Hey, friends!

Ethereum really can’t be stopped. It continues marching higher and higher. With EigenLayer and now Ethena Labs really getting a product market fit, it looks like we’re about to fly.

Will we see $3,500 before EIP-4844 in 3 weeks?

Right now this doesn’t seem very unlikely anymore.

If you want to start trading crypto in the new year, use my ref link on Bybit:

https://partner.bybit.com/b/route2fi

You get lower fees, a bonus of up to $30,000, and are able to join my trading group.

I have a trading group only for my affiliates where I share my own trades + the ones from people much smarter than me once they share in their private TG/Discord.

Also, I will arrange a trader contest in cooperation with Bybit starting this week where PnL % is what matters, so even small traders have a chance to win the money prizes + an iPhone.

Once you've signed up on the ref link —> go here to join my private trading group: t.me/route2fiibot

Some thoughts about what to look for when buying crypto tokens + mindset in a bull market

The bull market is pumping a long, and literally, every coin out there is pumping in some way.

Today I wanted to talk about some basic principles you should look at for considering tokens.

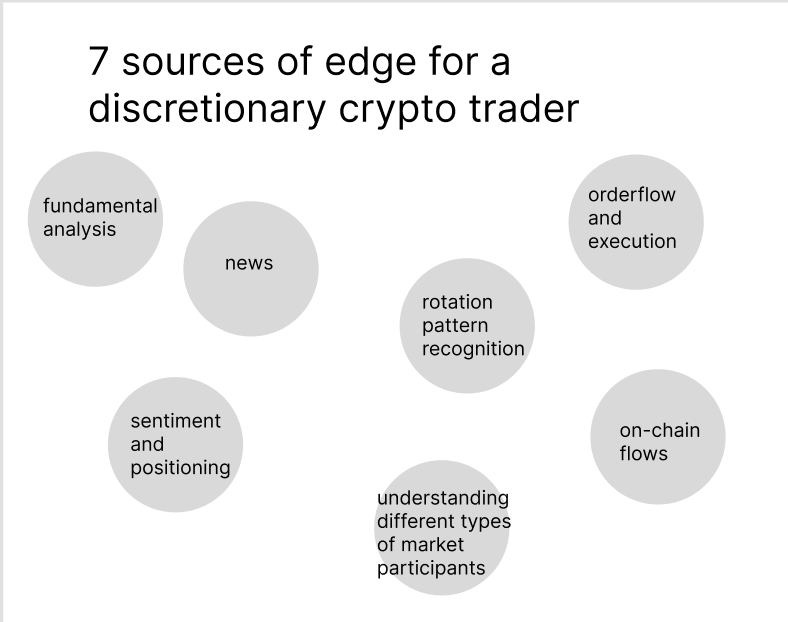

Thiccy shared this screenshot in his TG group the other day, and I think it summarizes well what you have to look for.

Above you can see the 7 different categories:

Fundamental analysis

News

Sentiment and positioning (incl. technical analysis)

Rotation Pattern recognition

Understanding different types of market participants (difficult unless you are deep in the industry)

Orderflow and execution

On-Chain Flows

Let’s go right to work and start with some tokens. I am not going to deep dive heavily here, this will be more like a cheat sheet.

$MATIC

Polygon has been a market laggard over the last year because of supply overhangs, a perceived lack of focus in its roadmap, flopped product launches in mid 2023.

AggLayer Mainnet launch on Friday 23rd

Polygon is shaping up to be the dominant ZK ecosystem

MATIC → POL transition in Q2 2024

POL stakers to receive airdrops from new L2s on Polygon similar to Celestia

POL can be restaked for yield from new L2s on Polygon similar to Eigenlayer

Everyone has sold, low downside

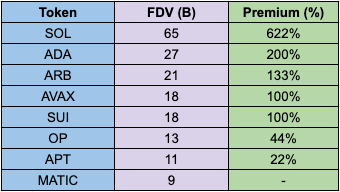

FDV: 9b. Compare this with many of the other L1’s it’s easy to see that MATIC is priced on the lower end.

The hard part is rotation pattern, reading flow and to know overall where the general market will go next.

We are in an uptrend, L2’s will benefit from EIP-4844 (Matic should benefit as well under this narrative). Downside seems low for Matic, but it’s a cursed coin and personally I don’t see a huge upside.

$SEI

It's an L1 chain with ultra fast TPS & finality (settlement) geared specifically for asset exchange, or colloquially: trading. Perfect for DEX perps. Ok so what, don't we have DEX’es already? Well, they still kind of suck compared to the CEX experience, and that's what $SEI fixes.

Fastest L1

Team former Google, Goldman Sachs, RobinHood, Nvidia

Raised over $130m (Jump, Coinbase Ventures, Circle, Delphi++

Devs from Terra (slick UX/UI)

2bn mcap, 9bn FDV

Rotation (quite often mentioned by influencers like Hsaka)

Just launched v2

Seems like a candidate to replace $LUNA of last cycle in terms of pumpementals, well-liked by people in the space

As a drawback, only $20m TVL in DeFi. That’s basically nothing. However their biggest goal is to launch a trading dex that can compete with Binance/Bybit etc., I think it’s therefore not meaningful to take TVL into consideration this early.

This leads me over to the dangers of this bull market.

The dangers of this bull market

I read this on Twitter some months back and noted it into my notebook, can’t remember who originally said it, but it was good advice:

Being the guy who is not bullish enough, has no long-term investments, no diamond hands, fears much, doesn't understand the power of the bull, cannot hold. He takes much profit after little pnl. This guy does not make a lot of money because he has no balls, no vision, and cannot handle pressure. Day trader type. Technical analysis kind of guy

Being the guy who has diamond hands, believes every narrative, holds positions and investments because of delusional optimism, and makes generational paper gains. which is all good. but he can't fully comprehend it. so he bets more. and he doesn't stop betting. supercycle kind of guy. this guy does not keep his money, some yes, but most he gives back. the reason he wins becomes the reason he loses

Who to be

Be the biggest bull. Believe it all. The future is bright type. Future of France kind of guy. Up only. Wen lambo. Wen moon. Bet more. Long your longs. Type of degen. But at some point, this guy suddenly exits the market fully, goes into the wilderness, and laughs about the dynastic wealth he just made on a soon collapsing, never recurring, coordinated ponzi.

Many people who performed well in the bear market of 2022 might have a hard time in the bull, at least in the initial phase. The reason? You can't trade both environments in the same way and only those who adapt will outperform again.

In bull markets, instead, money is greedy and therefore there is a lot of speculation. The best thing you can do in bubbles is to invest in promises and projects that aren't very quantifiable yet. A perfect example is Worldcoin. They want to scan all the eyes of people in the world, and wonderkid Sam Altman is behind it. It's easier to reach hundreds of millions or even billions of valuation, when you don't understand something and hear everyone talking marvelous things about how something is going to revolutionize an industry. You start seeing integrations, projects "using" a new tech or a new platform, and partnerships, and everything looks great.

If you watch carefully, some coins with 0 revenue streams and activity are still promises, yet they are performing much better than coins with solid revenue streams. Next time you see a project, don't fade it cause it doesn't have a working product yet, cause it doesn't have many users, or cause it's not generating as much revenue as you would like to be comfortable. Those shouldn't be the reasons. If you want to make crazy money, embrace speculation.

Many people think that once a token has been pumped, it is too late or too risky to buy it.... but think about it another way.

The primary purpose of a token is to pump. therefore, once a token has pumped, it has shown itself capable of pumping.

Therefore it is less risky.

…

That’s it for today!

Happy trading and good luck with buying all the dips in 2024!

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

Great as always.