Understanding the Meta-game - an attempt at adding structure to a dynamic concept

Hey, friends!

Today we have a guest post from my friend @0x8104 at Midas Capital discussing the meta game and game theory in crypto.

This post is in full published first on his Substack which you can subscribe to here.

I read it yesterday and my first thought was to create something similar with my own thoughts, but eventually, I found the post so great and that I shared many similar views, so it became more natural to ask 0x8104 if I could share his post on my Substack.

So let’s jump right into it!

Understanding the Meta-game - an attempt at adding structure to a dynamic concept

Introduction

The idea of the meta-game is among crypto’s more esoteric concepts – it has neither a concrete definition nor a repeatable structure. It’s one of those ‘if you know, you know’ things. However, once you see it, it’s hard to unsee. In today's piece, I will attempt to unpack how I think about it in the hopes that the reader will have a clearer idea of what the meta-game is and how they might think about it.

Before we kick off, it’s prudent to note that the idea of the meta-game was popularized by Cobie in his article “Trading the Metagame.” Prominent traders such as Light Crypto and Dan from CMS Holdings have touched upon it during various podcasts. This idea is by no means a new one, but I hope to shed some new insights as well as establish a structure around it.

The idea of the meta-game is best thought of through the lens of game theory, which is a subset of behavioural economics. It involves understanding the rules of the game, the best response functions of your counterparties, and your optimal response function given all other information. We will be using intuition and looking at data in order to pick apart these games as well as understand the optimal strategy with which to play each game.

It’s important to understand that each meta-game is different. There are similarities, but no replicas. Thus, it’s important to have a general framework from which you can back out a strategy — this is what we are looking at today.

—

What is the meta-game?

I won’t bother defining the meta-game. It’s more useful to explain how the mechanism works and detail our framework for understanding it. There are a few components to a meta-game, which can be generalised as follows:

The Underlying Mechanism

The Change in Behaviour

The Best Response Function

The Reflexive Loop

The underlying mechanism can be thought of as the foundation of the meta-game, it can be broken down as follows:

A catalyst, this is usually (but not limited too) price movement - this sparks a narrative and price follows narrative. The reason for price movement can usually be traced back to a protocol upgrade, KPI, or other event/metric.

The nature of the catalyst is the underlying mechanism, this mechanism underpins a reflexive loop.

The change in behaviour is how market participants express an opinion on the catalyst

The best response function is how you, as the trader, should respond to the catalyst, how other market participants are viewing the catalyst, and how other market participants will respond to the catalyst. The best response function involves thinking about sizing, entry, and exit.

The reflexive loop can be categorised as follows:

Market participants identify the underlying mechanism → they play the game → price behaves in a manner conformant with the rules of the game → the rules become increasingly self evident → more participants identify the underlying mechanism → additional players enter the game → ad infinitum.

The four components listed above provide a high-level overview of how meta-games develop, evolve, and dissipate.

—

Theoretical Framework

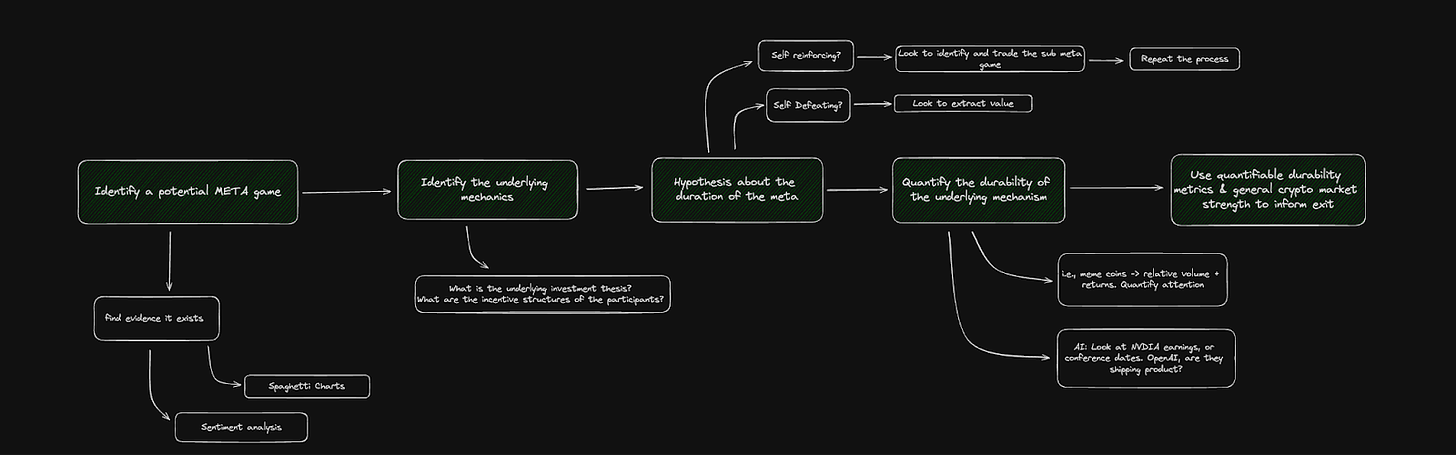

Below is a flow diagram detailing how one goes from identifying the meta-game, to understanding it, and then hopefully extracting value from it. Let’s work through it in a bit more detail. First some theory, then we will look at examples and data.

Step 1: Identify a potential meta-game, look at/for the following:

Developing narratives, sentiment analysis, abnormal price behaviour.

Protocols or sectors that position themselves as a solution to a well understood problem

A binary event that is known and understood widely.

Step 2: Identify the underlying mechanism

Given the catalyst and the perceptions of it, how does it drive a change in market participant behaviour?

There are two types of underlying mechanisms, self reinforcing and self defeating

Self reinforcing: An underlying mechanism that is enduring, where the catalyst is persistent, thus the meta-game will exist for a while. An example of this is BTC ETF inflows/outflows – given the data is published daily, this can be thought of as a repeated interaction game.

Self defeating: An underlying mechanism that drives a type of behavior that causes the meta-game to dissipate. An example of this is when Facebook rebranded to META – this was a one-off event, which can be thought of as a single interaction game.

Step 3: Hypothesis about the duration of the meta-game

The nuances of the underlying mechanism dictate the duration of the game, as well as, the entry and exit strategy.

Generally speaking, self reinforcing meta-games will lead to the creation of submeta-games while self defeating meta-games will dissipate as fast as they appeared.

Step 4: Quantify the durability of the underlying mechanism

One needs to make assumptions about whether the game is self reinforcing or self defeating, then find data that will solidify or invalidate these assumptions

E.g., if we are playing a memecoin meta-game, it’s good to look at data like relative volume (as a proxy for attention)

E.g., if we are playing the BTC ETF meta-game, it’s helpful to look at the ETF inflows/outflows, where they come from and how price is behaving in response to these data points.

This is largely an intuition informed by data problem to solve.

Step: 5: Use quantifiable metrics and general market strength to inform exit.

There is no concrete, or repeatable, exit strategy.

The time for exit is different for each meta-game, generally the use of intuition is key here.

It helps to look at data, market cap, relative volume, et cetera - but at the end of the day, it’s a discretionary choice.

—

Examples of Meta-games

Let’s have a look at some examples of current and previous meta-games, as well as the associated logic and data. In this section, we will be looking at a self-reinforcing meta-game (the ETH killer trade), a self defeating meta-game (Facebook rebrands to META), and a meta-game that is currently live (BTC ETF flows).

Example 1: The ETH killer meta-game

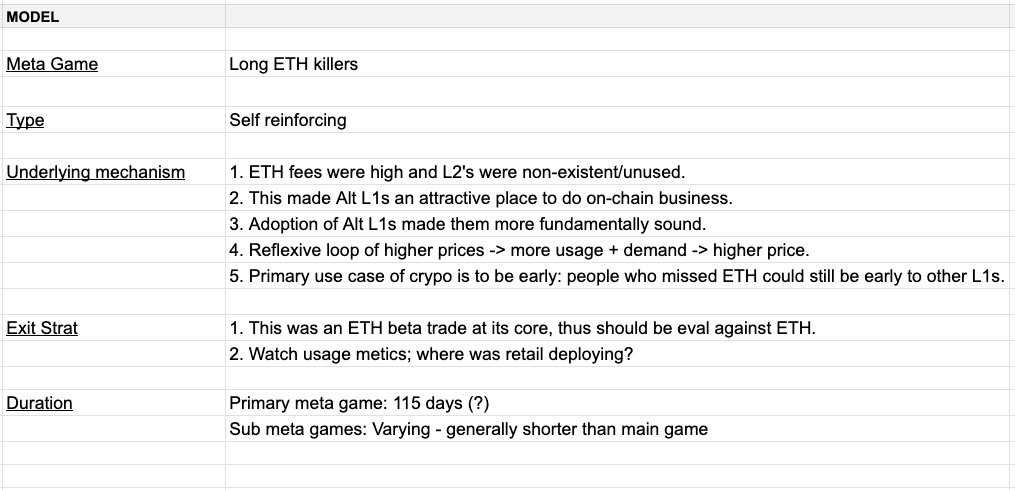

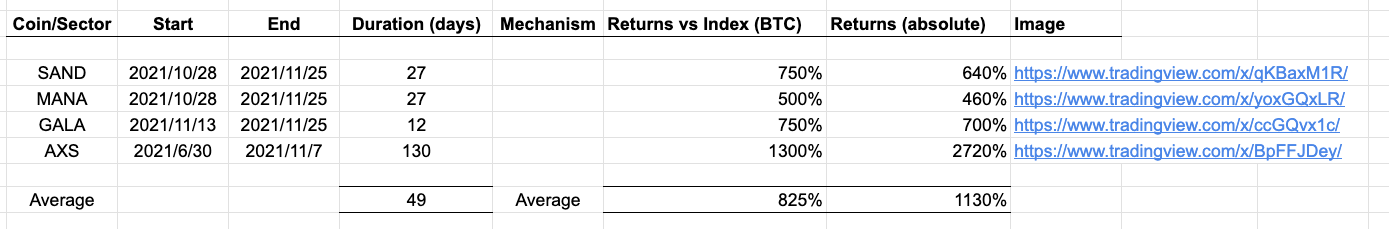

I assume this is a meta-game that most readers will be intimately familiar with, it was the trade of the 2021 bull run. Below is a table outlining the basic parameters of the meta-game.

In case the table isn’t clear, I’ll spend a bit of time elaborating on this meta-game. To set the scene, let’s think back to the 2021 bull run. Retail arrived to gamble, ETH fees were expensive and scaling solutions were inadequate — Solana and Avalanche positioned themselves as a solution to the problem (i.e., transactions were faster and much cheaper). This was the underlying mechanism.

The underlying mechanism was self-reinforcing (reflexive) in so far as ETH fees would remain high while we were in a bull market, thus the reason to be long ETH killers would exist for the entirety of the bull market. As SOL and AVAX outperformed ETH, the trade became more clear and more participants put the trade on. The nature of the underlying mechanism underpinned an upward reflexive loop.

Given the persistence of the meta-game, it birthed sub meta-games - these are games that are offshoots of the main game. Namely the boom in SOL and AVAX DeFi as well as the emergence of the FOAN trade. Cobie outlined the dynamics of the SOL and AVAX sub meta-game well, so I won’t bother rehashing it here. The FOAN sub meta-game was interesting as market participants positioned Phantom, Harmony, Cosmos, and Near as the new Alt L1 trade. Mechanically, those that felt late to the main game found tangentially related sub-game to play.

As a general rule of thumb, sub meta-games have smaller returns and don’t last as long as the main game.

Legend:

Primary → Main meta-game and Secondary → Sub meta-game

Start, End, Duration → Time parameters

Mechanism → A description of the underlying mechanism

Returns vs Index → A measure of performance vs a major or the subject of the underlying mechanism

Returns (absolute) → A measure of in absolute terms

The parameters of the game are largely subjective — it’s objectively clear that X outperformed Y, but it’s subjective as to when the outperformance started and end when it ended. The same subjective logic can be applied to the choice of index – how do we define outperformance? The function of the table is simply to get closer to some idea of objective truth.

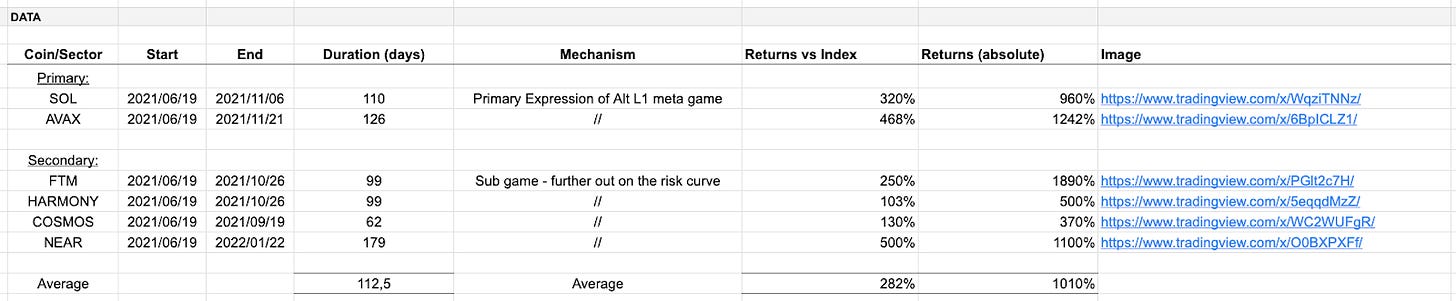

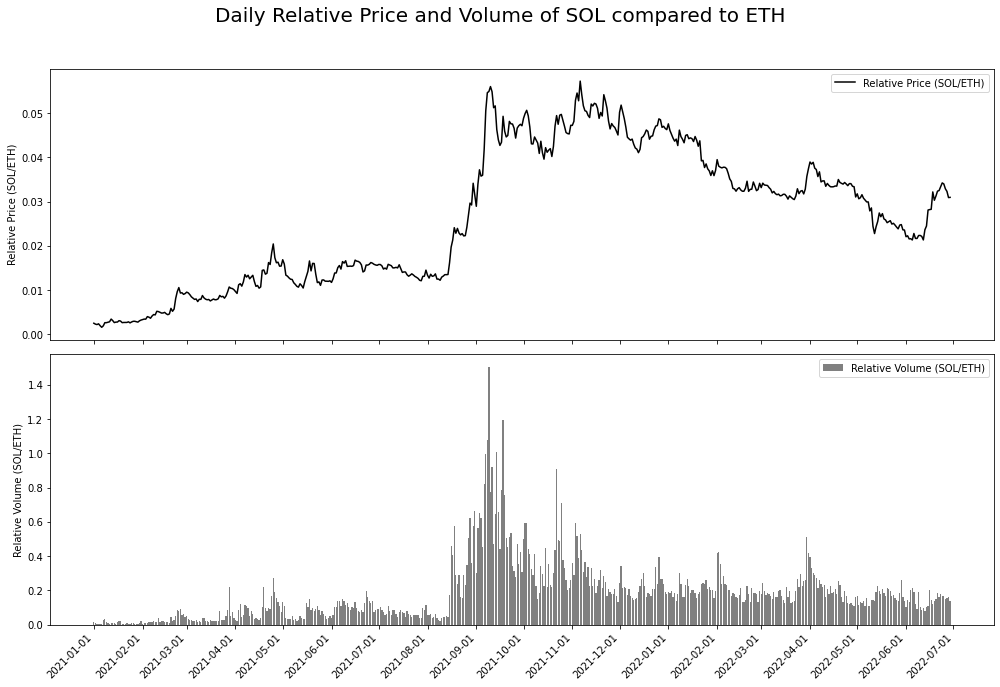

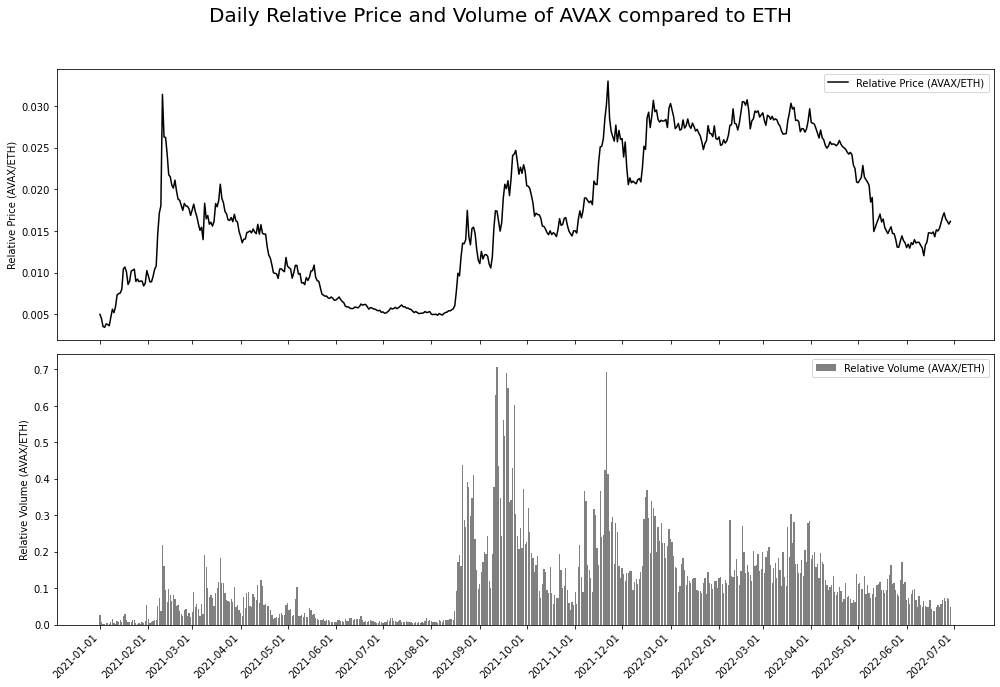

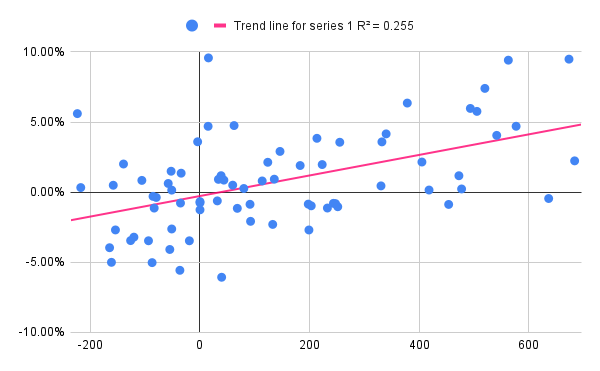

Below are two graphs - SOL v ETH, and AVAX v ETH. They show the relative volume and the relative price of SOL and AVAX vs ETH, the data is pulled from the Binance Futures API. The idea is quite simple - use relative volume as a proxy of relative interest, and look at how this matches up with relative price performance.

It’s notable that the excess returns to being long this meta game were found in the second half of 2021. I hypothesise that the reason for this is the cool off in price over the summer of 2021, this put all the games on hold while the narrative reached more participants. When the market rebounded, it was clear where to allocate capital. Perhaps this is motivated reasoning, but I think it’s somewhat accurate.

In order to think about exit strategy, we need to revisit the assumptions surrounding the underlying mechanism → this meta-game is a solution to a persistent problem (high ETH fees), a problem predicated on a bull market. Thus, the most basic exit strategy is to sell when one thinks we’re close to the end of a bull market.

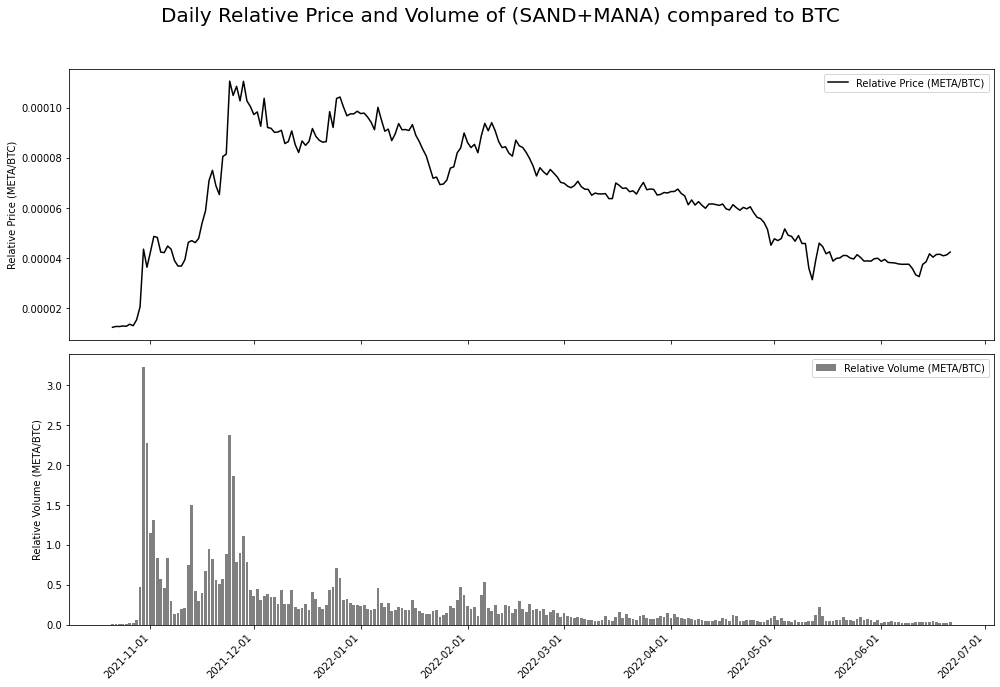

Example 2: Facebook rebrands to Meta

On October 28th 2021 Facebook rebranded to META, this catalysed a speculative frenzy in metaverse related crypto projects - this was the underlying mechanism, rather straightforward. The key difference between this underlying mechanism and the previous one is the duration. Example 1 was self reinforcing, while Example 2 is self defeating, by this I mean that the catalyst in Example 2 was a once off event. This slightly changes the rules of the game, let me explain.

Have a look at the graph below - it illustrates the amount of attention as a function of time. If we assume each project has some equilibrium share of the attention economy, we have our baseline. Following the once off catalyst, we have a massive rerating in metaverse coins share of the attention economy. This drives abnormal price action, which attracts additional attention to the trade. However, the meta-game begins to break down quickly as the catalyst moves further into the rearview mirror. This can also be understood through the lens of fragility; the coordination point becomes more fragile to external forces over time (i.e., price action of majors) – and to a large extent, BTCs -9% day on 26/11/21 brought an end to the party. The ability of a once off catalyst to act as a coordination point is decreasing with time - this is reflected in the waning amount of attention below.

Prior to the rebrand, Axie Infinity had already had a semi isolated run up and the idea of the metaverse was gaining traction in Silicon Valley. All the ingredients were there for this narrative to catch, the META rebrand was just the spark that lit the fire. The primary beneficiaries of this meta-game were Decentraland ($MANA) and Sandbox ($SAND) - they repriced immediately.

Once again, to think about exit strategy we need to revisit the assumptions surrounding the underlying mechanism. Namely, the underlying mechanism of a once-off catalyst and is self defeating. Thus, one should be actively looking to get out of the trade. If we look at the graph below, we can see that it mirrors that of the stylised example above - relative volume can be used as a proxy for the relative share in the attention economy. Moreover, it’s important to understand market structure, $SAND & $MANA cannot sustainably do 3x the trading volume of $BTC - this is against the laws of logic.

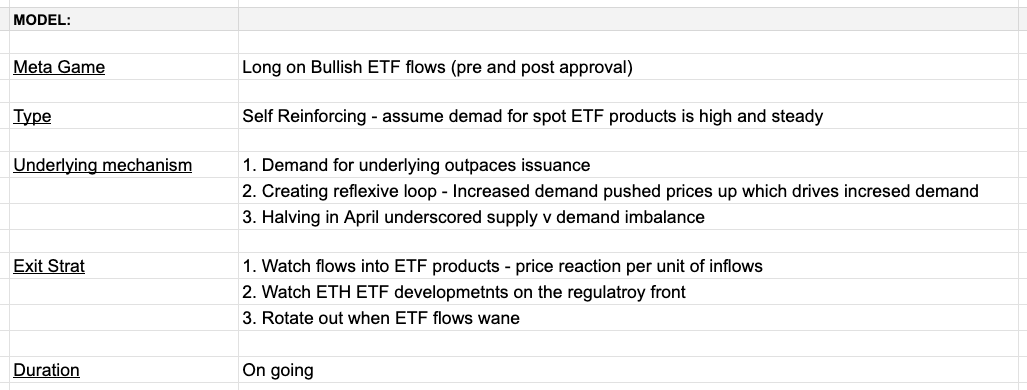

Example 3: BTC ETF meta-game.

Caveat — this section was originally written in late march, I’ve decided to leave it as it is. Updated thoughts on this meta-game can be found later in this section.

This is an example of a meta-game that is currently live; the majority of crypto market participants have variations of this trade on. The underlying mechanism is ETF inflows are bullish for a couple reasons:

We are going into the halving and the number of coins flowing into ETF products is an order of magnitude larger than new supply coming on line. This makes the finite supply + hard money narrative even more compelling.

The approval of ETF products gives an air of legitimacy to crypto as an asset class as well as gives a whole new investor base a conduit through which to purchase BTC.

Similar to the ETH Killer meta-game (Example 1), this meta-game is self reinforcing. ETF products trade every day of the week, thus BTCs price trades (loosely) as a beta to these ETF flows. Given the underlying mechanism, we can make some assumptions about ETF flows and price

ETF inflows are bullish for BTC price

ETF outflows are bearish are BTC price

Using the above as a basic model, this is a pretty straightforward game. However, as with all things in life, the devil is in the details. A vast majority of the outflows are coming from GBTC, given the vehicle was originally a closed-end fund - these flows are expected to slow going into the back half of the year. All else equal, GBTC outflows will wane, thus net inflows should get a boost - bullish.

Current thoughts on this meta-game:

I suppose this will serve as a reflection of my original BTC ETF meta-game thesis. A lot has happened since I originally wrote this section, specifically the halving has occurred and the ETF flows have subsided and are occasionally negative. I am of the opinion that this meta-game is still live, but the reflexivity is operating in the opposite direction — i.e., ETF inflows have turned to ETF outflows and price responded. It seems reasonably clear that the relationship between ETF flows and BTC price performance runs in both directions.

It’s worth noting that ETF flows and price are not mechanically related, as with all meta-games, it’s somewhat of a shared illusion. As ETF flows find equilibrium, which could very well be 0 daily flows, I expect this meta-game to dissolve. It’s been noticeable that the amount of attention paid to ETF flows is a function of their size, days with large +ve and -ve flows make headlines while the average day goes largely unnoticed. As this meta game moves further into the rearview mirror, I expect only outlier days to grab attention.

It seems reasonably obvious that, in the near future, we get an ETH ETF meta-game that was somewhat similar to the BTC ETF meta-game. All else being equal, I expect:

ETH to trade higher as it becomes more obvious that the ETF will be approved, we can use the odds of approval and the word of the Bloomberg ETF bros as a proxy for this.

A derisking post ETF approval as the market parses out both how the ETF inflows look and how the ETHE (grayscale product) outflows look.

If Inflows are reasonably comparative to BTC (which I doubt), this is bullish. Underwhelming inflows are bearish, and possibly bullish for Solana.

I assume that the fees of the ETH ETF products will be similar to those of the BTC ETF — I’m not entirely sure what the result of higher fees would be, Occam’s Razor says this will be bearish. BTC price action and BTC ETF inflows set the stage for the ETH ETF to do well, it’s somewhat of an ipso facto type reality — as we begin to trade the ETF ETF meta-game, I think the market will price it as a function of how the BTC ETF performed. Should there be a mass exodus from the BTC ETFs between now and the approval of the ETH EFT, I think the ETH ETF will be dead on arrival. Other interesting things to keep an eye on are weather the ETH in the ETF will be staked and if the ETF holders will get that yield, this seems unlikely because “muh, securities laws, Howie test, etc” but it would be a pleasant surprise.

—

Some General Thoughts:

There are a certain set of laws or logics that govern how this market behaves, assets that behave in a manner that violates these laws are subject to a swift reversion to the mean. The logics/laws are dynamic to a large extent, but the Overton window moves slower than most think. Moreover, there are fundamental laws - as immutable as gravity - that should not be violated.

The meta-game is not an investment framework so much as it’s a mental model — it’s hard to put a solid structure around how these games develop, evolve, and behave because they’re all different. One requires a certain level of intuition to both identify these games and then theorise over how they will develop — intuition like this is honed thought time in the market and first principles thinking.

I have provided a detailed outline of a self-defeating, self-reinforcing, and live meta-game, other examples include:

Memecoins, 2021 (self-defeating)

ETH Merge, 2022 (self-defeating)

Crypto x AI, 2024 (self-reinforcing)

SOL killers, 2024 (unclear)

Memecoins, 2024 (self-defeating)

RWA protocols, 2024 (self-reinforcing)

New coins, 2024 (varies)

BTC ETF beta, 2024 (self-reinforcing)

There have been many meta-games, all different from each other. However, the basic protocol remains the same → identify the meta-game, understand the underlying mechanism, make inference over the meta games longevity, and then plan how to best extract value.

A major thanks to 0x8104 for this great guest post. Make sure to follow him on Twitter too.

Stay safe in the markets.

That’s it for today, anon!

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads