Reflexivity -what happens when too many altcoins and token unlocks hit the market going forward?

Hey, friends!

The total market cap of altcoins are steadily increasing as a consequence of constant new token launches + new supply hitting the market.

I think when BTC.D trends lower and altcoins can run free, there will be a selected few altcoins that will run hard. Not everything as people are used to.

More about this below.

Today’s newsletter is sponsored by Swell Network

Swell L2 is the L2 for Restaking.

It will provide a platform for the next stage of Swell ecosystem expansion, unlocking new opportunities for both restakers from synergies between AVS's and dApps on the chain.

It will offer native restaking yield, unified liquidity through the Polygon Agglayer, and an innovative tri-staking model that employs SWELL, ALT, and rswETH.

rswETH will also be the native gas token.

Deposit in the Pre-Launch to earn airdrops from multiple projects building on the chain. This growing list includes Brahma Finance, Ambient Finance, and Ion protocol. More to come.

You will also earn a bonus airdrop from Swell on the launch of the L2 in Q3, and a share of 1M EigenLayer Points.

Finally, you also retain the points and rewards of all deposited assets. For example, on weETH you retain your EtherFi Points (and get a 2x bonus) and with rswETH you get EigenLayer Points and 4x Pearls plus staking yield (and future restaking yield).

The full list of supported assets is here: https://www.swellnetwork.io/post/l2prelaunch

Just yesterday they launched support for several Pendle PTs, including PT-pufETH, PT-USDe, and PT-weETH. This now enables PT depositors to enjoy fixed yields of typically around 40-50%, and get multiple airdrops plus a share of EigenLayer Points.

Reflexivity -what happens when too many altcoins and token unlocks hit the market going forward?

Let’s talk about altcoins, how launches are being done these days, and the consequences for the markets.

There has been a trend in this cycle to launch tokens at high FDV, big airdrop, with a low float, and with huge unlocks coming from VCs later on.

Crypto assets are reflexive. What does that mean?

This post is inspired by tweets, Telegram chats, conversations with crypto friends, etc., and is a post I wanted to write for a while. Have to give a special credit to Cobie, Thor Hartvigsen, Thiccy, Andrew Kang, and Regan Bozman for great thoughts on this already. Follow them on Twitter.

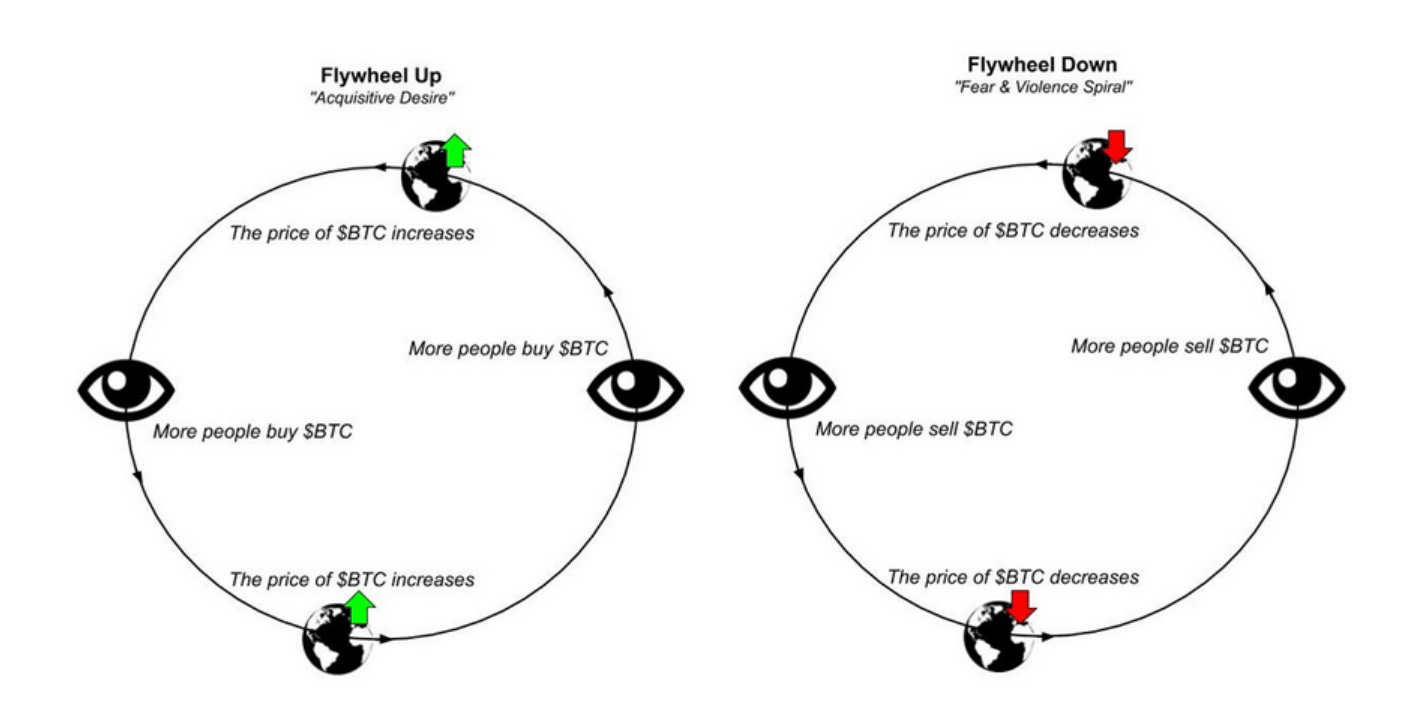

Reflexivity - the grand idea about feedback loops

Originally proposed by George Soros, reflexivity is a theory that positive feedback loops between expectations and economic fundamentals can cause price trends that substantially and persistently deviate from equilibrium prices. Bitcoin has always been characterized by strong reflexivity. Bitcoin's positive cycles are likely to continue for extended time periods, however, bitcoin's negative cycles are notorious for their length and depth.

According to Cryptonary, it's crucial to remember that, when analyzing markets and how they move and operate, the idea of market reflexivity defies conventional wisdom. In theory, markets are always looking for equilibrium and all players are reasonable people who base their decisions on facts. Bubbles, capitulation events, and boom and bust cycles are examples of market oscillations that are anomalies; prices will eventually revert to equilibrium. Price has no bearing whatsoever on the factors that establish that equilibrium.

On the other hand, in market reflexivity, everyone makes judgments based on their interpretation of reality and prices do have an impact on the market's fundamentals. You can see where this is going: if pricing affects fundamentals, then a change in price must also affect fundamentals, which in turn affects investor expectations, which in turn affects the price as investors act on these revised expectations. Boom or bust cycles are caused by the positive feedback component of market reflexivity because herd behavior reinforces price changes, which make prices increasingly distant from reality and ultimately become the new reality—a self-fulfilling prophecy if you will.

Prices should tend toward equilibrium, but because of the market's reflexivity, they frequently overshoot or undershoot that equilibrium for prolonged periods of time. Only when market participants realize that their view of the market is no longer grounded in reality will prices start to buck the present trend; this usually happens long after prices have moved beyond or below what is sensible.

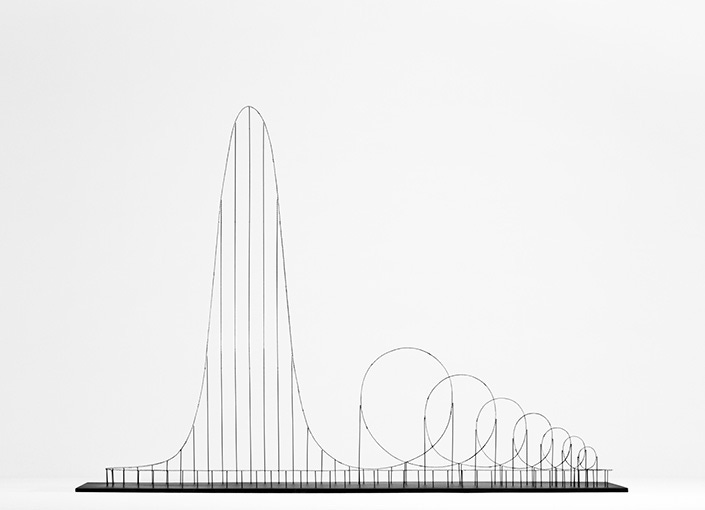

And this my friends is why we have the figure below:

You see, reflexivity works both ways. There's no denying that a ball thrown into the air will, in the end, fall back to the ground.

It is nearly a given that the price of Bitcoin will rise for a while following the initial move if it increases significantly in a short period of time. In the other direction, this also holds true. The cryptocurrency market is still in its infancy, and as a result, large price swings are "easier" to occur.

Look at the figure above. This perfectly describes reflexivity. I think you have a good understanding of the concept now, so let’s move further.

Now, let’s take a look at altcoins and what will happen to the market in general over time with all these new token launches.

New shiny coins are good (until the circulating supply increases)

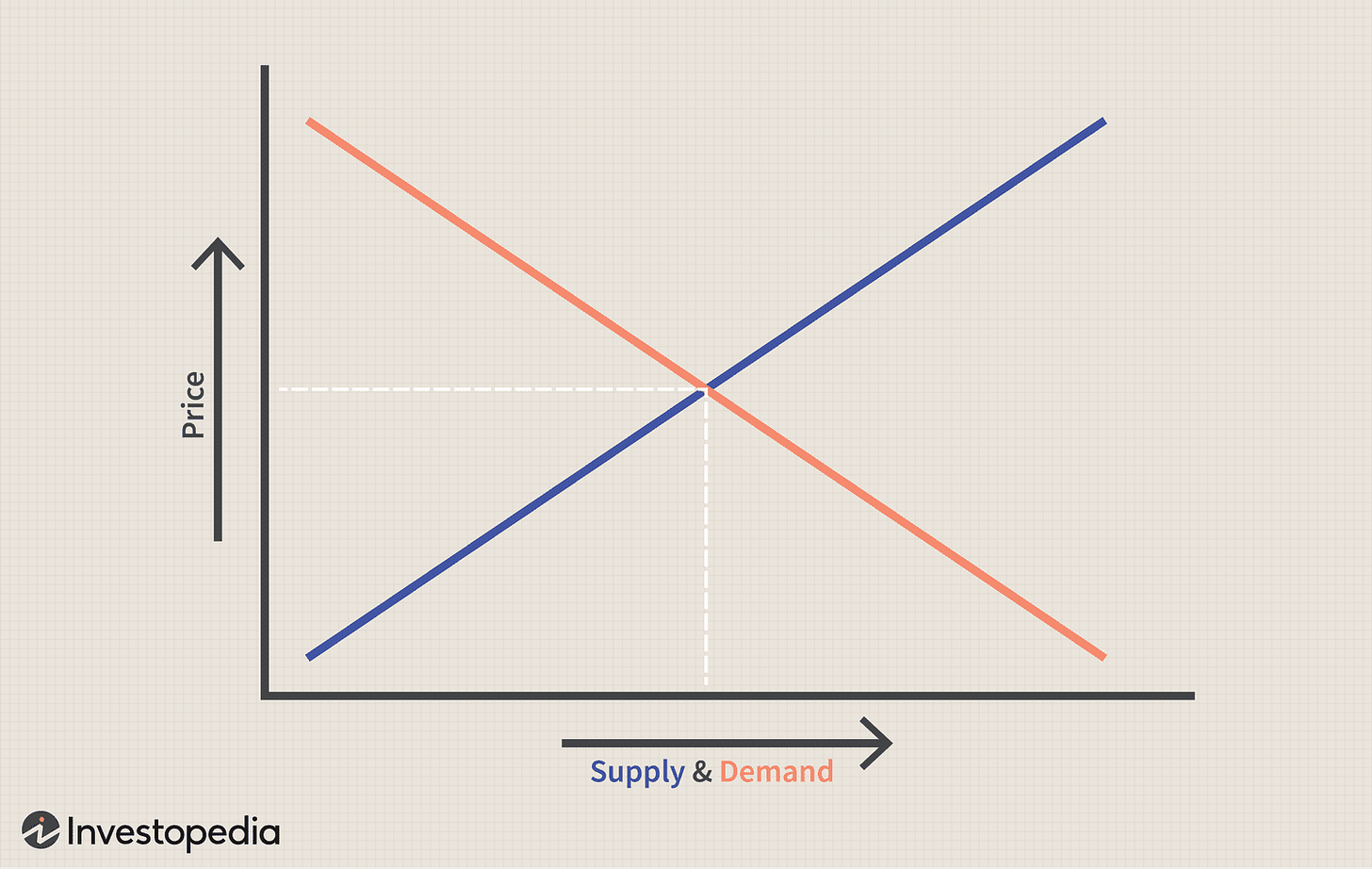

I have written about supply and demand in crypto earlier, but let’s just repeat a little bit.

Market cap: circulating supply x price

Fully Diluted Valuation (FDV): all tokens (also non-issued) x price

This is important to understand the VC/angel game (especially in the eyes of a retail investor).

Most crypto companies raise capital from investors through a SAFT (Simple Agreement for Future Tokens). In the stock market world, a SAFT can be compared to a simple agreement for future equity (SAFE), which allows startup investors to convert their cash investment into equity at a point in the future if specific conditions are met.

To illustrate what a typical SAFT deal might look like, let’s do a very quick example.

Token name: Yolo Coin

FDV: 100m

Vesting terms: 10% on TGE, then 1 year cliff, and thereafter 3 year linear vesting

Circulating supply at TGE: 12% (some through airdrop)

Yolo Coin launches after lots of hype and the FDV is now 1bn (10x for seed investors). The investors are happy because they can sell at breakeven, and still, they have 90% of their allocated tokens left that will be unlocked gradually over 36 months (after the 1-year cliff).

But wait? Why is the lockup so long for VCs? The short answer is to ensure long-term alignment so that it won’t be dumped on TGE.

Let’s look at why this is problematic:

Since investors are locked up for a long time, this means that when they finally start unlocking it will be a constant sell pressure on the market.

Look at the figure below.

Let’s say that the price of Yolo Coin is $1 at launch (investor’s price = $0.10). 12% of the supply is in the market at launch, but as we know, more and more supply will hit the market as tokens unlock gradually.

This leads to increased supply.

But the question is: where is the demand? Who will buy the tokens VC dumps on you?

You could argue that because of narrative X, Y, and Z, the price will go up, increased TVL in a DeFi protocol, a bullish event, etc., and this can work for a while. But at some point, the supply will outnumber the demand and we will start spiraling downwards due to massive inflation.

Early buyers will get trapped, which leads to bearish sentiment among the community, reduced TVL in the protocol/protocols, devs (if any) leaving for greener fields, team members quitting, etc.

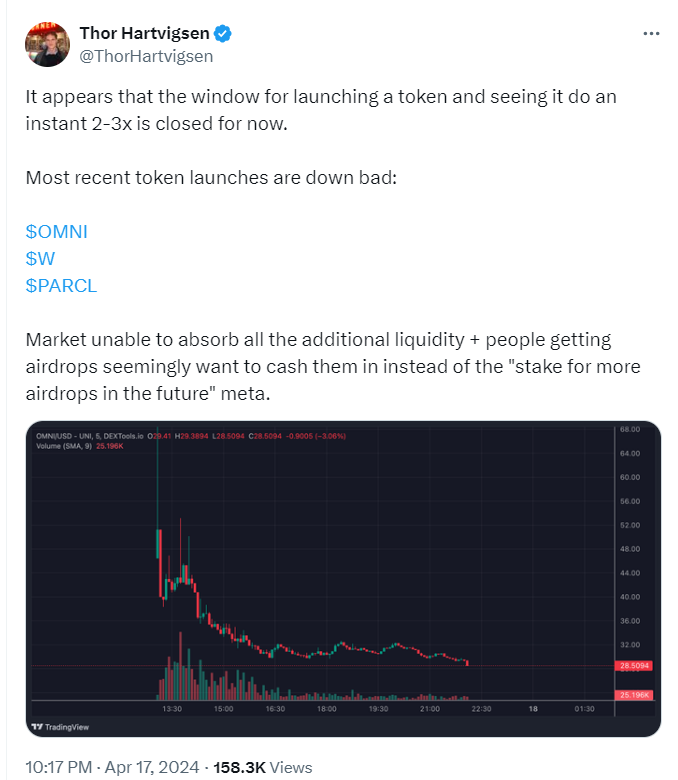

Thor Hartvigsen summarized it well: “The market will be unable to absorb all the additional liquidity + people getting airdrops seemingly want to cash them in instead of the "stake for more airdrops in the future" meta”

So far this cycle the biggest change is the dispersion in the space. We are conditioned to think that altcoins will pump together. But now there are probably 300 decent projects. There is not enough liquidity for all of them to pump.

We hear a lot about altseason, but this time around I think things will be different. We’re used to hearing that every coin out there will pump given the right conditions. But is this true?

Remember there are a lot more tokens with “utility” on the market today than in 2021. Every week now 3-5 “quality” coins are added to the market. Total3 mcap goes up, and everyone seems happy. But ask yourself who is going to buy all these tokens. Unless institutions or retail are coming in masses, it will just be a forever PvP fight.

An example from 2 weeks ago is the Wormhole airdrop. Launched at a 10bn valuation. Now ask yourself why you would own that. I can’t see any other reasons than from a pure speculation perspective. The price is down 40% since launch putting it at 6bn FDV.

As Cobie said:

“Market cap is a measure of demand, while FDV is a measure of supply.”

That means that market cap is the total value of public demand and that it rises and shrinks with price action. FDV will also increase if the price goes up, but also when tokens unlocks.

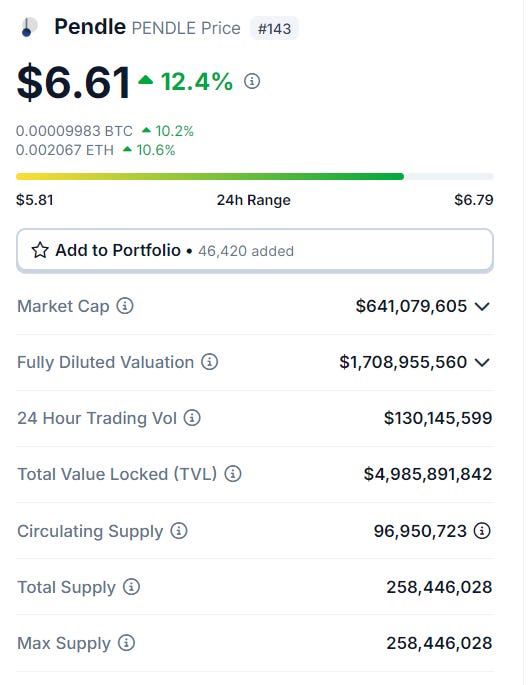

Let’s take a look at Pendle. Everybody loves Pendle these days due to the fact that their TVL has increased massively due to points farming and Eigenlayer narrative.

Mcap: $640m

FDV: $1,7bn

Also, notice that 95m out of 258m tokens are circulating today (37%). As the price increases the market cap will go up. However, the market cap going up does not mean there is additional demand for those locked tokens. To explain why, think about it from an investor’s perspective. I know people got into Pendle at less than 10 cents. The price is now over $6. Do you really think that investors who get their tokens unlocked care if the price is $6 or $7? Nope, so they dump it. Again: increased supply, but the same demand. (I haven’t checked the unlock schedule for Pendle, and I don’t know the FDV people invested in. Just made some assumptions to explain supply/demand).

Are high FDV coins scary? Not always, and a good example was $TIA in November 2023. $TIA has a 12bn FDV atm, but since locked tokens are off the market until autumn 2024 it wasn’t looking so bad + other traders may be scared by the high FDV.

More about this in Cobie’s article here:

Okay, but back to the question of where the demand is aka. where are the buyers?

As I stated in the intro, there are new “quality” projects launching every week now with super high FDVs. This means countless supply hitting the market, and unless new buyers come in, these tokens have to go down (at least long-term).

Retail is here, and they're in memecoins and SOL shitcoins. They don't buy the fancy VC tech tokens. They learned from the 2021 run. They are much smarter today. Permissionless token listing and money-hungry VCs are bad for the individual token long term. Every year 100 new tokens launch. Diluting existing ones.

It’s now April 2024, and inflows into altcoins seem way more selective and not enough to offset big unlocks.

Is there a solution?

We’ve understood that a low float token model is bad. But can we solve it?

Obviously, a huge part of the problem is the number of projects that are launching. Not everyone can buy all of these projects. But a more linear unlock schedule will probably be smart (opposite of Arbitrum), and also retroactive airdrops: think Ethena and EtherFi which are doing 2 airdrop rounds. Maybe bringing back ICOs would help, this will create more loyal fans.

Back to the road from here:

I think when BTC.D trends lower and altcoins can run free, there will be a selected few altcoins that will run hard. Not everything as people are used to. There are more people in crypto at this point than in the last cycle, but people are smarter now. Think we will have rotations as we have been used to in the last 6 months, and that blindly longing for coins can be a losing game.

According to Thiccy, $250m+ supply of altcoins is entering the market daily from new tokens and older tokens from earlier cycles with unlocks. Because of reflexivity to the upside (positive feedback loop), most of these tokens weren’t sold when people got them airdropped or from investing rounds due to the fact that the market was up only (“why sell today, when you can earn more by selling tomorrow-mentality”). That’s why we saw a heavy sell-off in April, the market just needed a reason for it first (war).

Okay, so token unlocks, new tokens hitting the market + staking rewards from existing tokens have led to an increase of $250m of altcoin supply daily so far in 2024. FDV growth has outpaced circulating due to the number of new coins launched, adding roughly 70% YTD. The spread between FDV and Circulating supply which represents how much future supply will hit the markets has increased by over $150B YTD. As inflows to the majors slow down, the weight of daily altcoin supply becomes increasingly apparent. The more I learn about trading, the more I realize how +EV tactically shorting crypto altcoins actually is. At least when you trade in pairs. Naked shorting of altcoins in an uptrend can be dangerous.

Anyway, total market cap of altcoins are steadily increasing as a consequence of constant new token launches + new supply hitting the market.

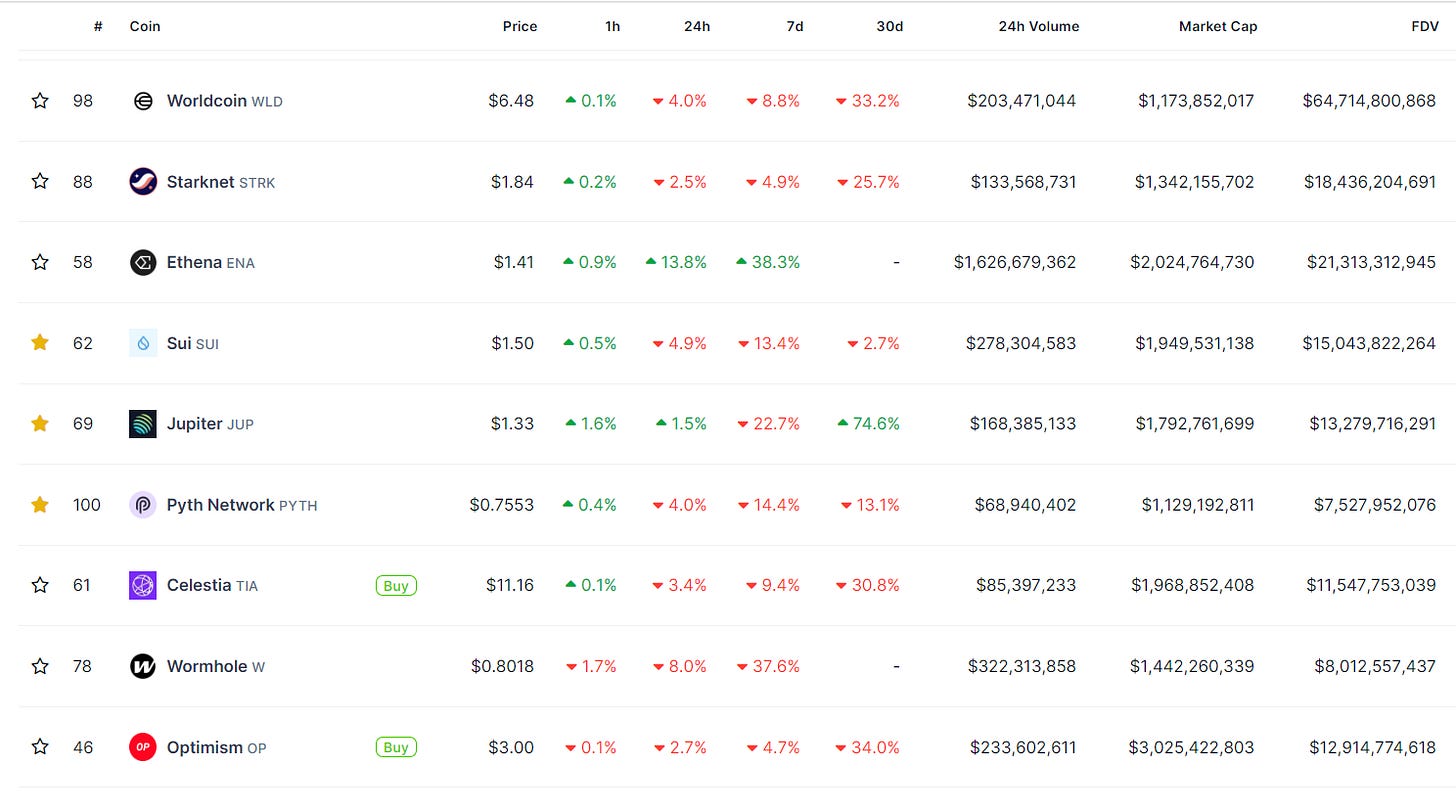

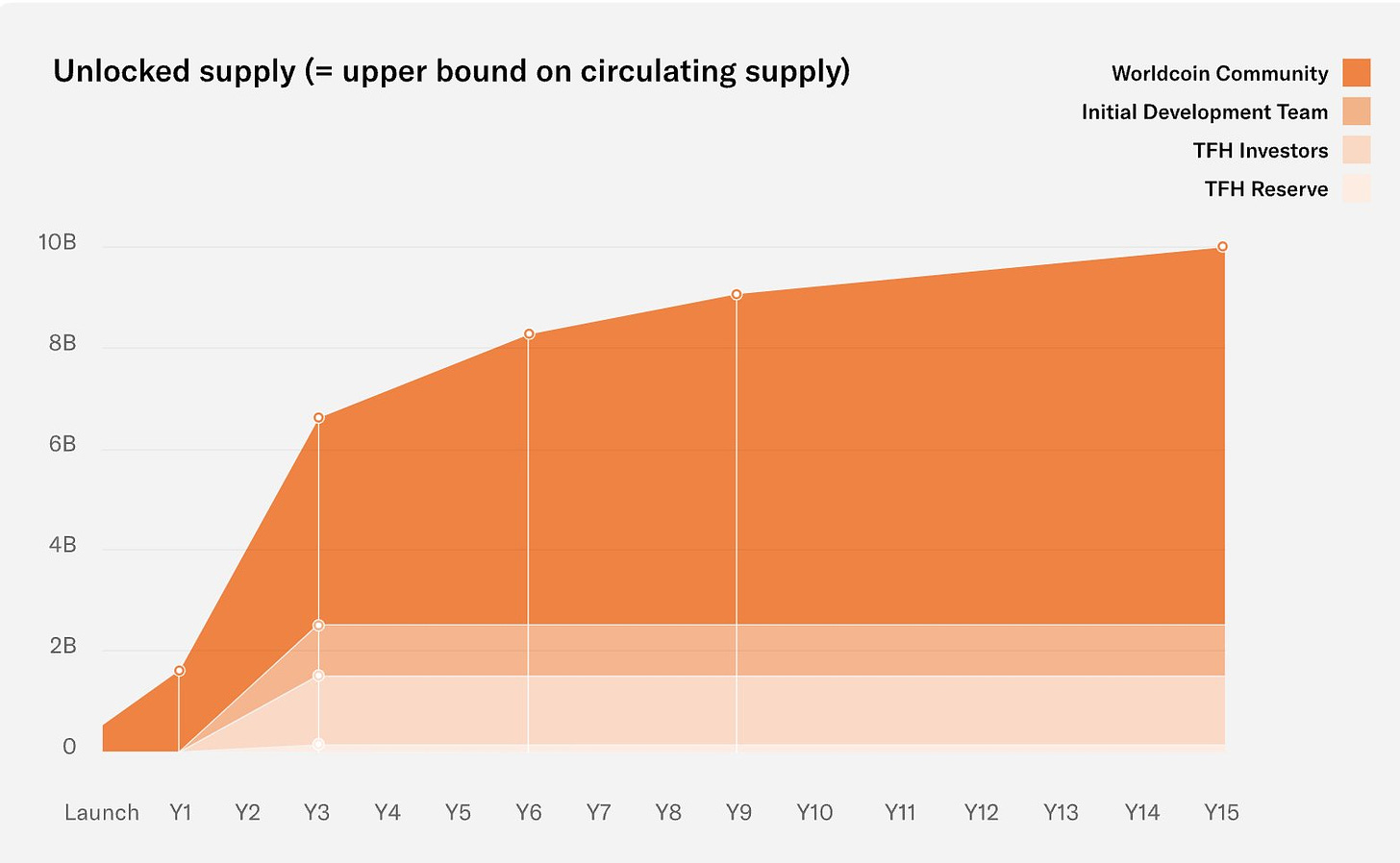

Examples above with some high mcap/FDV tokens. Look at Worldcoin: 1bn market cap, but $64bn FDV. What does that mean?

Well, it means that Worldcoin will have a constant supply to the market in the future. In July 2024 they will start a crazy unloading with 6m $WLD tokens hitting the market every single day. For context, it’s 181m $WLD tokens at the market today…

You don’t have to be a rocket scientist to understand that this is extremely bearish.

With a basic supply/demand curve it’s easy to see that it will be very hard to keep the $WLD price up when this supply is hitting the market.

Who will buy 6 million $WLD tokens daily?

What does this mean for the bull market?

As long as BTC/ETH goes up, it probably won’t matter much. It’s in bearish market conditions we will see this play out.

However, I like the approach that Anteater has with longing strong coins, and shorting weak ones. It’s a hedging strategy and it’s not delta neutral as how Ethena operates. To hedge in a bull market can sound strange, but on the way to the top, there will be several downtrends. It’s not a straight line to the top.

Also, several posts on CT lately say that this cycle is 70% over already. Who knows, so take the amount of risk you are comfortable with.

I think most new VC scam coins (high FDV coins) eventually will dump hard AF. And that you can use this to your advantage in pair trading or in situations where you want to hedge.

Examples of weak coins could be $STRK, $APE, $BOME, $ADA, $CRV, and $XRP. Or if altcoins in general outperform, then combine these weak altcoins with strong ones: Strong ones at the moment: $ENA, $TON, $FTM, $PENDLE. However, this is not a recommendation to long/short these as the market momentum changes rapidly.

The good thing with memecoins is that they’re actually one of the few honest coins left. Look at $WIF, $PEPE, $DOGE, $POPCAT, etc. Circulating and total supply are the same. No one is coming to dump on you in a crazy unlock schedule. It’s just player vs. player.

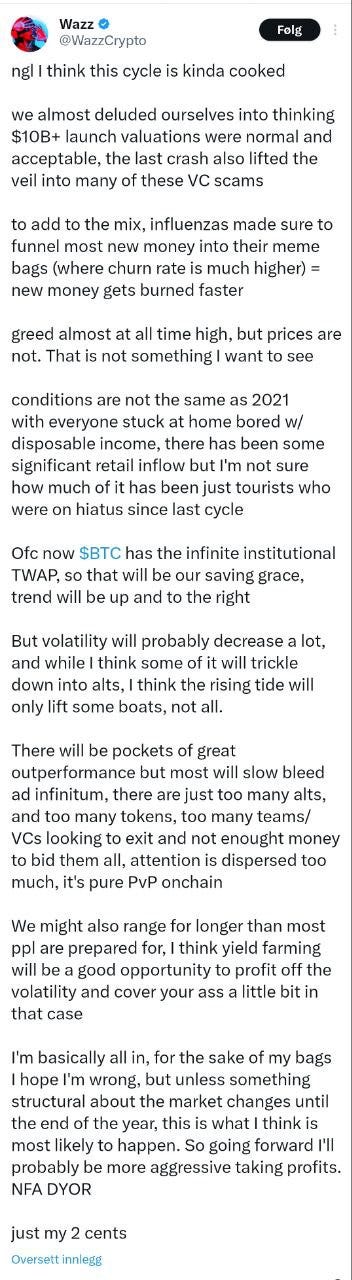

To just finish this up, here are some words from crypto trader Wazz:

I think his thesis is rational and makes a lot of sense. Too many altcoins, too many projects, and too many unlocked coins that will hit the market going forward.

If the price of Bitcoin jumps a significant amount in a short amount of time it is almost a given that the price will increase for a period after the initial move. The same is true in the other direction. The low liquidity of the crypto market means that it is “easier” for prices to move up and down by significant margins.

Okay, I’ll stop writing for now.

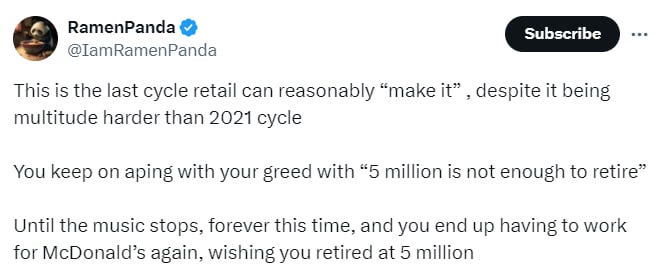

Ramen Panda will have the last word:

I continue being long spot, but don’t trade too much these days. It’s just chopping me to death.

Stay safe.

That’s it for today, anon!

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

Holyy shit Route this is one of your best ones, thank you!

Very very good article bro!!!!