A beginners guide to DeFi

In this newsletter, I will break down how to make it in DeFi. There's a lot of misinformation on Youtube/Twitter and other social media channels.

It is easy to step wrong in this game.

My hope is that after you have read this you will become a little bit smarter.

If you’re doing crypto trading, check out my TG group here:

Before we start, let’s have a word from our sponsor LandX

🚀 LandX's xBasket Token Sale: Revolutionizing DeFi and Agriculture 🌾

Our $208K xBasket Lot token sale, selling out in a mere 7 hours, was not just a triumph but a clear signal of interest of investors in DeFi to this novel blend of real-world agriculture and digital finance.

xBasket: Your Inflation Hedge with Targeted 18.8% APR

xBasket tokens are more than digital assets; they're a crucial piece in bridging the agricultural funding gap with DeFi. By linking real farm yields to digital finance, they offer a robust hedge against inflation. Targeting an 18.8% APR, xBasket stands out as a yield bearing low volatility asset.

Didn’t Catch the Sale? No Problem!

Miss the initial rush? No worries. You can still acquire xBasket tokens directly at https://landx.fi.

Join us on the LandX journey and be a part of the future where agriculture meets DeFi innovation.

🌍 Discover More and Get Involved: https://landx.fi 🚜📈

A beginners guide to DeFi

The purpose of this information is to get you from knowing nothing about DeFi to becoming an advanced DeFi degen.

I know what you’re thinking anon, why get out of Coinbase, Bybit, and Binance where everything is safe and well-known?

If you’re happy with buying/selling and trading high mcap tokens, this may be enough.

But crypto is so much bigger now.

Why not explore all the golden opportunities that are out there?

Why care about DeFi at all?

Let me present some of the opportunities in DeFi:

1. Use any token as collateral to borrow money

2. Stake your tokens (single-side staking) to earn APY, eg. stablecoins or ETH at Eigenlayer

3. Yield farm your tokens (two or several tokens in an LP-pair) to earn APY

4. Lend your tokens to earn money

5. Buy NFT’s (which is way more than a jpeg), and you can stake your NFT to earn passive income

6. Send money to anyone in your preferred currency without using a CEX (centralized exchange) as a middleman

7. Buy tokens at a lower price than themarket price (liq. protocols)

8. Use stablecoins to buy stocks and commodities

9. Self-repaying loans

10. Buy real estate (digital and physical)

11 Airdrops (ETH, Cosmos, Solana etc)

12 Privacy

+++

(I could probably continue this list forever with all the possibilities).

But for now, let's focus on how to start out in DeFi.

Read on.

How to start?

You need online wallets like Rabby, Metamask, xDEFI, Phantom, Leap, Rainbow etc.

As a practical example, let’s use the most known, Metamask, for now.

Step 1: Go to http://Metamask.io and create a wallet.

Never share your seed phrase and password with anyone ( there are a lot of scammers on Twitter asking you for this).

And when I say no one, I mean it.

Not even Metamask themselves needs to know this.

Read eg. this guide for how to set up your wallet: https://blog.wetrust.io/how-to-install-and-use-metamask-7210720ca047

Step 2: Your wallet is automatically set up for the $ETH network.

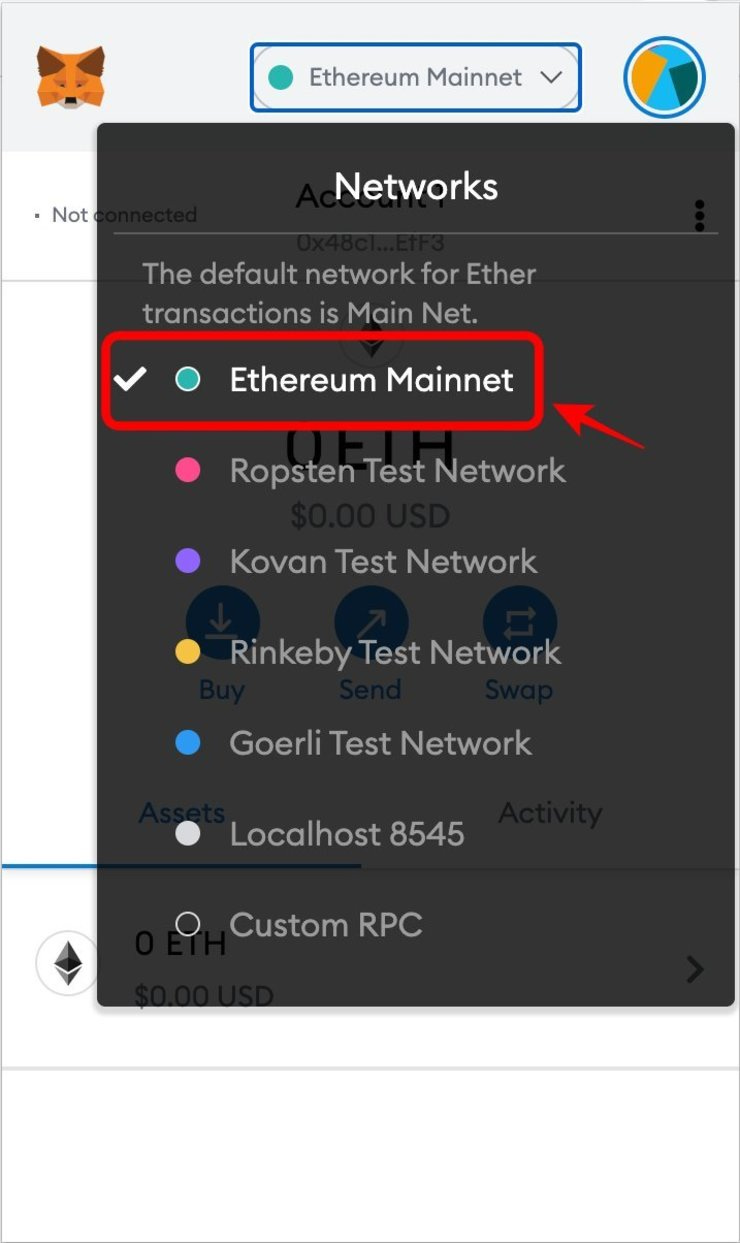

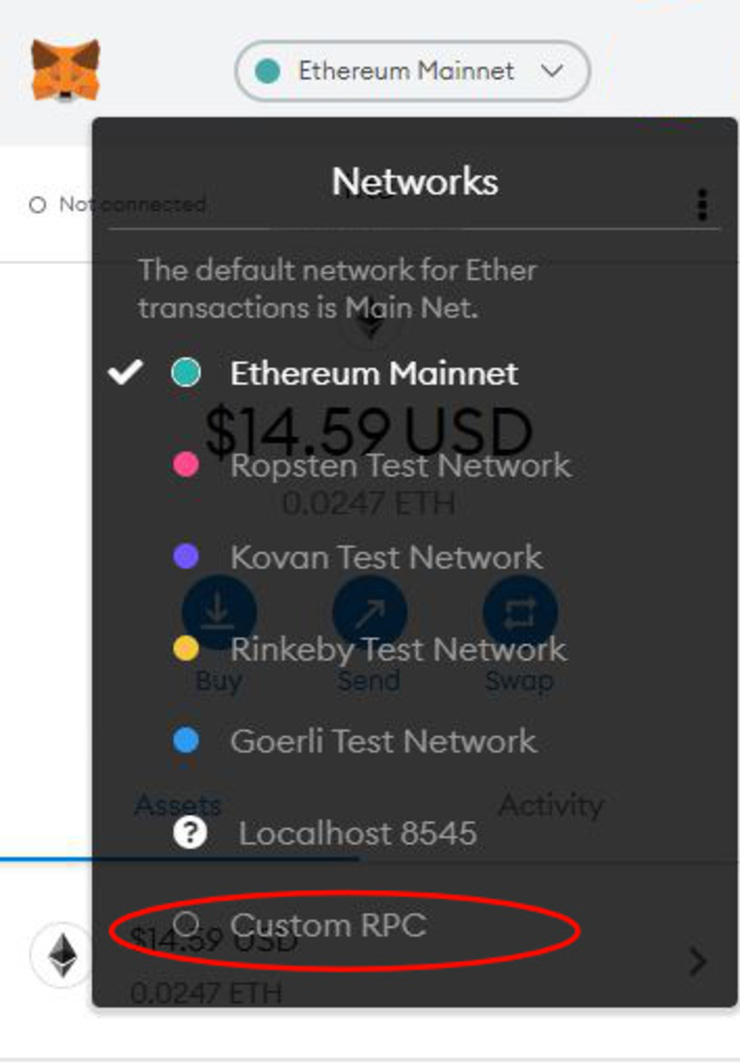

But on the top screen in Metamask you can see that you can change networks. Let’s say you want to use the Fantom Opera Network instead because you are bullish on $FTM and want to send some $FTM tokens from Binance to your Metamask.

Step 3: Switch network from Ethereum mainnet to Fantom Opera network. Copy your wallet address.

If you don't have the Fantom network in your Metamask already, read this quick guide on how to add it: https://docs.fantom.foundation/tutorials/set-up-metamask

Step 4: Go to Binance.

First, you need to buy $FTM.

Then go to wallet --> fiat/spot --> search for FTM

Choose to withdraw FTM.

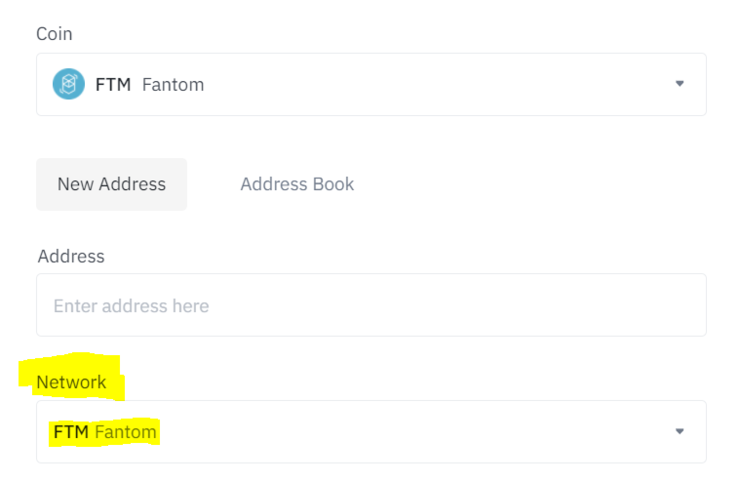

Step 5: Paste your Fantom address. Choose the Fantom network

Step 6: Enter your amount and press send.

If this is the first time you do this, choose the smallest amount possible.

For some reason, a lot of people do this too quickly and end up losing their funds because they entered the wrong address or chose the wrong network.

The gas fees are very small on $FTM, so it’s basically free to send money through this network.

If you use another exchange, make sure that the exchange is sending your Fantom through the Fantom network.

Step 7: Your money should now be in your Metamask.

The transaction happens in seconds, but it’s the CEX (Binance) that uses the time to transfer the money.

If your money hasn’t arrived yet, check the status of your transfer in Binance.

Let’s just pause for a second now.

Because if you want to be in DeFi with more than $1,000 you should absolutely get yourself a hardware wallet or take on advanced security measures.

Why? Because of security purposes.

If someone knows your wallet password, they could immediately transfer all your funds to themselves.

But if you use a hardware wallet you must connect this to your online wallet in order to transfer anything out of it.

You can read more about this here: https://www.ledger.com/academy/security/the-safest-way-to-use-metamask

The two most known hardware wallets are Ledger and Trezor.

Personally, I use Ledger, but in my opinion, they’re equally good.

One thing to note though is that Ledger has had several issues lately, and to be honest I am starting to get unsure if they are as safe as we think.

You can read more about wallets here and a comparison between Ledger and Trezor: https://www.investopedia.com/trezor-vs-ledger-5193580

Step 8: You now have $FTM in your Metamask and you’re ready to explore DeFi.

Okay, so right now I honestly don’t know what you can do in Fantom DeFi that is worth exploring.

You could check DeFiLlama to see if there are some interesting yield farms or staking opportunities here: https://defillama.com/chain/Fantom

Right now I think the most interesting stuff on Fantom is the shitcoins, but I don’t want to mention them here because they have so low mca that you can get totally rekt.

If you want to find them, you’ll find them in the trenches on crypto Twitter.

Airdrops

Right now I think the most important reason to understand DeFi is to capture the airdrops.

I wrote about the best opportunities here:

I am not going to repeat everything from it, but basically get yourself Leap/Keplr and Phantom wallet. Read my guide and maximize your airdrop game. It can give you plenty of dollars from putting in as little as $100.

Anyway. You should never go all in, if you do you will end up losing everything one day.

Let’s talk about risks in DeFi.

What are the risks in DeFi?

You've probably seen that there's a lot of new DeFi protocols popping up every single day.

But how do you know if you can trust a DeFi protocol? And how much should you invest?

It's about time we talk about risks and where to seek information in the DeFi space.

Now, let's talk about risks in DeFi and what you should look out for:

1) Smart contract risk: All small contracts can get hacked. This isn't something you can spot immediately. You should therefore look if it's audited by firms that are well-known (more about this later)

2) De-peg risks: This is very important for stablecoins (think: what if USDT/USDC/DAI isn't worth $1?). Do you remember when UST went to zero? OR when USDC depegged to $0.85?

3) Liquidity risk: Let's say you lend out your tokens to a DeFi platform, and then the DeFi platform lets people borrow your tokens. If you want to withdraw your tokens you can't (unless there are tokens available at the moment). This is also a problem when you are doing shitcoin trading at low mcaps at Uniswap.

4) Bank-run risk: A bankrun happens when suppliers, suddenly anxious about a market’s stability, attempt to rapidly and simultaneously withdraw more funds than are available on the platform, causing further panic and distrust of the system. In extreme cases, the DeFi protocols reserves may not be sufficient to cover the withdrawals.

5) Admin key risk: Always be on the lookout for centralized admin controls that allow a developer or team to lock or move funds deposited into the DeFi app. Changes should only be allowed with approval from multiple parties or a DAO that governs upgrades and proposals.

All right, you're probably tired AF of reading theory about risks, right?

Let's have a look at how I gather information and what I look for in a new project:

The 8 steps to find out if a DeFi protocol is worth investing in:

Step 1 Social media: When I hear about a new project the first thing I do is to check their Twitter page and if they have a Discord/Telegram channel. Are the projects followed by many people on Twitter? And is their following good? I've been on Twitter for a while, so it takes me a max of 30 sec to spot if a project seems promising or not. Another metric I watch is how many of the people I follow are already following the project. If there's no one, then that's probably not a good sign.

Step 2 Whitepaper/roadmap: If the information I find through Twitter/Discord looks promising I check their website and the whitepaper. It's important that the project has a solid roadmap. If there's no roadmap/whitepaper I stop my process right there.

Step 3 Audit: Is the project audited?

Audits are the first line of defense when it comes to finding a safe staking/yield farm. But even if a project has been audited, your funds are never 100% safe.

You see, the auditing process is not equally good in all auditing companies. 4 things to think about:

1) Is the DeFi protocol really audited? There's a lot of protocols bluffing about this.

2) When a DeFi protocol wants to get an audit they can send the code that they're using, get it audited but then launch with a totally different code. The contract should therefore be on-chain, not on Github.

3) The DeFi protocol may hide some of the code (not delivering everything for an audit).

4) Quality of the auditor/audit company.

The most famous auditing companies: OpenZeppelin, Certik, PeckShield, Trail of Bits, Obelisk, Solidity Finance, Omniscia, Paladin, Hacken, and Consensys Diligence. There are a lot of auditing companies and the list could be longer. If you don't feel safe about the company, ask a friend you trust if it is legit.

Step 4: Find out more about the team. Are they doxxed with their full names? Or are the team anons? Anons are also good, but it's certainly easier to trust non-anons. At least try to find out more about what they've done earlier, what they've worked with etc. You can also send a DM to the team.

Step 5: Check DeFi Safety. It's a review of different protocols. Takes a while before new protocols are getting listed here, but for the protocols you want to put a lot of money in, they should be listed here. Also worth checking www.rugdoc.io to read more about the DeFi protocols.

Step 6: If the protocols are checking off on all the 5 steps, I feel safe about going in. I always buy a small sum first, just to check that the protocol works smoothly and that the staking/unstaking function works. On one occasion I put money in a protocol and there wasn't an option to unstake (money lost). This is called a honeypot.

Step 7: Discuss with friends on Twitter about the protocol, if all your crypto-skilled friends are negative it could be a red flag.

Step 8: On several occasions, you're going to hear about DeFi protocols that don't check off on all these steps in terms of security. Personally, I'm not allocating more than a max of 5% of my total portfolio for these high-risk projects.

There are a lot of DeFi protocols out there, and it's impossible to

monitor them all.

I think the best way is to focus on some ecosystems rather than to try everything.

I hope you learned something new in this newsletter. If I didn't answer all your questions, comment below and I'll try my best to answer it.

If you like my work, follow me on Twitter at @route2FI

Thank you for reading my newsletter!

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads