Hey, friends!

I hope you enjoy the bull market!

What a crazy month we have had.

My feeling is that Ethereum could see a new ATH very soon.

Tuna Chain

Today is a sponsored deep dive on Tuna Chain - and if you are as excited on the BTC L2 narrative as I am, or looking to learn more about this narrative, I hope this gets you to take a look at Tuna.

What is Tuna Chain?

Tuna in its simplest form is the first modular Layer 2 (L2) on Bitcoin, which seamlessly fuses Bitcoin’s security, with Ethereum’s versatility. Tuna is also introducing three revolutionary innovations: a native stablecoin, a modular DA layer and hybrid ZK-OP technology. These developments hope to boost BTC yields, cut gas costs, and improve Dapp execution on Bitcoin. It is also worth noting that within the first two months of Tuna Ocean’s ecosystem development, they have established close partnerships with the likes of Bybit, OKX, Unisat wallet and much more.

The BTC L2 narrative holds several challenges and opportunities, let’s highlight a few:

BTC miners, holders and CEXs are looking for better and secured revenue & asset management solutions.

Assets in the bitcoin ecosystem need a more scalable solution for future development.

Greater capital inflows are seeking more opportunities in the Bitcoin ecosystem after the BTC ETFs.

So what makes Tuna unique?

Firstly, it is fast and secure; accelerating secure transactions and empowering smart contracts with groundbreaking dual-phase architecture, with this architecture in place, Tuna is also then able to enhance the security level of the Bitcoin network.

Secondly, Tuna is easy to integrate - it is EVM compatible and seamlessly accessible for all Dapps, this boosts the development of the Bitcoin ecosystem through more adaptable infrastructures.

Third, modularity - this elevates trust, by slashing transaction costs, and redefining efficiency in L2 data management, offering a practical solution to scale the Bitcoin ecosystem.

Lastly, via their unique mechanism of their native stable coin ($TORO) backed by BTC as collateral, it would allow users to utilise their BTC into high-yielding assets whilst ensuring seamless transactional stability without having to liquidate spot BTC holdings - further optimising asset management on Bitcoin’s network.

A question you may have would be where does Tuna rank in the Bitcoin L2 narrative scene? A comparative analysis of Tuna’s scaling solution as compared to two of its competitors may be helpful: Lightning Network and Stacks.

An interesting thing to note here is that the one feature Tuna has which both its other competitors do not, is the fact that it is modular, making Tuna the first modular L2 on Bitcoin.

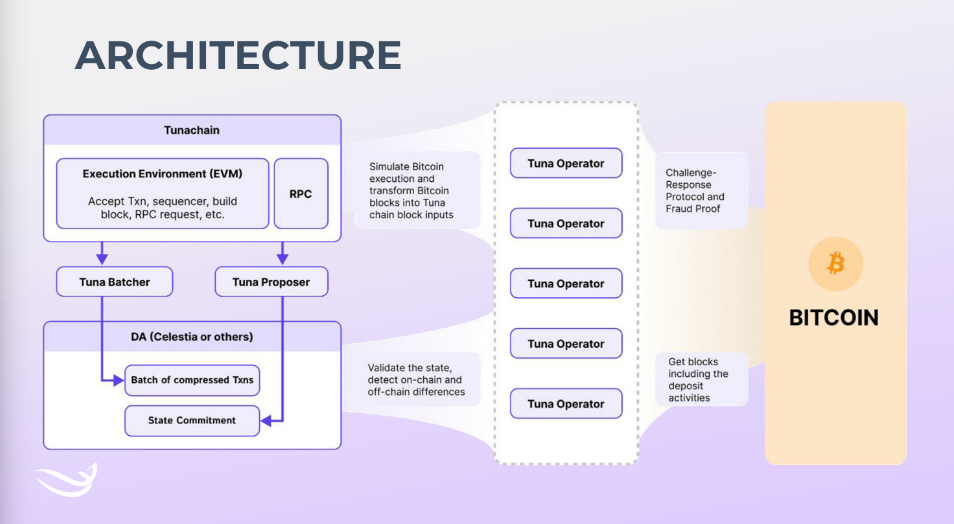

Tuna uses the BTC network as a settlement layer, due to the absence of smart contract automated execution, the Bitcoin network simply cannot truly achieve a settlement layer similar to Ethereum. Therefore Tuna simulates the settlement layer of the BTC network through a method similar to OP rollups: assuming each transaction optimistically and resolving conflicting transactions through challenge-response mechanisms. The data of the execution layer will be stored on a dedicated DA network, ensuring transparency, auditability and traceability of the data.

As mentioned above, there is hybrid ZK-OP tech, but why does Tuna prioritise OP over ZK in the execution layer? In their own words, the most significant advantage of ZK over OP is its instant finality confirmation. However, due to the absence of smart contracts on the Bitcoin network, it cannot guarantee automated settlement according to agreed-upon states. Thus the most crucial advantage of ZK cannot be realised on the BTC network, on the contrary, OP, since it aligns with the execution environment of Ethereum, is the most suitable EVM-equivalent choice in the execution layer.

Below is an image that outlines the architecture of Tuna Chain, which should provide clarification on what was said above.

As of current, after having spoken to the team their roadmap is simple:

Tuna Testnet Alpha

This will also ensure that there is a safe bridge between Bitcoin and TunaExplorerTuna Testnet

Here the team outlines that the DA layer will be live, OP stack optimisation, cooperation with third party bridges, and wallet support for bitcoin and eth. They hope to have basic Dapps and multiple explorers by this stage.Tuna Mainnet Alpha

This stage will include ecosystem building and grants, hackathons, their unique native stablecoin and native yield-farming Dapps.Tuna Mainnet

The entire Tuna stack being live, with ZK-based fraud proof.

Tokenomics for Tuna Chain

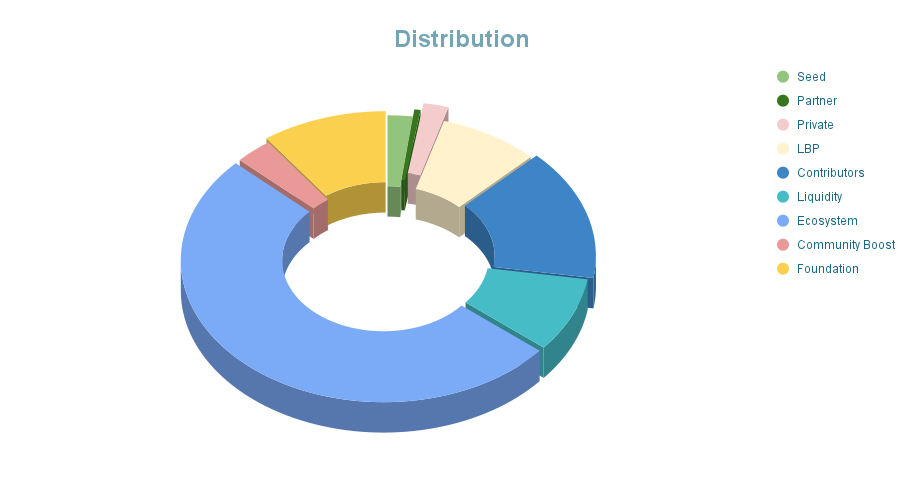

The total supply of $TUNA is 210,000,000

The distribution is as follows:

Seed 2%

Partner 0.5%

Private 2%

LBP 8%

Liquidity 8.5%

Contributors 15%

Ecosystem 51%

Community Boost 3%

Foundation 10%

Initial circulating supply 11.6%

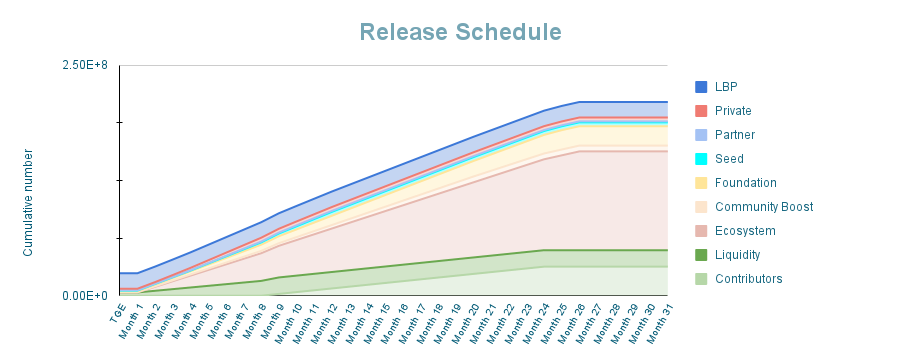

The release schedule of $TUNA tokenomics can be found in the diagram below.

TUNA Token

The $TUNA token is used for voting on network decisions.

Demand for blockspace generates revenue, supporting the Tuna Foundation and protocol development.

Builders and contributors receive direct funding for on-chain activities, fostering growth in tools, apps, and infrastructure.

Token holders benefit from revenue and savings generated by transactions and decentralized applications, driving demand for blockspace.

Users benefit from ongoing incentives funded by $TUNA token, derived from on-chain activities and applications.

Active users may receive airdrops to support the TunaChain ecosystem.

To summarise, $TUNA's utilities for now:

1. revenue generation and sharing

2. Reward the contributors (builders and users)

3. Governance

$TUNA launch details

Tuna is the first $BTC Layer2 launching LBP on Fjord on March 12th (today).

Link to the LBP event here: https://app.v2.fjordfoundry.com/pools/0x4856861e67B8a0deBCe9c5C8AB284326Fa3f4f13

Starts: 1pm UTC 12th March

Ends: 1pm UTC 17th March

LBP works like a Dutch auction, starting with a high token price that decreases gradually. Benefits include countering sniper bots, ensuring fair distribution, promoting community involvement and trust, and democratizing early chances.

Summary of why Tuna Chain is interesting

In the past cycle, we saw a large demand in ETH L1s and even L2s showing that this Layer 2 narrative could be an emerging scene, where there are multiple attractive features to users and application developers alike.

However, with the way Bitcoin has been built, previous cycles saw no development in the L2 scene for this sector, and with the current ETF inflows, investors will be trying to look for ways to diversify their assets, all whilst maintaining their positions in Bitcoin. With the introduction of Tuna, which also will be using Bitcoin as their native gas token, holders are then able to utilize their Bitcoin as a form of yield-bearing asset.

It will be interesting to see how this narrative plays out, given that with the rise of Bitcoin’s price recently, we have seen a large demand in derivatives to Bitcoin itself, such as BRC20s, $STX (Stacks another L2) and also with other BTC L2 competitors.

That’s it for today!

Thanks for reading :)

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

Is the project open source? I couldn't find the repository on their Github.