Hey, friends!

Getting more and more bullish for every day that is passing.

Even though the prices remain constant.

In the last issue, we talked about EigenLayer and the different opportunities.

But today, let’s look at the math behind the EigenLayer airdrop and if it’s worth it.

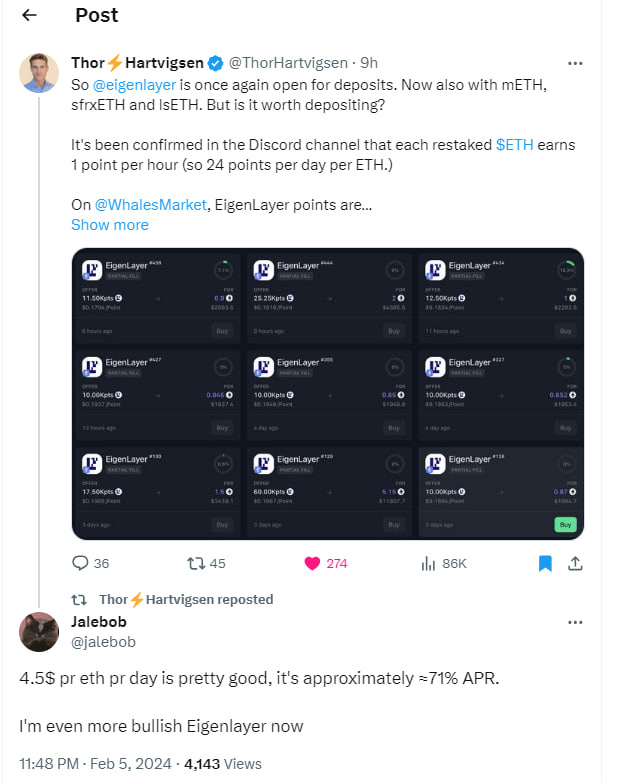

EigenLayer points are being sold for $0.10-0.15 per point OTC on Whales Market.

If you know what this means you’re going to get rich, and if you don’t know I recommend you to read the following text.

If you want to start trading crypto in the new year, use my ref link on Bybit:

https://partner.bybit.com/b/route2fi

You get lower fees, a bonus of up to $30,000, and are able to join my trading group.

I have a trading group only for my affiliates where I share my own trades + the ones from people much smarter than me once they share in their private TG/Discord.

Also, I will arrange a trader contest in cooperation with Bybit starting this week where PnL % is what matters, so even small traders have a chance to win the money prizes + an iPhone.

Once you've signed up on the ref link —> go here to join my private trading group: t.me/route2fiibot

Before we go any further, let’s have a word from our sponsor ZKX

DeFi faces challenges like poor UI, limited fiat on/off ramps, illiquid markets, and scalability issues for on-chain derivative trading.

ZKX, an omnichain perpetual exchange, aims to address these challenges one product at a time. Their main goal is to bring the power of DeFi to Asia, Latin America, Africa, and the rest of the world by providing fair access to decentralized products.

Set to launch in Q1 2024, the exchange is backed by investors like StarkWare, Amber, Huobi Global, Haskey Capital ventures and others.

How can you use the platform now?

Enter ZKX Account, their answer to painful DeFi onboarding.

Picture ZKX Account as your all-in-one DeFi Hub, giving you control over your funds at all times.

The Account has made seamless onboarding a reality, thanks to Starknet's native account abstraction and their L1 to L2 bridge, Starkway.

What are the benefits of having a ZKX Account?

Creating the Account unlocks milestones leading to the exchange's Q1 2024 mainnet, offering early access to platform features.

The Account also turns your ZKX journey into a gamified experience, recognizing your engagement through NFT badges.

So create your ZKX Account Today and Be the First to Experience ZKX.

Check out the full announcement here.

How much can you earn on the EigenLayer narrative?

EigenLayer opened up its caps again yesterday, and it will stay open until Friday.

I wrote about EigenLayer and the different opportunities here:

But today we’ll look into what the points potentially are worth.

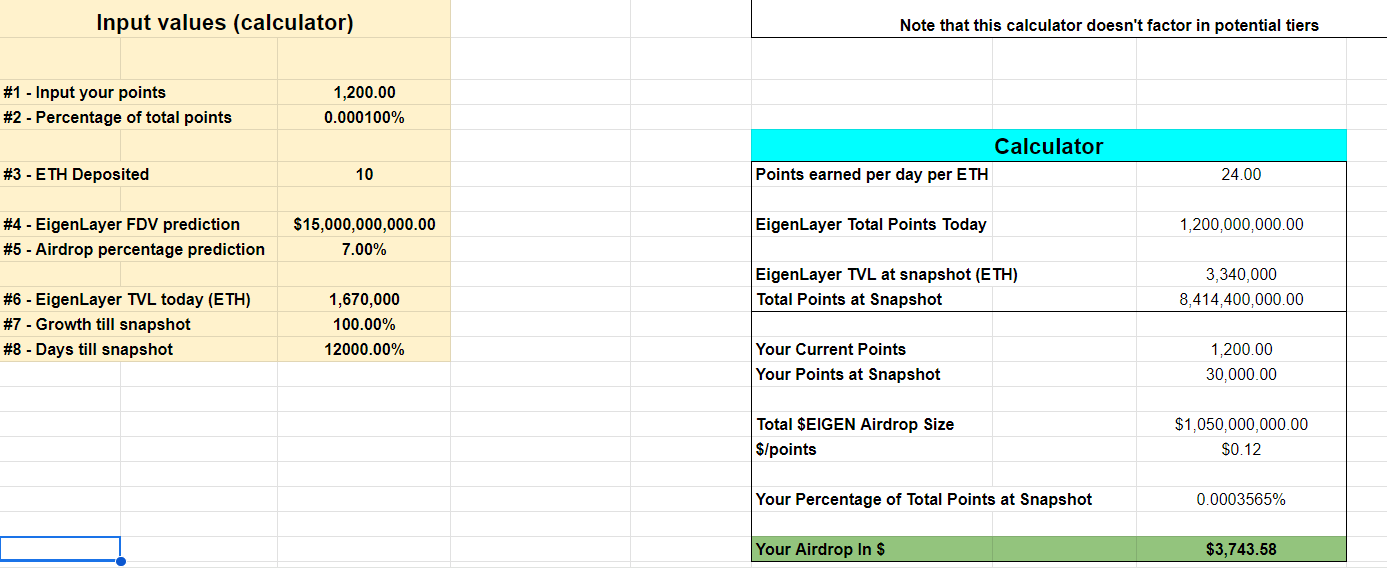

The EigenLayer points formula goes like this:

Number of ETH x 1 x 24 = EigenLayer points per day

Example: 10 ETH x 1 x 24 = 240 EigenLayer points per day

And how much is a point worth?

This is speculation as of now, but some people have made their predictions based on assumptions.

Assumptions:

24 EigenLayer points per day per ETH you deposit

1.670.000 ETH in TVL ($3,89 bn)

Growth of TVL until airdrop snapshot: 100%

120 days until snapshot (start of June 2024)

Airdrop % prediction: 7%

FDV prediction: 15bn

Starting capital: 10 ETH

As you can see there are a lot of assumptions. The hardest part is knowing if they will do tier systems, and what the FDV will be. Celestia is currently at 18bn FDV, and with all the hype EigenLayer have I’m pretty sure that we’ll see it around 15bn, maybe even 20bn.

With the current assumptions, every EigenLayer point is worth $0.12. I have talked to several people and estimates lie around $0.05 - $0.20 per token. On Whales Market, people are selling points for $0.15 per point as we speak. I expect this to go lower. You can check this out for yourself here: https://app.whales.market/points-markets

You can try Thor Hartvigsen’s EigenLayer airdrop calculator here:

https://x.com/ThorHartvigsen/status/1747263102943744122

So to summarize you’ll get roughly $400 per ETH you stake if you do it for the next 120 days. The number could be lower, maybe even $200, but it could also be substantially higher. $1,000 per ETH isn’t totally unrealistic. It’s a wide range though, but it should be one of the more juicier airdrops of the year. Is it worth risking your ETH into a smart contract that is on testnet? I can’t give you an answer to this, but if you don’t like binding capital you should look for the opportunity to buy points instead on Whales Market. But you may end up paying a high price for your points.

One alert that is starting to blink a little bit for me is that the LST/LRT narrative is starting to feel a little bit too easy.

Eg. buy mETH and get 7,2% APY. Then deposit it to EigenLayer to get Eigen points, restaking rewards, and ETH appreciation (if ETH price goes up).

I don’t know, but when everyone is winning…what’s the catch?

The other day I got this feeling that we’re back at the “easiness” I felt when Anchor Protocol was around.

I hope I am wrong here, but it’s worth talking about.

I mentioned this in the last issue, but just repeating it here about which of the LRT/LST coins I am playing with at the moment. All of them have advantages/drawbacks depending on how you see them.

If you’re an airdrop hunter:

Swell, EtherFi, Kelp, Puffer, EigenPie, Renzo

If you want the highest yield:

Mantle ETH (mETH) - 7,2% on your ETH + EigenLayer points

If you want “safety”:

I’m writing safe with ““. Because nothing in crypto should be declared safe. Even stETH (which has 70% of the market depegged during summer 2022.

However among the safest ones (based on how long they’ve been around (Lido, RocketPool, Binance Staked ETH.

I think Puffer has solid backing, and I have a feeling this could be considered one of the safer options after a while.

What am I playing:

I am doing all of the airdrop plays and mETH. Personally, I like sizing up too, and mETH with a juicy 7.2% APY is very nice.

If you’re a degen and bullish ETH you could buy let’s say 10 wstETH, deposit it to AAVE, borrow against it, eg. borrow 50% ETH (5 ETH). And then buy swETH, mETH, ETHx and do what is suggested above to get airdrops + EigenLayer points.

Do also keep in mind that several LRT tokens are launching soon: Genesis and Inception are 2 of them. Also, Pendle has some degen strategies too where you can get up to 30% yield.

Never bet more in EigenLayer than what you’re comfortable about losing.

Take care, anon.

See you!

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

What is your take on Vector Reserve and their liquidity position derivative play with $vETH / $VEC?

Best place to get mETH? Or what Mantle LSP are you using to deposit your ETH? Noob question I know