Hey, friends!

Another week is coming to an end.

Honestly, I was surprised to see the Greyscale $BTC selling vs. the buying from other ETFs. Things aren’t looking as bad as CT says, and I have a feeling that we might see some optimism in the market again very soon.

Today’s piece is about tokenomics, and could be valuable for you when you’re looking at new projects to see if they’re worth buying into.

If you want to start trading crypto in the new year, use my ref link on Bybit:

https://partner.bybit.com/b/route2fi

You get lower fees, a bonus of up to $30,000, and are able to join my trading group.

I have a trading group only for my affiliates where I share my own trades + the ones from people much smarter than me once they share in their private TG/Discord.

Also, I will arrange a trader contest in cooperation with Bybit starting this week where PnL % is what matters, so even small traders have a chance to win the money prizes + an iPhone.

Once you've signed up on the ref link —> go here to join my private trading group: t.me/route2fiibot

Today’s newsletter is sponsored by Saros

Saros is incubated by C98 the leading non-custodial Web3 wallet in South East Asia with over 10mm active users. Over at Saros, they aim to solve a ton of liquidity and frontend issues that many users face when interacting with dApps via the introduction of Saros Solana Super App with one-click transactions, simplified DeFi, and smooth on-chain experience overall.

Prior to Saros, crypto UX requires users to be on multiple different dApps from AMMs, money markets and liquid staking services involving a million clicks, leaving you with a ton of confusion, this all changes - Saros takes this away with their one-click transaction for everything on one platform.

$SAROS had a successful TGE on the 19th of January and they are here to stay, offering holders the opportunity to HOLD and EARN even more. Saros has dedicated a total of 90m $SAROS in rewards, all that stands between you and the rewards pool is one click. Seems incredibly simple, stake $SAROS, earn more $SAROS with over 90m $SAROS delegated to the rewards pool.

You can buy Saros on most exchanges, including Bybit and Kucoin.

Tokenomics 101 - valuable knowledge before the 2024-2025 bullrun

Many people talk about tokenomics, but only some people understand it.

If you’re considering whether or not to buy a crypto asset, understanding tokenomics is one of the most useful first steps you can take to make a good decision.

This newsletter goes through the basics so you could learn how to analyze a project for yourself.

To understand if a coin should go up or down in price we have to understand supply and demand.

To understand this better let’s do an example with Bitcoin ($BTC).

Let’s start with the supply side.

Supply

1) How many $BTC tokens exist?

Answer: 19.2M $BTC

2) How many tokens will ever exist?

Answer: 21M $BTC

3) How often are new tokens being released on the market?

Answer: The increase in a token's supply over time is called emissions and the speed of emissions is important. You can find info about this in the token's whitepaper. Emissions can come from staking rewards/airdrops, and token unlocks.

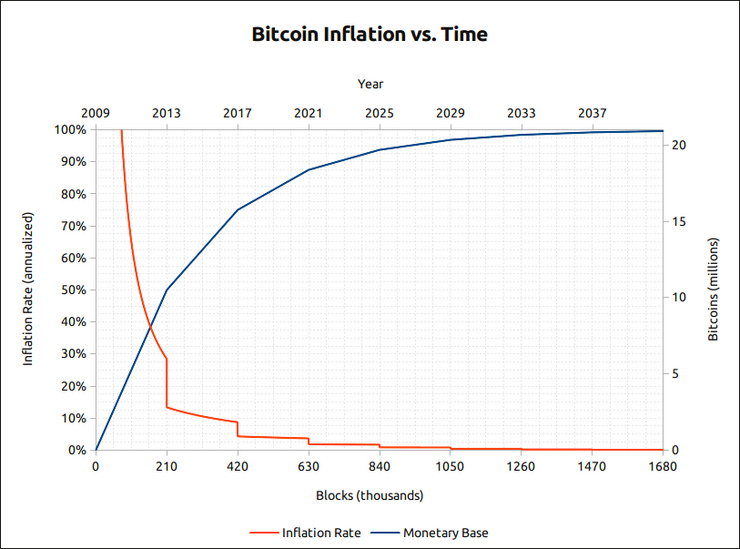

Every 10 minutes, Bitcoin miners verify one block of bitcoin transactions. The current reward for verifying one block of bitcoin is 6.25 bitcoins. So, approximately 900 bitcoins are released into the market every day.

On average, the blocks created will keep “halving” every four years (called "the halving"), until eventually only 0.000000001 Bitcoin are awarded per block “mined” by the year 2140.

In other words, by the early 2030s, nearly 97% of Bitcoin is expected to be unearthed. The remaining 3% will come into existence over the following century, until 2140.

This means that the token price should increase if there are fewer coins that exist, and vice versa the price should go down if more tokens exist.

For $BTC this is pretty easy to understand, but when we look at other tokens, eg. $ETH it is a little more complicated because there’s no cap on how many Ethereum tokens can exist. However, as long as the Ethereum gas fees are at reasonable levels, it’s actually a net deflationary asset.

Important metrics to know about

Circulating supply: number of tokens existing today

Total supply: Onchain supply minus burned tokens

Max supply: The maximum number of tokens that can exist

Market cap: Today’s token price x Circulating Supply

Fully Diluted Market Cap: Today’s token price x Max Supply

Another essential thing to consider with the supply side is the token allocation. This isn’t a big deal with $BTC. But something to think about when you evaluate a new token that you consider buying.

Also:

1) Are there whales out there that own most of the tokens?

2) How is the unlocking schedule?

3) Did the protocol give most of its tokens to the early investors in the seed round?

My point is: don’t end up rekt investing in shitcoins like $KASTA created by The Moon Carl because you didn’t read up on tokenomics.

IMO, @UnlocksCalendar and @VestLab are good resources to check the unlocking schedule.

To quickly summarize what's important in the supply side, check:

-circulating supply

-total and max supply

-token allocation

-the unlocking schedule.

With that said, supply alone isn’t enough to take a decision if a token is worth buying.

This brings us to demand.

Demand

Okay, so we know that Bitcoin has a fixed supply of 21 million tokens and that the inflation rate in $BTC is approx. 1.6% and trending lower every year.

So why aren’t the price of $BTC $100,000 yet?

Why is it “just” $40K?

Well, the short answer is that having a fixed supply alone does not make $BTC valuable.

People also need to believe $BTC has value, and that it will have value in the future.

Let’s divide demand into 3 components:

Financial utility (ROI on token)

Real Utility (Value)

Speculation

1) Financial utility: How much income/cash flow can you generate by holding the token. For proof-of-stake tokens, you could stake the coins to generate a passive yield.

This is not possible for $BTC, unless you wrap it to $WBTC, but then it’s not normal $BTC anymore. If holding a token benefits the holder by rewarding staking yield or by providing a LP in a yield farm then the demand naturally increases.

But do remember that the yield has to come from somewhere (token inflation), so just be a little skeptical when you see these really high APR projects (think $OHM-fork season in 2021).

2) Real utility: For many projects, the truth is that there is no value. It can be discussed, but eg. Bitcoin has value because it functions as a store of value and a unit of exchange.

Bitcoin is referred to as digital currency and as an alternative to central bank-controlled fiat money. Ethereum is a digital currency that has several purposes through decentralized finance applications (dApps).

You can actually do things with ETH, outside of holding it, sending, or receiving it. To decide if there’s a real utility you have to consider who is on the team, which advisors they have, and their background. Which firms are backing them, what are they building, and are they solving a real problem, etc.

3) Speculation: This includes narratives, memes, and conviction. Basically, a future belief that other people will want to buy it after you.

The speculation aspect of the demand side is hard to analyze and predict. Bitcoin has no ROI and no staking opportunities. But it has a super strong narrative. The belief is that it could be a long-term store of value. Bitcoin also has a huge advantage that it was the first one.

When you hear people talk about crypto the first thing they will mention is $BTC. A strong community can drive demand, so always remember to do research on Twitter and Discord about the community before you invest in something.

IMO the speculation aspect is one of the biggest drivers in crypto. Don’t underestimate how far a token can get with the right narratives, memes, and followers that obey their leaders. Think $DOGE, $SHIB, $ADA, and $XRP.

Most crypto tokens are highly correlated and move together. If you’re holding anything other than $BTC and $ETH it should be based on something on the supply/demand side of tokenomics that makes you think it will outperform them.

Another important aspect in valuing a token is the tokenomcis trilemma between yield, inflation, and lockup period:

Proof-of-stake projects want to give their tokens high staking yield to attract users. But high APR can lead to inflation and selling pressure.

On the other hand, if the staking yield isn’t attractive it can be hard to get users. A way to keep people holding the token is to provide a higher yield the longer the lockup, the drawback is that if the lockup period is too long people will simply avoid the project. Another thing is that one day the unlock will happen which will lead to a huge sell-off because investors want to withdraw profits.

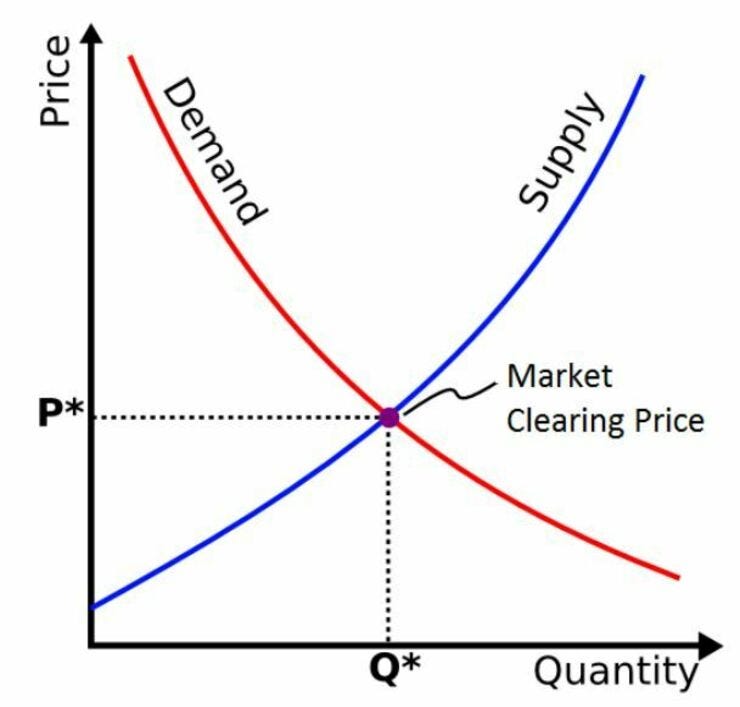

If you think supply/demand is hard to understand just try to think about it in an easy way:

What would happen if the Ethereum Foundation decided to print 100M new $ETH tokens tomorrow? Answer: the price would collapse due to increased supply and reduced demand.

What would happen if Michael Saylor announced that he wanted to buy 100.000 more Bitcoin within the next 6 months? Answer: the price would increase because the supply would decrease and the demand would increase.

Just think about this model below:

The price will always move to an equilibrium based on the supply/demand curve.

Is $ETH worth $100 or $10,000?

Is $BTC completely worthless or worth $300K?

No one really knows, and since crypto doesn’t have an underlying value compared to for example stocks, it remains very hard for investors to land on a price.

Which makes crypto assets very volatile and speculative. But this also leads to gigantic opportunities for the few of us that actually spend time in crypto.

What should a new project/protocol focus on?

Let’s take a look at the Curve ($CRV) structure.

In essence, Curve provides incentives to LPs and encourages participants via their tokenomics in an attempt to participate in governance. Whereas for Convex, the ultimate goal here is to secure as much $veCRV to maximize $CRV rewards.

After defining set goals, a founder of a project should then look into the actual value proposition of the token - what value can participants gain from holding the token?

There are several, ie:

-staking

-governance

-store of value

etc.

Nowadays it is common to see founders come up with tokens consisting of multiple value propositions - more of these, of course, may lead to a higher demand for tokens.

A perfect example would be $GMX - the token holds several value propositions such as governance (ability to inspire real preferences of participants), claiming (ability to convert escrowed GMX into $GMX over a time period) and stakeholding (receiving protocol revenue).

With the value propositions, comes also what we know as functional parameters, this relates to the variables that dictate the literal functions of a token, the simplest examples are transfer or burning. It is absolutely crucial for teams to ensure that a token’s functional parameters are not in conflict with its value propositions - for example, a token’s whose goal and value proposition used for value transfers should have features that ensure they are fungible. Below are some functional parameters of tokens:

1. Transferability (transferable + non-transferable) -> $GMX and $esGMX respectively.

2. Burnability (burnable + non-burnable) -> $BNB and SBTs respectively.

3. Fungibility (fungible + non-fungible) -> ERC20 and ERC721 (nft) respectively.

4. Rates (floating + fixed) -> $MKR and $DAI

There are times, teams intentionally decide that a token is assigned a conflicting value proposition or function - in this case, tokens could be split into two or more types. The famous case of $AXS is the prime example here. Shifting from their initial single token model, to a multi-token model.

Initially, $AXS had 3 value properties: value transfers, governance and stakeholding - the conflict here derives from the fact that if participants decided to spend $AXS in value transfer within the game, it meant forfeiting governance and stakeholding benefits - this created an issue for the game economy. As a fix to this: they released a “new” token $SLP, which then became the go-to value transfer within the game. You might remember the same dual system from STEPN with $GMT and $GST.

However, implementing a dual token system may overcomplicate tokenomics design and at times it may be important to consider external coins as supplementary tokens to ensure smoother interactions. A prime example here is $ARB - which is primarily used for governance.

In order to ensure smoother interactions, $ARB uses $ETH as a means to pay transaction fees, because the transactions occurring on L2s are bundled up and sent to the L1 state - if this external coin ($ETH) were not introduced as the means to pay transaction fees this would be what happens: $ARB were used to pay transaction fees (gas), operators would then have to exchange $ARB to $ETH for verification on the L1 and lose out in further gas fees, creating somewhat of a paradox for the growth of $ARB.

In the above segments, I’ve covered the general dynamics of tokenomics and the various driving factors teams should consider, now let’s take a look at token supply - as this directly impacts token price (this is what the degens want). The structure for token supply is as follows:

1. Max supply

2. Allocation in % (sale, investors, team, marketing, treasury etc)

3. Distribution of the allocation -> what goes to initial, vested and reward emissions.

Maximum supply is important, because this decides whether the team is able to issue a max cap of the tokens, uncapped tokens may not have very good price distributions. This does not directly impact the price, but are factors to issuance rates and whether or not the token is deflationary or inflationary <- this is what impacts price.

For a limited max supply, such as $CRV (3b tokens), the price is able to go up due to the fact that as the network grows, demand for the token increases, creating a high demand area with a limited supply, the issue with this type of max supply is that if the token is not distributed quickly, it can become challenging to also provide incentives to future/new contributors.

Having an unlimited max supply on the other hand, can avoid having issues regarding depletion of future incentives, the downside here of course is that there may be a token price decline in the long term, as there is in essence, infinite supply, without the use of external models to decrease circulation (ie: staking, burning etc), there can only ever be a downtrend in the long run, regardless of its growth.

For allocation, this is normally based on a percentage (%) of the max supply, it essentially determines what % of the max supply should be allocated to each category. The main categories are as follows: team (contributors such as founder, developers, marketing, etc, essentially the individuals responsible for building up the project), investors (pre-seed/seed/private round participants), treasury (operational costs such as R&D, reserves etc), community (airdrops, LP rewards, mining rewards etc), public sale (ICO, IDO, IEO, LBP, etc) and marketing (advisors, KOLs, agencies etc).

These are some of the key ones projects would consider, however these are essentially unique to each project, which can either simplify or subdivide categories further depending on their “strategy”.

One noteworthy thing to consider is that during the rise of defi 2020-21 there was a large increase in token allocation to treasuries and community incentives because teams realized that by allowing higher rewards to their community, or having airdrops to increase the initial float of holders, it could potentially lead to a boom-worthy network growth and a sustainable token economy.

Lastly, distribution - the initial supply is the initial float released into the open market immediately on “launch” or some know it as TGE - the categories of allocation falling into this are normally a % of treasury, public sales and the notorious airdrops we’ve been seeing around everywhere.

For vested tokens, these are often locked up for x amount of months/years, this normally applies to investors/treasuries/team tokens, it is their discretion the duration and at what point vesting begins, generally the vesting prevents mass token dumps, especially because participants falling in this section are often investors at a lower valuation than that of the listing price.

So why do all these matter?

Simple - token demand and value capture, in order for there to be a demand for these tokens, market participants should, in theory, be able to capture value through being a holder of the token.

Let’s again take a look at $CRV, we have to identify and understand the meta demand for this, so let’s break down their value proposition, that they are a governance token - participants are able to vote using their $CRV to decide how much $CRV is issued weekly - why does this matter? Why does this capture value?

Well, because market participants who are holding $CRV are eligible to receive 50% of the project fees, therefore the more $CRV they hold, the more revenue they receive, making the ultimate meta demand for $CRV the ability to maximise user profits all whilst encouraging them to hold, being an excellent mechanism to induce positive behaviour (users holding) whilst capturing value (earning rewards).

Going back to the beginning, many tokens struggle to regain their value - this sparked interest from projects to capture value via generating profits for the market participants via being holders.

Lots of creative token models in the space today, another prime example I think Cosmos has solved well is the hype around airdrops.

I’ve written about it earlier, but you might remember that staking $ATOM, $OSMO, $KUJI, $INJ and $TIA might qualify you for most of the airdrops in the Cosmos ecosystem today.

This has led to a booming increase of stakers in the Cosmos ecosystem. And they won’t stop staking because of the future promise of more airdrops. This incentive people to hold the tokens and not dump. And since it is a 21 day unstaking period, it becomes quite hassle to unstake, so you rather hold.

One DeFi Degen described what the Cosmos ecosystem is doing as 3,3 (The OHM ponzi), and to some degree he is right.

You can read more about the Cosmos airdrops and the requirements to get them in the article below:

Want To Learn More About Tokenomics?

Here are 4 good threads that have deep-dived into tokenomics:

That’s it!

See you next week.

Happy trading and good luck with buying all the dips in 2024!

Want To Sponsor This Newsletter? 🕴️

Send me a DM on Twitter: https://twitter.com/Route2FI or reply to this email. I have a sponsorship deck I can send you.

Join My Free Telegram Channel 🐸

I’ve launched a free Telegram channel where I share tweets, threads, articles, trades, blog posts, etc. that I find interesting within crypto.

Join it for free here: https://t.me/cryptogoodreads

cool, thanks!

Hi! I want to join your bybit gang and get your trades but I already have a bybit account. I can do a identiy transfer to a new account that I signed up via your link. I will ofc transfer my funds to the new account, but do I still have to do 100 usdt deposit? Would be great if I can just transfer and then good to go. I tried adding another account but I am not allowed to have 2 accounts. Please advise what is best.