Visualizing that you will make it + what the f*ck is wrong with industry?

Happy Thursday, friends!

I once felt trapped as a corporate engineer, commuting daily and dreaming of a life beyond my 9-to-5. I spent hours visualizing my ideal future—relaxing on a beach, free from financial worries, and pursuing my passions.

I encourage you to do the same: vividly imagine your dreams, whether it’s starting a business or spending more time with family.

Now is the perfect time to seize opportunities, especially as the crypto market is poised for growth. Every challenge you've faced has prepared you for this moment. Believe in yourself and go after your dreams.

This newsletter is brought to you by CredBull

Credbull’s $CBL Token is LIVE for trading!

Buy and stake for 50% APY plus bonus rewards https://www.incredbullearn.io/raging-bulls

Gate: https://www.gate.io/trade/CBL_USDT

MEXC: https://www.mexc.com/exchange/CBL_USDT

Balancer Pool will be live soon!

Credbull is the first on-chain, licensed private credit fund and offers 15% FIXED yields plus token top-ups to 40%+ APY backed by RWAs. Serving DAOs, Treasuries, Institutions and Retail, Web 2&3.

Launchpad raise oversubscribed by 3.3x

$5.2M raised with Gnosis as Lead

$500M tokenized on Plume Network

$10m TVL committed pre-launch

215k+ users

625k+ community

Partnerships: Plume, Centrifuge, Ondo, Arbitrum, Polygon

Team: Ex-Blackrock, UBS, Goldman Sachs, OSL, Cobo, Harvard

Tier 1 exchange listings to be announced.

Visualizing that you will make it + what the f*ck is wrong with industry?

My Personal Journey

Believe it or not, I was once a normal engineer with a low net worth. I was the epitome of a high-achieving corporate employee, commuting 1 hour each way daily to an office where I'd pretend to work. Ngl, I actually did a lot of stuff, but this wasn’t my dream. That an employer tells me what to do, where to be and that I have to finish extra work over the weekend to get that bonus. However, I consistently visualized my ideal life. Without exaggeration, I spent about a quarter of my waking hours daydreaming about my future success. It wasn't a chore; it was my default state of mind.

During your daily activities - walks, workouts, or commutes - vividly imagine your ideal life:

Picture yourself relaxing at a beach

Envision an ocean view infront of you

Feel a refreshing cocktail in your hand

Imagine a beautiful partner by your side

Embrace the feeling of being free from financial worries

Most importantly, visualize reclaiming all the time you'd otherwise spend working for someone else.

So, you don’t need the beach vision. Maybe you just dream of quitting your 9-5. But visualize what you would like to do. Who will you spend time with. Maybe you want to start your own business? Or just focus more on sports, spending time with the kids and in general more hobbies.

Make this a daily practice. Engage in these visualizations frequently. While there's no guarantee, the potential benefits make it a worthwhile exercise. Who knows? It might just work for you too.

Get ready, because the next year is set to be the most pivotal of your life. A bull market is on the horizon, and both VCs, retail, founders, and everyday investors are poised to pour significant resources into our industry. It’s your moment to seize opportunities and secure a prosperous future for yourself and your family.

You’ve put in the hard work over the past two years during the bera, facing challenges and setbacks while navigating the tough landscape of crypto trading. While some promised you the moon, you experienced some tough drawdowns instead. But remember, every struggle has prepared you for this moment.

There are times when making money feels effortless, and times when it requires grit and determination. You’ve just emerged from a challenging phase, and now you’re stepping into a period ripe with potential. It’s time to aim high and chase that financial milestone. Now is the moment to focus your energy and determination on the main goal - to make it. I believe in you!

Now let’s talk a little bit about what’s wrong with this industry, and why it has been so incredibly hard for retail and traders so far this cycle to make it.

What’s wrong with this industry

The crypto industry has seen a recurring pattern of DeFi protocols projects raising substantial funds, operating for a short period, and then vanishing without a trace. This phenomenon is not limited to a small subset of projects but is unfortunately prevalent across all of crypto.

At the heart of this issue lies the utility token model, which has become the standard for many crypto projects. This model, while beneficial for founders, can be detrimental to both retail, angel investors and hedge funds.

Key characteristics of the utility token model:

No equity distribution (unlike a SAFE in a company who gives stock equity)

Tokens created without intrinsic value (surprise: 98% of all tokens

Arbitrary "utility" assigned to tokens

Limited accountability for the founders and projects themselves

Comparison with Traditional Startups

Unlike traditional startups where investors receive equity and have certain rights as shareholders, crypto projects often operate in a regulatory gray area. This lack of oversight can lead to:

Reduced accountability for project teams

Limited legal recourse for token holders

Increased risk for investors

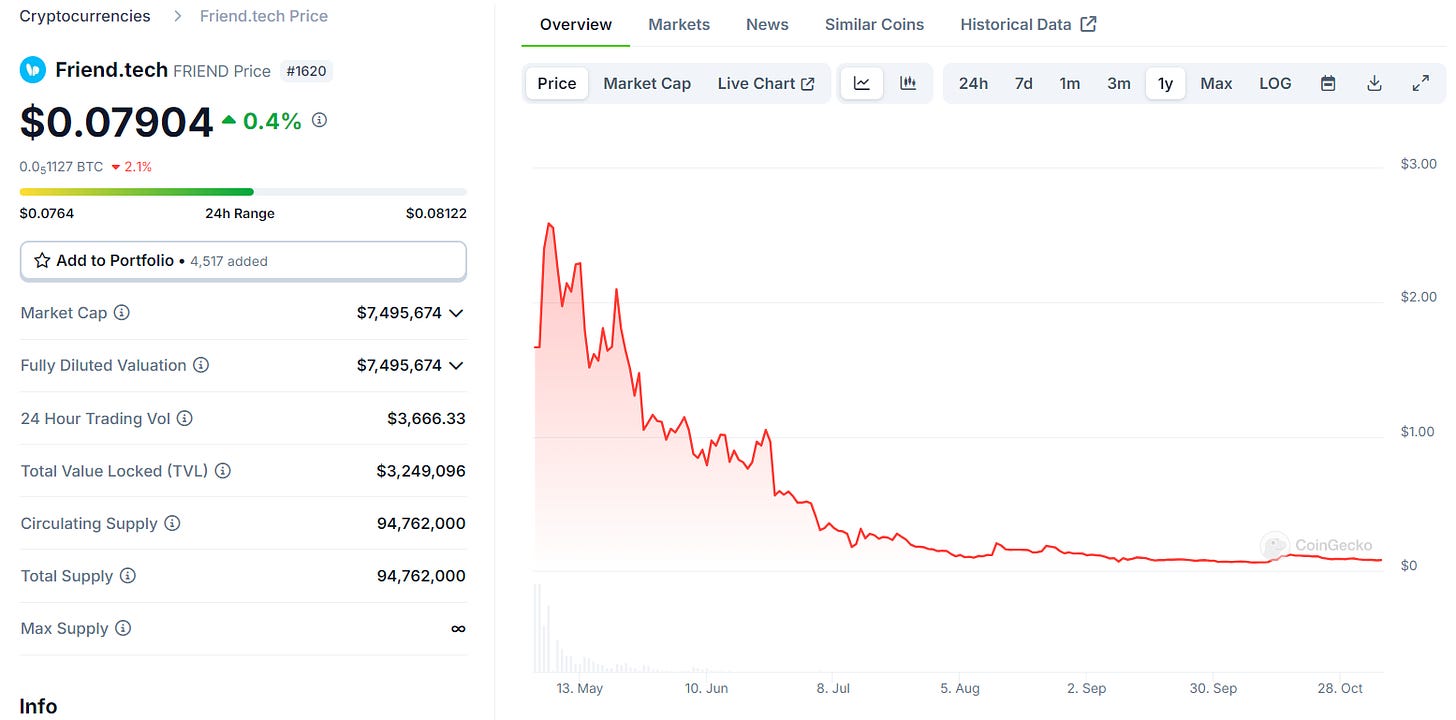

The crypto space has witnessed several high-profile cases of projects disappearing after raising significant funds. Lately Friend.Tech was completely abonded after the founder earned too much money in a very short time. Do you remember how hyped the $FRIEND token was in early May?

The chart is down only (97,5% down from launch). The only holders left are probably people that forgot that they had bags.

Beyond the concerning token distribution model, there's another layer of issues to consider. Many projects have secured funding from VCs at valuations exceeding $1b. This high valuation significantly limits the potential for substantial profits for average users or investors.

Cobie wrote a full article about it, and I discussed it briefly in my newsletter back in April. It's crucial to understand that early investors, like VCs who backed projects like Ethena in its initial $20 million funding round, have already seen their investments grow by a factor of 500.

This raises an important question: Are these early investors likely to hold out for even greater returns, or will they start gradually selling their holdings to lock in profits? (spoiler: they will sell!)

The structure of many low float high FDVprojects seems designed to facilitate a transfer of wealth from retail users to the hands of VCs and project team members. This setup potentially undermines the decentralized and democratizing principles that blockchain technology initially promised.

Every token, with few exceptions, can be considered a meme coin to some degree. Their value is largely driven by collective belief and speculation rather than intrinsic utility. Take the AAVE token, for instance. While associated with the popular AAVE lending DEX, AAVE's primary function is governance voting. It doesn't directly capture AAVE's economic value or provide holders with fee revenue.

Yet, its market cap has reached billions based on the perception of its importance. OP, the token for Optimism, is another prime example. Despite Optimism being a major Ethereum Layer 2 scaling solution, the OP token is mainly used for governance. The majority of voting power is concentrated among the team and VC investors, calling into question its decentralization.

Nevertheless, OP has attained a multi-billion dollar valuation. With the exception of gas tokens for Layer 1 blockchains, most tokens derive their value from collective belief rather than fundamental utility.

Their worth is upheld by the shared notion that they somehow represent the growth and success of their associated protocols or projects. This phenomenon highlights the speculative nature of much of the cryptocurrency market.

Summary

The crypto industry frequently sees DeFi projects raise substantial funds, operate briefly, and then disappear, largely due to the problematic utility token model.

Unlike traditional startups, these crypto projects often lack accountability and investor protections, functioning in a regulatory gray area.

High-profile cases of project abandonment, such as Friend.Tech, highlight the significant risks for token holders and investors.

Additionally, early investors and VCs often benefit disproportionately from these ventures, potentially undermining the democratizing principles that blockchain technology initially promised.

Ultimately, most tokens resemble memecoins, deriving their value from collective belief rather than intrinsic utility or economic capture.

…

That is it for today.

See you in the orderbook, anon.

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

If you just want to follow my journey on Twitter, you can simply just follow as well :)

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads