Thoughts about OTC secondary markets, stablecoins, and prediction market platforms

Happy Wednesday, friends!

Seeing more and more traders on Twitter starting to buy altcoins at the moment. Also, many people believe OG DeFi coins will make a comeback (see Aave right now for example).

Personally I am locked up in lots of altcoins through either OTC deals or angel rounds + have a good stack of $ETH.

Today I want to talk about something I tweeted some weeks back:

These 3 categories are huge, but let’s try to dive deeper into them and see why they’re interesting and why there is a lot of innovation going on in this sector right now.

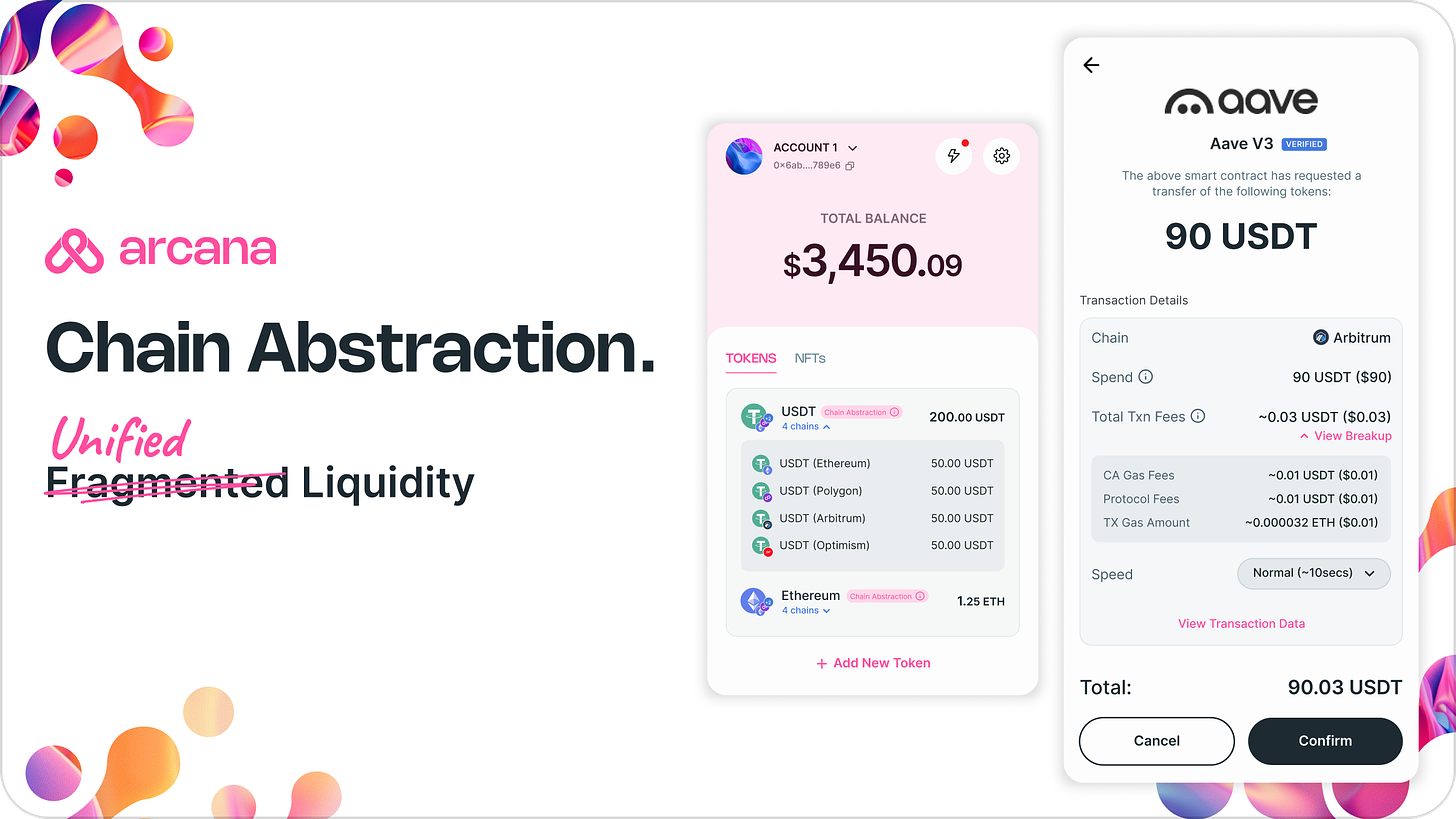

Before we start, today’s newsletter is sponsored by Arcana Network

The proliferation of 100s of chains (L1s, L2s, L3s, Appchains, Sidechains..) has led to fragmented liquidity across chains. Arcana's Chain Abstraction protocol unifies your balance across chains and allows you to spend the entire balance on any app, any chain, without bridging, in one-click. Removing the friction of bridging with unified balances brings new users and liquidity to new chains and apps.

Checkout Arcana’s Chain Abstraction demo on Aave, Uniswap, & Polymarket.

Arcana’s private beta is now open, Signup to get access to the first ever wallet to ship with chain abstraction.

Powered by a modular L1 chain and $XAR, Arcana’s Chain Abstraction:

✅ Works with your regular EOA wallet

✅ Requires no integration, no lock-up of assets

✅ Doesn’t use smart contract wallets with absurd gas fees

✅ Unifies balances across chains

✅ Automatically funds gas fees on target chain

✅ Enables 1-click instant transactions

OTC markets, Stablecoins, and Prediction Platforms

Hey, friends!

Picture this: you wake up to find your locked tokens suddenly worth 100x, but you can't access them for another year.

Oh, just imagine a world where your locked tokens aren't just sitting idle, where stablecoins are anything but boring, and where you can bet on the future with surgical precision…

Let’s start with talking about secondary markets first.

1. Secondary Markets for OTC Deals

Remember when Binance contributed significantly to the fall of FTX? Yeah, fun times. There *wasn’t* enough liquidity for the OTC deals, so Binance started selling their $FTT tokens on the market. Investors with vested/staked/locked FTT positions would love to seamlessly sell their positions to anyone, at, obviously, lower prices.

That event highlighted a massive problem in crypto: what do you do when you're sitting on a potential goldmine (or ticking time bomb) of locked tokens?

Enter the world of secondary OTC markets.

Not Only For Whales

First, let me ELI5 it a bit.

OTC (over-the-counter) deals in crypto are trades that happen directly between parties, outside of traditional exchanges. Historically, this was the realm of big players making massive moves they didn't want to broadcast to the world.

But here's the thing: OTC isn't just for whales anymore. With the explosion of token sales, airdrops, and vesting schedules, there's a growing need for more accessible OTC solutions.

And that's where secondary markets come in.

Why Secondary Markets Matter

Picture this: You're an early contributor who got in early on a promising project. The token's current fully diluted valuation (FDV) is sitting pretty at $10 billion, but you entered at a measly $100 million. Congrats, you're up 100x on paper!

But there's a catch – you're locked in for another 36 months.

This scenario isn't just a thought experiment; it's happening all over crypto. Early investors are sitting on potential fortunes, but they're trapped by vesting schedules and lock-up periods. Secondary markets offer a way out – or at least, a way to realize some of that value now.

Currently, there are some projects that try to solve that problem: Stix, OffX, Http OTC, and Secondary Lane.

How Those Work

Generally, it goes something like this:

1. You show your SAFT (Simple Agreement for Future Tokens) to prove you actually own what you're trying to sell.

2. The platform presents your offer to a closed group of potential buyers.

3. If there's interest, you'll need to get legal approval (because, you know, securities laws and all that fun stuff).

4. You might also need to get approval from the protocol itself, depending on their terms.

It's not exactly as simple as listing on Uniswap, but for those sitting on locked tokens, it can be a lifeline.

Tokenized SAFTs and Decentralized OTC

Now, here's where things get really interesting.

What if we started tokenizing SAFTs themselves or creating other derivative instruments based on locked tokens? Imagine being able to trade fractions of future token allocations. We have liquid staking, so why not go further, and introduce liquid vesting?

Let’s add to it a platform that is a fully decentralized OTC market to trade those derivatives seamlessly. No intermediaries, no closed groups – just pure, permissionless trading of locked assets. It sounds great in theory, but the regulatory challenges are... well, you know how it is.

And yes, secondary markets for OTC deals aren't all sunshine and lambos. They could potentially increase liquidity and price discovery, which is great, but there are also some serious concerns:

- Insider Trading: What happens when team members start offloading tokens before bad news hits?

- Market Manipulation: With relatively low liquidity, these markets could be prime targets for pump-and-dump schemes.

- Regulatory Nightmares: The SEC is already giving crypto the side-eye. Adding another layer of complexity isn't going to make them any happier.

The Future of OTC Secondary Markets

So where is all this headed? If I had to bet (more about this in the third part of the article), I'd say we're going to see a lot more innovation in this space. The demand is there, and where there's demand in crypto, solutions tend to follow – for better or worse.

We might see:

- More sophisticated derivatives based on locked tokens

- Integration with DeFi protocols for increased liquidity and lending/borrowing.

- Fully decentralized, regulatory-compliant platforms that cater to everyone, including institutional investors globally.

One thing's for sure: as long as there will be more and more projects that inherently come with lock-up periods and vesting schedules for their tokens, there will be a need for secondary markets.

Whether they end up being a net positive for the ecosystem remains to be seen.

But hey, that's half the fun, right?

Well, how to get vested locked tokens over in a contract that is mutually acceptable? Is it possible without talking to the DeFi protocol or the startup team?

What if it was possible to make a contract (smart contract address) that transfers/withdraws tokens for an exact ticker for an exact address?

Example:

-Bob is going to get Monad tokens in 6 months (15% on TGE). Then 85% over the next 36 months. Bob has the wallet address 0x….. At the moment his tokens are valued at 5bn (token valuation) and all his tokens have a paper value of $200k

-Karen wants to buy the tokens for $100k (50% off = 2.5bn valuation) because she has to accept the vesting terms which are 36 months.

-Bob goes into his wallet where he will be sent the tokens from the protocol, and he then signs a message from Karen that makes all future tokens auto-transfer to Karen. The 15% on TGE and then monthly for 36 months.

Not sure if this is possible today, but there should be possible to create a token standard for it.

Risks:

-Bob tells the protocol that he wants to change the address for payment. Therefore it is probably best to be in contact with the team.

Okay, just FYI I can’t remember the valuation for Monad, and this was just an example.

I am not sure how to solve this OTC secondary problem today without any interaction with team/legal, but that would be the dream. Making OTC sales as simple as borrowing USDC on AAVE.

If you’re reading this and are geared toward this idea to solve this, let’s chat.

2. Innovative Stablecoin Platforms

Alright, let's talk stablecoins. But not the old-gen USDT or USDC – but those weird and intriguing stables 2.0. Because let's face it, during those recent 20% daily swings, it’s nice to use a little more stability in our lives.

Also, stablecoins are the bedrock of DeFi, the safe haven in a storm, and the thing you probably wish you'd moved into before that last crash.

But traditional stablecoins like USDC and USDT have some issues:

- They're centralized, which means a single point of failure

- They face ongoing regulatory challenges

- They're not exactly capital-efficient

But we have a few projects aiming to solve these problems and maybe create a few new ones along the way.

Ethena's USDe

Let's zoom in on Ethena because these folks are trying to do something... interesting. They're calling it a "synthetic dollar protocol," which sounds like something you'd find in a sci-fi novel about financial dystopias.

How USDe Works (In Theory)

1. You deposit staked ETH (like stETH) as collateral.

2. Ethena opens a corresponding short position on a derivatives exchange.

3. You get USDe tokens in return.

The idea is that the short position hedges against the ETH price movements, keeping the value stable. It's like playing both sides of a see-saw and hoping you don't fall off.

Basically, you can stake your USDe for sUSDe and earn yield from:

- Staking rewards from the ETH collateral

- Funding and basis spread from the hedging positions

The Risks (Because There Are Always Risks)

- Funding Risk: What happens when funding rates go negative for an extended period?

- Liquidation Risk: If the spread between ETH and stETH gets too wide, things could get messy.

- Smart Contract Risk: Because it wouldn't be DeFi without the looming threat of a hack, right?

Ethena has an insurance fund to cover some of these risks, but in crypto, we learnt that "insurance" often means "the first thing to disappear when shit hits the fan."

And while Ethena is making waves, they're not the only ones trying to reinvent the stablecoin wheel:

Usual Money

At its core, Usual is positioning itself as a secure and decentralized fiat stablecoin issuer. They are building a multi-chain infrastructure that aggregates tokenized Real-World Assets (RWAs) from big players like BlackRock, Ondo, Mountain Protocol, and others.

The endgame? Transforming these RWAs into a permissionless, on-chain verifiable, and composable stablecoin called USD0. It's like they're trying to build a bridge between the boring (but stable) world of traditional finance and the wild west of DeFi.

USD0 is being marketed as the world's first RWA stablecoin that aggregates various US Treasury Bill tokens. Here's why it might be a big deal:

Security: The stablecoin is backed with actual US Treasury Bills.

Transparency: Real-time transparent reserves are addressing one of the biggest criticisms of existing stablecoins.

Bankruptcy-remote: Unlike some stablecoins that are tied to commercial bank deposits (looking at you, USDC during the SVB crisis), USD0 aims to be truly disconnected from traditional banking risks.

They also have a " useless governance token", that might not be that useless:

It grants ownership rights over actual protocol revenues, not just voting power on proposals nobody reads.

Staking $USUAL earns you more $USUAL, creating a virtuous cycle for long-term holders.

There's talk of future buybacks to enhance "real value" – always a popular move in crypto circles.

Perhaps most interestingly, Usual is distributing 90% of the supply to the community. That's a bold move in a space where founders and VCs often keep a lion's share for themselves.

Challenges and Questions

Of course, it's not all smooth sailing. Usual faces some significant challenges:

Regulatory Scrutiny: Anything involving US Treasury Bills is bound to attract attention from regulators. How will Usual navigate this complex landscape?

Competition: The stablecoin space is crowded and competitive. Can Usual carve out a significant niche?

Adoption: Will it make a difference for DeFi users to embrace a stablecoin backed by Treasury Bills, not US dollars?

The Potential Impact

If these new stablecoin models actually work (work, like they will actually become relevant and used broadly, not in the sense of being a speculative fun fact), we could see some major shifts in DeFi:

- More capital-efficient lending and borrowing

- New types of yield-generating strategies

- Potentially lower systemic risk (or just new, more exciting types of risk)

I'll be honest, part of me looks at these new stablecoin platforms and thinks, "Haven't we learned our lesson?" I mean, I lived through the UST collapse, and that was about as fun as a root canal performed by a drunken gibbon.

But another part of me – the part that's been huffing hopium since 2017 – gets excited. Because this is what crypto does best: take existing financial concepts, add a bunch of complexity and risk, and somehow end up with something innovative.

I will look more closely into opportunities for stablecoins in the next issue. Looking at yield opportunities and the best plays for Ethena, Usual, Anzen, Elixir USD and Mountain USD.

3. Betting Platforms/Prediction Markets

Alright, degens, it's time to talk about everyone's favorite hobby: gambling – I mean, "speculative forecasting." Because why limit yourself to betting on price movements when you can bet on literally anything?

Imagine if you could have bet on the exact date of the last Bitcoin halving, or the color of CZ’s shoes once he gets out of jail.

Welcome to the world of crypto prediction markets, where your random shower thoughts can potentially make you rich (or, rather, cost you a small fortune).

Prediction markets aren't new, but blockchain technology is giving them a serious glow-up. The idea is simple: create a market for any future event, let people buy and sell shares based on their predictions, and watch as the wisdom (or collective idiocy) of the crowd emerges.

Non-Sports vs. Sports Betting

We got two flavors in the crypto prediction market:

1. Non-sports prediction markets: Bet on anything from rate cuts to whether Vitalik will ever wear a suit.

2. Sports betting: For when you want to combine your gambling addiction with your love of sports.

Polymarket and Friends

Let's focus on the example of crypto prediction markets: Polymarket.

How it works?

Just simply build a market around any yes/no question, and allow people to trade on the outcome. And voila!

Popular markets include politics, crypto events, celebrity gossip – if you can name it then there is someone probably keen to bet on it.

But Polymarket isn't alone.

Up-and-coming platforms like LimitlessExchange and HedgehogMarkets aim to take a pie home as well. LimitlessExchange offers ETH-denominated markets while HedgehogMarkets on Solana is appealing with a unique pooled betting system.

One of the most exciting developments in this space is permissionless markets. Imagine the world in which one can create a prediction market on literally anything without needing permission from old farts who never lost some Ks on some obscure memecoin.

The ultimate form of free speech backed with crypto.

Another revelation is the application of AI in market resolution. Imagine a predictive market where artificial intelligence could automatically, without human intervention, resolve the result for such complex and nuanced events.

It is as if we are constructing an oracle of reality.

Sports

Let's talk about putting your ETH where your mouth is in sports. SX Bet, Azuro, and Overtime are taking sports betting into the Web3 era:

Instant payouts: Gone are the days where you had to wait several days to access your wins.

Transparency: All bets are settling on-chain, along with the odds. No more shady bookies.

Global access: Perform betting anywhere, at any time.

Some crypto sports betting platforms find the daily volumes to be those that small countries might envy.

But here's where it gets really wild.

Signs are surfacing of some pretty fairly heavily lev’d betting within the crypto prediction markets. Examples abound: LogX Trade is building out perpetual futures for “if things” such as a Trump election win happens. Because regular gambling isn't risky enough, so…what could possibly go wrong, right?

But don’t forget that low-key prediction markets are also found in memecoins.

$TRUMP and $BODEN tokens became nothing more than proxy bets on the election outcome; holders were nothing more than speculators on not only who would win, but how others would speculate.

It's like meta-betting, and it's just fascinating to observe.

Looking ahead, I ask myself: will decentralized prediction markets become a standard tool in business and governance decision-making, or will a day come when the almighty blockchain needs to be consulted on maternity when making babies?

One thing is for sure: the line between gambling, investing, and forecasting has become incredibly gray in crypto prediction markets.

These possibilities are both thrilling as well as terrifying.

The Future of Prediction

So where is all this headed? If I had to bet (and clearly, I do), I'd say we're looking at a future where the line between prediction markets, traditional finance, and everyday decision-making gets real blurry — like, really blurry. What can we expect?

- Creating a market and resolving it using artificial intelligence: Imagine when markets will simply, automatically crop up around trending topics, with the AI just handling all that jazz of determining outcomes.

- Combine this with real-world governance: can we see prediction markets influence policy decisions?

- Micro-predictions for everything: bet on tomorrow's weather, tweet likes, or whether my crush will finally notice me.

Also think like this: another innovative solution includes using yield-bearing stablecoins or even designing a lending protocol that allows users to borrow against their positions.

Eg. betting $1,000 for Trump to win with leverage. The position won't settle before November. So bet 1,000, but only spend $200 on the bet (5x leverage —> capital efficient). Actually https://www.levr.bet/ is doing this.

Or you could borrow against the position. This way can make prediction markets more attractive.

Your $1,000 Trump bet —> Take out a loan of $500 USDC which can be spent on anything.

The potential here boggles the mind. We're talking about a world where collective intelligence is tied together in real time, where information has a price and is traded as efficiently as stocks.

That's sort of what would happen if Wikipedia and Wall Street got together and had a baby, and that baby had a thing for gambling.

But let's not get too excited, we still have some hurdles to overcome:

- Regulatory challenges: Governments aren't too excited about unregulated gambling-based applications. As if by magic, huh?

Oracle problems: How to ensure the resolution of bets is performed in a manner that is both fair and accurate?

- Market manipulation: With great liquidity comes great responsibility – and the potential for some serious fuckery.

The Future is... Unpredictable

The landscape is changing fast. From secondary OTC markets giving locked token holders a lifeline, to innovative stablecoins challenging our very concept of value, to prediction markets that let you bet on quite literally anything – the future of finance is being written (and rewritten) in real-time.

Are these innovations the key to unlocking the next wave of crypto adoption? Or are they just more complicated ways for degens to lose money?

Honestly, it's probably a bit of both.

Here's what I do know: the creativity and sheer audacity of the crypto space never cease to amaze me. Just when you think you've seen it all, someone comes along and creates an AI-powered, quantum-entangled, blockchain-based solution to a problem you didn't even know existed.

So what's next? Hell if I know.

But I'll be here, strapped in for the ride, probably making ill-advised bets on prediction markets and aping into whatever new stablecoin promises me untold riches.

Because in crypto, the only thing crazier than the latest innovation is missing out on it entirely.

Remember, anon: the future is unwritten, but with these new tools, we might just be able to bet on it.

Just don't bet more than you can afford to lose. Not financial advice, of course – but then again, in this wild west of finance, what is?

Nonetheless, stay safe out there, anon!

…

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

If you just want to follow my journey on Twitter, you can simply just follow as well :)

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads