Some Thoughts On Money Management In Crypto: The Kelly Criterion, Position Size, Stop Loss & Take Profit

Money Management In Crypto

Let's pretend you're a trader.

You have $100, and you want to earn money from crypto.

But in order to make capital, you have to be a master of protecting your existing capital. That's why you need money management.

You want the money to last as long as possible, and you don't want to erase all your capital by one or a few bad trades.

Think of your $100 as your full bankroll ($100 is just chosen for the following examples in the text. It will be relevant if you have 5, 6, 7, 8, or even 9 figures net worth).

What is the optimal betting size (trading size) that mmaximizes profits, but also protects the downside in case you're wrong?

Meet John Kelly and the "Kelly Criterion".

The Kelly Criterion

The Kelly criterion (first proposed by professor John Kelly) calculates the proportion of one’s net worth to wager in order to maximize the expected logarithm of wealth increase.

It tells you how much to bet on every trade without ever going bankrupt.

Okay, back to our $100 example.

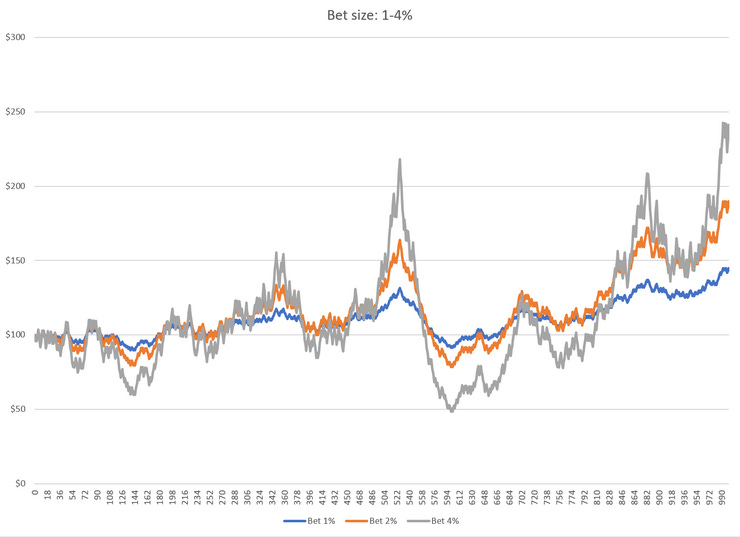

Let's look at the differences in the expected outcome if you do 1,000 trades and you bet respectively 1%, 2%, and 4% of your bankroll every time. In other words, if you bet 1%, you're risking $1 the first bet. If you lose 10 trades in a row, your total portfolio is now worth $90 (and therefore your bet size is now $0.90, which is 1% of your total portfolio).

Below the expected outcome is illustrated:

As the bet size increases, so does the profit.

But you can also see that the volatility increases the higher bets you take.

For example, you can see from the figure that after 590 bets (4% bet size), you've actually lost $50, which is equal to a 50% drawdown of your portfolio, meanwhile the 1% bet barely has a drawdown below $100.

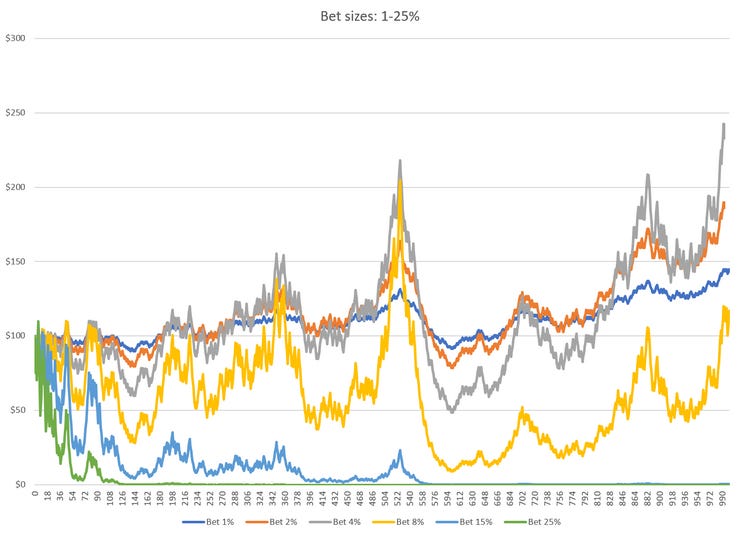

But let's look at what happens if we increase the bet size gradually up to 25%.

Do you already see some surprises?

I can list several:

-The 8% bet size actually performs worse after 1,000 trades than the 1% bet size

-Both the 15% and 25% bet size makes you bankrupt after respectively 400 and 100 trades.

-The 4% bet gives the highest total return, but from a risk/reward perspective the 1% and 2% bet sizes look better because of lower total drawdown when you have a losing streak (and trust me, you will experience that from time to time).

At small bet sizes, the profit grows when we win. But at higher bet sizes, the big drawdowns makes it impossible for the portfolio to come back.

The optimal bet size

We can calculate how much we should bet by using the Kelly percentage below:

Every trade has an optimal trade size (let's call it K%, or the "Kelly percentage" of your portfolio).

This is the value that maximizes expected returns over many successful trades of similar risk.

How to calculate K:

Let's say that we take a trade on $BTC. You check your PnL stats from years back and find out that your win ratio is 51% of the time.

After studying the market, and looking at technical analysis you're spotting a trend. But since no one really knows how $BTC will perform next, we'll just assume that the probability that it goes up or down is 50%.

W = 50%

R = 51/49

So, K = 50% - (1-50%) x (49/51) = 1.96%

In other words, the optimal trading strategy that maximizes long-run returns if we were to wager again and again on this game is to risk about 2% of net worth each time.

Let's say your win ratio is 55%.

Then K = 55% - (1-55%) x (45/55) = 8.18%

Hmm. Let's stop and think about that.

Didn't we see in the start of this text that somewhere around 1 - 2% of your total portfolio should be the optimal bet size?

It's about time we discuss the drawbacks and disadvantages of Kelly.

Kelly represents the largest bet that could still be rational assuming no value is placed on risk.

However, betting anywhere near the Kelly-optimal amount is irrational by most standards.

To utilize the Kelly Criterion in the real world, be extremely conservative with your assumptions. Take the worst of various possible scenarios. Instead of betting a full-size Kelly, bet a fraction of the Kelly Criterion (maybe 0.3x to 0.5x).

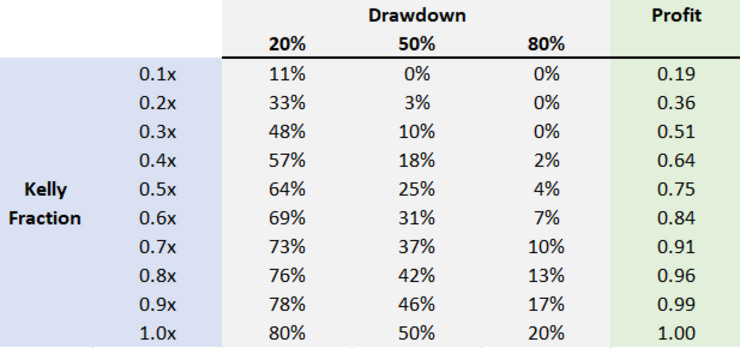

Let's look more at this in the figure below:

We calculated that you should bet 8.18% of your portfolio ($8.18) in the last example by using the Kelly formula. The problem is that if we're wrong a lot, this could lead to a substantial drawdown of our portfolio.

Then why not bet a fraction of the original Kelly size? As you can see from the figure above you could actually bet 0.9x the Kelly size and still earn 99% (0.99 as in the figure) of the profit as with your original bet size.

So if we bet $8.18, you could bet $8.33 x 0.9 = $7.1, and it wouldn't matter since the profit would be almost identical (0.99 vs. 1.00).

In other words, lower risk but same reward.

A 0.8x fraction of Kelly gives 96% of the result with the full-size Kelly.

A 0.7x fraction of Kelly gives 91% of the result with the full-size Kelly.

A 0.5x fraction of Kelly gives 75% of the result with the full-size Kelly.

A 0.3x fraction of Kelly gives 51% of the result with the full-size Kelly.

For example, by always betting 0.3x of the Kelly-optimal bet size, you reduce the chance that you'll have an 80% drawdown of your portfolio from 1-in-5 to 1-in-213, but you still keep 51% of the growth of a Kelly-optimal bet.

The point of all of this is that if you size your bets small enough, your portfolio will survive to see the next big winner (i.e. will survive long enough for the positive expected value to play out).

Applying Kelly And Optimal Bet Size To The Real World

Okay, I get you anon.

Risking 1 or 2% of your total portfolio in every trade sounds boring.

If you have a $100K, that means that you shouldn't risk more than 1-2% of your total portfolio.

But this is what most people don't understand about trading.

Risking 2% of your portfolio and betting 2% of your portfolio is not the same.

Confused?

Let me explain:

In trading, we use stop loss. How big your stop loss depends on what kind of trader you are and what trading style you have. Scalp traders have much tighter stops than for example swing traders.

Let's just assume that you use a 5% stop loss.

An example with taking a trade in $BTC

At the moment $BTC is sitting at $21,000.

We have $100,000 and wonder how much we should bet.

From Kelly, we saw that somewhere around 1-2% of your total portfolio should be risked.

Let's say that you want to risk 1.5% of your total portfolio.

Position size in $BTC = Risk % / Distance to SL %

1.5 / 5 = 0.3

Position size: $100,000 x 0.3 = $30,000

That sounds better, right?

You buy $BTC for $30,000, which is equal to 30% of your portfolio.

But you're only risking 1.5% because your stop loss is 5%.

Still confused?

You bought $BTC for $30,000. If $BTC goes down 5% ( $30,000 x 0.95) = $28,500.

It means that you have lost $30,000 - $28,500 = $1,500 which is equal to 1.5% of your initial $100,000.

In other words, your bet was 30% of your portfolio, but there was only 1.5% of the portfolio that was at risk.

A rule of thumb is to have a max. risk of 1-3% of your total portfolio.

How Low Should You Set Your Stop Loss

There's no 100% right or wrong answer, but we can try to generate a rule of thumb.

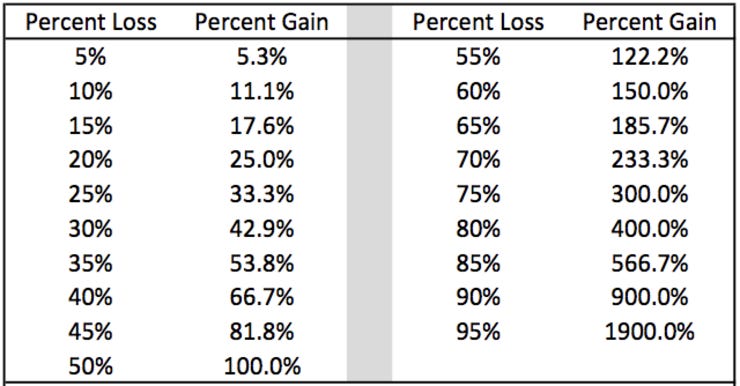

First of all, look at the table below:

It's important to understand this, because the bigger the stop loss, the more you have to earn to make it back.

For example, up until 10%, there's only an 11.1% gain that is required to break even. But at 50% it's actually a 100% increase to break even, and at 90% you need 900% to break even.

I don't think I've heard of traders using more than 20% stop loss, but if they do then that's more of an investing strategy IMO.

Personally, I like to cut my losses fast and usually use a stop loss of max 5-10% (usually 5%).

Some General Trading Advice

Most traders tend to focus too much on the rewards side and not enough on the risk side.

If you regulate a portfolio with sentiments and not discipline, then be prepared for an explosive and depleting ride.

Your goal should be risk management, not risk avoidance. Risk can be managed by significantly controlling the possibility and the amount of loss.

Before each trading day, you must mentally rehearse about handling each position based on what can unravel during that day.

Planning plays an important role because it helps you to make good decisions when you need them the most. You can't control the crypto prices, however, you can monitor the amount you lose on each trade.

Always define your risk in advance. Not defining a predetermined level of risk may prove to be more fatal and costly than any other mistake.

Praying and hoping for a loss recovery can't be a part of your psychology if you want to achieve great trading results Sticking to rules and discipline and maintaining a positive reward/risk ratio will result in money inflow.

I haven't discussed take profit strategies in this newsletter issue, I think that is something I should write more of in a coming issue. As with the stop loss it really depends on what kind of trader you are.

If you are scalp trading on the 5/15M chart you want a tighter stop loss and a lower TP than if you're using the 4H/1D for swing trading.

Also, what assets should you trade? Which pairs? Which setups? Which indicators? I'll discuss this at a later point. I think what's important is to find something that works for you. There is no one golden strategy. As long as you have discipline and follow your plan, you have done a lot correctly already.

The source for the write-up about the Kelly Criterion was this article: https://nickyoder.com/kelly-criterion/amp/?__twitter_impression=true and this Twitter thread: https://twitter.com/FabiusMercurius/status/1507770848488218625