Hey, friends!

Some people would claim that the bull market hasn’t started, but onchain activity never lies and personally, I think there are more opportunities out there than ever before.

Today I wanted to talk about airdrops because there are so many now on SOL, Cosmos eco, and on ETH.

Before we get into today’s newsletter, let’s have a word from our sponsor Swell - the LST for DeFi

DeFi is back, anon, and there is no doubt that airdrop season is here.

Unless you’ve lived under a rock lately you must have heard about Swell’s explosive recent growth and restaking on Eigenlayer.

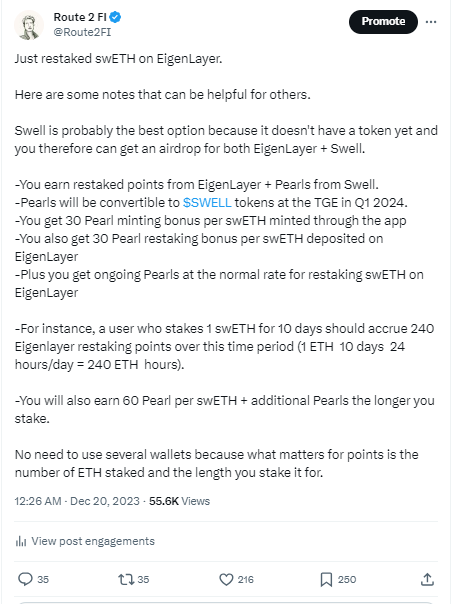

If you want to maximize your ETH staking yield + get 2 airdrops you should stake your ETH for swETH and deposit to Eigenlayer.

This is how you do it:

Step 1: Go to: https://app.swellnetwork.io

Step 2: Go to stake and convert your ETH into swETH

Step 3: Go to https://app.eigenlayer.xyz/ and deposit your swETH into the “Swell Staked Ether pool”

But you need to hurry because Eigenlayer has a max cap of 500k ETH, and it is filling up fast.

You will earn:

Pearl points which will be convertible to SWELL tokens at the TGE token launch in Q1 2024.

Eigenlayer restaked points which will turn into an Eigenlayer airdrop probably in Q1 2024 as well

And of course more swETH the longer you stake

No need to use several wallets because what matters for points is the number of ETH staked and the length you stake it for.

Use my Swell ref link here and we will both earn extra Pearl tokens:

Stake swETH and get free Pearl tokens here

The best airdrop opportunities in crypto right now

Let’s start with the Cosmos ecosystem.

Cosmos airdrops

Cosmos is well known to have plenty of airdrops, and to qualify a rule of thumb is to have this number of coins in your Keplr or Leap wallet:

15x ATOM (approx. $150)

100x OSMO (approx. $200)

50x KUJI (approx. $250)

20x TIA (approx. $250

10x INJ (approx $4000)

In total $1,250 for a shitload of upcoming airdrop opportunities.

Let’s see how you can do it.

Step 1: Download the wallet of your choice: Keplr or Leap

Step 2: Go to: https://cosmos.leapwallet.io/transact/stake for Leap and find “Plain Stake” or https://wallet.keplr.app/chains (if you choose Keplr)

Step 3: Find the asset of your choice, let’s start with ATOM (Cosmos Hub) - 16% APR

Step 4: Select validator and amount to stake (often smart to diversify and stake with several validators)

Repeat step 1-4 with OSMOSIS (10% APR), TIA (16% APR) and INJ (15% APR).

For KUJI (Kujira) you have to go to: https://blue.kujira.network/stake and connect your Keplr or Leap wallet. Choose stake and the validators of your choice. APR right now is 27%, but expect this to go down.

If you did all of these steps you should expect to receive most of the Cosmos airdrops.

In the Leap wallet you can see all the upcoming airdrops on Cosmos: https://cosmos.leapwallet.io/explore/airdrops/all

Also follow this Twitter account to keep yourself updated:

https://twitter.com/Cosmos_Airdrops

And here is a good thread for INJ-specific airdrops: https://x.com/milesdeutscher/status/1737103950028181636

Solana airdrops

For Solana there’s a super nice airdrop tracking spreadsheet here which is updated daily:

https://docs.google.com/spreadsheets/d/1cQTQTQDC_glduX254-TDbwNsJ7jrCMTCxBtAlwz7yEA/edit#gid=0

In the spreadsheet you can check what tasks you have to do in order to qualify for the airdrops.

Those I think have the most potential are: Wormhole, Magic Eden, Fractal, BetDex, Backpack, Parcl, Credix Finance, Zeta, Marinade and Eclipse.

The best thing you can do is to stake SOL through your Phantom or SolFlare wallet via Marinade.

Then simply use the protocols. Swap, trade, buy/sell NFT’s and play around. In the spreadsheet it says what the optimal strategy is, but it isn’t always said what the best thing to do is. But from a DeFi protocol perspective, they want you to use their product, make transactions, and talk about it.

Ethereum Eigenlayer airdrops

So as mentioned in the intro maybe the biggest airdrop of the year for Ethereum people is on Eigenlayer.

On EigenLayer, users can "reuse" or "restake" their ETH or a liquid staking token (LST) on its smart contracts. By doing so, users can earn additional rewards on the same ETH capital.

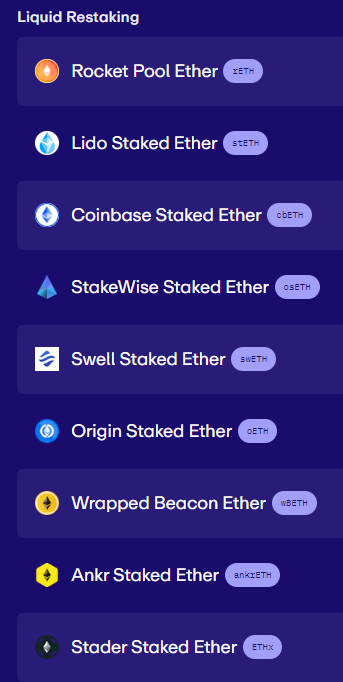

There are several options to choose from on Eigenlayer:

RocketPool, Lido, Coinbase, Stakewise, Swell, Origin, Beacon, Ankr and Stader.

Swell is my first priority as mentioned here:

I also like Lido stETH because of the deep liquidity. However, Lido already have a token. The same is true for all the others too: RocketPool, Coinbase (Base token), StakeWise, Origin, Beacon (Binance has BNB), Ankr and Stader.

So why do I think Eigenlayer is a big deal?

-Only 25,000 wallets are currently competing.

-EigenLayer's got massive partners, including Google Cloud.

-They've bagged almost $65M from top investors.

Here is a recommended thread for Eigenlayer:

Okay, I think that’s it for now!

PS! The bullish vibe in the space is back, wouldn’t surprise me if we get a $BTC ETF approval before Christmas now. Let’s see!

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

Great article. This is a question for my own curiosity. It shouldn't matter if you have ATOM, OSMO, INJ, TIA in Keplr staked and Kuji in Leap staked, correct? Using two different wallets still checks the boxes?