The Bull Case For Arbitrum 🐂

Arbitrum has been a major success so far in crypto.

It's been growing at an astonishing rate for many months and it currently sits as the 4th biggest chain by TVL and as the 3rd biggest chain for its 24hrs trading volume.

Arbitrum is Ethereum's biggest Layer 2 to date.

A Layer 2 blockchain is an extension of Ethereum that benefits from the security assurances provided by Ethereum while operating independently. It can do all of this because it's an Optimistic Rollup.

Optimistic Rollups speed up Ethereum's smart contract by using a second-layer chain to handle most of the work, while still recording everything on the main chain for security.

This week I wrote a big thread about Arbitrum and walked you through:

What is Arbitrum

What makes it so special?

3 great DeFi protocols you must know about

Strong DeFi protocols with lots of upside

An update on my 2 Arbitrum portfolios

You can read the full thread here:

🐸 Also, join my free Telegram channel here: Crypto Goodreads 🐸

5 Small Cap Gems On Arbitrum 🍒

In the following text, I’ve outlined 5 DeFi protocols that are fairly small, but that have potential.

This is not a buying recommendation, and you should always manage your risk yourself. No one other than you is responsible, anon :)

1. FactorDAO ($FCTR)

FactorDAO is in essence a “no-code” asset management platform for creating portfolios and indices where individuals, builders, and fund managers are able to create “vaults” with differing investing strategies.

FactorDAO has partnered with several of Arbitrum’s top protocols so its users are able to utilize these protocols as an infrastructure to form their own passive/active investing strategies; the generic degen would choose specific vaults to enter and HOPEFULLY profit from it.

FactorDAO has an extremely interesting business model where they incentivize both individuals and fund managers ie: fund manager generates a successful strategy, he/she gets management fees and a percent (%) fee on the profits - vice versa for individuals, they would make good returns on their investment.

FactorDAO also provides Curve ve tokenomics and fee sharing; users of the protocol are able to stake $FCTR to get veFCTR, which would accrue 50 percent (%) of protocol fees, there is also a time-based multiplier. Protocols that have adopted this sort of revenue model have seen large successes, to name the king of Real Yield: $GMX.

FactorDAO is conducting their public sale (20th Feb 2023 - 24th Feb 2023) held on CamelotDEX and as of the time of writing have already raised just over 4 million USD, putting their current FDV at 43 million USD.

Although FactorDAO is looking to be an extremely promising protocol on Arbitrum, their product is not out yet - this means it is impossible for us to determine if they will perform as intended.

There is, however, an early beta that is out for community members who applied over the past 2 weeks. Their full product is scheduled to be released at the end of the month.

Another consideration to keep in mind for those who are interested in participating in the fair launch held on CamelotDEX would be to watch the FDV and make your own determination of “fair market value” before participating.

There is no need to rush into the sale as there is until the 24th Feb to participate. And even then, who knows if it’s worth to ape in really.

Overall, FactorDAO has an interesting product and could have the potential to perform well in this market, as usual, DYOR and NFA.

2. CamelotDEX ($GRAIL)

Camelot is an Arbitrum native DEX that has emerged as one of the most significant among recent Arbitrum protocol launches. Since the launch of its protocol in late November, Camelot has seen its TVL grow from $6M to $69M in February. This has lifted it into the same conversation as both DeFi giants Curve and Uni V3’s Arbitrum protocols, commanding TVLs of $79M and $134.45M respectively.

Camelot’s DEX architecture follows that of Uniswap V2 and Curve’s stable swap AMM. This allows for volatile pairs to be traded using an invariant separate from stablecoins. This is ideal as slippage can be minimized as much as possible for stablecoins by having the gradient close to constant around the mid-swap point.

In addition to Camelot’s DEX, Camelot has a suite of other DeFi products which include launchpads and Nitro Pools. Camelot’s launchpads have seen some remarkable usage, with three fair launches having concluded so far. Collectively, these launches have seen USD 18M raised, which includes Camelot launching its native token, $GRAIL.

Nitro Pools are an interesting implementation of LP rewards, whereby users can deposit their staked positions (represented by a spNFT token) to receive a new layer of yields on top of existing position yields. This is in effect a permissionless vehicle through which protocols can incentivize liquidity without the need for rent-extracting intermediaries.

Nitro Pools are completely customizable, giving projects the ability to tweak the rewards incentive scheme to align a staking user’s profile with the desired behavior/liquidity goal.

Camelot has also thoroughly thought out its tokenomics and value accrual design. The Camelot ecosystem uses a dual-token model of GRAIL and xGRAIL. GRAIL is the transferable governance token, while xGRAIL is an escrowed, non-transferable version of GRAIL. xGRAIL can be deposited into a ‘plugin’ of choice that allows the depositor to benefit from plugins such as protocol fee share, boosted yields and launchpad discounts.

Finally, we take a look at Camelot’s financials:

Mkt cap: $26M

Price: $2,250

24h fees: $216k (annualized $11.2M)

P/E ratio: 2.3

New volume ATH on 21/2/2023

35% of fees accrue directly to GRAIL via xGRAIL staking

3. Nitro Cartel ($TROVE)

Nitro Cartel is an Arbitrum-native DAO with a treasury that aims to generate yield & further grow Arbitrum’s ecosystem. Nitro Cartel aims to achieve this with the introduction of Arbitrove: Providing users exposure to Arbitrum’s ecosystem assets whilst reducing user friction.

Nitro Cartel’s community is able to gain exposure to Arbitrum’s native ecosystem assets, through the introduction of Arbitrove’s first yield-bearing index, ALP.

The following tokens (GMX, MAGIC, GRAIL, DPX, JONES, RDNT, GNS) will be included in the initial composition of ALP and will be deployed in custom strategy vaults, earning yield for users through a variety of strategies.

Users are able to gain access and mint ALP through depositing ETH and blue-chip Arbitrum tokens, with the amount of $ALP minted per asset based on three different factors: latest price of the asset deposited relative to the latest composition of $ALP, the price of the assets inside the $ALP, and the number of outstanding $ALP fetched by Arbitrove’s oracle.

In order to incentivise minting and deposits of ALP, Arbitrove’s dynamic deposit fee is introduced. ALP minting and redemption costs are asset-dependent and constantly adjusted according to the discrepancy between the index and target composition, allowing for the automatic rebalancing of different strategies.

Users can stake ALP on Arbitrove in exchange for esTROVE and further yield produced by their strategies. The vaults of Arbitrove generate yield through single-coin staking, LP farming (either only LP farming in DEXs, staking LP tokens in the protocols' contracts, or staking LP tokens in DEXs), with future yields also aiming to be generated through the lending out of various assets.

Arbitrove can expand on its use case to be the underlying asset for Arbitrum leveraged trading, by establishing the index token standard of Arbitrum.

Key Highlights:

-8,222.2178 ETH raised through Nitro Cartel’s Public Sale on Camelot

-Circulating Market Cap: $20,621,715

-Fully Diluted Valuation: $68,711,751

4. TridentDAO/OasisSwapDEX ($PSI)

TridentDAO is a GameFi project launched on Arbitrum which aims to bring a whole new sustainable model for GameFi: RiskToEarn (R2E). Traditional P2E models for GameFi are flawed as it creates an infinite supply pressure. This inspired TridentDAO to introduce the R2E model where players must “wager” an asset of value when “competing” with one another.

The loser loses their “wager” to the “winner”. The rewards from the winning player come from the wager risked by the losing player which is distinguishable from traditional P2E models where losers do not suffer any penalties when losing. This creates a zero-sum mechanic in the game as the rewards are from the opposing players instead of being printed from thin air.

Milestones achieved so far:

$PSI relaunch on Arbitrum

$PSI would be used to purchase in-game items and as “wagers” in the R2E model between competing players. Currently, there are no plans for $PSI to be emitted. This 0 emission model coupled with in-game sinks would make the token net deflationary.

Token info (from CoinGecko)

MarketCap as of the time of writing: $11.5mil

Total supply: 9,440,815

Circulating supply: 2,421,010

OasisSwap will serve as the DEX for the Trident ecosystem. First order of business when this DEX launches is for the TridentDAO team to seed liquidity for $PSI. On Day 1 of the DEX launch, the team will use $1mil for the $PSI LP on OasisSwap to allow $PSI trading with low slippage. On Day 31, the team will deposit $100k TWAP, every 7 day cycle, for 5 sprints. This totals into $1.5mil that the team will use to provide liquidity for $PSI, which is 50% of the funds raised on Arbitrum.

Instead of emitting tokens to bootstrap liquidity into the protocol thus hurting $PSI, TridentDAO will incentivize liquidity into the DEX through “Missions”. These “Missions” would be based on user actions on the DEX and accrue points over time. These points would determine the amount of $INK tokens the users will be airdropped (similar to $Blur point system maybe). Lastly, $PSI can be staked to participate in the DEX’s “DEX Fee Ownership Model”. This revenue share is based on a tiered system allowing $PSI stakers to earn “real yield”.

There are many other future plans for OasisSwap, developing the MMO game, introducing R2E competitive modes etc. to bolster the TridentDAO ecosystem. There is a free to play version of one of the game modes on the TridentDAO website. Although many components of the overall ecosystem are still in development. The roadmap is potentially promising for $PSI combining GameFi, DeFi, and real yield narratives. They are looking to be close competitors of $Magic.

5. Arcadeum ($ARC)

Arcadeum has emerged as the primary storyteller in the GambleFi narrative. GambleFi in a nutshell is essentially the idea of integrating DeFi tokenomics into a casino-themed product or decentralised application (dApp).

The current market cap of $ARC is around $17 million, and it offers unparalleled real yield and tokenomics. In short, Arcadeum is a casino product released on Arbitrum that aspires to be the "GMX of casinos"; the development team has shown steady progress, with new games being released almost daily.

They use a GLP-style revenue model for their stakers and have the most games of any GambleFi project at the moment. sARC, xARC, esARC, and ALP are the four staking pools users can select from.

The ALP pool is essentially a tokenized basket used to pay out winners and collect losses, while the staked $ARC variants yield platform fees distributed among stakers. As of right now, the USDT pool was only open for the first 500k deposits; this was reached in under an hour on February 17th.

The ALP pool, meanwhile, has a triple-digit USDT APR. Take note that this is the highest APR stablecoin yield on the entire Arbitrum ecosystem. The ALP pool guarantees that users will always receive their winnings, and the LPs serve as passive market makers in exchange for a cut of the house's profits. As the ALP pool is +EV, this is crucial information that is supported by the house edge. The house usually wins in the long run, despite short-term fluctuations.

Arcadeum has sought advice from two independent auditing firms, Vital Block and Solidity Finance. The token audit performed by Vital Block was successful. The results of the comprehensive protocol audit being conducted by Solidity Finance are expected to be made public by the end of this week.

Arcadeum is launching its sports betting platform in the coming days. All things considered, Arcadeum appears to be in the driver's seat when it comes to the GambleFi narrative, and it offers what could be an interesting service.

This is probably the riskiest bet of them all. Be careful if you ape.

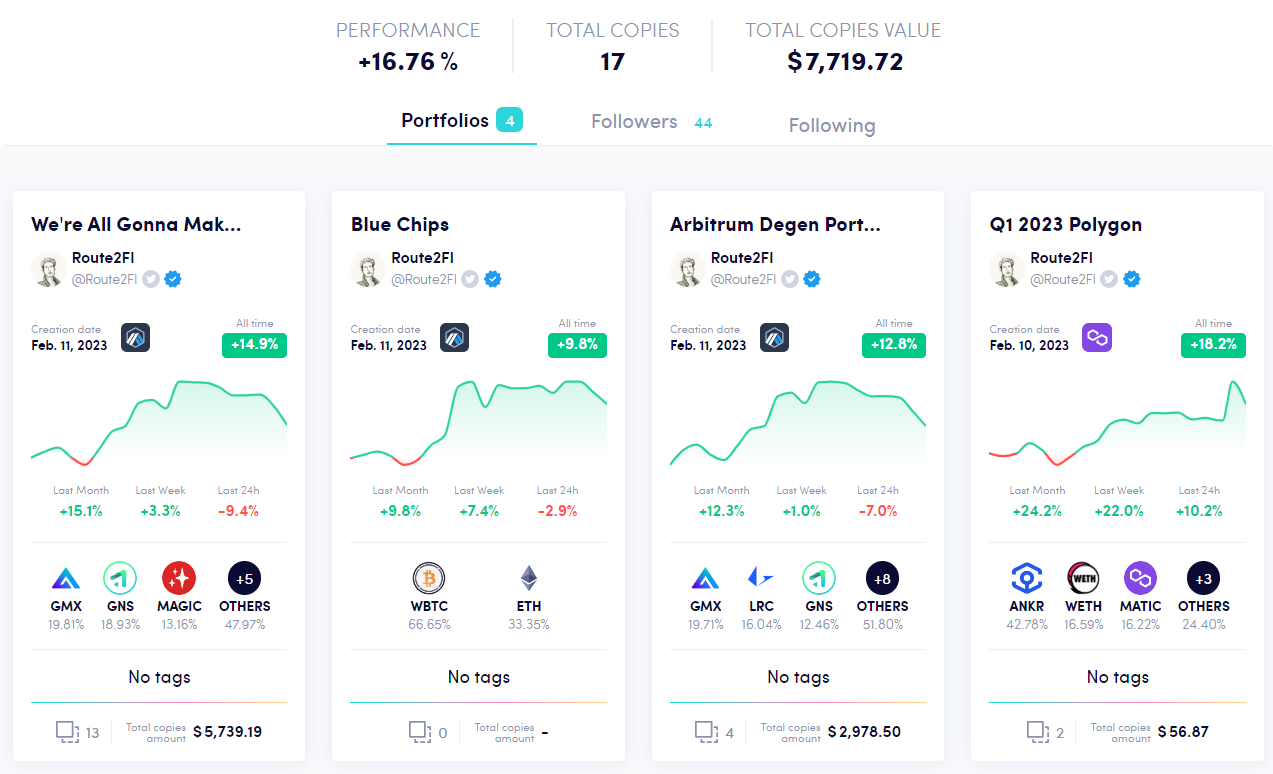

An update on my 3 Arbitrum portfolios ⚡️

I am tracking my portfolios with the help of the Chads at @NestedFi

I have 3 Arbitrum portfolios (click on the links to get directly to them).

We’re All Gonna Make It: My first portfolio is called “WAGMI” and is a portfolio that will perform better than $BTC during an uptrend.

Blue Chips: My second portfolio consists of $BTC and $ETH and is a “safer” portfolio with less volatility.

Arbitrum Degen Portfolio: My third Arbitrum portfolio is called the “Arbitrum Degen Portfolio” It consists of $VELA and $GRAIL (among others) which have done more than 60% in the last week alone + some other tokens to diversify.

I’m usually updating my portfolio 1-2 times a month, but changes could occur more often/seldom depending on the market conditions. For example, if we get a new bearish pattern I might reallocate more into stablecoins.

You can head to Nested here and copy these portfolios with 1-click, or add your own portfolio

*We have entered into a long-term partnership with Nested.

Thank you for reading!

See you next week :)

Follow me @route2fi on Twitter for more threads and crypto content.

If you’re not subscribed to my newsletter yet, subscribe for free below:

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

Very informative article! Thank you!