Hey, friends!

Ethereum really can’t be stopped. It continues marching higher and higher. With EigenLayer and now Ethena Labs really getting a product market fit, it looks like we’re about to fly.

Will we see $4,000 before EIP-4844 in 1 week?

Right now this doesn’t seem very unlikely.

If you want to start trading crypto in the new year, use my ref link on Bybit:

https://partner.bybit.com/b/route2fi

You get lower fees, a bonus of up to $30,000, and are able to join my trading group.

I have a trading group only for my affiliates where I share my own trades + the ones from people much smarter than me once they share in their private TG/Discord.

Also, I will arrange a trader contest in cooperation with Bybit starting this week where PnL % is what matters, so even small traders have a chance to win the money prizes + an iPhone.

Once you've signed up on the ref link —> go here to join my private trading group: t.me/route2fiibot

Earning passive income by being delta neutral in the crypto market: is it a good strategy?

All right, guys. Let’s talk about a strategy that is for passive income enjoyooors.

Basically what we are going to do is to do what Ethena Labs is doing (long ETH spot, short ETH perp), but we are going to do it ourselves + we are going to choose the asset we want (hint: it doesn’t have to be ETH).

If you’re not sure about what Ethenea Labs is, I wrote about them here:

If you don’t want to read that, I’ll try to explain it as easily as I can.

If we use Ethereum as an example, we want to go long ETH (preferably staked ETH).

Let’s use stETH as an example (3.6% APR), and we want to short $ETH on perp (eg. on Binance or Bybit).

So if we are equally long and short, we will be delta neutral. This means that no matter what happens to the ETH price, we will not lose/earn money by ETH price fluctuation.

What we will earn money from is ETH staking yield and funding rate on ETH.

Funding is the primary mechanism to ensure that the last traded price is always anchored to the global spot price. It is similar to the interest cost of holding a position in spot margin trading.

The funding fee is exchanged directly between buyers and sellers at the end of every funding interval. Using an 8-hour funding time interval as an example, funding will occur at 12 AM UTC, 8 AM UTC, and 4 PM UTC.

When the funding rate is positive, long position holders pay the short position holders. Likewise, when the funding rate is negative, short position holders pay the long position holders (this is the case for bull markets, I will come back to this)

Traders will only pay or receive a funding fee if they hold a position at the funding interval (12 AM UTC, 8 AM UTC, and 4 PM UTC).

If positions are entirely closed prior to the funding exchange then traders will not pay or receive funding fees.

The funding fee charged will be deducted from the trader's available balance. In the event where trader has no sufficient available balance, the funding fee will be deducted from the position margin and the liquidation price of the position will be more prone to the mark price. The risk of liquidation will increase.

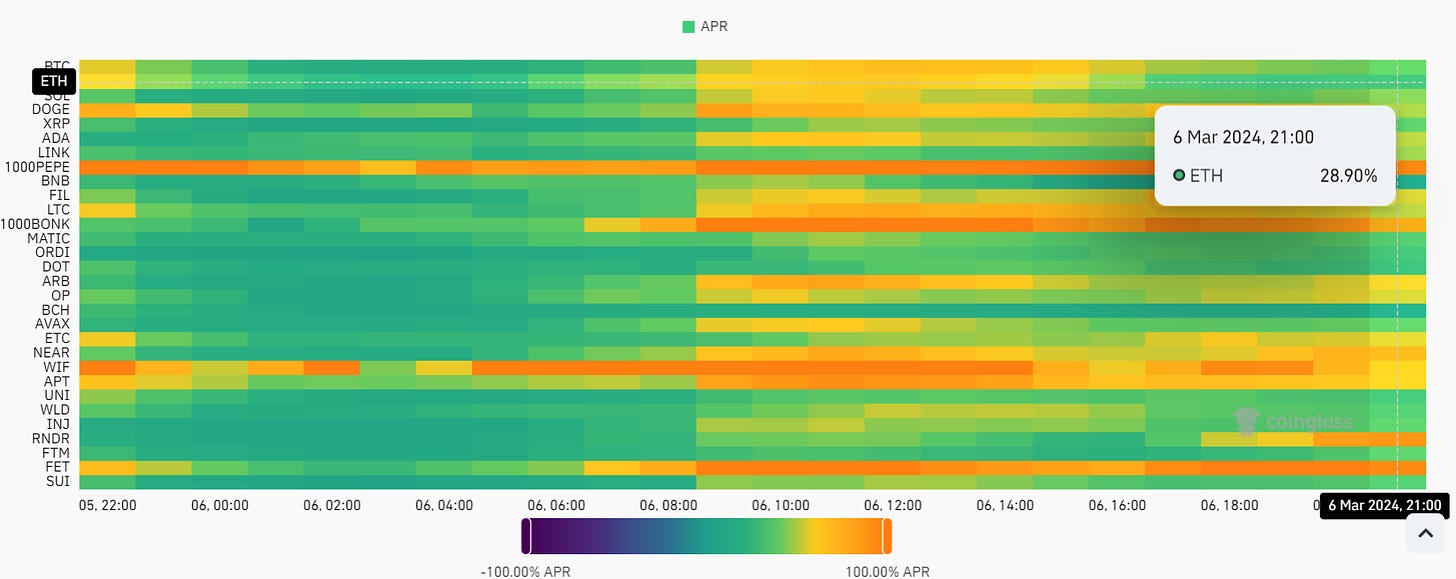

Okay, let’s look at the funding. I usually check this at CoinGlass: https://www.coinglass.com/FundingRate

Right now the funding rate for Ethereum is 28,9% (but the % you see on Binance/Bybit may look different). Why does it look different? Well, it’s because it is constantly changing due to the difference between the spot and the perp price. In periods of high volatility, the price between the perpetual contract and the mark price may diverge a lot. In such instances, the premium increases or decreases accordingly.

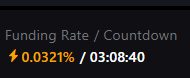

Here is the funding rate right now on Bybit. So 0.0321% means that the APR is: 0.0321 x 3 x 365 = 35,15%.

Note that the funding rate is never constant, so the APR will be fleeting. When the market is less volatile you will see the funding rate is 0.01% (10,95%).

Okay, hopefully you’ll understand the basics by now, so let’s look at an example.

Example with Ethereum

Let’s say you have $50,000 and want to try this with Ethereum.

You buy eg. 10 $stETH = $3,800 per ETH = $38,000. stETH gives 3,6% APR. You could also buy mETH (7,2% APR). Or cbETH, rETH etc.

So now you are long ETH and you are getting paid yield for it.

Then we have to short 10 ETH on perp so that we are delta-neutral.

So you short 10 ETH at $3,800 on perp.

You will soon see that this is easier said than done.

On the long side: 3,6% APR (7,2% if mETH).

On the short side: 10-40% APR (let’s use 20% as an avg. in the bull market).

So that gives us a 20% annual yield. Not too shabby.

Your daily yield from funding will be: Funding Fee = Position Value x Funding Rate

Let’s use 0.0321% as it is on ETH right now.

Daily payment from funding: 10 ETH x 3,800 = $38,000 x 0,0321% = $12,2 x 3x per day = $36,6

Daily payment from staking yield: 10 ETH x 1,036 = 0,36 ETH per year / 365 = 0,001 ETH per day = $3,800 x 0.001 ETH = $3,8

So in total, it’s $36,6 + $3,8 per day = $40,4. For some, this might be a lot, for others this is nothing.

And if you have $38k only I’d say that this probably isn’t the best use of capital. Let’s see what you can use this method for later.

All right.

Let’s look at some of the risks/challenges:

-opening long/short simultaneously is hard: go and look at Binance/Bybit on the prices for ETH on spot vs. ETH on perp/futures. do you see a difference?

As I am writing this right now the price is $3,852 on spot and $3861 on perp.

First of all, how do you do it? Try yourself with a small amount and see that it will basically be impossible to catch the perfect long/short. The spread in this case is $9.

Should you go long first and then hope that the price increases so you can short higher? Or should you short first and hope that you can buy spot lower? Should you DCA and hope that you get an equal long/short entry?

-fees for open/close perp and open/close spot: this is obvious, but you have to pay trading fees for opening and closing positions, so if you don’t plan on holding for at least 24 hours you might lose due to trading fees

-rebalance if low capital: you’re equally long and short. what happens if you’re very skewed? like let’s say ETH doubles and goes to $7,600. Your position would now been deeply red, while your long position is very green. Watch out for liquidation.

-liquidation risk: Depending on the amount of capital you have available on the exchange, you’ll be in danger of getting liquidated on the short side if the position goes very much against you.

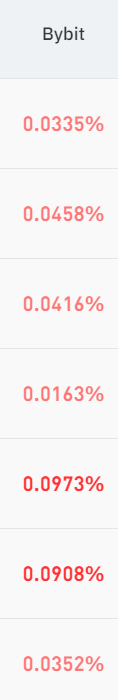

-funding can (and will change): Below you can see the last 7 funding rates (new one every 8 hour). why do you think the funding rate went from 0.0973 to 0.0163 in the matter of 8 hours? You guessed right, a massive liquidation event. ETH went from $3800 to $3,200 in the matter of hours. As you’ve probably understood by now, the higher the funding rate —> the more overheated the market is.

-closing long/short simultaneously will be equally hard as opening: not much more to say about this, see the first point.

-CEX risk: what if Binance/Bybit goes under? Similar to smart contract exploit in the DeFi world

-fat finger: if you’re not experienced with perps you should be very careful. Over and over again you see people buy market orders that create giga wicks and you end up getting a very bad price. Also, it’s just a push of a button to close/long a position. Be careful so that you don’t fuck up the trade.

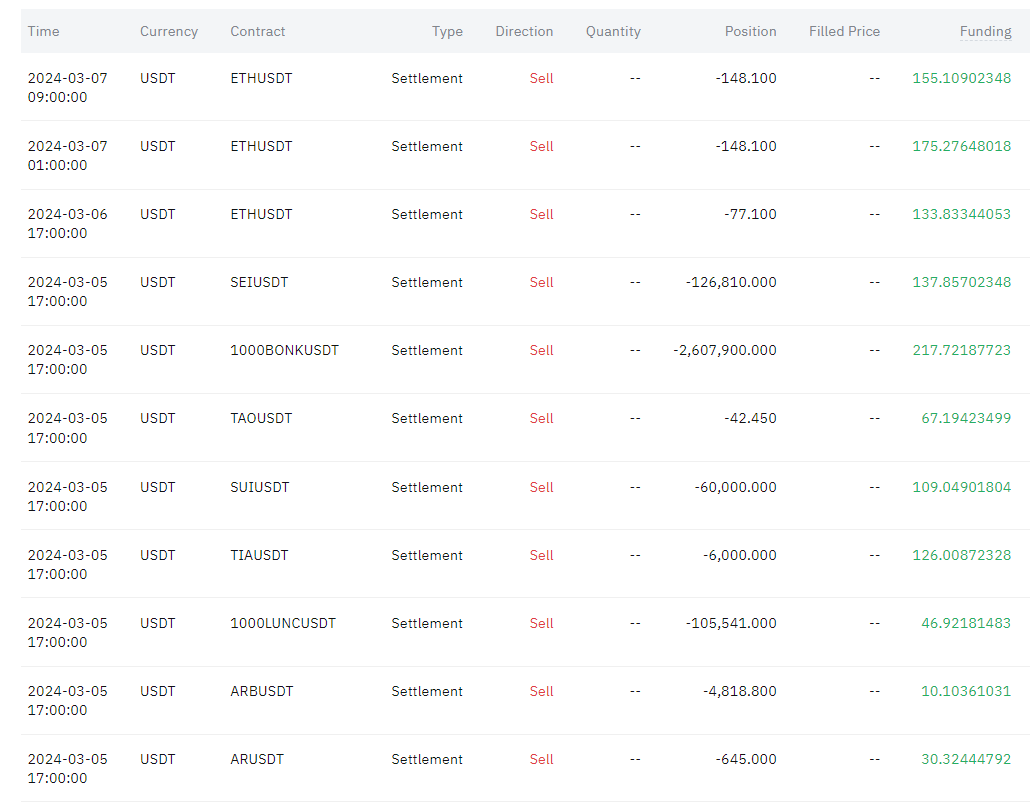

Here’s some funding I’ve been collecting lately.

It’s not much, but it’s honest work.

This is more of a test for me, but my plan with funding in general is:

Let’s say we get a new flash crash in some weeks. I could try to time the market by closing the short at the stone bottom. Since my long is already in, it could potentially give me a better entry than buying during a flash crash. Unless you limit buy, the problem with limits is that you don’t know where the bottom is and risk end up having a super bad entry. As you probably understand this is not necessarily a winning recipe. But if it is an asset that you are bullish, eg. ETH, I don’t see anything wrong in trying. While you wait for a crash you can collect funding. In a bull market this has a huge opportunity cost, so I think playing with funding only makes sense in very overheated market conditions (when funding is high and people flexing PnL screenshots on Twitter

When you want a break from the market, but still want some money flowing in

Btw, you could also check out option trading…it might be easier and save you some money :)

I just wanted to show you how you could do the Ethena Labs trade yourself.

…

That’s it for today!

Happy trading and good luck with buying all the dips in 2024!

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

really interesting read, thanks for that!

how well with this work if you wanna use this as passive income for multiple years?