Hey, friends!

The total market cap of altcoins are steadily increasing as a consequence of constant new token launches + new supply hitting the market.

I think when BTC.D trends lower and altcoins can run free, there will be a selected few altcoins that will run hard. Not everything as people are used to.

More about this below.

If you want to start trading crypto in the new year, use my ref link on Bybit:

https://partner.bybit.com/b/route2fi

You get lower fees, a bonus of up to $30,000, and are able to join my trading group.

I have a trading group only for my affiliates where I share my own trades + the ones from people much smarter than me once they share in their private TG/Discord.

Also, I will arrange a trader contest in cooperation with Bybit starting this week where PnL % is what matters, so even small traders have a chance to win the money prizes + an iPhone.

Once you've signed up on the ref link —> go here to join my private trading group: t.me/route2fiibot

Today’s newsletter is sponsored by Term Finance

Term Finance, the fixed-rate lending protocol, is thrilled to announce its collaboration with Lido, offering lenders the chance to earn wstETH rewards by participating in Term’s weekly USDC / wstETH ‘Bomb Pot’ auctions.

Throughout April, lenders participating in Term's USDC / wstETH auctions will receive a share of wstETH Bomb Pots to enhance yields for lenders.

Here's how it works:

1. Place offers to lend USDC in any April USDC / wstETH auction, setting your preferred minimum interest rate.

2. After the auction concludes, the protocol automatically determines the optimal interest rate. If your offer falls below this rate, you secure it for the loan term.

3. Successful lenders receive their share of Term's Bomb Pot auction incentive program based on their contribution.

Visit app.term.finance to learn more and participate in this week's USDC / wstETH auction.

Some thoughts about altcoins

We hear a lot about alt-season, but this time around I think things will be different. We’re used to hear that every coin out there will pump given the right conditions. But is this true?

Remember there’s a lot more tokens with “utility” on the market today than in 2021. Every week now 3-5 “quality” coins are added to the market. Total3 mcap goes up, and everyone seems happy. But ask yourself who is going to buy all these tokens. Unless institutions or retail are coming in masses, it will just be a forever PvP fight.

An example from this week is the Wormhole airdrop. Launched at a 10bn valuation. Now ask yourself why you would own that? I can’t see any other reasons than from a pure speculation perspective.

I think when BTC.D trends lower and altcoins can run free, there will be a selected few altcoins that will run hard. Not everything as people are used to. There are more people in crypto at this point than in the last cycle, but people are smarter now. Think we will have rotations as we have been used to in the last 6 months, and that blindly longing coins can be a losing game. According to Thiccy, the crypto altcoin sector has added $20B of supply year to date through unlocks and staking rewards. This is an average daily altcoin inflation of $250m at these prices. Altcoins have added roughly $200m of market cap or up 53% YTD, while BTC is up 53% and Ethereum 45% YTD.

FDV growth has outpaced circulating due to the number of new coins launched, adding roughly 70% YTD. The spread between FDV and Circulating supply which represents how much future supply will hit the markets has increased by over $150B YTD. As inflows to the majors slow down, the weight of daily altcoin supply becomes increasingly apparent. The more I learn about trading, the more I realize how +EV tactically shorting crypto altcoins actually is. At least when you trade in pairs. Naked shorting of altcoins in an uptrend can be dangerous.

Anyway, total market cap of altcoins are steadily increasing as a consequence of constant new token launches + new supply hitting the market.

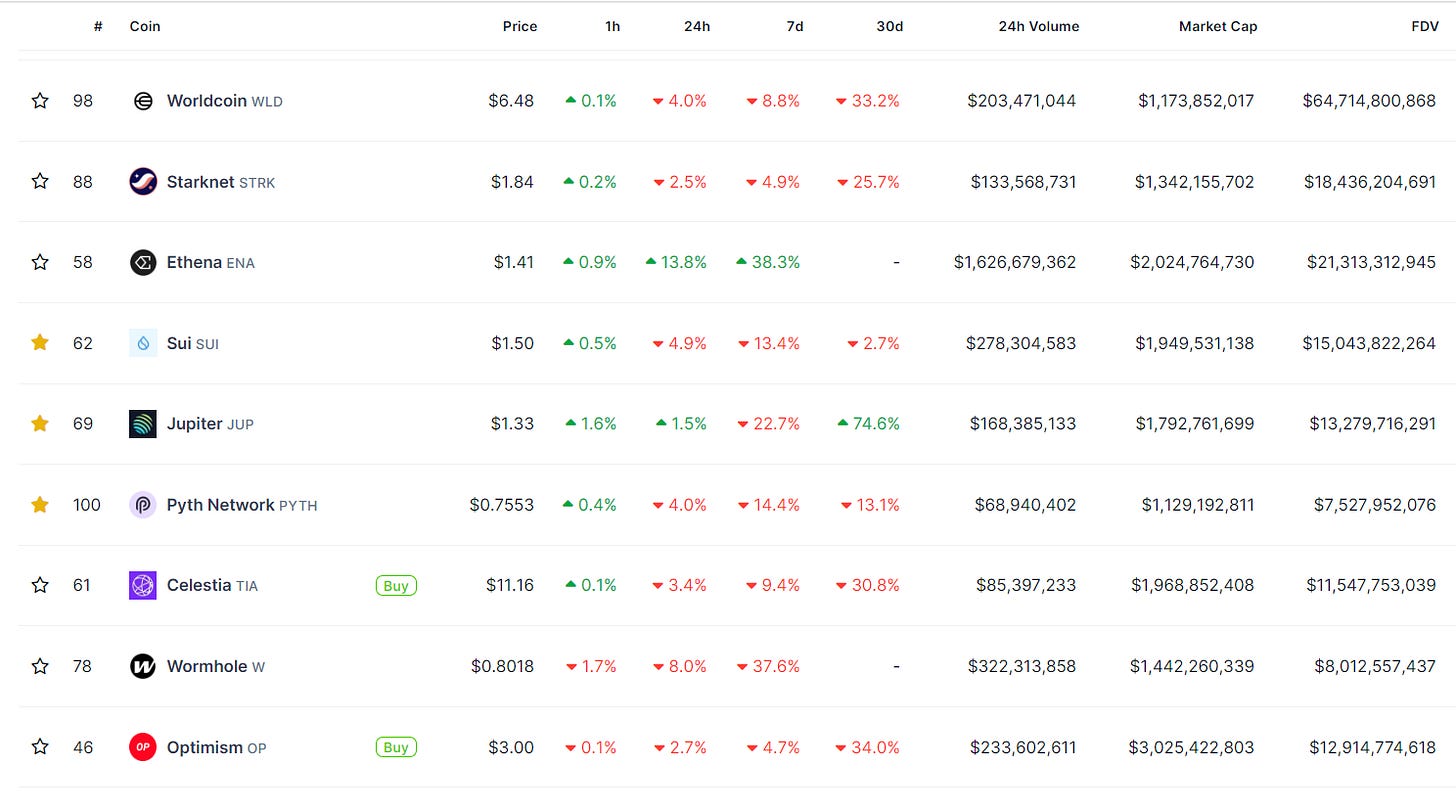

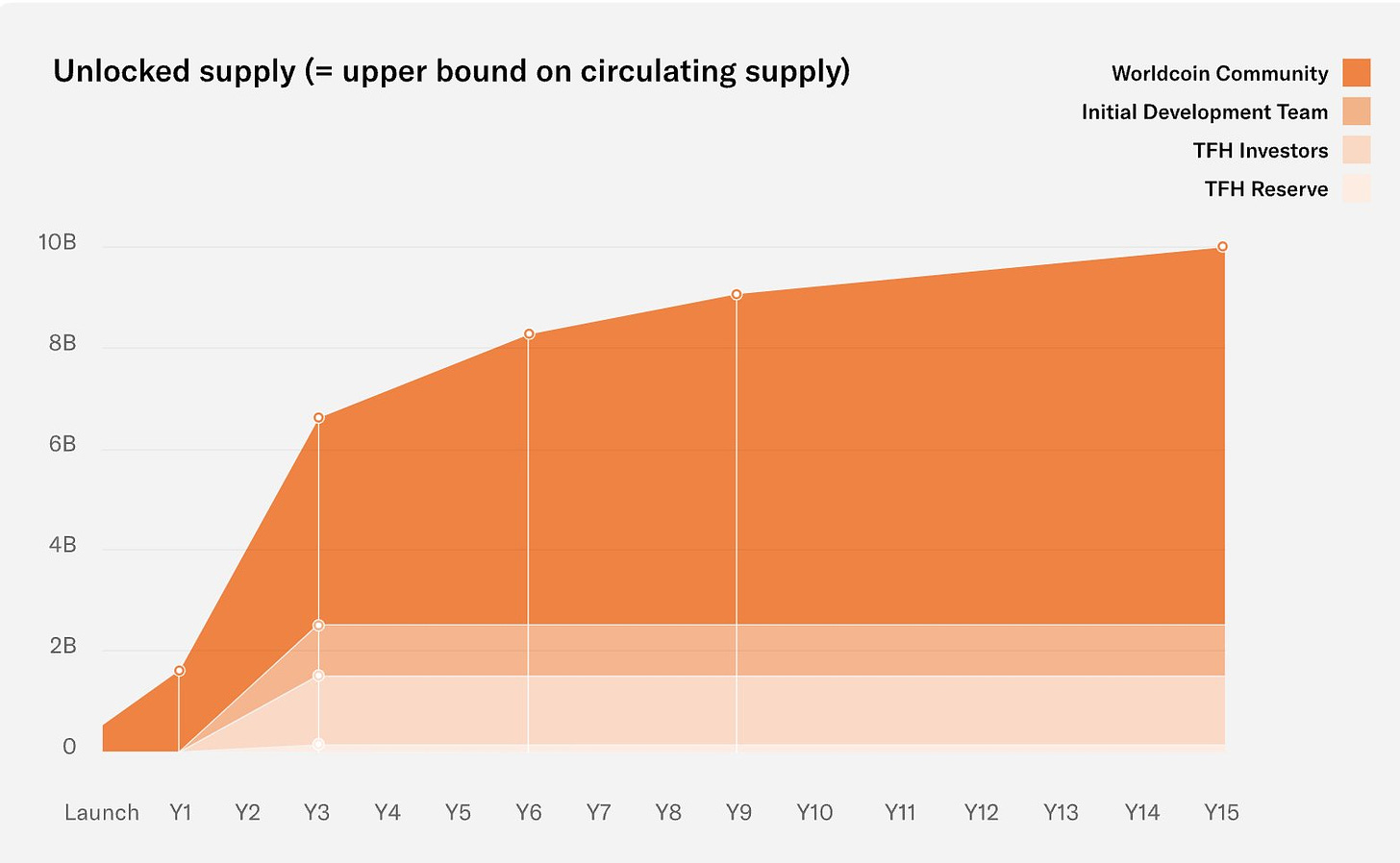

Examples above with some high mcap/FDV tokens. Look at Worldcoin: 1bn market cap, but $64bn FDV. What does that mean?

Well, it means that Worldcoin will have a constant supply to the market in the future. In July 2024 they will start a crazy unloading with 6m $WLD tokens hitting the market every single day. For context, it’s 181m $WLD tokens at the market today…

You don’t have to be a rocket scientist to understand that this is extremely bearish.

With a basic supply/demand curve it’s easy to see that it will be very hard to keep the $WLD price up when this supply is hitting the market.

Who will buy 6 million $WLD tokens daily?

Does this mean that you are bearish on altcoins, Route?

Not necessarily, it just means that I think most new VC scam coins (high FDV coins) eventually will dump hard AF. And that you can use this to your advantage in pair trading or in situations where you want to hedge.

Now right before the halving, it makes sense to be long $BTC, short weak alts. Examples could be $STRK, $APE, $BOME, $ADA, $CRV, $XRP. Or if altcoins in general outperform, then combine these weak altcoins with strong ones: Strong ones at the moment: $ENA, $TON, $FTM, $PENDLE. However, this is not a recommendation to long/short these as the market momentum changes rapidly.

The good thing with memecoins is that they’re actually one of the few honest coins left. Look at $WIF, $PEPE, $DOGE etc. Circulating and total supply are the same. No one is coming to dump on you in a crazy unlock schedule. It’s just player vs. player.

I continue being long spot, but don’t trade too much these days. It’s just chopping me to death.

To be continued.

Let me know your favorite plays in the market atm in the comment section.

That’s it for today, anon!

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

Insightful. Besides FDV and market cap, what are some other metrics to determine the actual long-term utility of altcoins?

Excellent as always.