesting to see the app build out - essentially they plan to introduce additional exchanges ie: Bitget, GMX/GNS, Uniswap; they plan to also include additional news sources and additional features which includes Twitter list integration, AI sentiment analysis. With AI sentiment analysis, it would truly help new traders become news traders.

Although all sounds great, let’s consider one example. It is true that most people do have their CEX on their phones, so once the news comes up on Telegram for Newsly, people could just opt to execute the trade themselves on their CEX. In the event that there was huge news, users would have the long/short buttons there with the option to set custom leverages - why would a user go through the hassle of connecting their CEX to a bot, when they could utilise it just to get the news and just swap apps to long/short on their CEX directly, it would most likely be a +/- 3-5 second difference to do so.

After taking a look at their whitepaper, users currently require 10,000 $news in order to utilise certain features on the bot. However, their news feed seems to be free. Whilst it is not explicitly stated how the project generates revenue, the assumption is via a fee system and their 5% buy/sell taxes. This begs the question of: Are paying fees + holding 10,000 tokens more worth than losing 3-5 seconds on a trade? Let’s take a brief look at their tokenomics and determine if it is worth a hold. On face value, the liquidity of $news is extremely thick for the market cap it is at, they have a buy/sell tax of 5% and 20% of these taxes go back into the LP - this alone may benefit the project as whales do love liquidity. Aside from that the only use case for holding the tokens would be for the features of their bot. As of current it is still in beta so the worth of holding 10,000 tokens to utilise a bot is unclear - right now, the news feed seems to be free, and with simple notifications settings you could get notified upon news. The upside would of course be the AI analysis however this is still not out. The project may progress well if the roadmap is executed, personally it could be a useful tool and at current prices (5/9/2023), 10,000 tokens is worth $220. If you have excess funds it could be worth a shot, but definitely not necessary as the main goal of attaining quick news is a free option.

Speaking of free options, here are two of the quickest news sources on CT: db (@tier10k) and Tree of Alpha (@Tree_of_Alpha).

Some closing thoughts, news trading can be very profitable with the right strategies. As simple as it may sound, the ability to interpret news quickly, understanding how other participants interpret the same news and predicting how fast the news are likely to spread are huge factors in news trading. With the introduction of projects such as Newsly and also credible CT news sources, diligent readers may also be able to transform themselves into news traders, it may not happen overnight, but with sufficient practice, maybe even years, you may be profitable. I still struggle with this and trust me, I’m online 12-14 hours per day, and even then I’m far from one of the best.

The Bottom Line

To become profitable you might try to work on your edge for years. And even then, you might not become profitable. I still struggle with this. I think one of the smart things to do is to find a way to get higher up on the ladder in terms of timing the news.

News like the ones about Dogecoin doesn’t come out every day, so it is a patience game and it requires a lot of screen time.

Think of it this way, I’m probably online 12-14 hours per day, and even then I’m not one of the best, actually, I’m very far from being one of the best. That tells you everything about the competition here. There are several ways I could improve this, and I’m working on this. Planning to write more about improvements in coming newsletter issues.

Also if you want to learn more about trading I wrote a 25 min read about everything I know here:

Should be a good starting point, and also some of the text is for more advanced degens.

To end this you have to remember that in trading, you got to react quickly. Trading on news is 100% not a safe bet at all.

The moment a news headline like for example “Dogecoin is the new Twitter logo” comes out, the market participants start pricing in the new Expected Value (EV) for the asset (Dogecoin).

Your job is to calculate that EV more accurately and take position earlier, than most other participants.

This is how you can make money.

Sounds easy in theory, but very hard in practice.

But it doesn’t stop me from trying :)

I also compiled a Twitter list with the best news traders, take a look at them here:

https://twitter.com/i/lists/1590828215161036815?s=20

Hope you enjoyed this write-up.

See you next week, anon!

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads